Coinbase withdraws Impossible: the reasons and the solutions to unlock your funds

Do you want to recover your euros or cryptocurrencies from Coinbase , but do you face an impossible withdrawal on Coinbase ? The blocking of a withdrawal can sometimes seem incomprehensible and frustrating. However, the reasons behind this inability to transfer its funds are often linked to verification stages, safety limits or technical concerns.

Table of contents

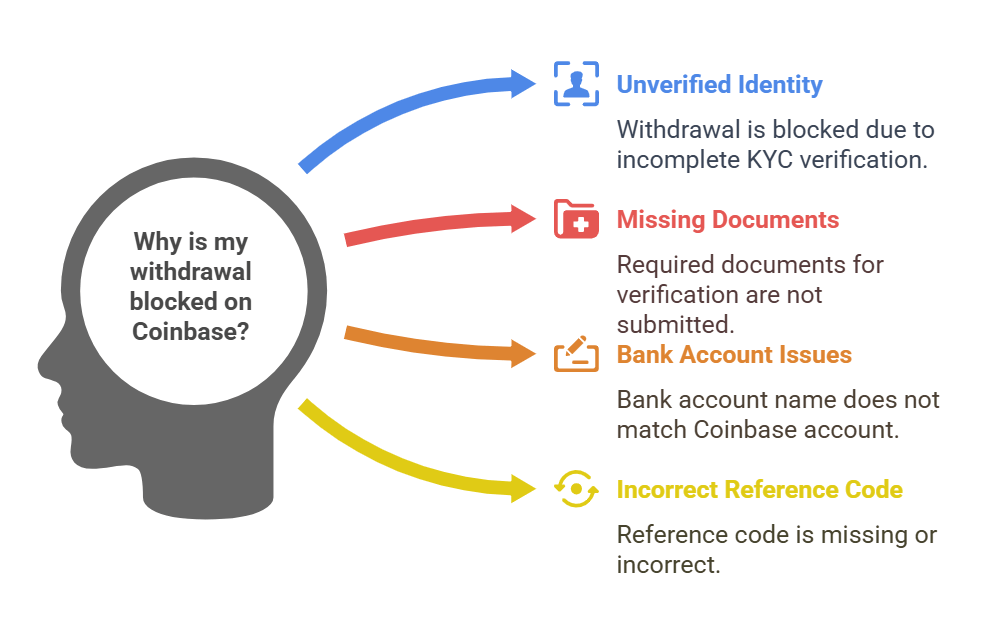

Frequent causes of an impossible withdrawal on Coinbase

When you try to transfer euros to your bank account or move your Cryptos assets to another Wallet , several factors may explain a blocked withdrawal. The most common cases include the non-tenification of identity ( KYC ), a non-compliant banking name, a restriction linked to regulation, a negative balance or even a suspicious activity detected by the platform. Coinbase , like other exchanges, implements compliance measures to comply with the obligations in terms of anti-flask and safety verification.

Noted identity

Your identity verification (Know Your Customer, better known under the acronym KYC ) is one of the first potential obstacles. On any platform offering fiat transactions (euros, dollars , etc.), regulations require collecting precise information on the identity of users. On Coinbase , if your account is not fully validated, the withdrawal option can be disabled. This measurement protects against fraud and guarantees conforming use of the platform.

Missing supporting documents

It is possible that the copy of your identity card, your proof of address or a selfie verification have not been accepted. According to several user testimonies, an unaccompanied account does not allow the withdrawal to a bank account or an external wallet. The requested documents generally include:

- Identity card, passport or driving license valid.

- Proof of domicile (electricity bill, tax notice, etc.).

- Questionnaire on the origin of funds or on your investment objectives (some countries require it).

Bank account problems or non -compliant name

Another frequent motive of blocked withdrawal concerns the correspondence of the names. Coinbase requires that the bank account holder is the same as that recorded on the platform. If you try to withdraw funds to a collective account, a professional account or a account belonging to a third party, the transaction may be refused. In the case of a SEPA transfer, the IBAN used must be in the exact name of the holder of the Coinbaseaccount.

Poorly informed reference code

For certain types of deposits or withdrawals, the platform provides you with a single reference code to indicate in the "reference" field during your transfer. If this code is forgotten, poorly spelled or placed in the wrong place (example: in the "pattern" field instead of the "reference" field), the amount returned to your bank can be instantly refused or waiting. Several testimonies evoke successive transfers rejected for this reason.

Negative balance and retrofing

Coinbase balance is negative, you may not be able to withdraw your funds. This can happen if you have made a deposit with a bank card or Paypal , but this payment was then canceled by your bank or the payment service. This process is called a retrofing (or Chargeback in English): it allows users to challenge payment and recover their money if they consider that there has been an error or fraud.

However, if you have already used these funds to buy cryptocurrencies, Coinbase can block your withdrawal, because the platform no longer really has the money that you initially deposited. Indeed, some people could abuse the system by buying cryptos, then canceling their payment from their bank, and trying to withdraw cryptos without ever having paid really. To avoid this type of fraud, Coinbase requires that the balance be reset to zero before allowing a new withdrawal. This means that you will have to reimburse the missing amount before you can send your cryptocurrencies or collect your money from your bank account.

Restrictions imposed by Coinbase

In the event of suspicion of fraudulent activity, non-compliance with the conditions of use or non-compliance with local regulations, Coinbase can restrict your account, or even temporarily blocks it. A Coinbase blocking is generally accompanied by a notification: the platform informs the user by e-mail or by message in the interface. The reasons for these restrictions can be multiple:

- Activity deemed unusual (from a country under sanction, for example).

- Transaction volume exceeding certain limits.

- Quick fund movements between several suspicious wallets.

- Attempt to send to recognized as fraudulent addresses.

According to the official recommendations of the Financial Action Group (GAFI) ( Financial Action Task Force - FATF ), cryptocurrency exchange platforms must apply strict compliance measures to combat money laundering and financing terrorism. identity verification procedures KYC ) and the fight against money laundering (AML) . Coinbase , as a regulated Exchange, sets up these controls proactively. Consequently, certain transactions, including withdrawals , can be blocked or delayed as long as checks are not fully validated.

Coinbase Removal Impossible: SEPA transfers, ceilings and other current dysfunctions

Problems linked to the deposit or withdrawal limits

Excess of the SEPA deposit limit

Instant transfers: costs and compatibility

Change of Iban Coinbase

Many users report that after several months or years of use, the RIB/IBAN displayed in their Coinbase interface has changed for a new one (in Germany, Luxembourg or Lithuania). It is crucial to check with each new deposit that you use the latest version of the IBAN supplied by the platform. A deposit to the old IBAN account can remain pending for several days, before being returned to your bank account.

Blockchain blocking

When you withdraw cryptocurrencies (bitcoin, Ethereum, etc.) to an external wallet, mining costs (network fees) come into play. If the costs are insufficient or if the blockchain is congestioned, your transaction may be waiting for validation for hours, or even days. During this time, you risk seeing a "pending" or "pending" status in your history Coinbase. In rare cases, if the costs are really too low, the transaction can be rejected by the network.

Lightning Network and Limitations

Lightning Network is a second layer protocol for Bitcoin, supposed to speed up transactions and reduce costs. However, if the transmitter has not properly finalized the transaction on the Lightning Network, the withdrawal can remain blocked up to 72 hours. Beyond this period, the funds may be reset to your Coinbase , making the user's confused situation.

Coinbase withdrawal impossible: stands on hold and notifications

You launch a withdrawal to your bank account, and Coinbase indicates "pending" or "in progress" without evolution for several days. In most cases, this situation is resolved by itself once network confirmations or internal Coinbase checks are finalized.

Prolonged anti-flow checks

If the amount withdrawn is important or if the account has a recent activity history deemed unusual, Coinbase can trigger an internal audit. This verification, linked to whitening control regulations (AML), sometimes requires that the user provides additional information. Platform managers may ask you:

- The source of your cryptocurrencies (mining, trading , heritage, etc.).

- Your bank statements to confirm the legal origin of funds.

- Documents justifying your job or income.

Incompatibility or refusal of the bank

In some regions, banks can refuse transfers related to the purchase or sale of cryptocurrencies. This phenomenon still occurs, despite better adoption of decentralized finance. When your bank blocks an incoming or outgoing transfer, it may make your withdrawal impossible. Regularly check your bank notifications and contact your advisor to confirm that the transfer is not blocked on the side of the bank.

Not supported banks

Coinbase periodically publishes lists of banks or payment institutions with which he encounters treatment difficulties, such as Wise, certain neo-banks or entities based in countries with gradually separate agreements. The transfer may then be rejected by default.

Coinbase withdrawal impossible: how to unlock an impossible withdrawal situation

Faced with an impossible withdrawal Coinbase , the first step is to precisely identify the blocking pattern. To do this, do not hesitate to consult the "Activity activity" or "notifications" section in your Coinbasearea. If you cannot find any information, you can contact the support via the contact form, official social networks or live messaging (when available).

Check and complete your profile

Make sure your account is fully verified:

- Import clear photos of your identity documents.

- Update your proof of address to prove your residence.

- Inform your bank information with accuracy (name, first name, IBAN, BIC code).

- Complete any questionnaire on the origin of funds if necessary.

Once these steps are finalized, you will receive an email or a notification confirming that your account is "verified". The withdrawal status should then activate.

Reset the payment method

If the SEPA transfer does not pass, try to delete and then rearrange your bank account in the Coinbasepayment settings. Check that the name linked to your bank account corresponds exactly to that of your Coinbase account (including in the case of a second first name or an accent). If there is an extra space, the platform may consider that it is a third -party account and refuse the transaction.

Use another bank account or another exchange

In case of persistent refusal, it may be wise to use another bank account. Be careful however, the platform may require that this account be also in your name. You will therefore have to proceed to a validation by performing a first test deposit (generally between 0.01 € and € 1) to prove that you are the holder.

Otherwise you can simply send your funds to another exchange and remove your funds from it.

Contact customer service and provide the necessary evidence

As part of an impossible persistent withdrawal, the safest way remains to contact the support . Transmit:

- The screenshots of your transfer attempts.

- Proof of debit on your bank account.

- The reference code you used for the deposit (if applicable).

- Any additional document attesting to your identity or the legitimacy of the amount sent.

The more precise you are in the description of your situation, the faster Coinbase can investigate and lift the blocking. Note that in periods of high traffic or during major market events (for example, a sudden peak in Bitcoin prices), response times can be longer.

Respect processing times

According to Coinbase , a Sepa withdrawal or a cryptocurrency withdrawal can take between 2 and 3 working days . There are also cases of delays when the network is saturated or during an internal control. Waiting for a few additional days can sometimes be enough to unlock the situation, without requiring any particular action on your part. Before restarting the support, therefore check if the normal deadline is not just in progress.

Coinbase Removal Impossible: errors to avoid to facilitate its withdrawals on Coinbase

To no longer meet the mention "impossible withdrawal" on Coinbase, some reflexes are to be adopted systematically. They mainly concern the rigor in the spelling of your information, the knowledge of your limits and the scrupulous respect for security procedures.

Forget to update your address

If you move or change the country of residence, you must notify Coinbase. In several countries, the regulations require strict correspondence between the address on your identity document and that indicated on the platform. A simple oblivion of update can block your withdrawals.

Mix personal and professional accounts accounts

The general conditions of Coinbase prohibit using a business bank account (company, association, etc.) for cryptos transactions on a personal account. The reverse is also true. If you have a professional activity related to cryptocurrencies, you will need to create a separate pro account or go through an adapted exchange service.

Send funds to an erroneous address

When you remove cryptocurrencies to an external wallet, scrupulously check the destination address. An incomplete strike or copy-paste is enough to lose your assets permanently. Transactions on the blockchain being irreversible, Coinbase will not be able to do anything to recover your tokens sent to the wrong place.

Use a QR code in a hazardous manner

Many cryptos wallets generate QR codes. Make sure it is your own wallet before scanning this code. It is easy to be wrong if you manage several addresses on the same phone.

Coinbase Removal Impossible: Practical advice to avoid being blocked in the future

To minimize the risks and take advantage of a fluid use of the platform, here are some simple but effective tips:

- Plan the withdrawals in advance: if you plan to withdraw a substantial amount, first test a low amount withdrawal to verify that everything works.

- Divide the transfers: rather than sending a large sum at once, split it into several transfers while respecting the limits imposed by Coinbase.

- Keep your documents up to date: before they expire, update your supporting documents (identity card, driving license, etc.). An expired identity document can block a withdrawal process.

- Secure your account: Activate the double authentication (2FA) and monitor any suspicious connection.

The safety of your account influences the ease of removing your assets without blocking.

Coinbase emails . In the event of a dispute, you will have all the supporting documents to present.

Coinbase withdrawal impossible: the role of regulators and market development

The growing popularity of cryptocurrencies has led to a gradual strengthening of legal controls. In many countries, authorities require platforms strict respect for KYC and AML measures. According to a report published by the European Banking Authority (EBA) in 2022, the majority of cryptocurrency exchanges undergo significant audits in order to ensure that they do not facilitate money laundering or fraud. This mechanically translates into more frequent restrictions for users, especially if the activities seem unusual.

Influence of macroeconomic events

When the cryptocurrency market experiences increased increases or drops, many users rush to sell or remove their assets at the same time. This phenomenon can engorge the platform. Coinbase, just like other services, can set up suspensions or slow down flows to manage the high volume of transactions. Prolonged processing deadlines can then be confused with a "blockage" of the account, while it is rather a temporary saturation.

Alternatives in the event of persistent blocking

If despite all your procedures, the situation does not unlock, some users choose to send their cryptocurrencies to another platform (for example, Binance , Kraken or Bitvavo), then to make the bank withdrawn from this new interface. However, this solution can generate additional transaction costs and requires the destination platform to accept your bank account. In the event of a prolonged dispute with Coinbase , the legal path remains a last resort, although it is rarely necessary and often long.

Conclusion: how to guarantee the success of its withdrawal on Coinbase

To summarize, an impossible withdrawal on Coinbase most often results from the application of safety and compliance rules. An incomplete identity, an unlikely bank account or an activity deemed at risk may result in the temporary or final blocking of withdrawal. In addition, there are technical aspects such as the SEPA deposit limits, the poorly placed reference codes and the congestion of the blockchain.

The best approach is to prepare your account carefully before making a withdrawal. Make sure that all your supporting documents are up to date, that your IBAN and your name correspond perfectly, and that you respect the deposit limits imposed by Coinbase. If a blockage persists, check your notifications, contact the support with concrete evidence and be patient regarding the processing times. In most cases, some additional checks are enough to unlock the situation and allow you to recover your funds.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .