Cryptocurrency Staking : risks, methods, and how to assess them

Cryptocurrency Staking and associated risks

Staking involves locking up your crypto assets on a blockchain using the Proof-of-Stake (PoS) consensus mechanism staking its variants to validate transactions and receive staking rewards in the form of new tokens . While cryptocurrency staking can generate passive income attractive returns , it also exposes you to specific risks that vary depending on the staking used: exchange ( CEX ), non-custodial wallet , staking pool , or liquid staking . Here is a comprehensive overview of the risks associated with staking and how to assess them.

Table of Contents

What are the risks of crypto staking ?

Market risk and volatility

The main risk of staking is the potential for funds to be locked up due to high market volatility . Even if you receive rewards , the value of the cryptocurrency can plummet during the lock-up period or the staking period . For example, a staking offering a 10% return can be largely wiped out if the token drops by 40% over the same period. This risk is compounded by the inability to sell or transfer assets during the lock-up period.

The lockout periods imposed by the protocol or platform prevent users from instantly withdrawing or selling their crypto assets . If a sharp drop occurs, users cannot react quickly, which exacerbates potential losses. Liquidity risks must therefore be considered, especially on blockchains where staking can staking several days or even weeks.

Risk of slashing

Slashing is a penalty applied if the validator whom you have delegated your tokens makes a mistake: validating a fraudulent transaction staking tokens may then be destroyed, directly impacting the users who delegated to that validator . On Ethereum , for example, less than $3 million worth of ETH has been lost through slashing since 2021, representing a small fraction of staked assets, but the risk exists.

Risk of hacking and security

Centralized staking platforms or smart contracts used for staking can be vulnerable to vulnerabilities or hacks. In the event of a hack, digital assets can be stolen or permanently lost. This counterparty risk applies to all solutions where you do not control your private keys staking

Counterparty risk

When you stake your cryptocurrencies through a exchange ( CEX platform 's solvency and management . A default, bankruptcy, or mismanagement can lead to the loss of your cryptocurrencies . This risk is reduced with non-custodial staking , but a technical risk still exists.

Smart contract risk

Thefts linked to vulnerabilities in smart contracts specifically used for cryptocurrency staking do exist, but they are relatively rare compared to more general incidents in DeFi. However, when they do occur, they can have a severe impact on users.

According to recent data from Dapp Radar, in 2025 , rug-pull attacks, or exploits of vulnerabilities in DeFi protocols, including those offering staking , decreased in frequency (7 cases recorded at the beginning of 2025 compared to 21 in 2024), representing a 66% drop. However, financial losses skyrocketed, reaching nearly $6 billion, a large portion of which was linked to a single project (Mantra), demonstrating that even if attacks are less frequent, they are often more devastating.

Risks associated with the staking method

Centralized platform Staking (CEX)

- Counterparty risk: loss of cryptocurrencies in the event of bankruptcy or hacking of the platform .

- Risk of blocking: the platform may impose a blocking period or delay withdrawals.

- Less control over the selection of validators , therefore indirect exposure to slashing .

- Example: staking on OKX.

More information about the rewards can be found here.

Staking via non-custodial wallet (direct delegation)

Staking via a non-custodial wallet (direct delegation) involves directly delegating your cryptocurrencies to a validator on the blockchain, giving you complete control over your funds and the management of your private keys.

- This method exposes you to the risk of slashing: if the validator you have chosen makes a mistake or acts maliciously, part of your funds may be penalized.

- There is also a technical risk: loss of access to your portfolio or incorrect handling can lead to the loss of your assets.

To stake your cryptocurrencies in a non-custodial manner, simply use a compatible wallet like Ledger. Ledger is the world leader in hardware wallets, meaning a wallet that stores your private keys offline, thus offering maximum security against hacking and malware.

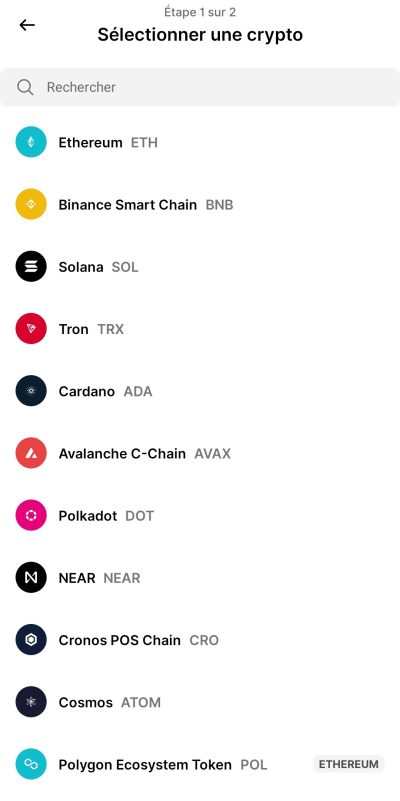

In addition to security, Ledger offers a wide range of staking options directly through its Ledger Live application: Ethereum, Solana , and many others.

You can track and manage your rewards, explore new opportunities, and easily choose the validator to whom you delegate your funds.

In summary, staking via Ledger combines offline security, complete control over your funds, and access to multiple blockchains and validators, while limiting the risks associated with centralized platforms or third-party custody . For more details, we invite you to read our guide to choosing Ledger model and how to staking on Ledger Wallet step by step .

Liquid staking

- Allows you to receive tokens representing your cryptocurrencies (e.g., stETH on Lido).

- Risk of decorrelation: the token may lose its parity with the original asset.

- Less risk of being locked in, but exposure to the volatility of the derivative token

How to assess and reduce the risks associated with staking ?

Carefully select the validators or delegates

- Analyze the history of slashing penalties and the reliability of validators .

Before staking, it is useful to consult the network's history regarding slashing (penalties imposed on validators): tools like Beaconcha.in (for Ethereum) allow you to analyze the reliability of validators and their performance history.

- the validator 's uptime , slashing rate .

- Avoid delegating to a single validator to limit exposure to slashing .

This information is usually accessible in your wallet's staking interface (such as Ledger Wallet, etc.) or on explorers such as Mintscan or Solscan.

Understanding the protocol and platform conditions

- staking rules , lock-up periods reward frequency and any applicable fees.

- Take into account local taxes on staking rewards .

Use recognized and audited staking platforms

- Favor staking platforms with security audits and a reliable history.

- Avoid protocols that are too recent or lack transparency regarding fund management.

Reduce liquidity risks

- Avoid staking all of your assets : keep a reserve for trading or unforeseen events.

- liquid staking options for greater flexibility, while being aware of the associated risks.

Is staking risky? Summary of potential risks

- Market volatility returns if the token falls.

- Lock-up period : inability to sell for a certain period .

- Slashing : partial loss of tokens in case of a validator .

- Hacking or bug in the platform or protocol .

- Counterparty risk on CEX .

- Regulatory and tax risks.

FAQ: Crypto staking risks

What are the risks associated with staking on a centralized platform?

The associated risks include the loss of access to your crypto in the event of bankruptcy or hacking of the platform , the risk of withdrawals being blocked for a period of several days or weeks, and indirect exposure to slashing depending on the management of validators .

How to reduce the risks of crypto staking ?

To reduce risks , diversify your validators , favour platforms , find out about the blocking period and keep some of your digital assets available.

What are the main penalties for slashing?

Slashing penalties vary depending on the blockchain : they can range from the loss of a few tokens to the entire delegated stake, depending on the severity of the validator .

Is staking suitable for all profiles?

Note that staking is not suitable for everyone: it is best suited to those who are willing to lock up their cryptocurrencies for a certain period and who understand the potential risks .

Conclusion

Cryptocurrency staking is an effective strategy for generating passive income and securing blockchains , but there are still risks associated with staking staking to be assessed. From volatility and slashing to periods of lock-up , hacking , and regulatory risks, each method has its own specific characteristics that must be understood. Before delegating or staking your cryptocurrencies , carefully analyze the risks of cryptocurrency staking and adapt your strategy to your profile and objectives.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital.

All our articles undergo rigorous fact-checking. Every key piece of information is manually verified against reliable and recognized sources. When we cite a source, the link is always integrated into the text and highlighted in a different color to ensure transparency and allow readers to directly access the original documents.

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .