Bitvavo Opinion: Complete experience return

Founded in 2018 in Amsterdam, Bitvavo is a European platform which is today a serious alternative to giants in the sector. Bitvavo was able to seduce a large audience thanks to a clear interface, a solid offer and competitive costs. Designed as a platform accessible to both beginners and experienced users, easy service

Bitvavo’s growth has been constant in recent years, and Bitvavo has crossed the 1.5 million users' milestone.

Bitvavo's intuitive interface facilitates navigation, identity verification is rapid, and the management of simplified assets. Bitvavo may not be the most known international platform, however it checks all the boxes for serious and secure use. BITVAVO also has reactive customer service.

On the price side, Bitvavo costs are among the most transparent and low on the market (up to 0.25 % maximum). Our opinion on the costs is therefore favorable, especially for beginners who wish to avoid unpleasant surprises. Note that Bitvavo is also regulated by the central bank in the Netherlands, which adds an additional level of confidence.

In short, whether you use Bitvavo for occasional purchases or for staking , the services offered by Bitvavo fully justify its growing success in Europe. And if you have known Bitvavo before its boom, you will see that the platform has continued to evolve in the right direction. We will now examine all of this to provide you with our detailed opinion.

Table of contents

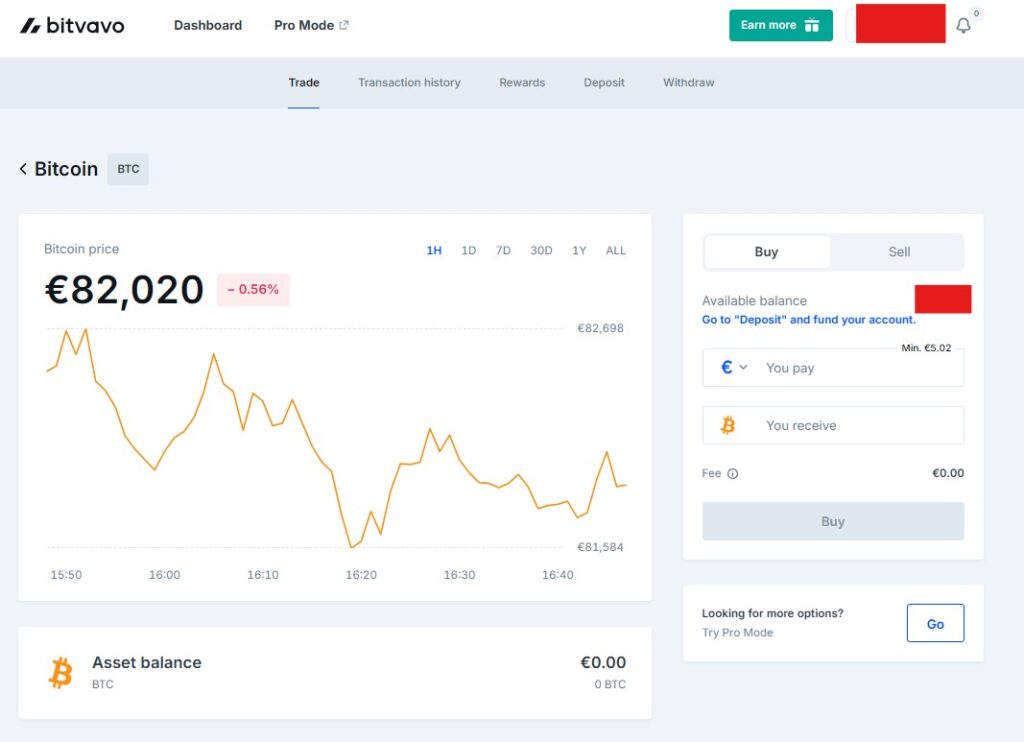

Opinion on Bitvavo: an ultra accessible interface, even for beginners

The interface is one of the strengths of the Bitvavo platform. Unlike other platforms that take you from the start on a professional trader dashboard, Bitvavo offers a simplified interface thought for crypto beginners.

Two separate interfaces, according to your profile

- Simplified interface : clear, intuitive platform, perfect for buying or selling some cryptos without taking the lead.

- Advanced interface (PRO) : Bitvavo Pro is a platform for those who want to access graphics, limited orders or other crypto trading .

It is very appreciable not to have to go through a complex environment when you start, while having the opportunity to go further if necessary.

0.25 %fees, even in simple purchase

Bitvavo in 2025 continues to stand out with a simple and transparent pricing policy. Unlike other platforms where the lowest transaction costs Bitvavo works differently: even on the simplified interface, the costs are capped at 0.25 %.

Concretely, this means:

0.25 % maximum of trading costs on purchases and sales in euros ( BTC /EUR, ETH /EUR, etc.), whatever the amount invested.

No spread : The price displayed for most cryptos is the real market price , with no hidden markups.

For some less liquid crypto pairs, a slight gap may exist, but Bitvavo is clearly posted before validation. It is rare, and always reported in a transparent way.

For more experienced traders that use Bitvavo's PRO interface, it is possible to obtain even more advantageous conditions, especially on USDC . On these markets:

Trading fees fall at only 0.05 % from the first volume level.

Additional discounts can reduce these costs up to 0.01 % for very large volumes (more than 100 million euros exchanged over 30 days).

In summary, Bitvavo in 2025 Combine accessibility and competitiveness: whether you are a beginner or active trader, the platform allows you to reduce your costs while maintaining a clear and efficient interface.

Even cheaper through USDC pairs

For comfortable traders with the PRO platform offering all the tools for a trading platform, Bitvavo offers USDC pairs where trading costs are very competitive. At Bitvavo:

- 0.05 % Maker/Taker fees from the first volume level, compared to 0.25 % on euros in euros.

- Additional discounts up to 0.01 % are possible in the event of a large volume (beyond € 100M over 30 days).

It is therefore competitive trading costs for those who want to minimize their costs in the long term.

Fiat deposits and withdrawals: the lowest costs on the market

As a European exchange platform Bitvavo offers its users simple and inexpensive options to deposit or withdraw euros.

The SEPA transfer is particularly highlighted: Bitvavo offers costs of 0 % both for deposits and for withdrawals through this, without minimum required.

For faster alternatives such as payments by bank card, Paypal or Somort, Bitvavo displays variable costs, generally between 1 % and 2.25 %, depending on the service provider.

Once your account has been credited, Bitvavo will send you an immediate confirmation, and the funds are generally available in stride to go to the purchase of cryptocurrencies.

All prices are clearly displayed on the official page:

👉 bitvavo.com/fr/frais - a readability model compared to the average of the sector.

More than 350 cryptocurrencies available on Bitvavo

Bitvavo offers a very solid catalog of cryptocurrencies, perfectly suited to the needs of the vast majority of users. In total, Bitvavo offers more than 350 digital active ingredients, including major blockchains as well as recent tokens with high potential.

Among the cryptocurrencies on Bitvavo , we find of course the essentials:

Bitcoin, Ethereum , Solana , Polygon , Avalanche , Cardano , Aptos, Suit…

Many ERC-20 , SPL and tokens related to emerging sectors such as artificial intelligence or the depolition .

The main stablecoin s like USDT , USDC or DAI are well supported.

Bitvavo also covers a variety of recent A ltc as well as several projects from the DEFI .

On the other hand, you have to qualify for very specialized profiles: if you are looking for very exotic Bitvavo crypto memecoin ultra-best or projects listed in the very first hours of their launch, Bitvavo will not be the most complete exchange. That said, for around 95 % of users, the available offer is more than enough.

Bitvavo customer service: responsive and available

Support available by email and form

- Response within 24 at 48 hours worked.

- Mainly Dutch in English or Dutch

- A well -supplied knowledge base for frequent questions .

In the event of a problem of identity verification , blocked deposit or sending error, the support team is competent and complies with clear procedures.

Regulation, safety and guarantees, Bitvavo is reliable

Bitvavo is registered with the Central Bank of the Netherlands (DNB) as PSAN (service provider on digital assets). Based in Amsterdam, the platform operates in a strictly regulated framework, far from the fuzzy standards of certain offshore structures. Note that Bitvavo now exceeds 1.5 million users, proof of the growing confidence it inspires. The company has crossed an important course by consolidating its position as one of the main European exchanges.

Unlike other unregulated actors, Bitvavo acts:

In accordance with European Union legislation

By applying the anti-balance directive (KYC, user verification, transactions monitoring)

By storing customer funds on separate accounts, a model similar to that of Binance Europe

By maintaining an infrastructure in accordance with European accommodation requirements

Bitvavo is also registered with the AMF in France , which facilitates its use by French customers by guaranteeing a clear legal framework.

Each user account benefits from advanced security measures: two-factors authentication (2FA), connection alerts, compulsory confirmation by e-mail for any withdrawal. In summary, the security of funds and personal data is processed with seriousness and transparency.

Bitvavo review: does it offer real crypto insurance?

Bitvavo does not offer regulatory crypto insurance, but an advanced protection system via its account warranty on each Bitvavo account . You can obtain a refund up to € 100,000 in the event of unauthorized access to your account, provided you have activated basic safety measures (such as 2FA) and not have been neglected.

The majority of assets are stored with depositaries insured up to 755 million euros, and the covered cases include:

- Theft of crypto money by fraudulent access,

- Unauthorized transfers in euros .

This isn't official insurance or a mechanism equivalent to bank guarantees, but it's a rare safety net among exchanges. That said, for large amounts, it's always better to use a wallet like Ledger .

Reviews on Bitvavo: Advanced features, staking and Lending

Bitvavo offers two options often sought by more experienced users: staking and crypto currency . Even if the platform is primarily intended for beginners, it does not forget the features that make it possible to make its cryptocurrencies grow .

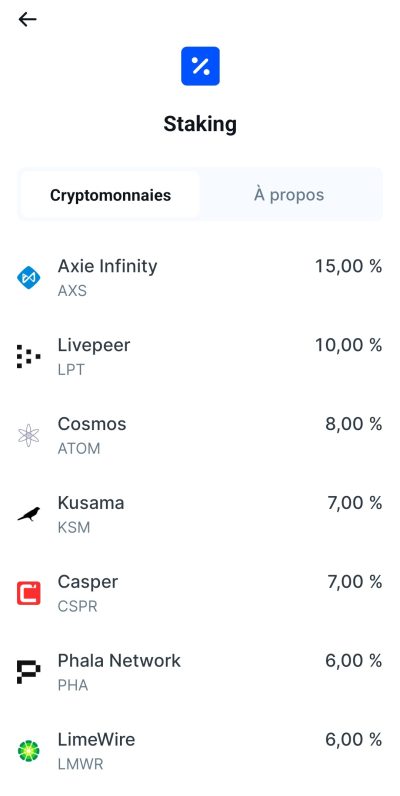

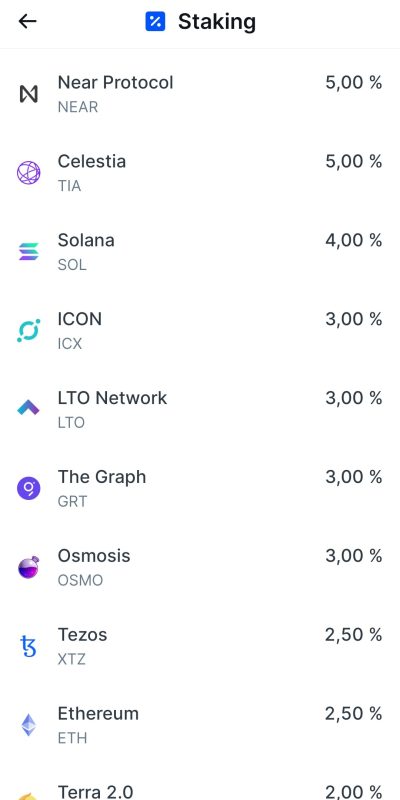

Staking on Bitvavo

Stoking Bitvavo allows you to generate rewards by immobilizing certain cryptocurrencies directly from your portfolio on the platform staking Bitvavo staking service , without a technical configuration or complex handling: everything is done in a few clicks, without having to interact with validators or manage manual delegations.

Although the catalog is not as wide as on some specialized exchanges, it remains very relevant. Crypto stuking on Bitvavo covers the main active ingredients sought by users, such as Solana , Ethereum , Near Protocol , staking Cosmos .

Rates of return vary depending on the asset, with competitive percentages ranging from 2 % to 15 %. Here are some concrete examples:

Axie Infinity (AXS) : 15,00 %

Livepeer (LPT) : 10,00 %

Cosmos (Atom) : 8,00 %

Ethereum (ETH) : 2,50 %

For a beginner or intermediate investor, it is a practical solution to do staking without getting your funds from the platform. The compromise between simplicity of use and passive return is well found.

Lending: a bonus option that is not very widespread

Lending Crypto is still rare on centralized platforms regulated in Europe. Bitvavo stands out by offering this functionality, even if it is not yet activated by default. The yields are more modest (between 0.05 % and 5 % ) but allow you to generate a passive income on assets like Bitcoin , Curve Dao Token , Alchemy Pay or Layerzero .

Even if this feature remains limited for the moment, it enriches the global offer and offers an additional portfolio management for more advanced users. It is also proof that Bitvavo seeks to evolve towards a more complete platform, by gradually integrating services defined in its centralized layer.

Bitvavo vs competitors: which distinguishes it

What strikes with Bitvavo is the right balance between simplicity, low costs and serious regulation. Here are some comparisons:

- Binance : No more cryptocurrencies but more complex to handle, especially for a beginner.

- Coinbase : just as simple to start, but extremely expensive in comparison.

Verdict: Do we recommend Bitvavo?

Very clearly, yes. For a European user especially a beginner, it is one of the best entry doors to the universe of cryptos. I particularly appreciate:

- Clarity of costs (it should be the norm everywhere).

- The possibility of having a simple interface without paying exorbitant costs.

If you are looking for a simple, secure platform without a pricing trap, Bitvavo is a safe bet.

Summary table: Bitvavo strong and weak points

| Strengths | Weak points |

|---|---|

| Very intuitive beginner interface | Good catalog of cryptos but not exhaustive |

| Competitive fees with 0.25 % max on the platform for beginners, without hidden Spreads unlike certain platforms, and 0.05 % maximum costs on the PRO platform on USDCpairs. These trading costs fall according to the volume of trading. | Native French -speaking customer support |

| Registered with the Dutch financial authorities and other certifications (PSAN, etc.) | |

| Free SEPA deposits and withdrawals |

How to open an account at Bitvavo

To open an account at Bitvavo , simply go to the Bitvavo site and follow a simple registration procedure, including a compulsory identity verification ( KYC ) . Bitvavo is registered as a service provider on digital assets with the Central Bank of the Netherlands (DNB), which guarantees a serious regulatory framework. Once the account has been validated, depositing funds on Bitvavo can be done by bank transfer, card or other means of payment depending on your country.

Bitvavo: a clear, competitive and complete platform

To conclude, Bitvavo allows you then buy, sell and store more than 350 cryptocurrencies. This platform also offers services staking accessible in a few clicks. Bitvavo is positioned as a very good compromise between low And Simplicity of use. She Allows users to easily manage their assets, with transparent and competitive costs. Finally, the Bitvavo customers benefit from a clear and intuitive interface, as well as a reactive support, including in the event of high activity on the markets.Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .