Transparency is a promise in blockchain, but in practice, tracking token flows and understanding fund allocation can quickly become complex. Who actually owns an asset? How do funds circulate? What signals might indicate market manipulation?

This is where Bubblemapscomes in, a tool that visualizes transactions and connections between wallets as interactive bubbles. Its main objective is to simplify on-chain analysis by making visible clusters of interconnected wallets, accumulations by whales, and anomalies in token distribution.

Thanks to Bubblemaps , it becomes possible to:

✔️ Quickly identify the main stakeholders in a project.

✔️ Identify connections between wallets and their interactions.

✔️ Detect potential manipulation patterns, such as wash trading.

✔️ Analyze the evolution of a project by visualizing the transaction history.

In this guide, we will first explain how Bubblemaps in general, before analyzing a concrete case: the Jupiter (JUP) on Solana , cross-referencing the data with Arkham , Tokenomist and CoinMarketCap for an in-depth study.

Table of contents

How to Access Bubblemaps and Select a Blockchain

The tool is partially accessible for free, but some advanced features require a connection via a Web3 (MetaMask, Exodus etc.) or an X account (Twitter).

Bubblemaps features , you need to hold 250 billion Moonlight tokens, which allows you to:

✔️ Explore all DeFi and NFT collections in depth.

✔️ Access the complete map history (Time Travel) and refresh data.

The free version still allows access to a substantial range of information.

Once connected, you can choose which blockchain to analyze from those supported:

- Ethereum

- BNB Chain

- Solana

- Avalanche

- Polygon , etc.

📸 Example: we will use several examples, Reserve Rights on Ethereum, the Squiggles NFT collection on Ethereum and finally Jupiter on Solana.

Exploring a Token with Bubblemaps : Connections and Clusters

Once the blockchain has been selected, it is possible to search for a specific project by entering its name or contract address.

Bubblemaps then generates an interactive map that displays:

🔹 Bubbles representing each wallet – The larger the bubble, the more tokens it holds.

🔹 Connections between bubbles – These illustrate transactions between wallets.

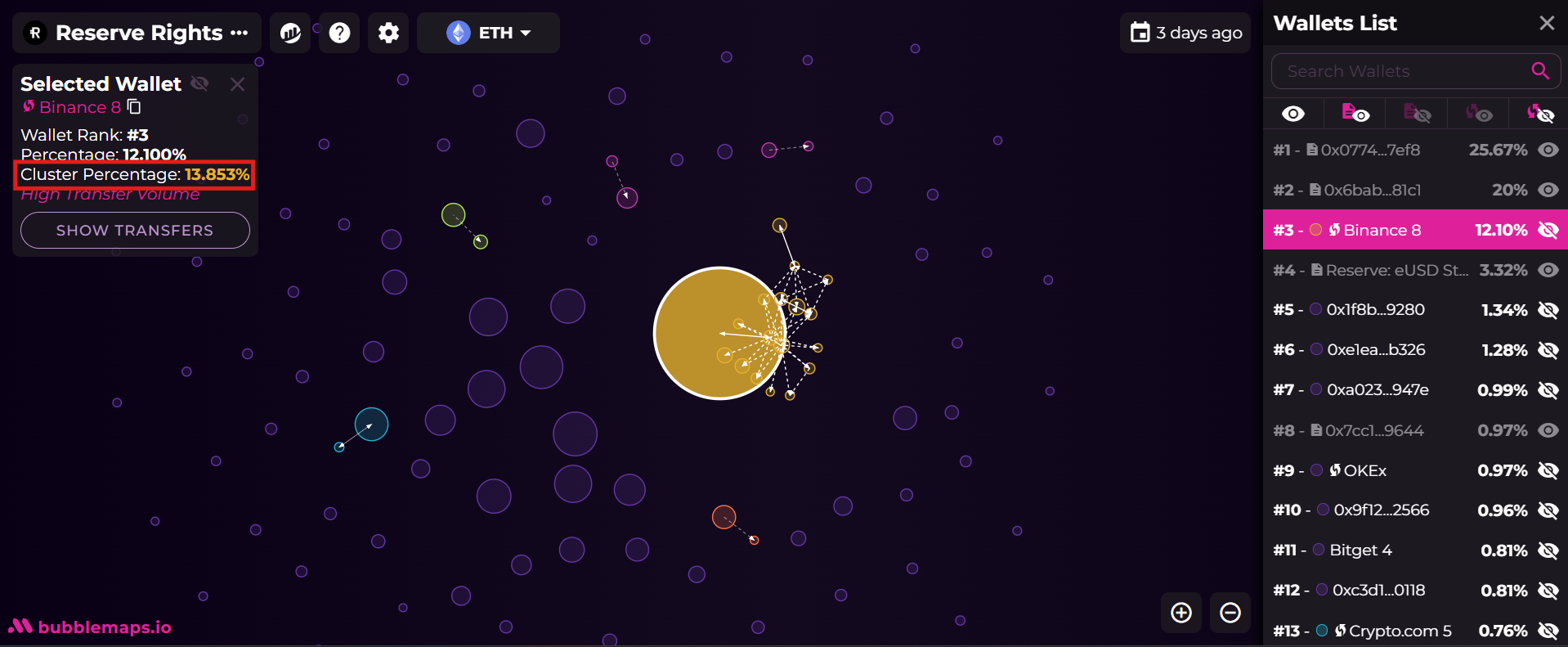

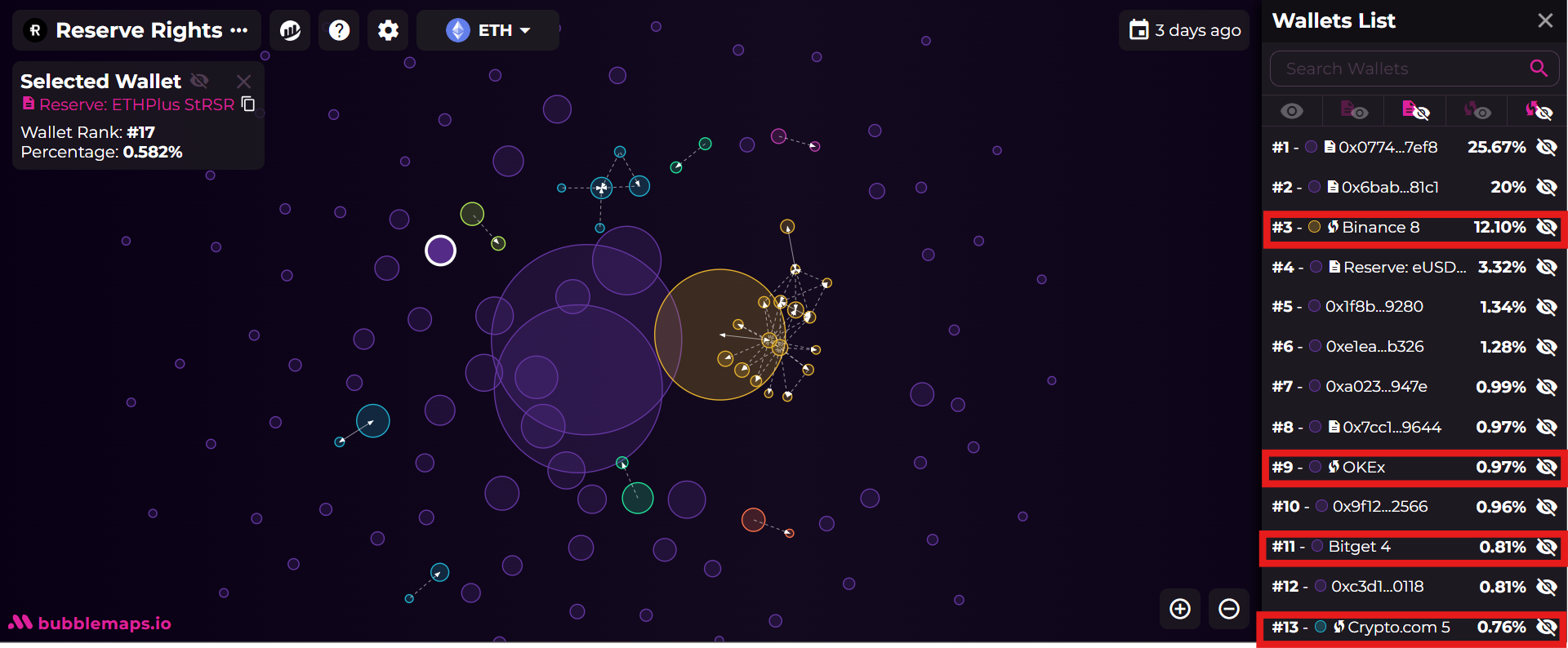

🔹 Colors indicating clusters of linked wallets – This allows you to identify groups of wallets that frequently interact with each other (example below with a Binance Ethereum blockchain ).

📌 Connections between wallets can mean several things:

✔️ A simple transfer of funds between wallets belonging to the same user.

✔️ A transfer to or from an exchange platform (CEX or DEX).

To learn how to use a decentralized wallet, we offer our free step-by-step guide, with supporting screenshots.

What you will learn:

✔ Buying your first cryptocurrencies – A detailed tutorial to get started on a centralized exchange platform.

✔ Securing your transactions – Best practices for buying, selling, and trading cryptocurrencies while minimizing risk.

✔ Understanding stablecoins stablecoin Their usefulness, differences, and how to use them to stabilize your funds during periods of volatility.

✔ Mastering a decentralized wallet ( DeFi ) – Learn how to manage your assets without intermediaries and interact directly with the blockchain.

✔ Transacting via a decentralized wallet – A practical guide to trading cryptocurrencies independently.

✔ Exploring decentralized finance (DeFi) – Discover advanced concepts like staking and NFTs .

📥 Download your free guide by filling out the form below:

✔️ A wash trading scheme (see next section).

✔️ A planned distribution (team allocation, vesting , staking , etc.).

Bubblemaps offers two essential options for refining the analysis:

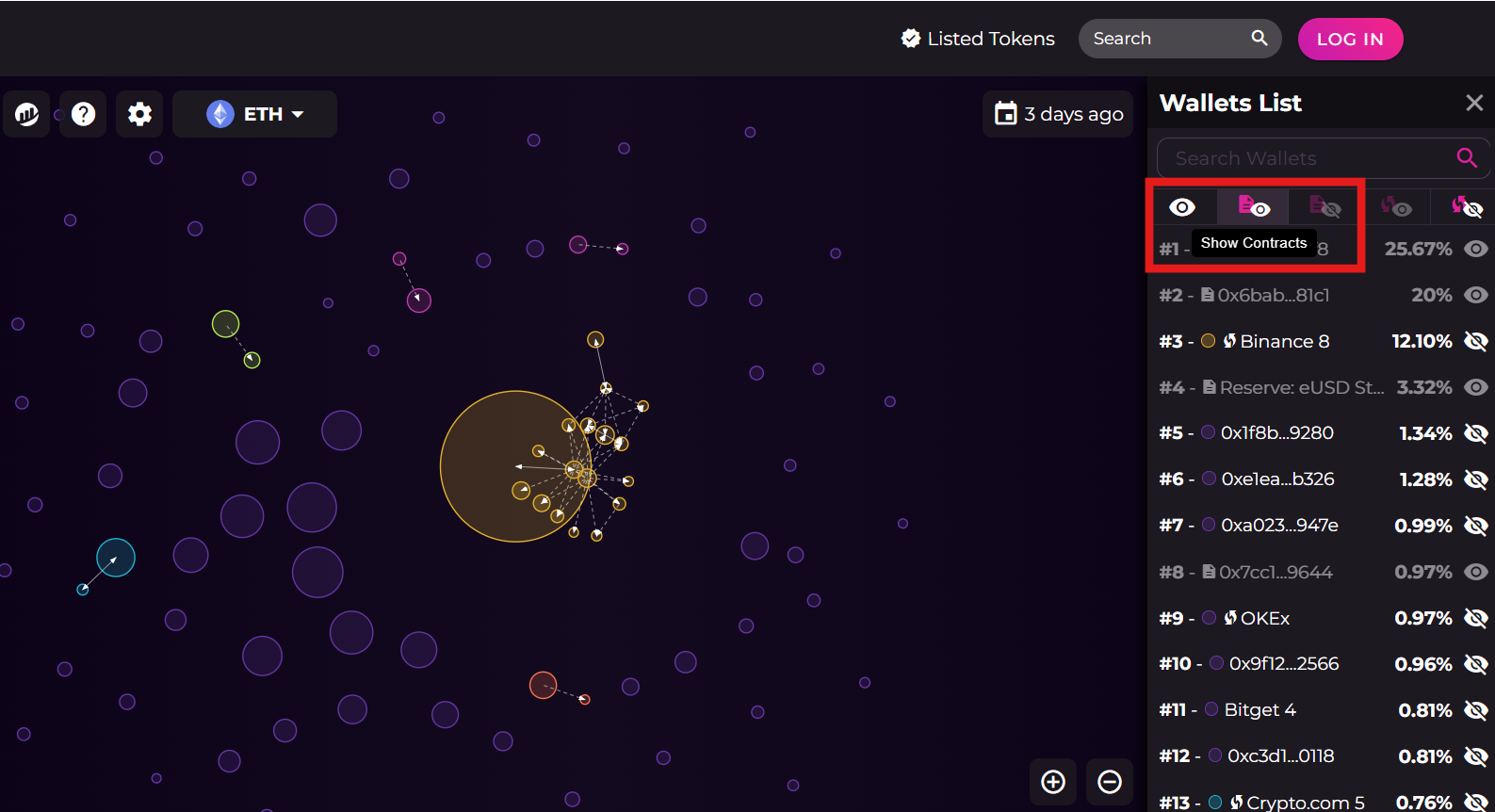

🔍 Show/Hide Contracts : Allows you to show or hide smart contract related vesting contracts , staking , or liquidity pools on DEXs.

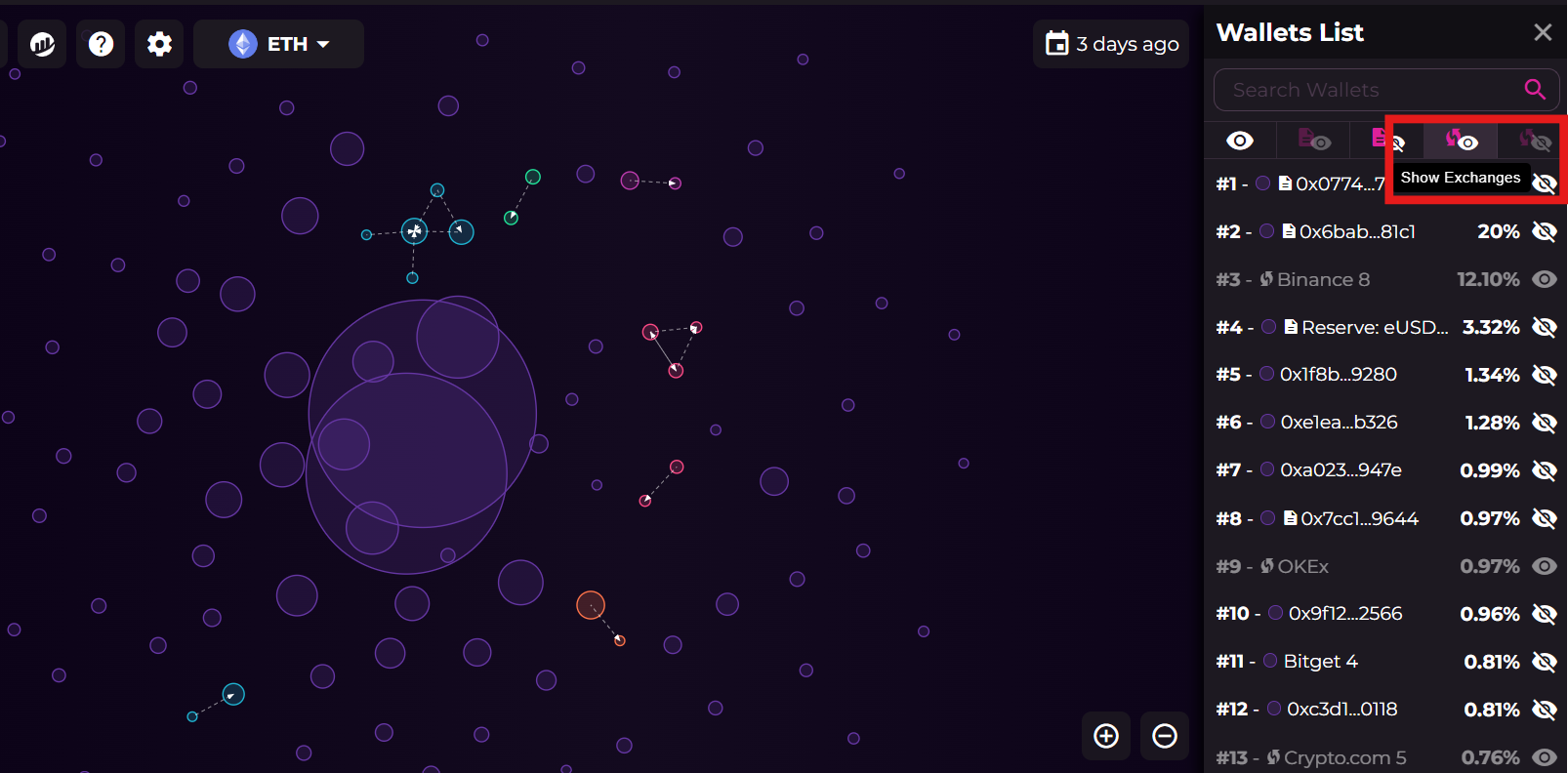

💱 Show/Hide Exchanges : Shows or hides wallets belonging to centralized exchanges (CEXs). These wallets are often used to store the liquidity of tokens available on the markets. This option helps identify if a large portion of the supply is held on a CEX, which can influence the token's liquidity and volatility.

Wash Trading: Why is Increasing Volume Advantageous?

Wash trading is a market manipulation practice where participants trade an asset among themselves to simulate significant trading activity.

📌 Why engage in wash trading?

✔️ Create a false sense of liquidity: Artificially increasing trading volume gives the illusion that the token is highly active.

✔️ Attract more investors: Traders and algorithms often identify high-volume assets. A token with high activity is more likely to attract new buyers.

✔️ Improve platform rankings: Exchanges and aggregators like CoinMarketCap often rank tokens based on their trading volume. Effective wash trading leads to higher rankings and increased visibility.

✔️ Facilitate exchange acceptance: A project with artificially high volume may appear more attractive to centralized exchanges, which seek to list popular tokens.

📸 Detection on Bubblemaps :

Wash trading can be spotted by observing repetitive connections between a small group of wallets, where tokens systematically return to the same addresses without significant external transactions.

Identifying and Understanding Clusters:

A cluster is a group of wallets that frequently exchange tokens with each other. Cluster analysis allows you to:

✔️ Determine the centralization of a token.

✔️ Spot suspicious activity, such as coordinated sales.

✔️ Identify fund management by a team or a DAO.

📌 Why is this important?

A very dense cluster controlled by a single entity can indicate that the project is highly centralized.

A group of wallets with repetitive transfers can suggest wash trading, a technique used to artificially inflate trading volume.

📸 Example: Some NFT projects like Squiggles have been exposed for wash trading. They could be detected on Bubblemaps .

Why can a highly centralized project cause problems?

A project where a small handful of players hold a large share of the tokens can pose several risks for investors:

📌 High Control Power:

If a single entity or small group holds a significant share of the tokens, this gives them disproportionate power over the project. This can include:

✔️ Vote manipulation in a decentralized governance (DAO).

✔️ The ability to sell off tokens en masse and trigger a crash.

✔️ Information asymmetry where insiders have an advantage over the rest of the market.

📌 Increased volatility and dump risk

If the team or early investors hold a majority of the tokens, this means that when their vesting expires, they can sell massively, causing a sharp drop in price.

📌 Low organic adoption:

A token that is too centralized may lack active participation because the majority of tokens remain in the hands of a few players. This can limit interest in the project and slow its adoption.

Case Study: Analysis of Jupiter (JUP) on Bubblemaps

After exploring the general workings of Bubblemaps , we will illustrate its usefulness with a concrete case study: the analysis of Jupiter (JUP) , one of the major tokens in the Solana . This study will help us better understand how to interpret the displayed data and avoid misinterpretations related to the distinction between circulating supply and total supply.

What Bubblemaps Shows About Jupiter

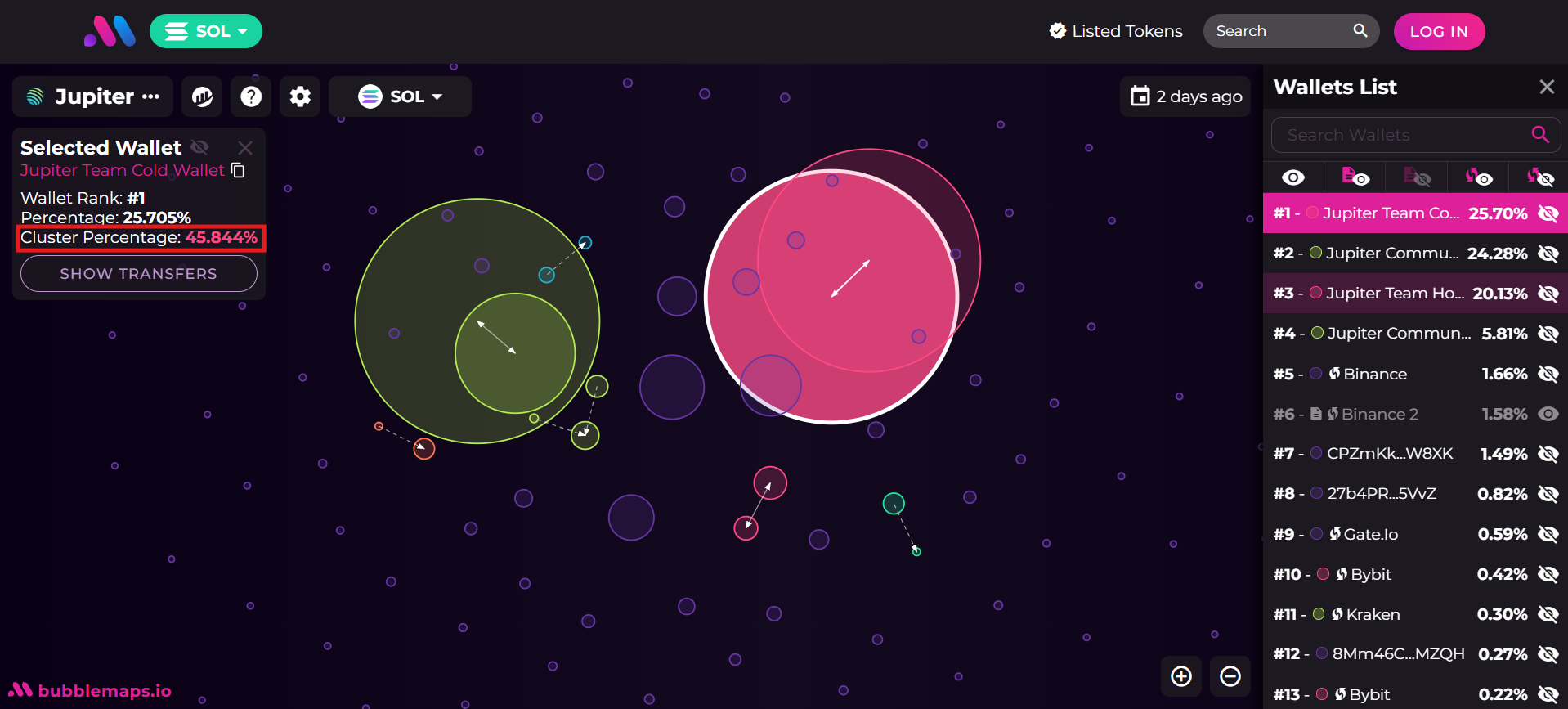

By selecting Jupiter (JUP) on Solana , Bubblemaps displays several wallet clusters that hold a significant share of the tokens:

- The cold and hot wallet of the Jupiter hold approximately 45 % of the tokens.

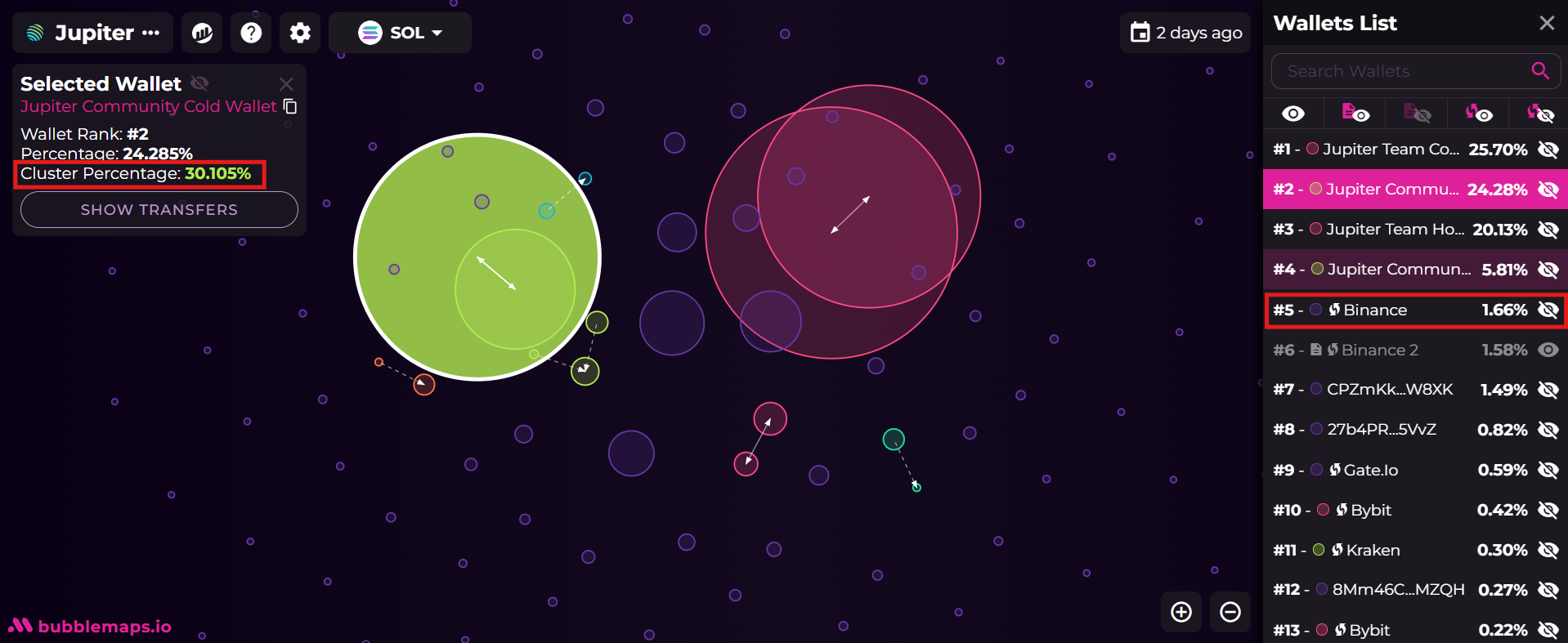

- Community-linked hot and cold wallet control approximately 30 % .

- Some centralized exchanges (CEX) like Binance own about 1.66% of the supply.

🔎 Interpretation problem detected :

These percentages are based on the total JUP supply (7 billion tokens) and not the circulating supply. Currently, only 1.7 billion JUP tokens are in circulation. This means that the majority of the tokens visible on Bubblemaps are still locked and not yet available on the market.

➡️ Why is this important?

An investor who only considers the distribution of wallets on Bubblemaps might overestimate the token's true liquidity. Some tokens are locked in vesting contracts , strategic reserves , or community funds , preventing their immediate sale.

What is the Community in a Crypto Project?

In cryptocurrencies, the community is a broad term that generally encompasses users, investors, and active contributors around the project. This can include:

- Users of the protocol (traders, developers, token holders).

- Participants in the DAO (decentralized governance).

- Members of the ecosystem benefiting from subsidies, incentives or airdrops.

However, in many projects , community funds are actually under the control of the team or a small group, with a phased release following a vesting .

📌 In the case of Jupiter (JUP) , a large portion of the tokens classified as “community funds” are still locked, meaning they are not actually in the hands of individual investors, but rather reserved for future allocations.

Determining the True Supply: Cross-referencing Data with Arkham and Tokenomist

To get a more accurate view of the actual state of JUP's supply, we cross-referenced data from Bubblemaps , Arkham and Tokenomist .

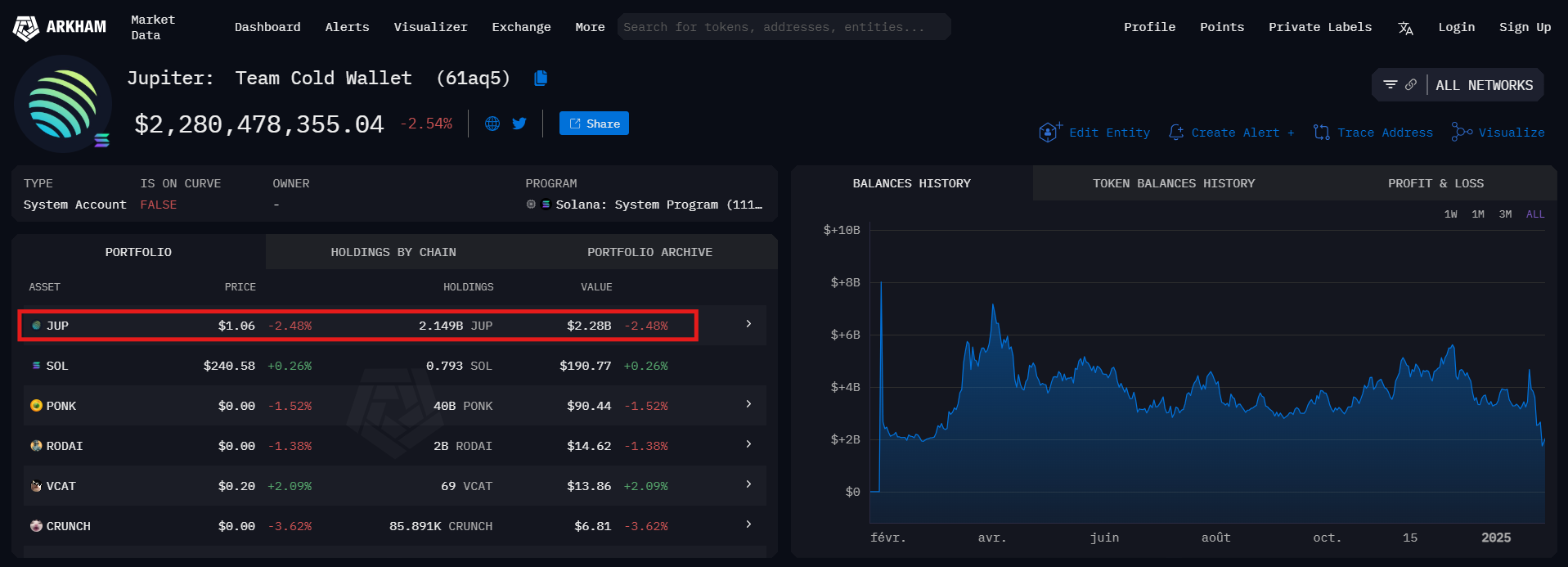

📌 Step 1: Checking funds on Arkham

Arkham allows us to identify the Jupiter , which holds 30% of the tokens on Bubblemaps . By checking its balance, we find approximately 2.1 billion JUP .

➡️ Interpretation :

This does indeed represent 30% of the total supply of 7 billion JUPs , which confirms that Bubblemaps displays the total supply and not the supply in circulation .

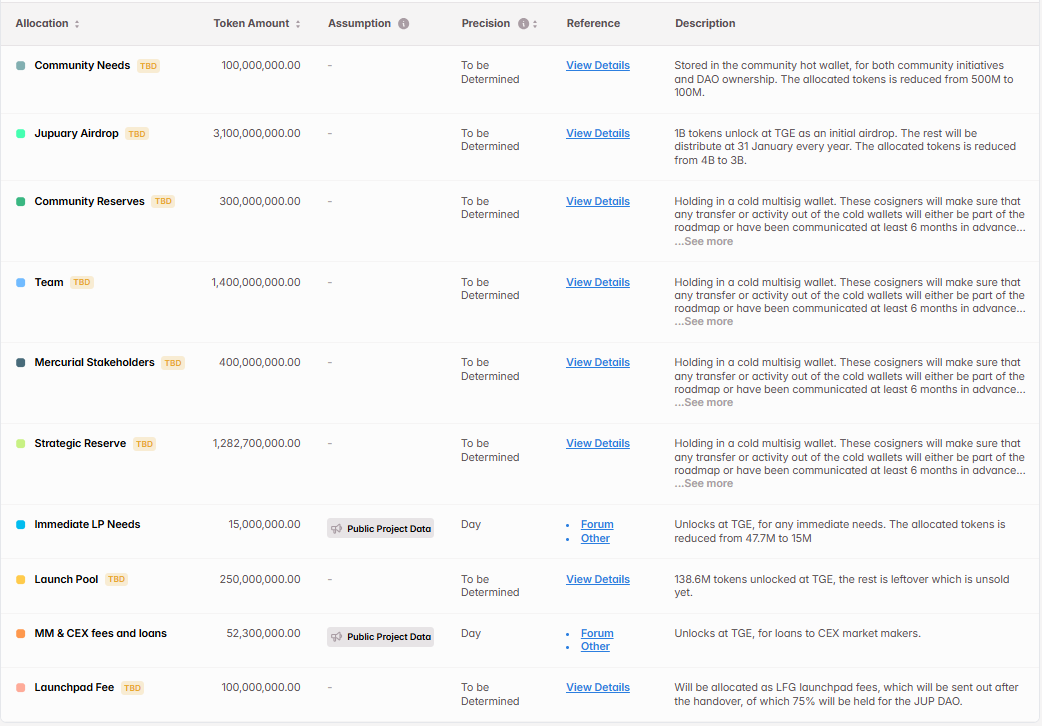

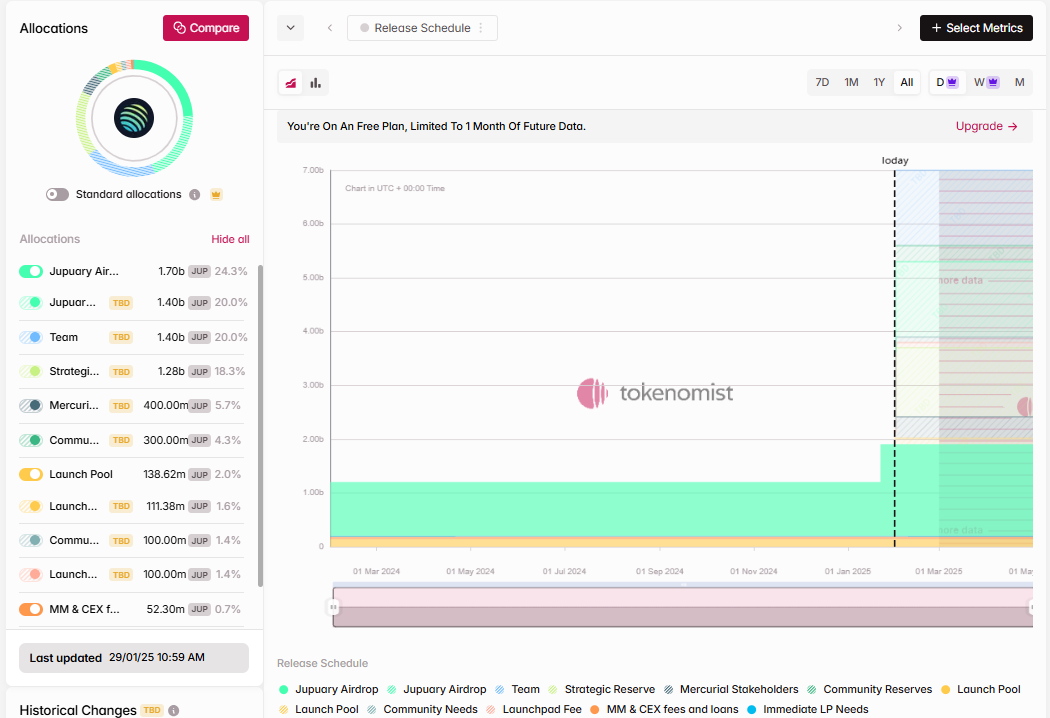

📌 Step 2: Verification of the total and circulating supply on Tokenomist

Tokenomist provides detailed information on token vesting

- 73% of the total supply is still locked (i.e. 5.09 billion JUP ).

- These tokens are divided into different categories with progressive release periods.

➡️ Conclusion:

The tokens visible on Bubblemaps include tokens that are still locked , which can give a false impression of the project's actual liquidity if the data is not cross-referenced.

Recommendation: Always cross-reference the data

💡 Don't rely solely on the clusters displayed on Bubblemaps .

Before investing, it's essential to:

✔️ Verify the funds on Arkham to confirm wallet ownership.

✔️ Analyze the circulating supply on Tokenomist to avoid overestimating liquidity.

✔️ vesting periods to anticipate potential selling pressure.

✔️ Analyze transaction flows to detect potential market manipulation such as wash trading.

Comparison and Implications for On-Chain Analysis

By cross-referencing data from different tools, here is a more precise breakdown of the total supply vs. the supply in circulation and what each tool contributes to the analysis:

| Tool | Main Information |

|---|---|

| Bubblemaps | Visualizes the distribution of wallets across the total , including typically locked funds. |

| Tokenomist | It details the allocation of funds with a precise categorization (team, community, strategic reserve). It confirms that 73% of the tokens are locked without a defined release schedule. |

| Arkham | This allows you to identify the entities behind the wallets visible on Bubblemaps (team, exchanges, DAOs, investors). It confirms that the address found on Bubblemaps (30% of the tokens) does indeed belong to the Jupiter . |

| CoinMarketCap (optional if Tokenomist is available) | Indicates that only 1.7 billion JUPs are in circulation , helping to avoid misinterpretations about the actual liquidity of the market. |

📌 Implications for on-chain analysis:

✔️ Do not confuse the total supply with the circulating supply to avoid misjudging the token's actual liquidity.

✔️ Use Arkham to allocate wallets and avoid assuming that some funds are accessible when they belong to locked contracts. vesting

schedules on Tokenomist to anticipate potential selling pressure when locked funds are released.

✔️ Observe flows between team wallets and exchanges to detect potential strategic sales or a gradual redistribution of tokens in the market.

Conclusion on Bubblemaps

Bubblemaps is a relevant tool for visualizing the distribution of tokens and understanding how a project is structured.

It is also important to note that some tokens are compatible with multiple blockchains. Therefore, a complete analysis can only be performed by exploring the token's distribution across all compatible blockchains.

For a true understanding of token distribution, it is essential to cross-reference your analyses with other platforms such as Tokenomist and Arkham in order to avoid misinterpretations of the actual available supply.

✅ A project may appear highly centralized while its funds are locked up, or vice versa.

✅ A savvy investor should always analyze the actual liquidity and token release periods.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Some links in this article are affiliate links, which means that if you purchase a product or sign up through these links, we will receive a commission from our partner. These commissions do not incur any additional cost to you as a user, and some partnerships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .