Bybit stops in the Netherlands? Not completely

For the past few months, Bybit , one of the largest cryptocurrency exchange platforms, has announced the cessation of several of its services in the Netherlands . This decision surprised many traders that used the platform for the trading of derivatives and future .

So, bybit really stops in the Netherlands or is it simply an adaptation to new regulations? What services are still accessible? And what are the best alternatives to Bybit in the Netherlands ? This article answers all these questions.

Table of contents

Why did Bybit stop certain services in the Netherlands?

Although Bybit did not obtain compulsory registration from the DE NEDERLANDSCHE BANK (DNB) to operate in the Netherlands, the platform was forced to stop the offer of certain derivatives , in particular perpetuals , future , options , trading via MT4 , tokens with leverage , as well as various savings and staking . These restrictions have been in force since March 5, 2024 , and all the positions open to these products were automatically closed on March 26, 2024 .

What services of Bybit remain available in the Netherlands?

Despite the lack of direct registration with the DNB, Bybit continues to offer certain services to Dutch users through a strategic partnership SATOS BV , a local company registered as a Virtual Asset Service Provider (VASP) with the DNB. As of September 15, 2023 , Bybit operates in the Netherlands under the brand name “ Bybit Powered by SATOS ” , allowing users to access the following services:

- Cash trading (spot trading)

- Trading on margin with a lever effect limited to 10x

- Flexible savings and staking ETH 2.0

- Crypto and Fiat deposits and withdrawals

- Access to a platform dedicated to Dutch users via bybit.nl

This collaboration with Satos allows Bybit to continue serving Dutch customers while respecting local regulations. It is important to note that, although Bybit has taken measures to comply with regulatory requirements by transferring its Dutch customers to Satos, the platform has not yet been registered on the list of entities approved directly by the DNB . However, by operating under the license of Satos, Bybit ensures the continuity of its services in the Netherlands in compliance with the legal framework in force.

What sanctions for Bybit in the Netherlands?

The Dutch Financial Markets Authority has sanctioned bybit for license -free operation . In October 2024, the platform received a fine of 2.3 million euros for non-compliance with registration requirements.

However, Bybit has taken steps to obtain MiCA certification (Markets in Crypto-Asets) , which would allow it, once validated, to operate legally throughout the European Union , including in the Netherlands.

In which Bybit countries is it accepted?

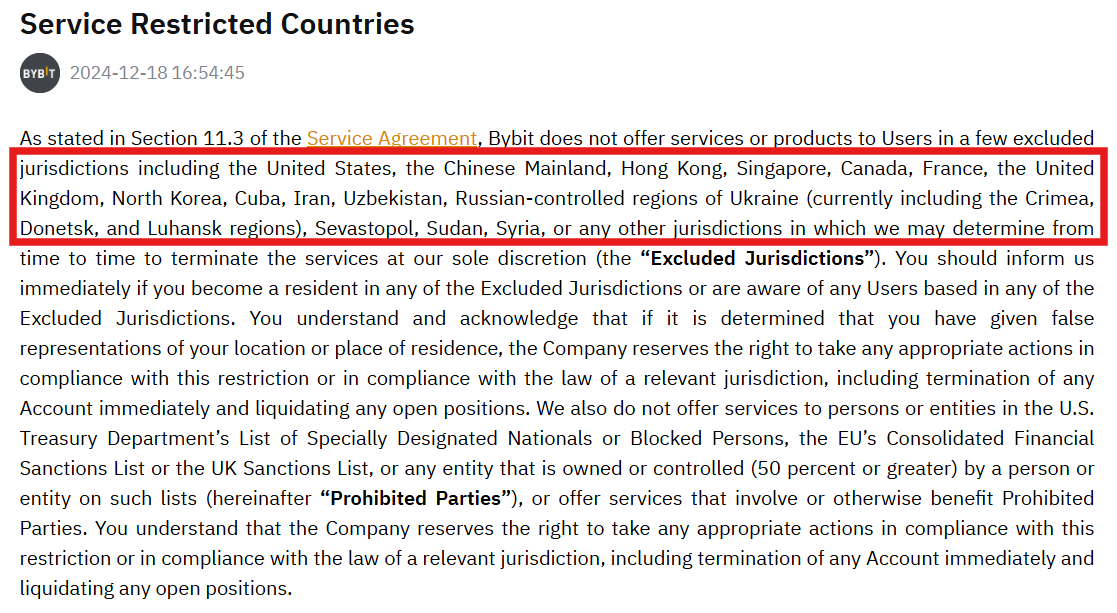

Bybit is available in more than 160 countries , but some jurisdictions impose strict restrictions on him. Among the territories where the platform is restricted , we find the United States, Canada, China, Singapore, the United Kingdom and France , due to rigorous regulatory frameworks or sanctions. Other regions, such as Crimea, Donetsk and Luhansk , are also prohibited from access for geopolitical reasons.

Towards regulation beyond Europe for Bybit

In parallel, Bybit works on the acquisition of additional licenses, especially in Hong Kong , a major hub for cryptocurrency in Asia. These approaches aim to strengthen the protection of users and guarantee the compliance of the platform against local regulations.

Bybit licenses and regulations

Bybit has already obtained several regulatory authorizations allowing him to offer his services legally on various international markets. Among the most notable:

- Kazakhstan : Registration with the Astana Financial Services Authority (AFSA) , which allows Bybit to operate as a regulated digital asset trading conservation and investment management services .

- Cyprus : Approval for providing trading and crypto-active trading services , in accordance with European regulatory standards.

- Georgia : Registration as a virtual asset service provider (VASP) with the National Bank of Georgia , thus ensuring its compliance with local regulations.

- Dubai : Obtaining a provisional license from the Virtual Asset Regulatory Authority (VARA) , a key step towards a complete authorization to serve private and institutional investors.

Thanks to these regulatory approvals , Bybit continues to extend its presence in various markets while respecting local legal requirements.

Alternatives to Bybit in the Netherlands

You can invest in cryptocurrencies in the Netherlands with Gemini.

The platform offers:

- Top-notch security, with “cold” storage of the majority of funds

- A dual interface: a simplified application for beginners and ActiveTrader , an advanced platform offering decreasing fees according to volume and a competitive order book.

- Access to more than 60 cryptocurrencies, as well as a rare offering on the market: tokenized stocks (Nvidia, Apple, etc.). These products replicate the price of real stocks via tokens issued directly on the Gemini platform, allowing them to be purchased and traded 24/7 like cryptocurrencies, without going through a traditional stock broker.

- Strict regulatory compliance, with Gemini being one of the first platforms approved in the United States and holding the European license ( MiCA ).

- Additional services such as staking to generate returns on these cryptocurrencies.

Gemini therefore allows you to invest in both cryptocurrencies and tokenized stocks, all in a secure and regulated environment.

Coinbase : Coinbase offers an intuitive interface, reactive customer service and simplified purchase ease. His commitment to regulation makes it a key player in the European market.

You can also buy your cryptocurrencies directly from a decentralized wallet ( Metamask , Exodus, Trust Wallet ) by holding your funds directly on the blockchain.

If you learn to use an online wallet and start in cryptocurrency, we have designed a detailed and illustrated guide, step by step, with screenshots. It will allow you to familiarize yourself with the fundamentals and learn to navigate with confidence.

What you will learn in this guide:

- Buy your first cryptocurrencies - a detailed tutorial to start on a centralized exchange platform.

- Trader safely - good practices to buy, sell and exchange cryptos while minimizing risks.

- Understand the stablecoin s - their role, their differences and their usefulness in securing your funds during periods of volatility.

- Use a decentralized portfolio ( DEFI ) - Manage your assets independently without going through a centralized platform and interact directly with the blockchain.

- Buy and exchange cryptos via a decentralized wallet - a practical guide to perform your transactions without intermediary.

- Introduction to decentralized finance (DEFI) - Discover advanced concepts such as staking and NFT.

Get your guide for free by filling out the form below.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .