Bitvavo Staking : A Complete Guide to Maximizing Your Returns

Staking on Bitvavo allows users to earn passive income by staking their cryptocurrencies. With rates of up to staking % and a user-friendly interface for beginners, Bitvavo offers an accessible solution for investors looking to optimize their digital assets. For a more comprehensive overview of the platform, we invite you to read our full Bitvavo review .

Table of contents

What is staking and why on Bitvavo?

Staking staking , used by many blockchains such as Ethereum , Solana , and Cosmos. It involves locking a certain amount of cryptocurrency to participate in block validation and network security. In return, users receive cryptocurrency rewards, typically expressed as an estimated annual yield (APY).

In a Proof-of-Work (PoS) network, validators replace miners. Their role is to:

- Verify and record transactions in new blocks

- Ensuring the proper functioning and security of the network

- Receive rewards distributed by the protocol, based on their reliability and commitment

But becoming a validator often requires a significant minimum investment (for example, 32 ETH for Ethereum ), dedicated IT infrastructure (servers connected 24/7), and advanced technical skills . Fortunately, there are other ways to participate in staking without having to become a validator yourself:

- Directly via certain non-custodial wallets like Ledger delegated staking options

- By connecting your wallet to a staking dApp dApp such as Lido, Rocket Pool or StaFi)

- Or more simply, by using a centralized exchange like Bitvavo

Bitvavo: an accessible staking intermediary

Bitvavo allows its users to enjoy the benefits of staking without any technical setup. In practice, the platform acts as an intermediary : it users' funds delegates them to carefully selected third-party validators , or uses its own validation nodes , depending on the asset in question.

As soon as an asset is compatible with the Bitvavo Rewards and the option is activated in the interface, everything happens automatically:

- Selection and management of validators by the Bitvavo team

- Weekly distribution of cryptocurrency

- Intelligent allocation between staking and lending based on market opportunities

Validators are selected through a rigorous due diligence , based on:

- Their performance history on the blockchain

- Their operational reliability and uptime

- Their reputation within the ecosystem

- Their compliance with the security protocols of the network in question

staking summary, staking via Bitvavo is:

- Accessible to all , with no minimum amount or technical skills required.

- Liquid , the assets can be exchanged or withdrawn at any time

- Potentially profitable , with competitive yields of up to 15% for some tokens like AXS

How do I staking on Bitvavo?

Steps to activate staking

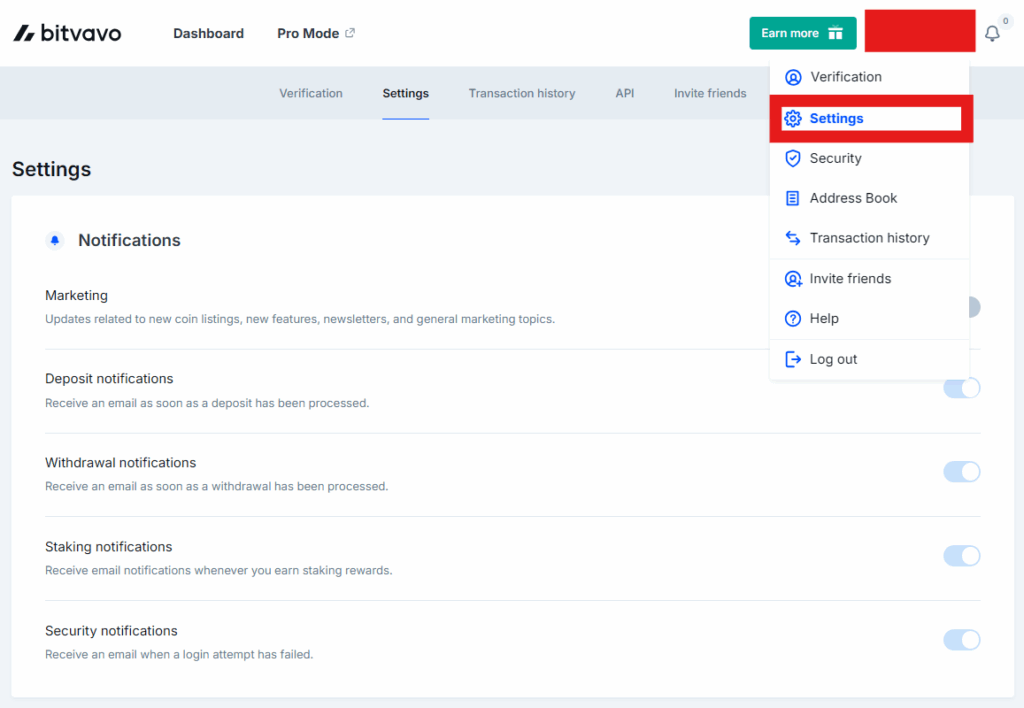

- Log in to your Bitvavo account.

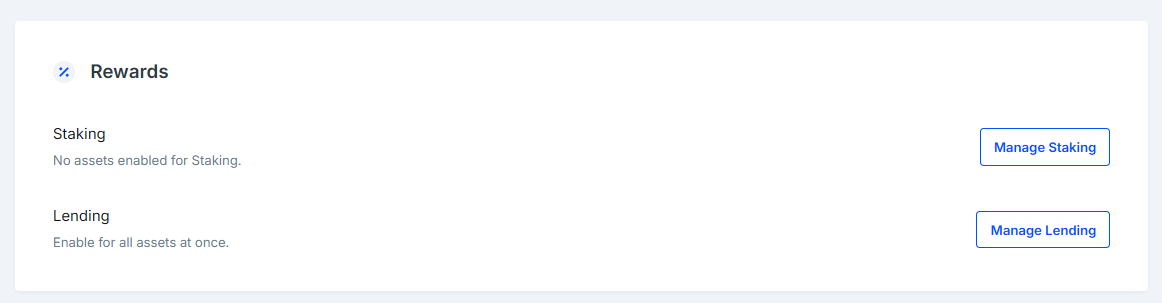

- Access the " Settings" in the dashboard, then "Manage Staking ". On the mobile version, go to "Account" then " Staking ".

- Select the assets you wish to stake.

- Activate the staking option for each asset chosen.

Once activated, staking starts automatically, and you begin to accumulate rewards.

Cryptocurrencies eligible for staking

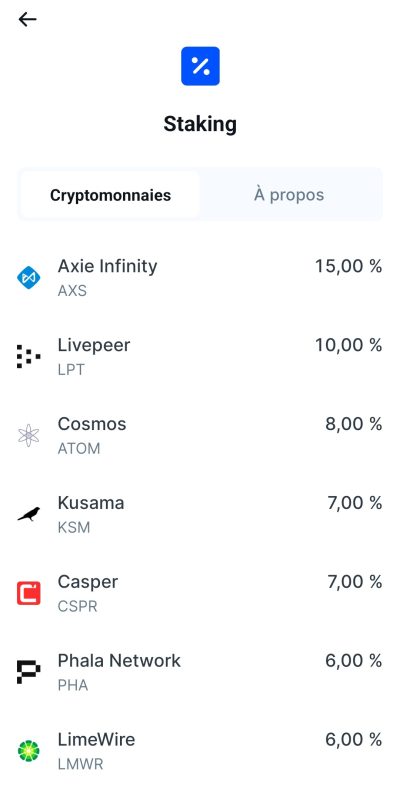

Bitvavo offers a variety of assets for staking, including:

- Axie Infinity (AXS) – up to 15%

- Livepeer (LPT) – up to 10%

- Cosmos (ATOM) – up to 8%

- Kusama (KSM) – up to 7%

- Phala Network (PHA) – up to 6%

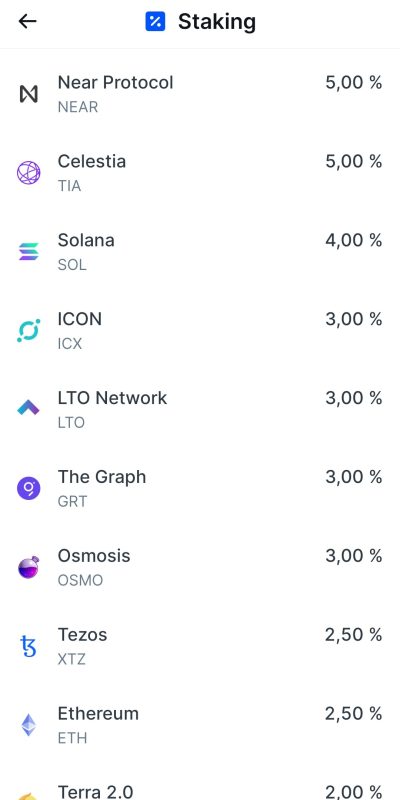

- Near Protocol (NEAR) – up to 5%

- Solana (SOL) – up to 4%

- Ethereum (ETH) – up to 2.5%

- Cardano (ADA) – up to 1.5%

Reward rates are subject to variation depending on market conditions.

Frequency of payments

staking rewards are calculated daily and paid out weekly, usually on Mondays, directly to your Bitvavo account.

Why choose staking on Bitvavo rather than elsewhere?

Staking is now accessible in several ways: via a personal wallet Ledger ), a dApp staking and security. Here's what truly sets Bitvavo apart.

Barrier-free accessibility

- No minimum amount is required to activate staking : you can start from the first euro invested.

- Unlike solutions such as Ethereum solo-staking (32 ETH required), Bitvavo allows you to stake in a few clicks, without significant capital.

Total flexibility over your assets

- No lock-up period : your assets remain available at any time for trading or withdrawal.

- Most dAppor wallets impose a delegation/return delay, sometimes several days. Here, you maintain continuous control.

Transparency regarding yields

- Reward rates are visible in advance on the user interface for each cryptocurrency.

- Unlike some platforms where returns are unclear, Bitvavo clearly indicates whether it is staking or lending, and specifies the exact rate.

Security managed by the platform

- Bitvavo rigorously selects its validators and partners, limiting the risks associated with technical errors or slashing.

- Users do not manage their own nodes , unlike in decentralized solutions: less risk of error, less direct responsibility.

Tax implications of staking on Bitvavo

Rewards earned through staking taxable income in most countries . Depending on your place of residence, this may impact your tax return (e.g., the BNC tax regime in France or tax in other jurisdictions).

- Bitvavo does not withhold tax at source.

- Rewards are paid in crypto and automatically accumulate in your wallet.

- Consult a tax advisor or your local government to understand your reporting obligations.

What are the specific risks of staking on Bitvavo?

No solution is without risk. Here are the main things to keep in mind if you stake via Bitvavo:

Market volatility

- As with any cryptocurrency, the value of the assets you stake on Bitvavo can fluctuate significantly. Even if you receive stakingrewards, a substantial drop in the asset's price can far outweigh the return earned. For example, a 10% annual return does not necessarily compensate for a 30% drop in the price of the staked cryptocurrency.

Risks associated with the staking protocol

Lock-up period and liquidity

For some cryptocurrencies, staking involves a lock-up period during which you cannot sell or transfer your assets. This can lead to losses or missed opportunities if the market moves rapidly. While Bitvavo offers flexible staking on many assets, there are exceptions where unlocking can take several days.

Regulatory developments

- staking is increasingly monitored by financial authorities (SEC, AMF, etc.). Future restrictions could limit the supply or modify the associated taxation.

- As Bitvavo is a platform regulated in the Netherlands, any legislative developments in the EU could influence its stakingservices.

Conclusion

staking on Bitvavo offers an attractive opportunity to generate passive income with your cryptocurrencies. Bitvavo positions itself as an attractive platform for investors looking to optimize their digital assets.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .