Coinbase withdrawal fees: How to save on every transaction?

Whether you're withdrawing euros to your bank account or sending your tokens to an external wallet, it's essential to understand these costs and how to reduce them. This article will explain in detail the withdrawal fees applied on Coinbase , the difference between the various withdrawal types (fiat or crypto), and, most importantly, strategies for paying less.

Table of Contents

Understanding the cost structure: between fixed costs and variable costs

Coinbase is one of the world's leading cryptocurrency exchanges. Launched in 2012, it claimed over 100 million verified accounts worldwide in 2022, according to its own figures. Since its inception, its service offerings have expanded: a user-friendly interface for beginners, the ability to trade multiple cryptocurrencies, a stakingservice, a payment card, and more. As its offerings have grown, so too has its pricing structure. To better understand Coinbasewithdrawal fees, it's essential to first distinguish between the different types of costs:

- Fees associated with blockchain transactions.

- The commissions that the platform applies depending on the network or payment method.

- Potential fees during conversions or inter-portfolio transfers.

Network charges: why are they billed?

When discussing cryptocurrency withdrawals (BTC, ETH, LTC, etc.), transactions are validated by miners or validators on the relevant blockchain. These validators receive rewards in the form of "mining fees" (or network fees). On Coinbase, users sending tokens off the platform are required to pay these fees, which are usually estimated in advance. However, the final amount can vary depending on network congestion at the time of the withdrawal.

Cryptocurrency withdrawal fees on Coinbase are directly linked to network fees imposed by the relevant blockchain. However, Coinbase uses an internal calculation system to determine these fees before displaying the estimated cost to the user.

🔹The impact of congestion on Bitcoin and Ethereum

- Bitcoin : When there are many pending transactions in the mempool, miners prioritize those offering higher fees. This leads to an increase in mining fees , especially during periods of high market activity.

- Ethereum : On this blockchain, gas fees vary according to the demand for space in each block. When a large number of transactions are sent simultaneously (e.g., NFT , arbitrage on DEXs , high volatility on stablecoin ), the gas price can reach record highs, making withdrawals very expensive.

🔹 Coinbase 's fee calculation method

Coinbase evaluates network fees based on several parameters:

- Real-time estimation : Coinbase checks the current state of the blockchain and anticipates the average fees needed to confirm a transaction quickly.

- Batching : To optimize costs, Coinbase sometimes combines multiple withdrawals into a single transaction, thus reducing the portion of fees paid individually by each user.

- Network fee volatility : The fees shown before a withdrawal is validated may differ slightly from those actually paid to miners, due to rapid changes in congestion.

- Optimization via transaction pools : Coinbase may sometimes group transactions into larger blocks to negotiate better rates, although this is not always transparent to the user.

🔹 Actual fees paid vs. displayed fees: Does Coinbase take a commission?

Unlike some platforms, Coinbase does not systematically apply an additional commission on cryptocurrency withdrawals.

- The amount charged generally corresponds to the actual network charges , although optimization via batching may create a slight discrepancy.

- On certain specific protocols such as the Lightning Network for Bitcoin , Coinbase charges a fixed commission of 0.1% of the amount sent , in addition to network fees.

🔹 Are Coinbase fees higher than blockchain fees?

It depends on the context:

- In some cases, the fees displayed by Coinbase may be slightly higher than the minimum network fees , especially if the platform applies a safety margin to ensure fast transaction processing.

- On the other hand, thanks to batching , the fees can sometimes be lower than if the user sent a transaction themselves from a personal wallet, because grouping operations reduces the overall load.

🔹 Comparison with an external crypto wallet

If you are using a non-custodial wallet (such as Metamask, Exodus, Trust Wallet , Ledger ), you can usually manually adjust the fees according to the desired execution speed.

- With a personal wallet , you can usually pay less by opting for lower fees (at the risk of slower validation).

More information about the rewards can be found here.

- On Coinbase , you cannot adjust these fees manually, but you benefit from an optimized estimate that avoids long waits.

Internal costs: commissions on the platform

In addition to network fees, Coinbase may apply a specific commission. For example, when withdrawing cryptocurrency to an external wallet, the platform charges a fee to cover costs. On some blockchains (such as Bitcoin via the Lightning Network), Coinbase uses separate pricing

With the Lightning Network, sending BTC is theoretically fast and inexpensive. Coinbase a processing fee of 0.1% of the transferred amount on these specific withdrawals.

As for withdrawals in fiat currency (euros, dollars, etc.), variable fees apply.

An outgoing SEPA transfer in euros (to a bank within the SEPA zone) may incur a fixed fee, often around €0.15 (the exact amount depends on the country).

Withdrawals to a bank card may be subject to a commission of approximately 2% of the amount, with a fixed minimum (e.g., €0.55).

These fees may fluctuate depending on updates to Coinbase . It is therefore advisable to consult the terms and conditions displayed at the time of the transaction.

Coinbase withdrawal fee summary

| Type of withdrawal | Fees applied | Details |

|---|---|---|

| SEPA transfer | 0,15 € | Fixed fees, delivery time of 1 to 3 business days |

| Withdrawal via bank card | 2% (min. €0.55) | Faster but more expensive removal |

| Bitcoin withdrawal (on-chain) | Variable (network charges) | Depends on Bitcoin network congestion |

| Bitcoin withdrawal (Lightning Network) | 0.1% of the amount | Additional fixed fees applied by Coinbase |

| Withdrawal in Ethereum | Variable (gas costs) | Heavily influenced by network congestion |

| Crypto withdrawals (other networks) | Variable depending on the blockchain | Layer 2 and alternative blockchains to Ethereum (BSC, Solana, Sui, Aptos…) are often cheaper |

| Withdrawal via PayPal | Variable | Depends on the country and currency |

For a complete overview of all fees applied between the 2 largest current exchange platforms, see our Binance vs. Coinbase fee .

Coinbase withdrawal fees in fiat currencies: what you need to know to spend less

When withdrawing euros or dollars from Coinbase to your bank account, you are no longer subject to blockchain mining fees, but rather to bank charges or commissions imposed by the platform. SEPA withdrawals are generally less expensive and considered simpler

SEPA transfer: the best simplicity/cost ratio?

SEPA transfers remain the most common method in Europe for transferring funds from Coinbase to a bank account. Several advantages stand out:

- Decent speed: most SEPA transfers are completed within 24 to 72 hours.

- Reduced cost: in most cases, the fees associated with these withdrawals are fixed and low (often around €0.15).

- Enhanced security: the IBAN must be validated and match your identity.

- To minimize your Coinbase withdrawal fees in fiat currency, using a SEPA transfer is often a good idea. However, keep in mind that if you reside outside the SEPA zone or are making transfers in other currencies (USD, GBP, etc.), you may face different costs.

Withdrawal by bank card: why is it more expensive?

Coinbase also allows direct withdrawals to a credit or debit card. This option may seem more convenient, especially if you want immediate access to your funds without waiting for a bank transfer to process. However, speed comes at a price. Card withdrawals are generally charged between 1.5% and 2.5% of the amount withdrawn, depending on the region and the card used.

This additional cost is explained by the interchange fees imposed by the card networks (Visa, Mastercard) and by the additional processing fees.

Always check the details of the fees before confirming your withdrawal.

To limit your bill, it is better to use a SEPA transfer, even if it means waiting a little longer before seeing your funds in your bank account.

Coinbase cryptocurrency withdrawal fees: understanding each parameter

For many users, withdrawing their assets directly to an external wallet (such as Ledger, Tangem, or Exodus) remains a priority, especially when they want to keep them in cold storage or perform other operations on DeFi platforms. Here are the criteria that influence these withdrawals:

Choosing the right network: a way to reduce your bill

Some cryptocurrencies are compatible with multiple blockchains or Layer 2 solutions. For example, ETH can be sent via the Ethereummain network, but also via sidechains or Layer 2 platforms like Arbitrum or Optimism (if the platform allows it). BTC, on the other hand, can be sent via the native Bitcoin network or the Lightning Network.

When selecting a network for your transfer, always compare the fees estimated by Coinbase .

Sending over Ethereum can be more expensive than sending via a secondary network if the Ethereum is congested.

For Bitcoin, using the Lightning Network can offer very low network costs, but Coinbase applies its 0.1% processing fee, making comparison necessary.

Generally, if your recipient accepts multiple networks, choose the one with the lowest congestion and estimated costs. Keep in mind, however, that each network has its own rules and addresses. Making an address error (sending BTC BTC Ethereum network , for example) can result in the irreversible loss of your funds.

Fixed fees vs. variable fees: how platforms calculate them

Coinbase regularly states that the fees displayed when confirming a withdrawal can vary throughout the same day. This is because their internal algorithm is based on:

Real-time network pricing (mining fees, gas, congestion, etc.).

Potential internal fees (flat or proportional).

Batching multiple withdrawals into one.

Therefore, two identical withdrawals made a few hours apart may not show the same amount. This fluctuation is a concern for some users, who sometimes prefer to postpone their withdrawal until the blockchain is less congested.

Coinbase withdrawal fees and spread

Users are often surprised to see a difference between the value of their cryptocurrency at the time of sale and the amount they ultimately receive. This difference can stem from:

The spread

The spread is the difference between the buy and sell price of a cryptocurrency. On Coinbase, when you place a "simple" order (instant buy or sell), the platform may include a spread in the displayed price, allowing it to "lock" the price for a few seconds or minutes, the time needed to execute the order.

The more volatile the market, the higher the spread can be.

Coinbase may retain a portion of this spread as compensation, in addition to its displayed transaction fees.

If you use Coinbase Advanced (formerly Coinbase Pro), you interact directly with the order book and often reduce these price differences. In this case, the spread is smaller because you directly set the price of your limit order.

More information about the rewards can be found here.

Internal conversion commissions

When you decide to sell cryptocurrency for euros, the service applies a fixed or variable percentage, separate from the spread. For example, for a small amount of BTC sold, you might pay a higher commission percentage than you would for a large volume. The combined cost of conversion fees and the spread can sometimes be higher than expected. To avoid the spread, interact directly with the order book on Coinbase Advanced.

Regarding withdrawal fees with Coinbase One: what are the advantages?

Coinbase One is a paid subscription offered by the platform, which provides certain benefits, including no transaction fees for buying and selling (under certain conditions). However, this subscription does not completely exempt users from Coinbase withdrawal fees

- Network fees continue to apply to cryptocurrency withdrawals.

- Potential conversion fees, or the spread, can still influence the final amount.

- Fiat withdrawals may retain a fixed cost (e.g., for a SEPA transfer, you always pay bank fees if they are charged).

Optimizing your withdrawals: concrete strategies to pay less

Waiting for a favorable window on the network

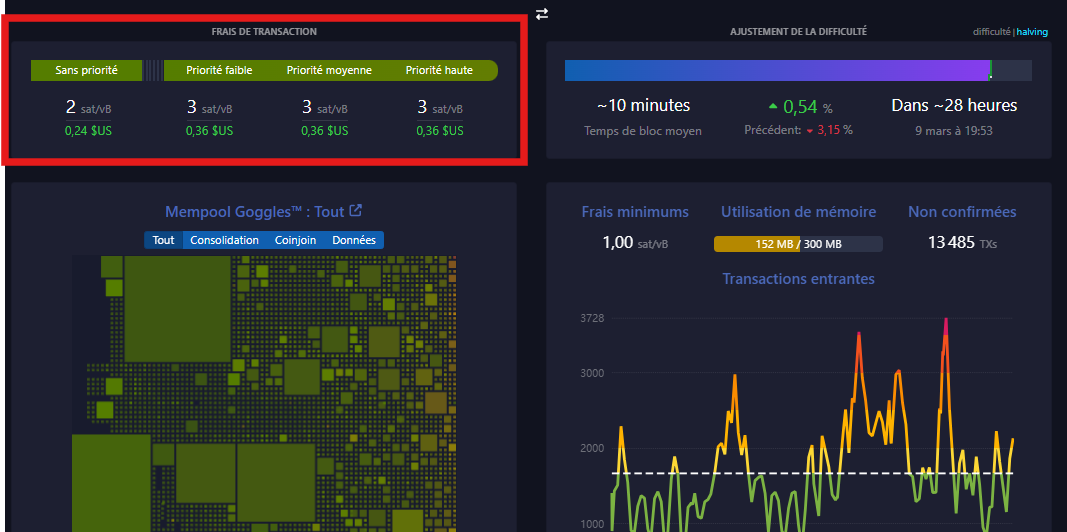

On Ethereum or Bitcoin, transaction fees can vary from hour to hour. There are third-party websites (such as 's Ethereum gas tracker for Ethereum , or Mempool.space for Bitcoin) that show real-time congestion and the average cost of a transaction.

On Bitcoin, if you see that the mempool is lightly loaded, it's the ideal time to make your withdrawal.

On Ethereum , wait for a period of low activity (sometimes at night in Europe) to take advantage of reduced gas fees.

Use Coinbase Advanced

Coinbase offers an advanced interface (formerly Coinbase Pro) that allows you to manually set buy and sell prices, thus avoiding some or all of the spread imposed on quick transactions. This lets you sell or convert your cryptocurrencies at a more favorable rate before withdrawing, reducing losses related to implicit fees.

Group withdrawals

If you plan to make several withdrawals within the same period, it may be more cost-effective to convert everything and then make a single large withdrawal, rather than multiple small withdrawals. The fixed fees will be paid only once, and you'll avoid accumulating multiple commissions.

For example, if each withdrawal costs you €0.15 plus a variable percentage, a single transfer of €2,000 will be cheaper than two transfers of €1,000 each.

Similarly, with crypto, you can reduce costs by pooling your tokens on a single network, provided the exchange rate is favorable.

Convert to a crypto with lower network fees

Some blockchains (BSC, Solana, Sui, Aptos, Base, etc.) generally have very low network fees. If your final destination supports these cryptocurrencies, you can convert your balance to a cryptocurrency compatible with these networks and then withdraw those tokens.

Once received in your external wallet or on another platform, you can convert them back into the desired cryptocurrency. This process generally saves you on network costs, although you should check Coinbase 's conversion fee and ensure that the conversion fees do not exceed the withdrawal fees saved.

Specifics regarding certain Coinbase services

Withdrawal and staking fees

If you staking, you won't incur any specific fees to unstake your assets, aside from any network costs if you then transfer them to another wallet. Coinbase takes a commission on staking rewards (up to 35% depending on the cryptocurrency), but this isn't a "withdrawal fee" per se; it's more of a percentage deducted from the interest earned.

Withdrawal fees and Coinbase Card

The Coinbase Card allows you to spend your cryptocurrencies directly in stores or online. There are no "withdrawal fees" as such for payments, but the platform may include a spread in the crypto-to-fiat exchange rate. If you use an ATM with this card, expect to pay higher fees (potentially 2.49% or more, depending on the ATM operator's terms and commissions).

Beware of errors in the pickup address

An error in the destination address can result in the total loss of funds, as blockchains do not allow for automatic cancellation or reshipment in the case of a non-existent address. Coinbase generally cannot recover your crypto if you use the wrong network or address type. Therefore, carefully check every character and prioritize copy-pasting over manual entry.

What will Coinbase withdrawal fees look like in the future?

Coinbase withdrawal fees have already undergone several changes over the years. The platform regularly adapts its pricing policy based on:

- From the adoption of new scaling solutions (e.g., Arbitrum, Optimism).

- Variations in mining costs on blockchains.

- From its desire to attract or retain new users (promotional offers, temporary reduction of fees, etc.).

We can expect Coinbase to continue to align itself with industry innovations.

For example, if transactions via the Lightning Network become more widespread and affordable, the 0.1% fee could change. Similarly, the increasing adoption of certain less expensive blockchains may lead the platform to offer more withdrawal options for the same cryptocurrency, with varying costs.

Summary of best practices for paying less fees on Coinbase

- Prefer SEPA transfer for your euro withdrawals, rather than using a bank card.

- Monitor the congestion of the Bitcoin and Ethereum before making a crypto withdrawal.

- Compare fees by network (Lightning vs. on-chain for Bitcoin, L2 vs. mainnet for Ethereum ).

Use Coinbase Advanced to reduce spreads on your trades. - Combine withdrawals when possible to pay fewer fixed fees.

- Convert your cryptos into an asset with lower network fees

Conclusion: Controlling costs to optimize withdrawals

Coinbase withdrawal fees depend on multiple factors: the blockchain used, the payment method, the platform's offerings, market volatility, and even your conversion choices. Understanding Coinbase 's pricing policy is essential to avoid paying more than necessary. Fees can quickly add up if you don't pay attention to the available withdrawal options.

By following the best practices outlined, you can minimize the impact of these costs, whether you want to withdraw euros to your bank account or transfer cryptocurrencies to an external wallet. Be sure to check the estimated fees in real time and, if possible, wait for a more opportune moment to perform the transaction (lower congestion, cheaper network, etc.).

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital .

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .