Binance Leverage: How Margin Trading Works on Futures Contracts

Are you looking to understand what leverage is on Binance and how to take advantage of it on futures contracts ? The idea is simple: borrow additional capital to increase the size of your positions without having to commit all of your funds. But be careful, leverage doesn't just amplify gains; it also increases potential losses . Here, we'll explain step by step how it works, the specifics of the Binance , and, most importantly, how to manage these risks Binance futures contracts are not available in some countries, including France.

Table of contents

What is leverage: basic principles

Leverage is a common practice in traditional finance that involves using borrowed funds trading platform , or exchange) to open a position larger than your own capital. With Binance leverage , the platform allows you to increase the size of your trade up to 125 times your initial investment, depending on the asset and your risk tolerance .

When you use leverage of x10 or x20, for example, it means that for every $100 invested, you can potentially risk $1,000 or $2,000 respectively on the market. The appeal? Potentially multiplied gains if the market moves in your favor. The downside? losses if the market moves against your expectations.

Leverage and margin call

When discussing leverage , we must also mention margin calls . This occurs when your margin (the amount you've actually invested) is no longer sufficient to cover the potential losses on your position . In this case, the platform will ask you to either inject additional funds or risk an liquidation of your trade to repay the loan.

The advantages of leverage on Binance

- Variety of cryptocurrencies : Binance offers a wide selection of futures contracts ( BTC / USDT , ETH/ USDT , BNB / USDT , etc.) with different levels of leverage .

- Solid reputation : Binance is one of the most popular crypto exchanges, with often high trading volume, which limits slippage and ensures good liquidity.

How does leverage work on Binance Futures?

The futures account and leverage selection

To benefit from Binance leverage , you must first open a futures account on the platform. Once logged in:

- Go to the Futures .

- Choose the pair you wish to trade (e.g. BTC / USDT , ETH/ USDT ).

- Adjust the leverage level : you can select, for example, x5, x10, x20… up to x125 on some contracts . The higher the leverage, the greater the risk .

- Transfer the funds ( USDT , BUSD or other stablecoin ) to your wallet to have a starting margin

Once your leverage is defined, you can open a long position if you anticipate a rise in the price, or a short position if you think the value will fall.

Cross margin and isolated margin

Two margin are offered to manage your leverage on Binance :

- Cross margin : your entire futures can be used to avoid liquidating a position . This can protect short-term positions, but increases the risk of losing your entire balance in the event of extreme market movements.

- Isolated margin : you allocate a specific amount to each position. Therefore, liquidating one currency pair does not affect your other positions. This is recommended to limit losses and compartmentalize your strategies.

Choice of margin method

- If you are a beginner , prioritize isolated margin trading . You will know exactly how much you risk per position .

- Cross margin may be of interest to more experienced traders, capable of monitoring several positions simultaneously, while accepting a higher risk

Essential tools for successful leveraged trading on Binance

Stop-Loss and Take-Profit

To limit the risks , you can define:

- Stop-Loss : an order triggered automatically as soon as the market reaches a certain price below it. It closes the position to prevent excessive losses

- Take-Profit : an order that locks in your profits when the market reaches a target price. This allows you to secure a gain without waiting for a potential reversal.

In Binance Futures , these two orders are often placed simultaneously. You specify the desired exit profit , and the acceptable loss limit.

Order Types

- Limit order : you set the price at which you wish to enter the market. If the price does not reach this limit, your order is not executed.

- Market order : you enter immediately at the best market price. The fees are generally slightly higher (taker) than for a limit order.

- Stop order : this is a conditional order, triggered only if the price crosses a certain threshold.

Understanding the financing rate

You will regularly encounter the concept of funding rates . This is a periodic adjustment mechanism (generally every 8 hours) between long and short . When the market is predominantly bullish, the "longs" pay a small percentage to the "shorts," and vice versa. This system maintains the convergence between the price of the perpetual contract and the spot price of the cryptocurrency .

A concrete example of using leverage on Binance

Let's say you have $500 in your futures account , and you decide to open a long position on BTC via the BTC / USDT contract . You select a leverage of x10 , allowing you to control a notional value of $5,000 (10 times more than your actual margin).

- Entry price : $26,000 per BTC

- Position size : 0.1923 BTC (approximately $5,000 / $26,000)

- Stop-Loss : at $25,000, to limit losses if the market falls.

- Take-Profit : at $27,500, if you are aiming for a quick rebound.

If the price rises to $27,500, your gain is (27,500 – 26,000) * 0.1923 = $288.45. On an initial capital of $500, this is a profit of approximately 57% (excluding fees). Conversely, if the market collapses to $25,000, you lose approximately $192.30, which is already 38% of your $500. Without leverage , your gains and losses would have been more moderate.

Without leverage , with the same $500, you could only have bought 0.0192 BTC ($500 / $26,000). A rise to $27,500 would have generated a profit of approximately $28.85 (5.77%) , and a fall to $25,000 would have resulted in a loss of $19.23 (3.84%) . Leverage therefore amplifies both gains and losses.

The different levels of leverage on Binance

From x1 to x125

- x1 : actually means that there is no leverage effect , but a simple notional exchange.

- Between x2 and x20 : common for beginner traders who want to slightly increase their exposure without running excessive risk.

- Beyond x20 (x50, x75, x100, x125): reserved for highly experienced traders aware of the volatility of the crypto market. The risk is enormous, as a 1% price fluctuation can wipe out your margin if you use excessive leverage.

Managing the risks of leveraged trading on Binance

Set a "maximum loss" budget

- Before each position , clearly determine the amount you are willing to lose. Leverage should always be chosen based on this budget, and not the other way around.

- If you are aiming for profit , make sure you have stop to cut your losses quickly.

Analyze market volatility

- The crypto market is highly volatile. A 2-3% drop in a matter of minutes is relatively common. With 50x leverage , your margin could disappear in an instant.

- Monitor support and resistance levels, as well as major announcements (project launches, regulatory decisions) that could cause the price to move against you. Also, be wary of potential market manipulation by large investment funds/ market maker who may deliberately disrupt liquidity to buy lower or sell higher.

Diversification strategies

- Some traders simultaneously use several moderately leveraged positions extremely leveraged position risk .

- It is also possible to hedge a long position on one cryptocurrency with a short position on another, if they are correlated. This is called hedging .

Binance Leverage FAQ

How long can you hold a leveraged position?

Perpetual futures contracts on Binance Binance no expiry date, meaning they can be held indefinitely, provided the trader meets the margin requirements .

Margin requirements refer to the minimum capital you must maintain in your account to cover your position. They are divided into two categories:

- Initial margin : Amount required to open the position.

- Maintenance margin : Minimum level to be respected to avoid liquidation.

If your account balance falls below this maintenance margin , Binance will automatically liquidate your position to limit losses.

Furthermore, the financing rate , which is a periodic fee paid between long and short traders to align the contract price with the spot market price, can become prohibitively expensive . When this rate is high, maintaining an open position over the long term becomes costly, thus reducing overall profitability and increasing the risk of depleting available capital. If a high financing rate and insufficient margin , liquidation becomes inevitable.

What are the fees on Binance Futures?

Binance bill:

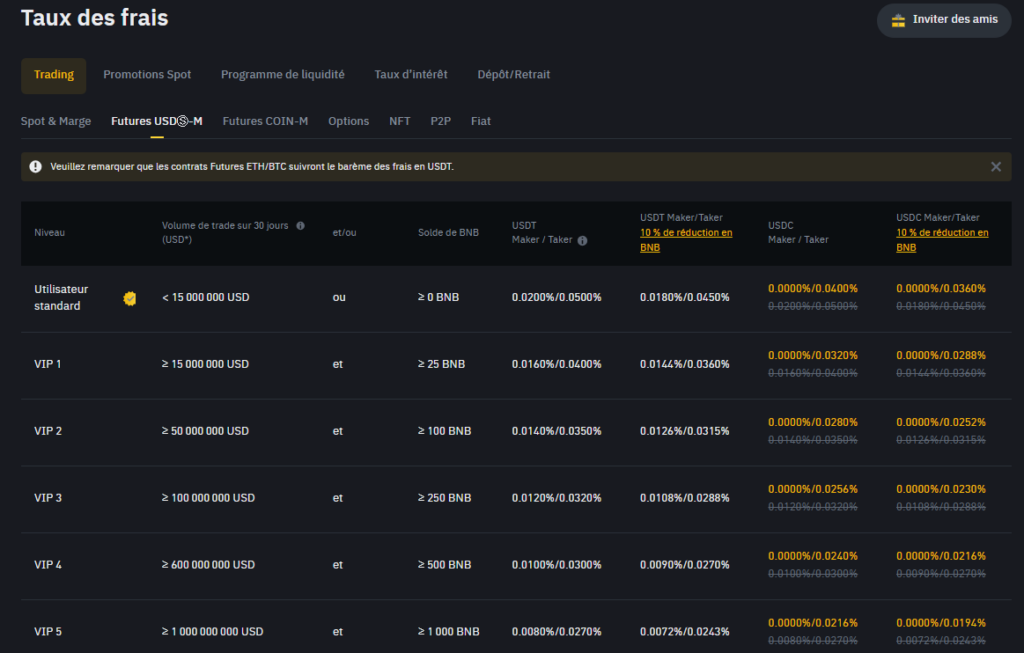

- Trading fees vary depending on whether you are a Maker or a Taker Binance user , the fees are as follows:

- A funding rate : this varies every 8 hours and depends on whether the position is "long" or "short". Based on this rate, you pay or receive a small, regular percentage.

How to avoid liquidation?

- Choose a leverage , less than x10 if you are a beginner .

- Place Stop-Loss to cut losses before reaching your liquidation price .

- Monitor the margin ratio : if you are working with isolated margin , you know exactly how much you are risking.

How to get started smoothly with leverage on Binance

1. Study the fundamentals of the crypto market

If you've never traded , start with spot trading . Learn to interpret candlesticks and identify trends. This way, you'll be less surprised when you add leverage .

2. Choose a low leverage

- Start with x2 or x3 , just to familiarize yourself with the risks .

- Avoid jumping straight to x20 or x50, even if you're aiming for big gains .

3. Define clear objectives

- Profit target : set a percentage or price at which you will sell part or all of the position .

- Loss threshold : from the opening, place a Stop-Loss to avoid losing more than a certain amount.

4. Monitor the calendar and current events

Leveraged trading can backfire during major events :

- Publication of macroeconomic data.

- Speeches from regulators or major figures in the crypto market.

- Fork or launch of a major protocol update (e.g.,Ethereummerge).

Advantages and disadvantages of leverage on Binance

Benefits

- Capital multiplication : you control a larger position

- Flexibility : you can easily make it long or short , and enjoy every movement.

- Diversification : with a small amount of capital, you can open several positions on different cryptocurrencies at the same time.

Disadvantages

- Rapid loss : a hostile market can wipe out your margin in moments.

- Financing rates : if you hold your position , these fees can eat into your gains .

- Stress : Following a volatile market while being exposed to three, five or more times your initial investment can be mentally taxing.

Common strategies in futures contract trading

Scalping or day trading

Scalping involves opening and closing positions over very short periods (a few seconds to a few minutes). With leverage , you can execute several micro-trades in a single day. The downsides are the stress and transaction fees .

Swing trading

Swing trading targets time horizons of a few days to a few weeks. You look for clearer trends stop-loss order . Binance leverage here can be 5x or 10x , to capitalize on a clear price movement.

Hedging

If you already hold Bitcoin or Ethereum Ethereum the spot market, you can open a leveraged short position to hedge your assets against a price decline. This allows your losses on the spot price to be offset by the gains from the short position.

Conclusion: The keys to mastering Binance leverage

In summary, Binance leverage earning potential , but also carries a risk of losses . Key points include:

- Determine your risk profile : do not use too high a leverage if you are a beginner .

- Protect each position : Stop-Loss and Take-Profit are essential to avoid unexpected liquidation.

- Monitor the funding rate and volatility : stay attentive to market conditions, a simple “tweet” or news item can reverse the trend.

- Prefer the isolated margin if you want to compartmentalize your positions and not lose everything in the event of a sudden movement.

- Continuing education : read, practice on a demo account or with small amounts before committing with a large amount of capital.

By choosing leverage that suits your experience level, you can capitalize on future market while mitigating the impact of a sudden downturn. The key is to maintain control of your emotions , clearly define your objectives , and adhere to your trading .

One last remark

Never forget that the crypto market is one of the most volatile in the world. 10x leverage might seem appealing, but a mere 10% move against your bet is enough to wipe out your entire margin . Binance leverage should therefore be handled with care, especially when starting out in futures trading .

These are the fundamentals of leverage on Binance . Take the time to manage risk , learn how to use limit orders or stop orders , and don't hesitate to get more training before using excessive leverage. The ultimate goal: to grow your capital wisely, rather than seeing it disappear overnight.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .