Have you heard of Artrade and its "crypto" (ATR)? Although it's a small-cap project , its ambition is to offer a platform combining art , blockchain , and certification . In this article, we'll explore the foundations of Artrade, its vision , its key features, and the advantages it intends to bring to the art market. However, we'll keep in mind that the project doesn't (yet) have the dominant position of some established players in Web3 .

The art market is often perceived as reserved for an elite, and a growing number of initiatives seek to make it more accessible and transparent . The cryptocurrency is presented as the heart of the Artrade ecosystem, supporting a range of services: the fractionalization of artworks, DAO (decentralized governance), and the use of NFC chips to authenticate physical pieces. However, this project is still under development, with a modest market capitalization and adoption that remains to be consolidated.

In the following paragraphs, we will delve into the major aspects of the Artrade project, explaining its tokenomics , its business model, and its roadmap. Of course, any newcomer to the crypto sector must maintain a critical eye on the reliability and viability of a project that is still young.

Table of contents

Context and rationale: why Artrade and its ATR crypto?

The importance of transparency in art

The art market is often perceived as opaque and complex, particularly due to the challenges of authenticating and verifying the provenance of artworks. Some estimates—discussed within the art world—suggest that a significant proportion of pieces on the market may be misattributed or forged. The Fine Art Expert Institute (FAEI) , for example, cited forgery or misattribution rates of up to 50% in the 2010s, although this figure is regularly debated and not universally accepted.

In this context, blockchain is emerging as a potential solution for creating a more robust authentication and traceability system, linking each transaction to an unalterable ledger. The idea is to reduce reliance on multiple intermediaries, while giving collectors and artists clear visibility into the artwork's history.

Decentralization as a possible solution

Decentralization theoretically offers several advantages :

- Enhanced authentication : Each transaction is recorded in a public ledger (blockchain), which limits the risks of certificate forgery.

- Cost reduction : By reducing the role of intermediaries, blockchain could simplify and potentially reduce certain transaction fees.

However, adopting these systems takes time and raises challenges, whether technical (developing secure platforms, integrating NFC chips, etc.) or related to trust. Artrade , a young project aiming to apply these principles to the art market, still needs to demonstrate that its solution is both viable on a large scale and attractive enough to convince artists, gallery owners, and collectors to participate.

Overview of the Artrade crypto project

Artrade's ambitions and value proposition

Artrade seeks to merge traditional art and blockchain , aiming to offer greater transparency , security , and liquidity to a world often perceived as reserved for insiders. One of its core principles is the use of tokenization .

- NFT creation and sale : Artists can associate their physical works with a digital token.

- Fractionalization : Offering several purchasers the opportunity to own shares (or “Fragments”) of the same work.

- Authentication : The use of NFC chips and blockchain to enhance traceability.

However, it's crucial to note that Artrade's potential remains to be seen. The crypto art market is highly competitive, and user trust is built only over time.

A young, innovative French company

Artrade is recognized as a JEI (young innovative company) in France. Its initial funding came from an ICO (Initial Coin Offering) of ATR tokens in 2021. To date, the project is expanding internationally but has not yet achieved the institutional scale comparable to other established NFT platforms. However, its presence is noticeable at various events (Paris Blockchain Week, Non Fungible Conference, etc.), demonstrating a commitment to building a network and fostering adoption .

Main features of Artrade

Fragments: the fractionation of artworks by the Artrade crypto project

Fragments feature , designed to make investing in art more accessible by fractionalizing works by great masters (Monet, Picasso, Warhol, etc.). According to information published on Artrade's official website and in their recent press releases, the first offering is a drawing by Pablo Picasso, valued at $200,000 USD, which pre-sale at the Non Fungible Conference (NFC) in Lisbon.

- Principle : The physical artwork is tokenized on the Solana and divided into several shares (or “fragments”). Each investor can thus buy a fraction of this masterpiece, instead of acquiring the entire piece.

- Objective : To offer increased liquidity to the art market and open access to works usually out of reach for the general public.

- Current state :

- The first Fragments focuses on this Picasso. After the pre-sale, each fraction should be tradable on a Solana compatible DEX , like any other token.

- the concept is still in the demonstration and testing with early adopters.

- Points to be aware of :

- It remains essential to ensure the preservation of the work (specialized storage, insurance, etc.) and to understand the legal structure that governs shared ownership.

- The model still needs to be tested on a larger scale, particularly for resale or liquidity on secondary markets.

In summary, Fragments opens up interesting prospects for democratizing the purchase of art via blockchain, even if the actual number of investors and the stability of this new market remain to be observed as these first concrete cases are implemented.

REAL Protocol: certifying authenticity

Artrade has implemented the REAL Protocol , which aims to strengthen the reliability and traceability of physical works of art. In practice, the process unfolds in several stages:

NFT Creation:

An NFT (Non-Fungible Token) is first issued on the blockchain to represent the artwork. This token serves as a unique digital fingerprint, associated with the physical version of the piece.NFC chip attachment

- An NFC (Near Field Communication) chip or similar device (e.g., an RFID tag) is then attached directly to the artwork, often to the back of the canvas or in a protective frame for paintings.

- This chip contains a unique and unforgeable identifier linked to the NFT. The idea is that anyone wishing to verify authenticity can "scan" the chip with a compatible smartphone or NFC reader and instantly access the information recorded on the blockchain (ownership history, creation date, etc.).

Escrow Smart Contract

- At the time of the transaction (buying/selling), an escrow - type smart contract contract comes into play.

- Role of the escrow : To block both the buyer's funds and the transfer of the NFT on the blockchain until the artwork is delivered.

- Procedure :

- The buyer sends the payment into the escrow (an automated smart contract ).

- The NFT also remains pending within this smart contract.

- The artwork is shipped to the new owner.

- Upon receipt, the buyer can scan the NFC chip to confirm that the artwork matches the NFT and is authentic.

- Once this verification is completed and validated, the funds are released to the seller and the NFT is permanently transferred to the buyer's wallet.

In practice, this system could significantly reduce uncertainties related to forgery or misattribution of artworks, thanks to the combination of blockchain and the NFC chip sealed on the physical object. However, the effectiveness of the REAL Protocol will depend on the adoption of artists, galleries, and collectors for this certification method to become a standard. Currently, it is still difficult to gauge how many people are actually using this protocol, as the market is in a phase of gradual adoption.

Artrade's CAD: Community governance under construction

Artrade expresses its desire to gradually transition from centralized management to a DAO ATR token holders could submit or vote on proposals related to strategy, communication initiatives, or the funding of artistic projects.

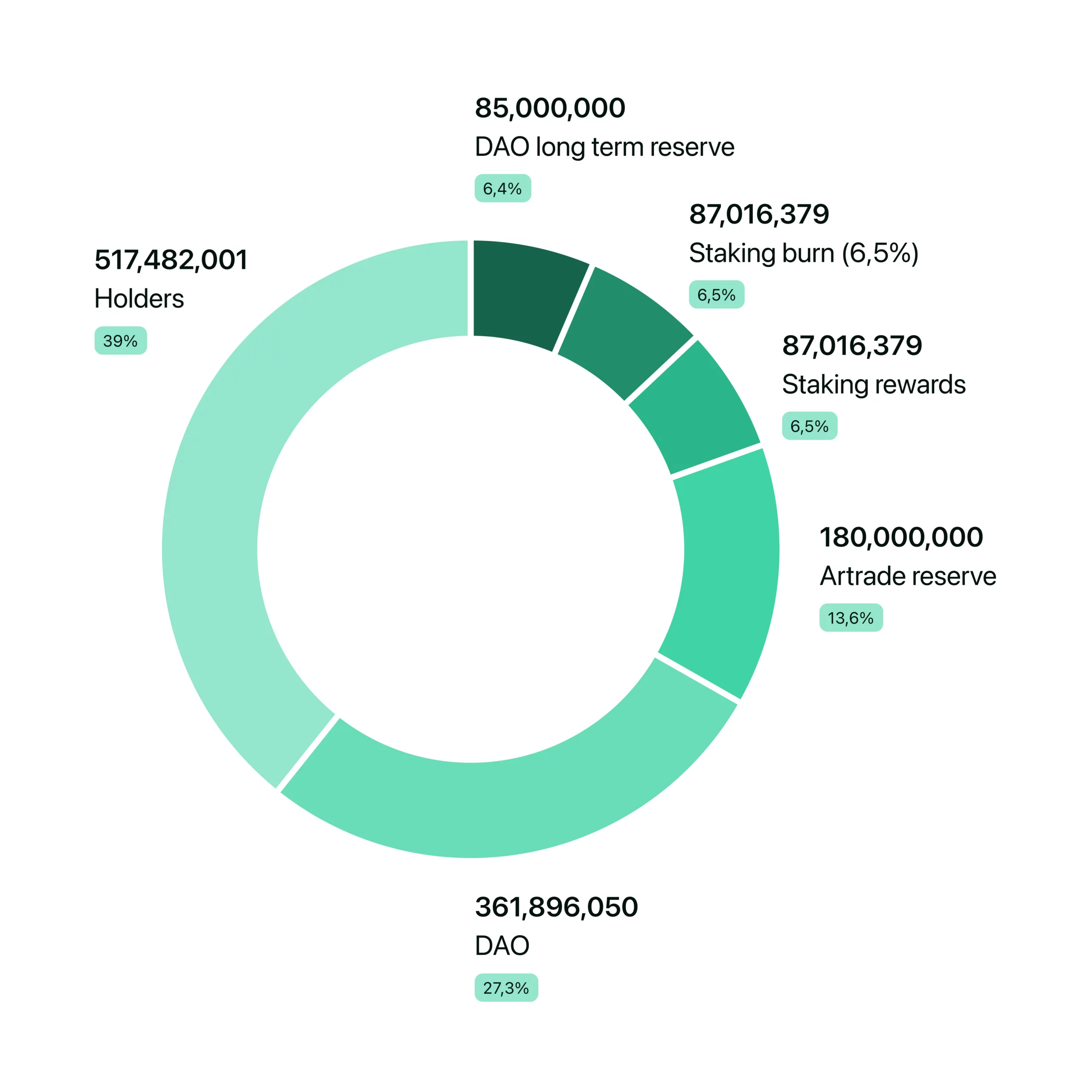

51% of the total offer allocated to DAO

- This means that more than half (51%) of all ATR tokens issued are intended for this governance.

- In practice, these tokens could be distributed between DAO coffers, staking , or artist support funds.

- The idea is that the community can hold majority decision-making power, ensuring in the long term that important choices (for example, which exhibitions to fund, which partnerships to sign) are validated by a majority of the community rather than by a small team.

Issues of legitimacy

- As with any DAO, it is necessary for a sufficient number of token holders to actively participate in order for the votes to be representative.

- Low participation rates can call into question the legitimacy of decisions, which is a common challenge in the world of decentralized organizations.

Partnerships and other services with Artrade

Artrade highlights several collaborations aimed at enriching its ecosystem. According to the information available to date, some partnerships are already in effect , while others are still in the planning stages.

- Moonpay ( effective partnership

Objective : To allow users to more easily purchase ATR tokens with their credit card, without necessarily going through an exchange.

Purpose : To simplify access to the platform for those unfamiliar with cryptocurrencies, and to reduce the barrier to entry (opening wallets, managing USDC USDC etc.).

- Subsidiary services and co-creation

- Artrade plans to offer paid subscriptions for galleries or art experts, providing advanced management, market analysis and promotion features.

- co-creation system is also mentioned, allowing gallery owners and artists to formalize their partnership via blockchain, with automated revenue sharing during sales.

- Web3 Initiatives: staking

- The platform plans staking schemes where ATR holders lock up their tokens in exchange for an APY (up to 30% announced).

- Revenues from transaction fees could support the staking program through a buyback and redistribution mechanism.

In summary, Artrade aims to develop a comprehensive ecosystem combining the certification of works (REAL Protocol), fractionalization (Fragments), and a decentralized governance model (DAO). Existing partnerships, such as the one with Moonpay, are designed to streamline access to the platform, while other announced collaborations are yet to be finalized.

A closer look at the Tokenomics of the Artrade crypto project and its ATR token

Basic characteristics

- Name : Artrade Token ( ATR ).

- Total supply : 1.8 billion tokens.

- Launch date : April 2022.

- Original blockchain : Binance Smart Chain (BSC).

- Migration to Solana from Q1 2024.

- smart contract addresses :

- BSC: 0x7559C49c3Aec50E763A486bB232fA8d0d76078e4

- Solana : ATRLuHph8dxnPny4WSNW7fxkhbeivBrtWbY6BfB4xpLj

Roles of the ATR token

- Governance : Participate in DAO votes, define promotion budgets, support artists.

- Staking : Lock your ATR to receive an APY (up to 30%, according to announcements). Initial rewards would come from a specific reserve, followed by daily buybacks on the market via platform fees.

- Burn program : For each token issued as a staking , one token is burned in order to maintain the scarcity of supply.

- Uses on the platform : Purchase of artworks, 2.5% cashback for buyer and seller, access to badges and premium features.

ATR Emissions and vesting

A timetable ( vesting ) has been announced for the gradual release of the tokens:

- Nov. 2023 : 84.59% outstanding.

- Dec. 2023 : 88,44 %.

- January 2024 : 92,29 %.

- Feb. 2024 : 96,15 %.

- March 2024 : 100 %.

The proposed strategy is to smooth the impact on the market. For early adopters, the question will be how the team manages this process and the announced migration to Solana .

Staking and burning of the ATR token

A fixed supply, without inflation

All 1.8 billion ATR were minted (created) at the project's launch. Unlike other cryptocurrencies that increase their supply over time, Artrade does not plan any additional minting mechanisms .

However, this does not mean that all ATR is immediately available on the market . A portion is still stored in reserves , including:

- The Staking Rewards , which is used to fund the rewards of users who lock their ATR.

- The Staking Burn , which is intended to be gradually destroyed to maintain the balance of the system.

- The reserves of the DAO , which will be released gradually according to the decisions taken by the governance.

These tokens are therefore not yet in circulation , which means that the amount of ATR actually tradable may vary depending on the speed of release of funds.

Where do staking rewards and cashback come from?

Artrade uses two separate sources to reward users via staking and cashback:

Buyback: a distribution funded by platform revenues

- Mechanism : Each transaction made on Artrade is subject to a 5% , collected in USDC or other stablecoin .

- Use of funds : These revenues are then used to buy ATRs on the market (CEX or DEX like Raydium ).

- Redistribution The ATRs thus repurchased are distributed to users in the form of:

- staking rewards for those who lock their tokens.

- Cashback for buyers and sellers (2.5% each).

In this case, no additional tokens are added to the supply : it is simply a mechanism for redistributing existing tokens.

The Staking Rewards reserve: a gradual release

- Why does it exist?

When the project was created, a quantity of ATR was pre-mined staking rewards .

- Potential problem:

If these tokens are unlocked and injected into the economy without compensation gradually increasing the circulating supply, even in the absence of mint. - Solution: a compensatory burn mechanism

The burn to stabilize (or even reduce) the circulating supply of Artrade (ATR)

To prevent the release of tokens from Staking Rewards reserves from causing a gradual increase in supply , Artrade has implemented an automatic burn program .

What is burned?

Each time a certain number of ATR are unlocked from the reserve to be distributed via staking , an equivalent amount is destroyed from the reserve " Staking Burn".

- Immediate effect : The total balance of tokens in circulation remains unchanged .

- Long-term result : If the burn volume exceeds the quantity of tokens distributed, the overall supply decreases, creating deflationary pressure .

Burn and buyback: two distinct but complementary mechanisms

| Mechanism | Role | Impact on the circulating supply |

|---|---|---|

| Buyback | Buying ATRs on the market to redistribute them (staking and cashback) | No increase, but price support by increasing demand |

| Burn | Destroying tokens issued from reserves to prevent hidden inflation | Gradual reduction of the circulating supply |

A balance between distribution and destruction of ATR

- No new issuance : The total amount of ATR is frozen at 1.8 billion .

- The rewards come from buybacks and existing reserves.

- The burn prevents hidden inflation due to the release of Staking Rewards reserves.

- The system can become deflationary if the tokens burned exceed the distribution.

In conclusion, even though all ATRs were minted from the outset, their gradual release and compensatory destruction ensure that the circulating supply remains manageable. If the burn rate continues to outpace the distribution, the total ATR supply will decrease, potentially increasing the token's scarcity in the long term.

Artrade Platform and User Experience

Simplified access

The Artrade team highlights several features to facilitate the use of its platform, particularly for investors or artists unfamiliar with Web3:

- Web3Auth : Authentication system via Google or other SSO services (planned for Q4 2024).

- Artrade Wallet : A dedicated wallet, integrated into the platform.

- Fiat integration : Stripe and Moonpay for card payments, which can reduce the barrier to entry.

Social network and collaboration

private messaging space for artists, collectors, and gallery owners, and encourages co-creation . The idea of a social network dedicated to art combined with a blockchain dimension is interesting. However, success will depend on an community and the ability to convince galleries and buyers to register on the platform.

Initiatives of the crypto project Artrade to popularize tokenized art

Education and awareness

The tokenized art market (or "tokenization") is not familiar to the general public. Artrade intends to launch communication campaigns to:

- Explain how blockchain works in the authentication of works.

- Promote NFTs as digital certificates.

- Train galleries and artists through tutorials or learning modules.

However, the extent of the resources allocated to these actions remains unknown. For a small-capitalization project, resources may be limited, even if it already benefits from some community support.

Supporting emerging artists

The DAO Artrade could eventually purchase works by emerging artists, allowing them to gain greater visibility. According to official documentation, a significant portion of the tokens (up to 51%) will be dedicated to these activities, but the roadmap does not yet specify the volume of artwork purchases already made or planned.

Indicators and key figures of the Artrade crypto project

Although the Artrade project is still young, several figures allow us to understand its current development:

Token price and market capitalization

As of mid-February 2025, the price is around 0.0188 USD per ATR and the market capitalization is around 23.77 million dollars , according to information displayed on the official platform.Amount burned and TVL

Artrade claims to have burned a total of 535.87 million ATR , illustrating the implementation of its burn program. Furthermore, the platform reports a total value locked ( TVL ) of 80.92 million ATR, equivalent to just over $1 million at the current time (February 2025) , indicating the volume of tokens currently locked for staking or other uses.Holders

According to CoinMarketCap , more than 8,700 holders own ATR, although some will still have to migrate their tokens to the Solana in the coming months.Artrade

highlights the first sale of "Fragments" of a Picasso drawing by Pablo Picasso , which sold for $200,000 to 159 investors . This transaction, conducted on the Solana , signals interest in the fractionalization feature, although it is still too early to gauge the true extent of adoption.

While these figures illustrate a certain dynamism within the Artrade community, the project is still in its deployment phase. Announced collaborations and future market developments will determine the extent to which Artrade can expand its user base and strengthen its legitimacy in the tokenized art sector.

Roadmap and next steps

Artrade regularly publishes its roadmap . Here is an overview of the objectives set, with the understanding that some deadlines may change:

Q4 2024 :

- Web3Auth integration (Google, other sign-ons).

- Artrade wallet operational.

- Card payments (Moonpay).

- Outline of an international crypto marketing campaign.

Q1 2025 :

- luxury brands .

- Improved UX /UI and launch of a more automated revenue-sharing

Q2 2025 :

- Increased participation in Paris Blockchain Week .

- R&D on RWA collateralization : possibility of using fractionalized works as collateral in certain DeFi .

Q3 2025 :

- Chainlink integration for oracles.

- Research and development on Real World Assets (RWA) and decentralized finance.

Q4 2025 :

- Advanced partnerships with luxury brands .

- Implementation of a tokenization infrastructure for other markets.

This roadmap is ambitious, but delays or adjustments are common for any crypto project. It's therefore wise to consider these milestones as goals rather than guarantees.

Conclusion: a project to watch, but still in the development phase

Artrade positions itself as a player seeking to lower the barrier to entry into the art world by leveraging blockchain technology . Its Fragments REAL protocol , and the potential for governance small-cap status and gradual rollout mean that the platform has not yet achieved the renown or financial stability of other major players in the Web3 sector.

For NFT and art enthusiasts, Artrade represents an opportunity to discover the emergence of tokenization applied to artworks. However, it's wise to remember that the success of this type of project depends on multiple factors: adoption , the rigor of the technological development, regulatory compliance , and the ability to deliver on its roadmap promises.

As always, be sure to do your own research (DYOR) before making any investment . The crypto market remains volatile, and a young project, despite its good ideas, needs time to prove its viability. Artrade is one such project to watch closely.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .