How Drift Protocol works: Decryption of a DEX Advanced on Solana

How to focus Drift Protocol? Drift Protocol is a decentralized finance platform ( DEFI ) built on the Solana trading services for perpetual contracts, predictive markets and portfolio management. Its native token, the DRIFT , plays a central role in the governance and the economy of the protocol. This article explores in detail the operation of Drift Protocol, its innovative mechanisms and its advantages for advanced traders.

How Drift Protocol works: a decentralized trading platform on Solana

Drift Protocol is built on the Solana blockchain . Unlike traditional platforms like Binance or Kraken , Drift does not keep your funds and does not manage your orders via a centralized server. Everything works with smart contract , autonomous programs that automatically run transactions according to coded rules. This means that you stay in control of your assets at all times.

On Drift, each action - open an position, exchange assets, lend or borrow - is recorded on the blockchain. Orders are managed in a decentralized manner thanks to two main systems:

- Smart contract s : They orchestrate the entire process, from the creation of an order to its possible liquidation, without intermediary.

- Keeper network : robots called "keepers" monitor the order book and help execute or update transactions on the blockchain in real time.

The Solana blockchain , renowned for its speed and very low costs , allows Drift Protocol to offer almost instantaneous trading, with minimal costs, while guaranteeing the total transparency of all operations. You can check on the blockchain at any time that your orders have been processed properly, without having to trust a third party.

How Drift Protocol works: main features

- Trading of perpetual contracts : possibility of opening long or short positions with a lever effect of up to 50x on major assets such as soil , BTC and ETH . Perpetual contracts allow you to speculate without time limit. It therefore allows access to perpetual contracts without KYC when they are prohibited in certain countries on centralized exchanges. So you can Short the market without a barrier.

- Cash trading (spot) : direct exchange of crypto active ingredients with lever effect up to 5x, ideal for those who wish to use their capital in a more flexible way.

- Predictive markets via BET : betting on the outcome of real events (elections, sports results, etc.) in a completely transparent and automated manner thanks to smart contract .

- Loan and borrowing of assets : generate passive income by lending your cryptocurrencies, or borrowing against a guarantee to finance other investment operations.

- Liquidity supply : Participate in the ecosystem by providing liquidity thanks to innovative systems such as Just-in-Time (JIT) and the Automated Market Maker (AMM) .

DRIFT native token is at the heart of the protocol economy. It is used for governance (vote on important decisions), to obtain economic advantages (reduction in costs, awards) and to support the entire Drift .

Drift works : Technical architecture and liquidity management

A hybrid liquidity model accessible to all

Drift Protocol is based on an intelligent combination of several systems so that users can buy and sell easily without missing counterparties. Here's how it works:

- Instant auction (just-time Auctions) : whenever a user takes an order, he is briefly auctioned (for about 5 seconds). Meanwhile, various liquidity suppliers can offer the best possible offer. This often makes it possible to obtain a better price than by sending order directly to the market.

- Decentralized order book (decentralized Limit Order Book - DLOB) : Drift has its own order book, such as classic trading platforms, but decentralized. This means that the purchase and sales offers are visible by all, without control of a central company. Robots called "keepers" ensure that everything is working properly.

- Automatic liquidity supplier (Automated Market Maker - AMM) : If no one offers to buy or sell on the order book, Drift uses an automatic system which guarantees that there will always be an available price. This mechanism is based on a simple mathematical formula to maintain the balance between supply and demand.

How Drift Protocol protects its users

To offer a reliable trading environment and reduce risks, Drift Protocol has set up several security:

- Partial liquidations : If a user takes too many risks and his investment becomes dangerous, only part of his position is sold automatically. This makes it possible to limit losses without disturbing the whole market.

- Insurance fund : Drift has created a special fund to cover any losses in the event of a problem on the platform, in order to protect users.

- Security audits : Before making Drift accessible to the public, independent cybersecurity experts, such as Trail of Bits and Neodyme , carefully inspected the code to detect possible flaws or errors.

How Drift Protocol works: Token DRIFT , Utility and Tokenomics

Utility of the DRIFT token

The DRIFT token is at the heart of the Drift Protocol ecosystem:

- Governance : Participation in decisions via a multi-branche DAO

- Reduction of costs for Drift and Stakers of DRIFT .

- Staking to win a share of the protocol income.

- Participation in the insurance fund by Stakant des DRIFT .

To find out more about the Drift and the evolution of its price, we invite you to see our article on

DRIFT price predictions .

Tokenomics

The total DRIFT offer is 1 billion tokens, distributed as follows:

- Ecosystem development : 41%

- Protocol development : 25%

- Strategic participants : 22%

- Launching ardrop : 12%

Currently, around 300 million tokens are in circulation. A significant increase in the offer is scheduled from November 2025, with a three -time multiplication of the supply in circulation by May 2027, which could exert downward pressure on the price of token.

How to use Drift Protocol

Connection to the platform

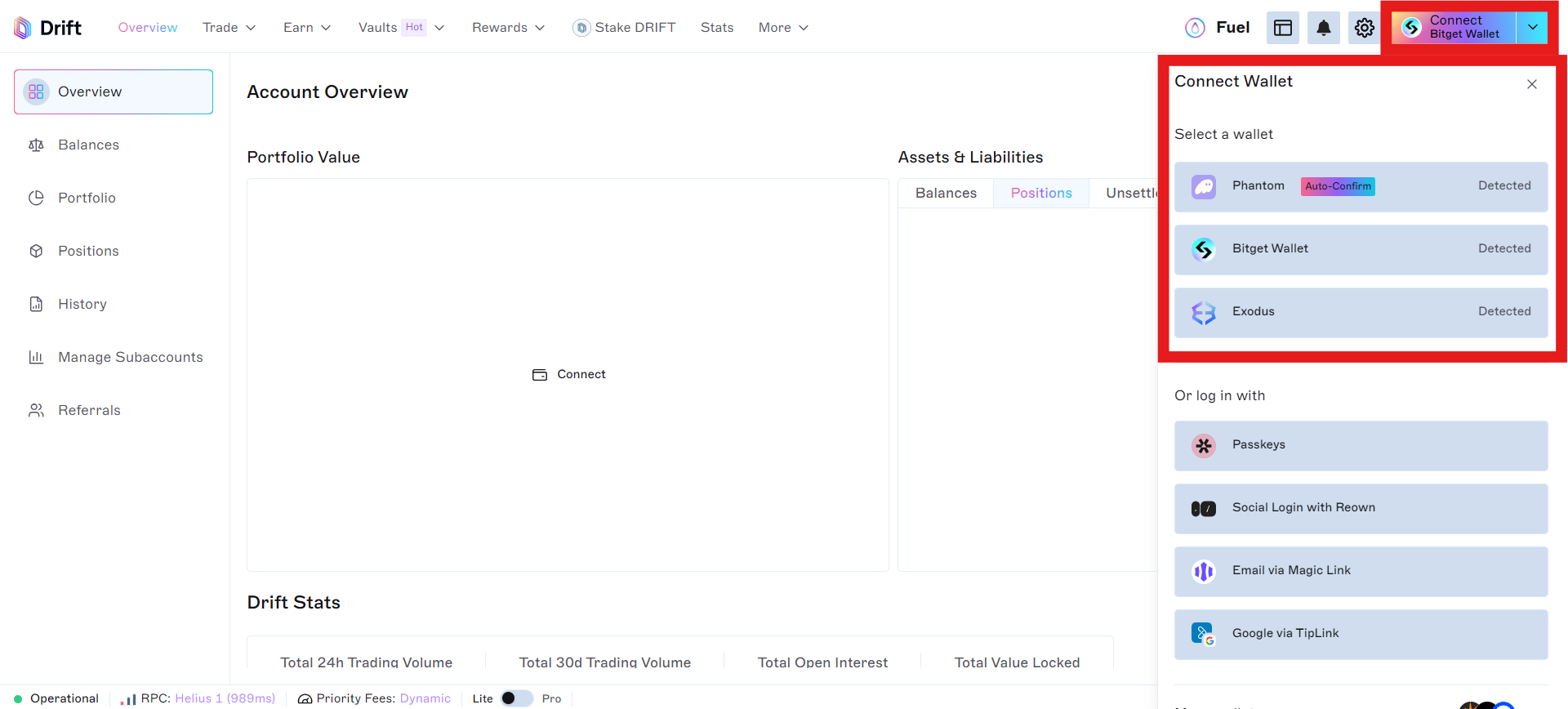

To start using Drift Protocol , go to the official application at APP . drift . Trade . The platform works on Solana , a fast and low cost blockchain. You must first connect a Solana compatible wallet , such as Phantom or Backpack .

- Open your portfolio compatible with Solana.

- Access the "Connect Wallet" tab on Drift.

- Accept the connection via a pop-up window.

Open a position on perpetual contracts

Once connected, you can access the trading of perpetual contracts , one of the main Drift . These are derivatives without expiration date, which allow to speculate upwards ( long position ) or downward ( short position ) on the price of an asset such as BTC , ETH , Sol , etc.

Here's how to proceed:

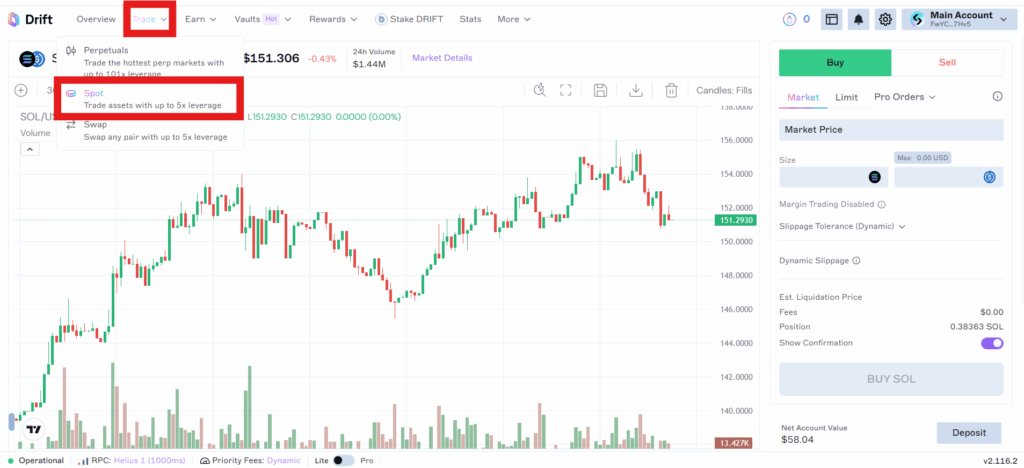

- "Trade" tab in the main menu.

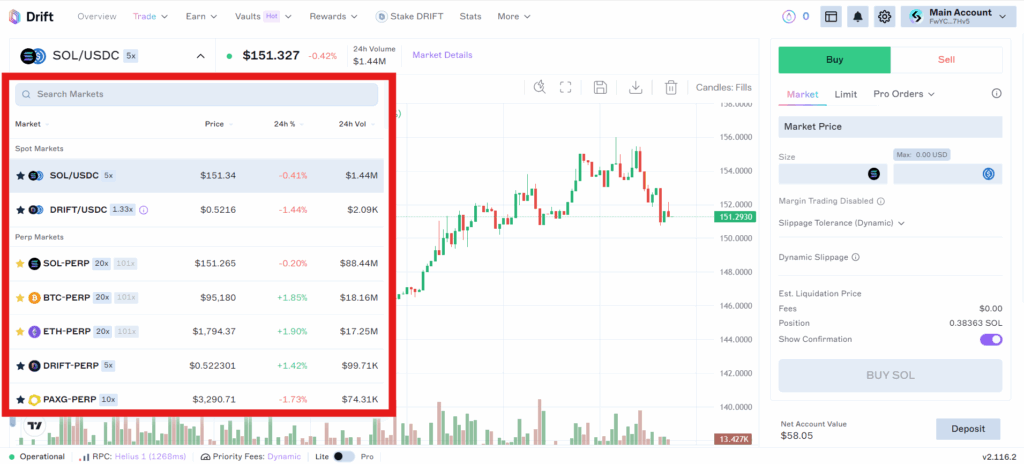

- Select the active to trader (eg Sol -Perp, BTC-Perp).

- Choose "Long" or "Short" according to your market intuition.

- Define the lever (up to 50x).

- Enter the amount and click on "Open Position".

Costs : trading costs are very competitive:

- Maker : between -0.02 % and -0.01 % (you are gaining costs if you add liquidity!)

- Taker : between 0.03 % and 0.10 %

Cash trading (spot) with lever effect

In addition to derivative trading, Drift also allows for cash trading (spot) directly on the platform, decentralized. This means that you exchange real tokens (for example USDC against Sol) and that the transaction is adjusted immediately.

You can even activate a lever effect of up to 5x , a rarity in the decentralized spot trading:

- Go to the "Spot Markets" .

- Select the pair (e.g. DRIFT/USDC, Sol /USDC).

- Choose your type of order (limit, market, stop, etc.)

- Activate the lever effect if desired.

- Validate the transaction.

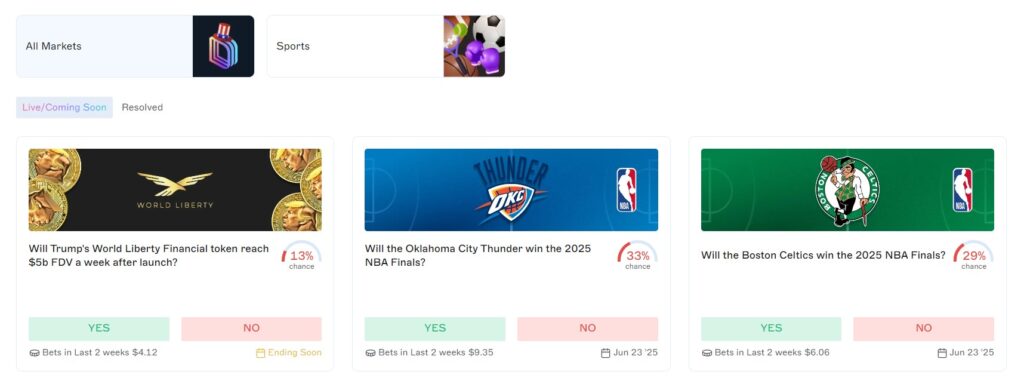

Predictive markets with BET

Drift innovates with its BET , inspired by platforms like Polymarket . You can bet on future events , whether political, economic or cultural. Each bet is supervised by an intelligent contract which guarantees the fair resolution of the event, without human intervention.

- "BET" tab in the main menu

- Choose an active market (ex: "Will Trump win in 2024?").

- Invest an amount in USDC in "Yes" or "No".

- At the end of the event, you receive your reward automatically if your prediction was correct.

This feature is built on the basis of Solana 's smart contract , which ensures speed , minimum cost and transparency .

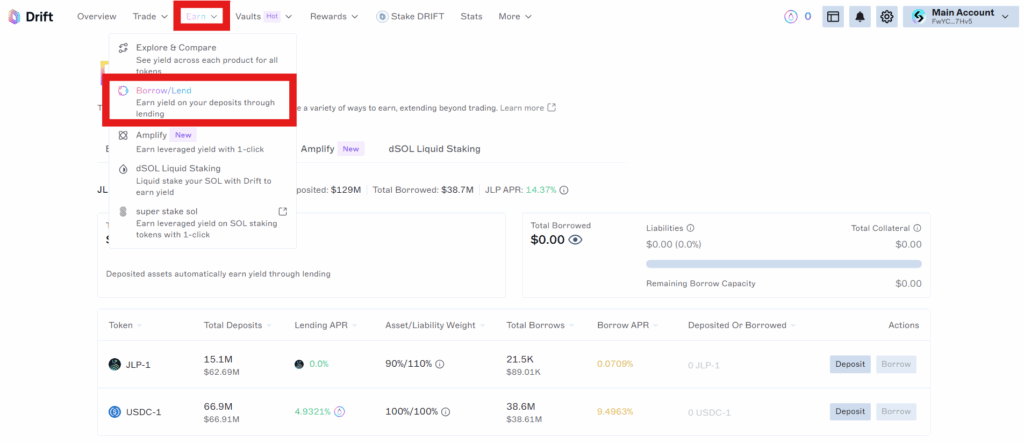

Decentralized loan and borrowing

Drift Lending and Borrowing system . You can :

- Provide assets (such as USDC , Sol, ETH) to the platform to generate interest .

- Borrow other assets by putting your existing tokens as a warranty.

For example, you can place the ground and take USDC USDC which you can then reinvest, trader or remove. The entire process is done via smart contract , without bank or centralized institution.

Position monitoring and portfolio management

Drift offers a detailed dashboard to follow all your positions and sales:

- Evolution of open positions (NLP, lever, margin).

- Distribution of the portfolio between available assets, loaned, borrowed or in trading.

- History of transactions on the Solananetwork.

You always keep possession of your funds : everything remains on your non-custodial wallet.

Conclusion on cment works Drift protocol

Drift Protocol embodies a new generation of decentralized trading platforms , combining the speed and low costs of Solana with an innovative technical architecture. Thanks to its hybrid liquidity model , its advanced functionalities such as trading of perpetual contracts , predictive markets and the loan/borrowing of assets, Drift offers a serious alternative to traditional centralized platforms. It also allows access to perpetual contracts without KYC when they are prohibited in certain countries on centralized exchanges.

By fully exploiting the power of the smart contract S and the transparency of the blockchain, Drift allows users to keep a total control over their funds while benefiting from rapid execution and competitive costs . Whether you are an experienced trader or a curious investor, Drift offers an exciting gateway to the expanding ecosystem of the DEFI on Solana .

Before you get started, it remains essential to fully understand the risks linked to the lever and highly volatile nature of the markets. But for those who wish to explore the future of trading on blockchain, Drift Protocol is already a reference to watch closely.

Want to test the adventure? Connect your portfolio and discover everything Drift can offer - speculation on major markets to betting on global events, in a completely decentralized and transparent .

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .