Cryptocurrency mining: profitability, how it works, and the best cryptocurrencies to mine

Can you actually make money by validating transactions on a network? The answer is nuanced. Crypto mining can be profitable if you master the equipment, optimize energy costs , and understand volatility . What costs should you expect? Which cryptocurrencies are best suited? How do you evaluate your ROI ? In this article, we'll review the key points you need to know to ensure your mining investment

Table of contents

What is cryptocurrency mining?

The principle of mining Proof of Work algorithm . In practical terms, this involves using the computing power of your computer hardware to calculate complex cryptographic equations. The goal is to verify the accuracy of transactions, secure the network , and add a new block to the blockchain . In exchange for this service, miners receive a reward , called a block reward , usually paid in the cryptocurrency .

a network is, the higher the mining difficulty Bitcoin mining today requires specialized machines (called ASICs ) to remain competitive. Conversely, some ltc allow mining with simple GPUs (graphics cards) or even a high-performance CPU. But what about their profitability?

Why can mining be profitable?

If the cryptocurrency rises and your operating costs (electricity, maintenance, etc.) remain stable, you can generate a significant profit, especially during a market rally. Other factors also come into play:

- Mining difficulty block and collect the reward .

- technology : some blockchains have algorithms that are more or less suited to specialized machines ( ASICs ), influencing competition.

- Cost of acquiring the hardware: a high-end GPU ASIC can represent a heavy initial investment.

- Personal strategy: Do you hold the cryptocurrency long-term or do you sell regularly to cover expenses?

The essential question remains: profitability compensate for your operating expenses and market fluctuations? That's what we'll look at in more detail.

Variables that influence the profitability of crypto mining

1. The price of cryptocurrency and its volatility

Cryptocurrency prices directly impact your return on investment. When Bitcoin reaches highs, many players start mining, increasing the difficulty and intensifying competition. This volatility can cause your earnings to fluctuate dramatically: it's a crucial factor to consider in any profitable crypto mining .

2. Electricity costs

Mining requires energy, often intensively. ASICs or GPUs run 24/7, which can drive up electricity bills. The higher your kWh rate, the harder it will be to achieve a return on investment . This is why many mining farms are located in areas where energy is inexpensive (sometimes near hydroelectric or geothermal sources).

3. Hardware: ASIC or GPU?

If you're targeting highly competitive blockchains (like Bitcoin ), you'll need to invest in a ASIC to compete with large mining farms . However, if you're targeting ltc or emerging projects, a GPU may suffice. Each option has its advantages and disadvantages:

- An ASIC offers a hashrate for a specific algorithm, but is less flexible.

- A GPU can mine multiple different coins, offering greater agility to adapt to the market.

4. The difficulty of blockchain

The difficulty adjusts automatically to maintain a consistent validation time. On Bitcoin , it adjusts every 2016 blocks, which is approximately two weeks. If the network 's overall hashrate increases rapidly, the difficulty will also increase. Your machine will then have to work harder to mine the same reward . On other blockchains, the adjustment algorithm may be faster or slower.

Crypto mining and profitability: the reference sites

Before embarking on this venture, you can compare earning potential using specialized tools:

- WhatToMine.com: This site allows you to enter your hash , your power consumption in watts, and your electricity cost. It will then show you the most profitable cryptocurrencies to mine.

- AsicMinerValue.com: ideal for evaluating the ROI of a ASIC . You select a model, and the site shows you its daily or monthly profitability, based on the cryptocurrency and the average electricity price.

These platforms provide estimates based on current market conditions, volatility , and network difficulty . The data changes daily, or even hourly.

Crypto mining and profitability: Which cryptocurrencies to mine in 2025?

The question of "which coin to mine?" comes up frequently. The answer depends on your budget, your goals, and your risk . Here are a few examples of popular projects that can potentially offer returns depending on the equipment and market conditions.

Bitcoin : the undisputed leader

Bitcoin remains the most reputable and widely traded cryptocurrency. However, mining requires expensive ASIC hardware and access to inexpensive electricity to maintain a positive profit margin. With each halving (every four years), the block reward decreases, which can impact profitability . By 2025, it had already dropped to 3.125 BTC per block . This means you must carefully calculate your acquisition cost , expenses , and price appreciation prospects to determine if you can make a profit.

For more details, see our dedicated article on which crypto to mine in 2025 .

Crypto mining and profitability: Is it still possible to mine at home? The realities of “home mining”

mining rig at home , which is a computer specifically assembled for mining cryptocurrencies. Several factors come into play:

- Noise and heat pollution : a ASIC or GPU generates significant heat and high noise, which can be difficult to manage on a daily basis.

- Electricity : your bill is likely to increase. In some cases, your current contract will not be sufficient, and you will need to consider a more suitable solution (three-phase subscription, for example).

- Performance : it all depends on the hardware chosen. A ASIC can be cost-effective if you have a competitive energy rate, whereas a GPU might struggle to cover costs.

Some miners circumvent these drawbacks by joining an online mining pool cloud mining , which we will discuss.

Crypto mining and profitability: Cloud mining, an alternative to buying hardware

Cloud mining involves renting hashing power from a data center . Instead of buying an ASIC or GPU , you pay a provider who handles the equipment, electricity, and maintenance. The advantages:

- No noise or heat in your home.

- No acquisition cost for the equipment.

- No advanced technical skills are needed to configure and maintain it.

However, cloud mining also presents risks:

- Profitability is not always guaranteed: depending on the contracts, the fees can be high.

- Reliability of the service provider: you must place your trust in a third-party company. In case of bankruptcy or fraud, you lose your investment.

- Lack of flexibility: you are bound by a subscription or contract, which limits your ability to switch to another cryptocurrency if profitability decreases.

How to calculate the profitability of your crypto mining?

1. Basic parameters

To determine the profitability of your mining , you must consider:

- Hashrate : hashing power (expressed in H/s, MH/s, GH/s, TH/s, etc.).

- Power consumption (in watts): the more powerful your equipment, the more power it consumes.

- Cost of kWh in your region: this is often the determining factor.

- Price of the cryptocurrency : this determines the value of the reward (in euros or dollars).

- Network difficulty the more effort you will have to put in to mine a block .

- Reward per block : for example, 3.125 BTC for Bitcoin after the last halving .

2. Practical Tools

As mentioned above, calculators like WhatToMine or AsicMinerValue greatly simplify this process. You enter your setup and electricity rate. These platforms update market data in real time to estimate your daily or monthly profit.

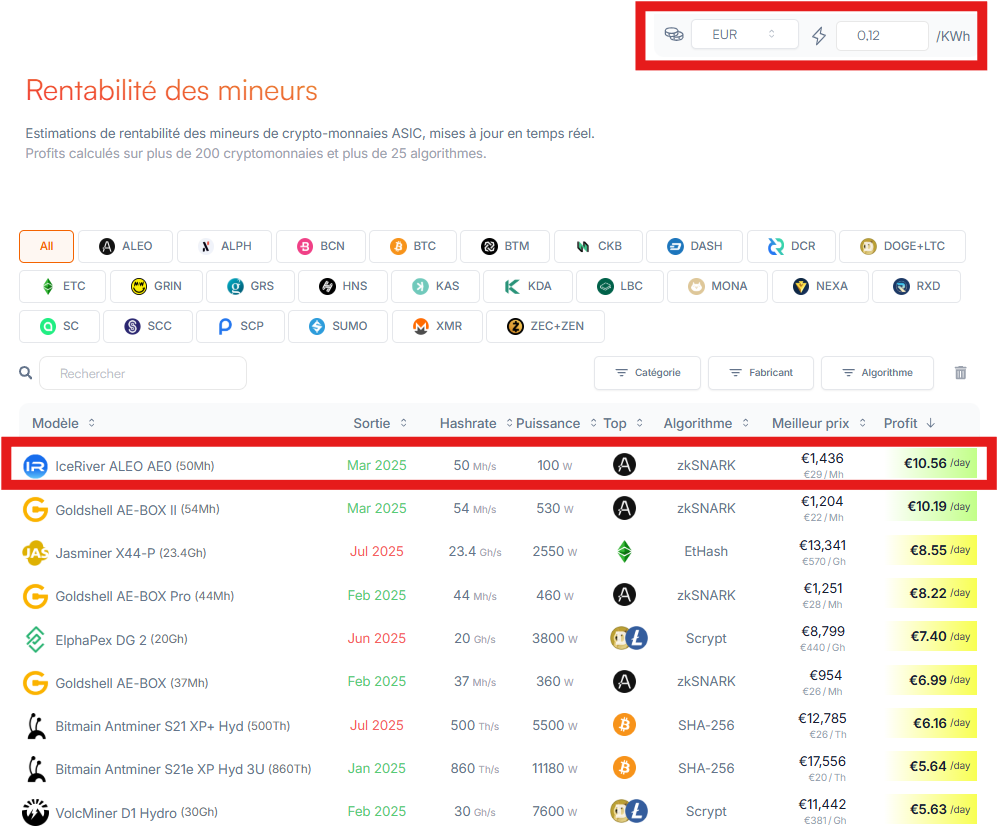

Example of profitability with the IceRiver ALEO AEO (50 Mh/s) – simulation according to AsicMinerValue

Among the ASIC miner models projected for 2025, the IceRiver ALEO AEO stands out, according to AsicMinerValue, for its combination of high energy efficiency and attractive net yield. This model specializes in the zkSNARK , used particularly for cryptocurrencies focused on privacy and zero-knowledge proofs.

Here are the machine's specifications:

- Model : IceRiver ALEO AEO

- Release date : March 2025

- Hashrate : 50 Mh/s

- Power consumption : only 100 watts

- Estimated price : 1 436 €

- Net daily profitability : €10.56 / day

The most remarkable feature here is the machine's very low power consumption (100 W), resulting in excellent energy efficiency. The cost-effectiveness calculation is based on an electricity cost of €0.12/kWh , as shown in the top right corner of the interface.

Quick calculation of daily consumption:

- 100 W = 0.1 kW

- 0.1 kW x 24 h = 2.4 kWh / day

- 2.4 kWh x €0.12 = €0.29 electricity cost per day

Estimated return on investment (ROI):

- Machine price: €1,436

- Daily profit: €10.56

- Estimated ROI : 1436 / 10.56 ≈ 136 days , or approximately 4 and a half months

Crypto mining and profitability: Return on investment and outlook in 2025

Mining remains a competitive sector in 2025. Industrial farms can deploy thousands of ASIC , benefiting from economies of scale. However, an individual can still generate profit if:

- He has access to low-cost electricity.

- He chooses cryptocurrencies that are compatible with his hardware.

- He regularly monitors his ROI and adapts his strategy to the market.

Opportunities sometimes shift towards lesser-known projects that are potentially more profitable in the short or medium term. Some ltc can prove very lucrative for a short period, until the difficulty and competition increase.

Should we get into crypto mining in 2025?

The answer depends primarily on your investor profile. Crypto mining profitability is not guaranteed and involves risks:

- Price fluctuation (your production may fall in value if the market falls).

- Possible regulatory changes (some jurisdictions restrict access to electricity for minors or prohibit the practice).

- Maintenance and renewal of equipment, which can become obsolete quickly.

However, for a patient and informed investor with a suitable setup (adequate power, efficient ventilation), mining remains a way to generate passive income by accumulating cryptocurrencies. It's up to you to decide if it's worth the effort.

Advantages and disadvantages of crypto mining

In conclusion, here is a summary of the main strengths and limitations of mining :

Benefits

- Passive income : once your rig or ASIC is configured, it generates coins without constant intervention.

- Direct access to cryptocurrencies : you obtain digital assets without making a purchase.

- Participation in blockchain security : you support the network and contribute to its integrity.

- Flexibility (especially with a GPU ): the ability to mine different coins if profitability fluctuates.

Disadvantages

- investment in equipment is often high.

- Energy costs that can put a strain on the budget.

- Volatility : the value of mined coins can fall sharply.

- competition over popular cryptocurrencies like Bitcoin .

- Maintenance and logistics: management of heat, dust and the risk of breakdowns.

Conclusion on crypto mining and its profitability

Several points are crucial:

- Choose cryptocurrency based on your beliefs and hardware ( ASIC or GPU ).

- Calculate precisely its acquisition cost , electricity costs profit margin .

- Monitor market volatility difficulty .

- Consider cloud mining if you do not want to host the hardware at home.

- Adapt your strategy in case of a sudden change in demand or a halving.

Tools like WhatToMine and AsicMinerValue greatly facilitate real-time analysis. From there, profitability will depend on your ability to manage risk and optimize your setup. Some individual miners manage to generate a consistent profit, while others prefer to turn to staking or more traditional investments.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .