Do you hear about Artrade and his “crypto” (ATR)? Although it is a project with small capital , its ambition is to propose a platform combining art , blockchain and digital certification In this article, we will explore the foundations of Artrade, its vision , its key features, and the assets it intends to bring to the art market. However, we will keep in mind that the project does not (so far) have the major place of certain major players established in the web3 .

The art market is often perceived as reserved for an elite, and an increasing number of initiatives seek to make it more accessible and transparent . The Crypto ATR presents itself as the heart of the Artrade ecosystem, supporting a range of services: the fractionalization of works, the DAO (decentralized governance) or the use of NFC Chips to authenticate physical parts. However, this project is still under development, with a modest market capitalization and an adoption which remains to consolidate.

In the following paragraphs, we will dive into the major aspects of the Artrade project by explaining its elements of Tokenomics , its economic model and its roadmap. Of course, any new entrant to the crypto sector must keep a critical eye on the reliability and viability of a still young project.

Table of contents

Context and reason of being: why Artrade and his crypto atr?

The stake of transparency in art

The art market is often perceived as opaque and complex, especially due to the challenges linked to authentication and the origin of works. Certain estimates - discussed in the community - suggest that a large share of the parts put on the market could be poorly allocated or counterfeit. The fine art expert Institute (FAEI) , for example, raised up to 50 % counterfeit rate or erroneous allocation in the 2010s, although this figure was regularly discussed and is not unanimous.

In this context, the blockchain emerges as a track to create an authentication system and more robust traceability, allowing each transaction to be linked to an inviolable register. The idea is to reduce dependence on multiple intermediaries, while giving collectors and artists clear visibility on the history of the work.

Decentralization as a track

Decentralization in theory in theory of several advantages :

- Reinforced authentication : Each transaction is registered in a public register (blockchain), which limits the risks of falsification of certificates.

- Reduction of costs : by reducing the role of intermediaries, blockchain could simplify and potentially lighten certain transaction costs.

However, the adoption of these systems requires time and arouses challenges, whether technical (development of secure platforms, integration of NFC chips, etc.) or linked to confidence. Artrade , a young project wishing to apply these principles in the art market, must still demonstrate that its solution is both viable on a large scale and sufficiently attractive to convince artists, gallery owners and collectors to participate.

Overview of the Crypto Artrade project

Ambitions and proposal for the value of Artrade

Artrade seeks to merge traditional art and blockchain , in order to offer more transparency , security , and liquidity to a universe often perceived as reserved for initiates. One of its basic principles is to use tokenization :

- Creation and sale of NFTS : artists can associate their physical works with a digital token.

- Fractionalization : offer several buyers to have shares (or “fragments”) of the same work.

- Authentication : the use of NFC fleas and blockchain to strengthen traceability.

However, it is essential to note that Artrade's potential remains to be confirmed. The art market in crypto is highly competitive, and users' confidence is only built over time.

A young French innovative business

Artrade is recognized as a JEI (young innovative company) in France. Its initial funding comes from an ICO (Initial Coin Offering) of ATR tokens in 2021. To date, the project is developing internationally, but has not yet acquired an institutional scope comparable to other NFT platforms established. However, its presence is noted during various events ( Paris Blockchain Week, not fungible conference, etc.), which attests to a desire to create a network and stimulate adoption .

Main features of Artrade

Fragments: the fractionalization of works by the Crypto Artrade project

Fragments functionality , designed to make the investment in art more accessible by fractionalizing works by great masters (Monet, Picasso, Warhol, etc.). According to information published on the official website of Artrade and in their recent press releases, the first launch concerns a drawing by Pablo Picasso, estimated at 200,000 USD, whose presale started during the non -Fungible Conference (NFC) in Lisbon.

- Principle : the physical work is tokenized on the Solana and split into several parts (or “fragments”). Each investor can thus buy a fraction of this masterpiece, instead of acquiring the full room.

- Objective : to offer increased liquidity to the art market and open access to works usually out of reach for the general public.

- Current state :

- The first sale fragments relates to this Picasso. After the presale, each fraction should be exchangeable on a Solana compatible DEX , like any other token.

- The concept is still in the demonstration and test with the first users.

- Vigilance points :

- It remains essential to ensure the conservation of the work (specialized warehouse, insurance, etc.) and to understand the legal structure which supervises shared detention.

- The model must still be tested on a larger scale, especially for resale or liquidity in the secondary markets.

In summary, Fragments opens up interesting perspectives to democratize the purchase of art via blockchain, even if the actual number of investors and the stability of this new market remain to be observed as the first concrete first cases.

Real Protocol: certify authenticity

Artrade has set up Real Protocol , which aims to strengthen the reliability and traceability of physical art. Concretely, the process unfolds in several stages:

Creation of the NFT

An NFT (non-Fungible Token) is first issued on the blockchain to represent the work. This token serves as a unique digital imprint, associated with the physical version of the room.Apposition of the NFC chip

- An NFC (Near Field Communication) chip or a similar device (for example, an RFID tag) is then fixed directly on the work, often on the back of the canvas or in a protective frame for tables.

- This chip has a unique and infalcilable identifier, linked to the NFT. The idea is that anyone who wishes to check the authenticity can “scan” the chip with a compatible NFC smartphone or reader and access instantly to the information entered on the blockchain (property history, creation date, etc.).

SCROW Smart Contract

- At the time of the transaction (purchase/sale), an intelligent contract ( smart contract ) of the Scam comes into play.

- Role of the scam : block both the buyer's funds and the transfer of the NFT to the blockchain while the work is delivered.

- Course :

- The buyer sends payment in the scam (an automated smart contract ).

- The NFT also remains pending within this smart contract.

- The work is sent to the new buyer.

- Upon receipt, the buyer can scan the NFC chip to confirm that the work corresponds well to the NFT and that it is authentic.

- Once this verification has been carried out and validated, the funds are released for the seller and the NFT is definitively transferred to the buyer's portfolio.

In practice, this system could considerably reduce uncertainties linked to counterfeiting or the poor allocation of works, thanks to the combination of blockchain and the NFC chip sealed on the physical object. However, the effectiveness of real protocol will depend on the support of artists, galleries and collectors, so that this method of certification becomes a standard. To date, it is still difficult to measure how many people actually use this protocol, the market being in the progressive adoption phase.

Dao d'Artrade: community governance under construction

Artrade expresses the desire to gradually move from centralized management to a DAO (decentralized autoomous organization). token atr holders could submit or vote on proposals related to strategy, communication initiatives or the financing of artistic projects.

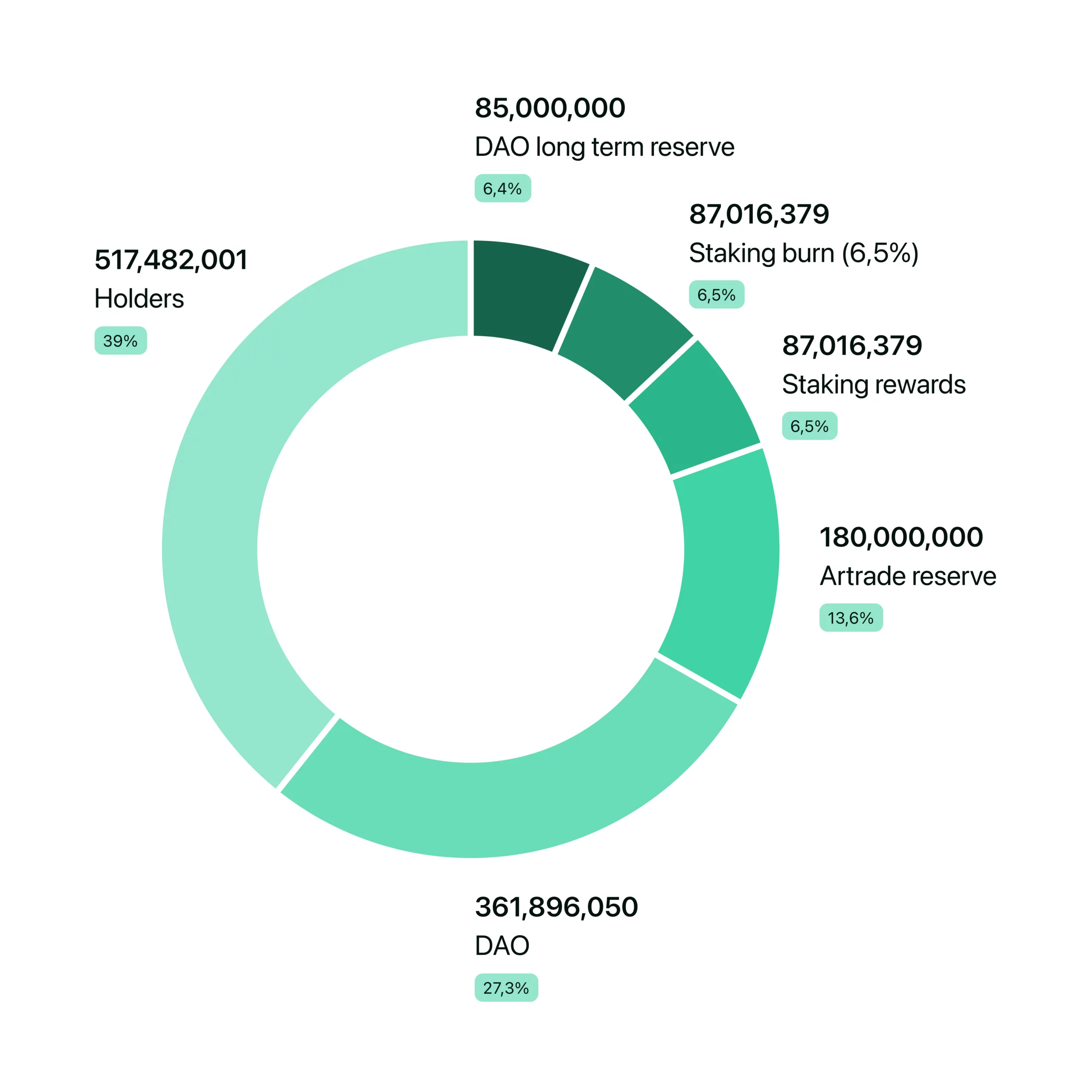

51 % of the total offer allocated to the DAO

- This means that more than half (51 %) of all atr tokens emitted are supposed to be intended for this governance.

- In practice, these tokens could be distributed between DAO boxes, staking or support funds for artists.

- The idea is that the community can have a majority decision -making power, ultimately ensuring that the important choices (for example, what exhibitions to finance, which partnerships to sign) are validated by a majority of the community rather than by a limited team.

Legitimacy issues

- As with any DAO, it is necessary for a sufficient number of tokens holders to participate actively so that the votes are representative.

- A low participation rate can question the legitimacy of decisions, which is a common challenge in the world of decentralized organizations.

Partnerships and other services with Artrade

Artrade highlights several collaborations aimed at enriching its ecosystem. According to information available to date, some partnerships are already effective , while others are still in future projects.

- Moonpay (effective partnership)

Objective : to allow users to buy ATR tokens more easily with their credit card, without necessarily going through a exchange scholarship.

Interest : simplify access to the platform for uninitiated to cryptocurrencies, and reduce the barrier to the entrance (opening of wallets, USDC management USDC etc.).

- Subsidiary services and co-creation

- Artrade plans to offer paid subscriptions for art galleries or experts, offering advanced management, market analysis and highlighting features.

- co-creation system is also mentioned, allowing gallery owners and artists to formalize their partnership via blockchain, with automated income sharing during sales

- Web3 initiatives: staking

- The platform provides staking plans where ATR holders block their tokens in exchange for an APY (up to 30 % announced).

- Revenues related to transaction costs could support the staking program via a buyout mechanism (Buyback) and redistribution.

In summary, Artrade intends to develop a global ecosystem, associating the certification of works (real protocol), fractionalization (fragments), and a model of decentralized governance (DAO). Effective partnerships, such as that with Moonpay, aim to streamline access to the platform, while other announced collaborations remain to be concretized.

Zoom on the Tokenomics of the Crypto Artrade project and its token atr

Basic characteristics

- Name : Artrade Token ( ATR ).

- Total Supply : 1.8 billion tokens.

- Launch date : April 2022.

- Original blockchain : Binance Smart Chain (BSC).

- Migration to Solana since Q1 2024.

- smart contract Addresses :

- BSC: 0x7559c49c3aec50e763a486bb232fa8d0d76078e4

- Solana : atrluhph8dxnpny4wsnw7fxkhbeivbrtwby6bfb4xplj

Roles of the token atr

- Governance : Participate in DAO votes, define promotion budgets, support artists.

- Staking : lock your ATR to receive an APY (up to 30 %, depending on the announcements). The initial awards would come from a specific reserve, then a daily buyback on the market via platform costs.

- Burn program : For each token issued as a staking , a token is burned in order to maintain the rarefaction of the offer.

- Use on the platform : purchase of works, 2.5 % cashback for buyer and seller, access to badges and premium features.

ATR programs and jacket

A calendar ( jacket ) was communicated for the progressive release of tokens:

- Nov. 2023 : 84.59 % in circulation.

- Dec. 2023 : 88,44 %.

- Jan 2024 : 92,29 %.

- Feb. 2024 : 96,15 %.

- March 2024 : 100 %.

The proposed logic is to smooth the impact on the market. For early adopters, the question will be to check how the team manages this process and the migration announced towards Solana .

Staking and Burn of the Token Atr

A fixed supply, without inflation

All 1.8 billion ATRs have already been mining (created) as soon as the project is launched. Unlike other cryptocurrencies that increase their supply over time, Artrade does not provide any additional Mint mechanism .

However, this does not mean that all ATRs are immediately available on the market . A part is still stored in reserves , in particular:

- Staking Rewards reserve , which is used to finance the rewards of users who lock their ATR.

- Staking Burn reserve , which is intended to be gradually destroyed to maintain the balance of the system.

- The reserves of the DAO , which will be gradually released according to the decisions taken by governance.

These tokens are therefore not yet in circulation , which means that the quantity of truly exchangeable atr can vary depending on the speed of liberation of the funds.

Where do the staking rewards and the cashback come from?

Artrade uses two separate sources to remunerate users via staking and cashback:

Buyback: a distribution financed by the revenues of the platform

- Mechanism 5 % commission , perceived in USDC or other stablecoin .

- Using funds : These income is then used to buy ATR on the market (CEX or Dex like Raydium ).

- Redistribution : ATR thus bought are distributed to users in the form of:

- staking rewards for those who lock their tokens.

- Cashback for buyers and sellers (2.5 % each).

In this case, no additional token is added to the supply : it is simply a redistribution mechanism of existing tokens.

The Staking Rewards reserve: progressive release

- Why does it exist?

When creating the project, a quantity of ATR was pre -tested and reserve for staking .

- Potential problem

if these tokens are unlocked and injected into the economy without compensation gradually increase the supply in circulation, even in the absence of Mint. - Solution: a compensatory burn mechanism

Burn to stabilize (or even reduce) the offer in circulation of Artrade (ATR)

To prevent the release of tokens from Staking Rewards reserves to cause a gradual increase in the offer , Artrade has set up an automatic burn program .

What's burned?

Whenever a certain number of ATRs has been unlocked from the reserve to be distributed in staking , an equivalent quantity is destroyed Staking reserve .

- Immediate effect : the total balance of tokens in circulation remains unchanged .

- Result in the long term : if the volume of burn exceeds the quantity of tokens distributed, the overall offer decreases, creating a deflationary pressure .

Burn and Buyback: two distinct but complementary mechanisms

| Mechanism | Role | Impact on the offer in circulation |

|---|---|---|

| Buyback | Buy ATR on the market to redistribute them (staking and Cashback) | No increase, but price support by increasing demand |

| Burn | Destroy the tokens from the reserves to avoid hidden inflation | Gradual reduction of the supply in circulation |

A balance between distribution and destruction of ATR

- No new emissions : the total quantity of ATR is frozen at 1.8 billion .

- The awards come from the Buyback and the existing reserves.

- Burn prevents hidden inflation due to the release of Staking Rewards reserves.

- The system can become a deflationist if burned tokens surpass distribution.

In conclusion, even if all the ATRs were minted from the start, their gradual release and their compensatory destruction ensure that the supply in circulation remains controlled. If the volume of burn continues to surpass the distribution, the total offer of ATR will decrease, potentially strengthening the rarity of token over the long term.

Artrade platform and user experience

Simplified access

The Artrade team highlights several elements to facilitate the use of its platform, in particular with investors or artists who are not familiar with the web3:

- Web3auth : authentication system via Google or other SSO services (provided in Q4 2024).

- Artrade Wallet : A dedicated wallet, integrated into the platform.

- Fiat integration : Stripe and Moonpay for card payments, which can reduce the barrier to the entrance.

Social network and collaboration

private messaging space between artists, collectors and gallery owners, and encourages co-creation . The idea of a social network dedicated to art associated with a blockchain dimension is interesting. However, success will depend on an community and the ability to convince galleries and buyers to register on the platform.

Initiatives of the Crypto Artrade project to popularize tokenized art

Education and awareness

The tokenized art market (or "tokenization") is not familiar to the general public. Artrade intends to deploy communication campaigns for:

- Explain the operation of the blockchain in the authentication of works.

- Highlight NFT as digital certificates.

- Train galleries and artists via tutorials or learning modules.

However, the importance of resources allocated to these actions is still unknown. For a small capitalization project, the means can be limited, even if it already has a certain community support.

Support emerging artists

Dao could ultimately buy works from new talents, allowing them to gain visibility. According to the official documentation, a substantial part of the tokens (up to 51 %) will be dedicated to these actions, but the Roadmap does not yet specify the volume of purchases of works already made or provided.

Indicators and key figures of the Crypto Artrade project

Although the Artrade project remains young, several encrypted data make it possible to understand its current evolution:

-

Price of the token and capitalization

in mid-February 2025, the price was around 0.0188 USD per ATR and the market capitalization is around $ 23.77 million , according to information displayed on the official platform. -

Quantity burned and TVL

Artrade claims to have burned a total of 535.87 million ATR , illustrating the implementation of the Burn program. In addition, the platform claims to be a total locked value ( TVL ) of 80.92 million ATR or just over $ 1 million at present (February 2025) , which indicates the volume of tokens currently blocked as part of staking or other uses. -

Holders

after CoinmarketCap , more than 8,700 holders (Holders) have ATRs, even if a game will still have to migrate their tokens to the Solana in the coming months. -

Fractionalization of a Picasso

Artrade highlights the first sale of “fragments” around a drawing by Pablo Picasso , sold for 200,000 USD to 159 investors . This operation, carried out on the Solana , represents an interest signal for the fractionalization functionality, although it is still early to measure the real magnitude of the adoption.

If these figures illustrate a certain dynamic within the Artrade community, the project is still in the deployment phase. The announced collaborations and the future development of the market will determine to what extent Artrade will be able to expand its user base and strengthen its legitimacy in the tokenized art sector.

Assets and limits of the Crypto Artrade project

Favorable points

- Global approach : Artrade is not limited to the simple NFT Marketplace, it incorporates an authentication solution (Real Protocol), a social dimension and fractionalization.

- Solana : The choice of this blockchain (fast, ecologically sober) could attract users concerned with costs and environmental impact.

- DAO : The ambition to delegate part of the decisions to the community meets the values of decentralization.

The challenges to anticipate

- Restricted adoption : The platform remains confidential if it is compared to Opensea or other more established solutions.

- Regulations : The tokenization of real assets (RWA) is a complex terrain, subject to controls according to the courts.

- Modest capitalization : financial resources could restrict the deployment of marketing campaigns or the ability to get major partnerships.

- Risks linked to migration : The transition from BSC to Solana requires managing a sometimes delicate transitional phase (conservation of the rights of early adopters, tokens safety, etc.).

Where to buy ATR?

However, it should be recalled that these actors do not have PSAN approval (service provider on digital assets) and that an additional level of vigilance is therefore necessary and that Bitget is even on the black list of the AMF.

In addition, users wishing to favor a decentralized approach can resort to decentralized Exchange) on the Solana , accessible via a non -custom portfolio (for example Phantom). This solution helps keep control of your private keys and to manage your chips yourself.

More information here

Roadmap and next steps

Artrade regularly publishes his roadmap . Here is an overview of the objectives set, with the awareness that certain deadlines can evolve:

Q4 2024 :

- Web3auth Integration (Google, other sign-ons).

- Operational Artrade Wallet

- Card payments (Moonpay).

- Draft of an international crypto marketing campaign.

Q1 2025 :

- luxury brands .

- Improvement of UX /IU and launch of a more automated income-sharing

Q2 2025 :

- Reinforced participation in Paris Blockchain Week .

- R&D on Rwa Collateralization : Possibility of using fractionalized works as collateral in certain DEFI .

Q3 2025 :

- Integration of Chainlink for Oracles.

- Research and development on Real World Assets (RWA) and decentralized finance.

Q4 2025 :

- Advanced partnerships with luxury houses .

- Implementation of an infrastructure tokenization for other markets.

This roadmap is ambitious, but delays or adjustments are common for any crypto project. It is therefore wise to consider these milestones as objectives rather than guarantees.

Conclusion: a project to follow, but also in the development phase

Artrade is positioned as an actor seeking to reduce the entrance barrier to the world of art based on the blockchain . Its concept of fragments Real protocol , and the possibility of governance via the DAO demonstrate a desire for innovation. However, its status as a small capitalization and its progressive deployment mean that the platform has not yet acquired a fame or a financial base comparable to other big names in the web sector3.

For enthusiasts of NFT and art, Artrade represents an opportunity to discover the emergence of tokenization applied to works. It is nevertheless prudent to remember that the success of this type of project depends on multiple factors: adoption of the general public, seriousness of technological development, respect for regulations , and ability to keep its promises of Roadmap.

As always, be sure to do your own research (Dyor) above all investment . The crypto market remains volatile, and a young project, despite its good ideas, requires time to prove its viability. Artrade is one of those projects to follow with interest.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .