Beginner crypto currency trading: how to take a good start

Do you want to get into crypto currency trading as a beginner and you wonder where to start? The first thing to remember is that the cryptocurrency market is very different from other areas such as the traditional scholarship or the currency market (Forex). It is characterized by strong volatility, a very diverse offer in digital active ingredients, and an accessible activity 7 days a week. To go on good bases, it is essential to understand the fundamental notions of trading, blockchain and fundraising. In this article, we will progress step by step to allow you to invest with method and serenity, even if you have no prior experience in finance.

Table of contents

Beginner crypto currency trading: the first benchmarks to start

You don't need to be a technology or mathematics expert to start. The important thing is to know some key principles:

- A digital asset such as Bitcoin ( BTC ) or Ethereum Ethereum ETH) does not work as a business action. There is a demand related to the potential use of these cryptocurrencies, but volatility can be more important.

- You can open a wallet (or wallet ") to store your offline cryptocurrencies, or trust a conservation service provided by an exchange platform .

- blockchain technology , a decentralized register that validates all transactions. Each cryptocurrency has its own network or is based on that of another.

- Trading pairs like BTC BTC USD or BTC /EUR allow you to convert a digital asset into another currency, whether Fiat (national currency) or crypto.

According to data published by CoinmarketCap, there are more than 20,000 cryptocurrencies referenced in 2025. This may seem impressive, but most transaction volumes are focused on a few dozen major assets. Rather than wanting to follow everything, focus first on one or two well-established cryptocurrencies and on a exchange platform to avoid unnecessary risks.

Beginner crypto currency trading: how volatility works and why it's crucial

The cryptocurrency market is subject to sudden and sometimes extreme price variations. For example, Bitcoin increased from $ 30,000 in July 2021 to more than $ 69,000 in November of the same year, before falling under $ 20,000 a few months later. This fluctuation is typical of the high volatility of crypto-active.

Impact on the beginner trader

Volatility quick losses. For many beginners, this phenomenon is difficult to manage on a psychological level. Studies on trading psychology show that fear and excess confidence are the two emotions that most often trap new arrivals. In order to prepare you:

- Avoid placing in cryptocurrencies of the sums that you cannot afford to lose.

- Define an output plan in advance (Take-Profit and Stop-Loss) to avoid any impulsive decision.

- Find out regularly via reliable sites or recognized analyzes ( Chainalysis , Messari, Glassnode , etc.).

Liquidity: find the right markets

Liquidity sell an asset without influencing its price significantly. In the area of cryptocurrencies, liquidity depends on the volume of exchanges on a platform. The stronger the liquidity, the more you can place your orders. Major pairs like BTC /USD, BTC /EUR or ETH /USD are generally very liquid, making these cryptocurrencies ideal for crypto currency trading for beginners .

Beginner crypto currency trading: Choosing an appropriate exchange platform

Your first concrete step is to select a site or an application to buy and sell cryptocurrencies. Several criteria must be considered:

Regulation and confidence

Many trading platforms are not yet regulated in all countries. Before investing, make sure that the platform you plan to use has official licenses, such as recording as a service provider on digital assets (PSAN) in France. This approval guarantees a certain level of regulatory and safety compliance for users.

The resounding bankruptcies of MT. Gox in 2014 and FTX in 2022 recall that even deemed platforms can disappear, resulting in the loss of their users' funds. It is therefore crucial to choose a reliable and well -established actor on the market.

Currently, among the platforms with the PSAN status and offering the lowest trading costs , Binance and Bitvavo stand out:

- Binance works mainly via the order book , allowing users to buy and sell cryptocurrencies with great flexibility on prices, as well as access a wide range of advanced trading options .

- Bitvavo , on the other hand, offers a more accessible approach with two separate interfaces : a simple platform for beginners and a “pro” version allowing access to advanced tools for traders.

These two platforms offer more than 300 cryptocurrencies available , thus ensuring a wide diversity of investments and good liquidity .

Fresh and transparency

Each transaction involves costs , whether it be trading, withdrawal or conversion costs between currencies. It is essential to take it into account in your strategy, especially if you perform frequent transactions.

- Binance and Bitvavo are currently distinguished by their particularly low costs compared to other PSAN platforms.

- If you plan to trader regularly , favor a platform with competitive costs to maximize your profits.

User interface

If you are a beginner , choose a platform with an intuitive and easy -to -use interface.

By progressing, you can use more sophisticated tools, such as:

- Limit orders , to set a specific purchase or sale price.

- Stop-Loss orders , which secure your capital by limiting losses in the event of a drop in prices.

- Take-Profit orders , which automatically lock your earnings as soon as a price goal is achieved.

Whether you are a beginner investor or an experienced trader, the choice of the trading platform will directly impact your results. Opt for a regulated actor, transparent on its costs and adapted to your level of experience.

Beginner crypto currency trading: the safety of your funds

A crucial point of crypto currency trading for beginners is to secure your assets. The very operation of the blockchain implies that transactions are irreversible. If you send tokens to the bad address, or if your account is hacked, there is no central organ that can go back to cancel the operation.

Wallet: Hot Wallet VS Cold Wallet

- When you buy cryptocurrencies, you can store them in a hot wallet ( hot wallet ), a type of wallet connected to the Internet. This storage mode is particularly practical for daily trading and fast transactions, as it allows you to easily access your funds at any time. However, it presents a higher risk due to its permanent connection to the network, making it potentially vulnerable to hacks and phishing attacks.

Among the most popular hot wallets, we find:

- Metamask : widely used to interact with decentralized applications ( dApp S ) on Ethereum and other blockchains compatible with the EVM.

- Exodus : an excellent compromise between safety, accessibility and intuitive design . Exodus supports a wide range of cryptocurrencies beyond EVM blockchains ( Solana , Aptos, Base, etc.) and offers an easy -to -hand interface for a beginner.

- Trust Wallet : A versatile wallet, popular for its compatibility with a large number of blockchains and its direct integration with Binance .

More information here

-

In a cold wallet ( cold wallet ), your cryptocurrencies are stored on an offline , which makes them much more secure against cyber attacks and piracy attempts. It is generally a wallet hardware , a physical device similar to a encrypted USB key, which allows you to keep your digital assets safely. Cybersecurity experts strongly recommend keeping a large share of your funds on a cold wallet , especially if you do not perform frequent transactions.

Among the most famous solutions on the market:

- Ledger : essential reference, Ledger offers portfolios like the Ledger Nano X and the Plus Ledger , offering an excellent compromise between reinforced safety and ease of use . Compatible with a wide range of cryptocurrencies and with an intuitive interface via the Ledger Live , it is acclaimed by investors wishing optimal protection.

- Tangem : a portfolio in bank card format, which allows easy access to assets without requiring connection to a computer, while offering high security thanks to its advanced encryption technology.

Elementary precautions

- Immerately activate two -factor authentication (2FA) for your trading accounts.

- Use a long and complex password, different from those used for your other accounts.

- Monitor the potential new flaws or alert messages from your platform.

- Divide your risks by distributing your assets on several platforms if necessary.

Starting crypto currency trading: Defining a trading strategy

Beyond the technique, a concrete strategy is the basis of trading success. Different approaches exist for debut :Day Trading

This method is to open and close positions on the same day, taking advantage of small variations. THE day trading implied :- A permanent responsiveness, to seize intra-day volatility opportunities.

- Strict respect for loss limits (stop-loss).

- Hours of practice to master the technical analysis on short time units.

Swing Trading

Here you keep your positions over several days or weeks. You try to capture more movements than a few percentages over a day. THE swing trading :- Requires less constant surveillance than day trading.

- Partly rest on technical analysis, but you can combine it with fundamental analysis.

- Allows you to cut your positions if the market turns against you, while giving time to the tendency to materialize.

Longer -term investment

It is “buy and hold”, that is to say buy an asset and keep it for a long time, for example over several months or years. This method:- Requires a strong conviction on the nature of cryptocurrency (utility token or value reserve?).

- Reduces the stress of daily variations.

- Can generate high yields if you have chosen a crypto at the right time with an adoption potential or innovative technology.

Startant crypto currency trading: Technical analysis: fundamental tools

To go from the beginner's stadium to crypto trading at a more enlightened level, it is essential to master the technical analysis . This is based on the study of past price movements in order to identify recurring configurations with a statistical probability of influencing the market. However, it is crucial to understand that the cryptocurrency market is far from being perfectly free : it is often subject to manipulations orchestrated by large institutions with sufficient capital to influence prices to their advantage.

Market manipulations and liquidity pocket hunting

Large financial institutions and actors with substantial funds have the capacity to dictate the market by influencing the liquidity and feeling of private traders. Their main objective : to cause liquidation waterfalls to enter or get out of a position at an advantageous price.

Concretely, here is how these manipulations occur:

- Creation of a false bruise or lowering signal : these actors place major purchase or sale orders , creating the illusion of a natural movement of the market.

- Hunting with liquidity pockets : they target areas where a large number of stop-loss and liquidations are concentrated.

- Trigger of a liquidation cascade : when these areas are reached, leverage orders are liquidated , causing an even more brutal movement of the price.

- Intervention at the best price : after this purge, they buy lower (or sell above) , thus benefiting from an optimized position before the resumption of a more natural trend.

How to spot these manipulations?

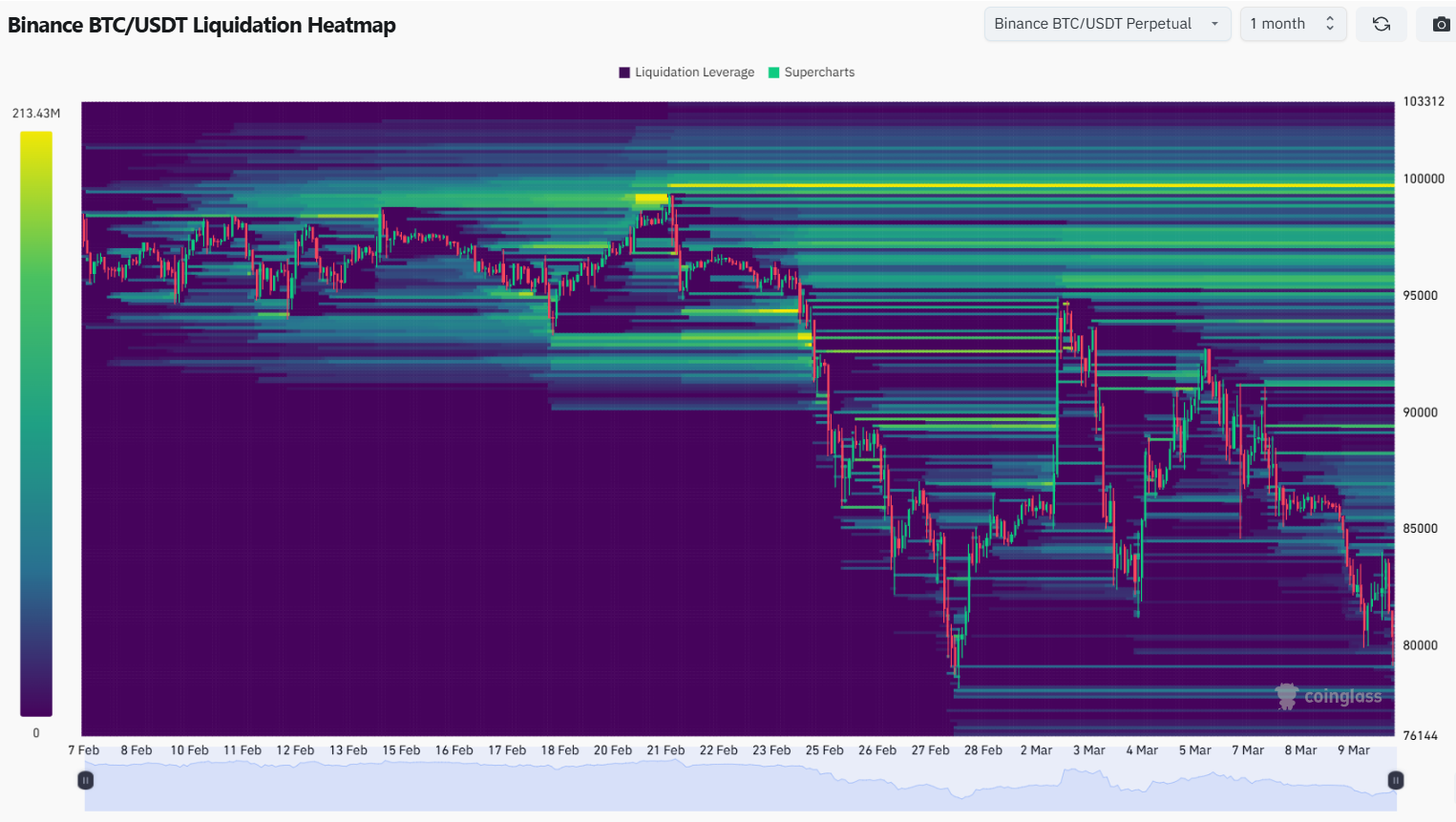

liquidity pockets are , it is useful to analyze the Heatmaps , which display the liquidity areas accumulated on the order book. These tools make it possible to visualize the price levels where massive orders are placed , often around key supports and resistances . By observing these liquidity cards over several days or weeks, we can identify areas where large institutions are likely to intervene .

Here is an example of Heatmap of the BTC/USDT pair on Binance on a scale of 1 month:

Supports and resistances: key tools

The supports are price levels where the market tends to bounce back , for lack of sellers ready to yield to a lower price. The resistances , on the contrary, are ceilings where the price has trouble progressing. These areas are essential because they often serve targets for market manipulation . The institutions know that many traders place their stop-loss and liquidity orders at these levels , making it strategic points to trigger volatile movements and recover liquidity .

Momentum indicators: confirmation of movements

If the supports and resistances make it possible to identify areas of interest, the indicators of Momentum help to confirm whether a movement has strength or if it may run out of steam .

- RSI (Relative Strength Index) : an RSI above 70 over-going asset , below 30 , it is occurred . Please note: in a manipulated market , an asset can remain in overcount or occur longer than expected.

- MacD (Moving Average Convergence Divergence) short and long mobile averages to detect trend changes .

- Mobiles (SMA, EMA) : Following the mobile averages allows you to have an overview of the trend , but also to identify areas where large institutions can cause rebounds or brutal breaks .

Understand the game of institutions to better trader

The cryptos markets are volatile , and this volatility is often orchestrated by powerful players who exploit the liquidity zones to maximize their profits . Being aware of these strategies and learning to spot them with tools like Heatmaps can help avoid conventional traps and better anticipate market movements.

Starty crypto currency trading: fundamental analysis: do not limit yourself to the graphic

If graphic indicators help you understand the short -term market behavior intrinsic value of cryptocurrency.

Study market capitalization

The market capitalization (or market cap) is calculated by multiplying the total number of tokens in circulation by the unit price. The higher it is, the more a project is often considered to be “established”, even if it does not necessarily guarantee its solidity.

Team, partnerships and use cases

Consult the White Paper (White Paper) of the cryptocurrency you are targeting: what are its applications, which are the developers, what is the history of the project? Also check if renowned organizations (companies, institutions, etc.) have been associated with it. An partnership can boost the credibility of the token.

Role of the community

In cryptocurrencies, user communities play a crucial role. They can bring out a project or abandon it. Monitor social networks, specialized forums and on-chain analyzes to identify the signals of real interest or a simple passenger enthusiasm.

Beginner crypto currency trading: manage the risk and protect its capital

Risk management is a pillar of long -term success. Even the best traders have losses. The difference is made in the ability to limit these losses and preserve a good share of capital so as not to be forced to abandon.

Stop-loss and Take-Profit

As mentioned above, the stop-loss automatically cuts your position when the price drops under a certain level. The Take-Profit makes the opposite when the price rises. This strict management protects both excessive losses and the scenario where you would drop a potential gain hoping for an even higher summit.

Diversification

As the financial advisers often repeat, do not put all your eggs in the same basket. Instead of betting everything on a single token or a single technology, remember to diversify. You can distribute your investment between many promisingltcoins and, if you wish, among other assets (precious metals, actions, etc.).

Master your lever

Some platforms offer leverage trading . This means that you can borrow additional funds to increase your position. If this approach can multiply your earnings in the event of good anticipation, it also multiplies your losses in the opposite direction.

Starty crypto currency trading: concrete examples of upper or lower market strategies

In a bull market

If the market is generally up (“Bull Market”), the trend often supports your long positions. Some tactics:

- Buy the DIP : Buy when the price corrects in the short term, betting on a bullish recovery.

- Cut less quickly: place wider stop-loss to accompany the trend.

- Gradually strengthen: if an A ltc Oin confidence consolidated, you can gradually increase your position.

Historical data prove that Bitcoin, during previous cycles, has experienced several corrections of 20 % or more in the upper market, before continuing its progression. Knowing how to detect these temporary corrections can be paid.

In a lower market

A “Bear Market” can last for months or more. Prices drop, confidence decreases. Possible strategies:

- Keep a part of cash in stablecoinS (USDT, USDC, etc.) to seize possible opportunities.

- Use Hedging: Take outdated sales positions (shorts) to compensate for the drop in your long wallet.

- Gradually buying: the programmed investment method (Dollar-Cost Averaging) is to invest the same amount at regular intervals, regardless of the price.

Beginner crypto currency trading: Taxation and legal obligations

When you start to generate gains, the tax question arises. The laws vary according to the country, and you must comply with the declaration obligations. In France, the tax regime for capital gains on digital assets generally applies as soon as you sell your cryptocurrencies against fiduciary currency up to 30 % on the gains made.

In some countries, the authorities also require to declare accounts on foreign platforms and to indicate the exact amount held in cryptocurrencies.

Beginner crypto currency trading: towards a more advanced approach

After a few months, if you want to go further:

Under -term contracts and derivative products

In addition to the direct purchase of cryptocurrencies, it is possible to speculate on their price variations using derivative products such as CFDs (contracts for different) , future or options . These instruments make it possible to bet both on the rise and on the decline , with the possibility of using a lever effect to multiply potential gains. However, this lever also amplifies the risks of liquidation , making these products particularly volatile and requiring rigorous risk management .

In France , regulators prohibit centralized platforms to offer future contracts on cryptocurrencies, which limits access to traditional derivative products for private investors. Binance , Bybit or OKX , although used internationally, cannot offer these services to French residents.

Alternatives: decentralized perpetuals platforms

For those who wish to Shorter (Sell uncovered) cryptocurrencies or trader with leverage, there are decentralized alternatives like Drift (Sur Solana ) and DYDX (on his own blockchain ). These platforms make it possible to open long (purchase) or short (sale) without expiration date.

Access to these platforms is by connecting its crypto wallet, usually a hot wallet To facilitate transactions.

More information here

After connection, the traders can deposit funds in the form of a stablecoin S ( USDC , USDT ) or other accepted cryptos, then open positions with lever according to the available margin.

On these platforms, the financing of positions is adjusted according to the funding rate : if the price of a perpetual contract diverges too much from the price of the SPOT market, a balancing mechanism adjusts the costs paid between buyers and sellers.

Be careful

Although perpetual offer advanced tools and better accessibility than centralized scholarships , they have major risks:

- Quick liquidation in the event of high volatility, if the maintenance margin is no longer sufficient.

- High lever effect (up to 20x or more), which can cause significant losses in a few minutes.

- Slipping and low liquidity on certain pairs, especially on less exchanged assets.

Before using these tools, it is crucial to master Stop-Loss orders, the calculation of margins and funding costs , in order to minimize exposure to market risks.

Conclusion on crypto currency trading for beginners:

Start with a modest amount, explore the concepts of volatility, liquidity and security. Select your exchange platform by assessing reputation and costs, then work on a simple strategy (Day Trading, Swing Trading or longer -term investment). Familiarize yourself with technical analysis as fundamental analysis to identify viable opportunities, and never forget to set up rigorous risk management.

Even if the road may seem complex, the Crypto universe offers great flexibility and overall access to investment. Each step has taken - from the discovery of the first orders to the extensive understanding of the markets - will strengthen your confidence and your competence. Ultimately, you will be able to navigate between atltcOins, decentralized finance tokens, derivative products and blockchain applications with a clear vision of potential and dangers.

The biggest challenge is to remain informed in a rapidly evolving sector. Market reversals, regulatory developments or the emergence of new blockchains can change everything overnight. So cultivate your ability to learn, assess and adjust your trading plan according to market signals. This is how you will maximize your sustainable chances of success in crypto currency trading.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .