How to Get Good Returns from Crypto Staking : A Complete Guide

Have you heard about cryptocurrency staking and want to know exactly what returns to expect and how best to maximize your gains? In this article, you'll discover everything you need to know: the most common interest rates, the different types of platforms, the concept of security, and the factors that truly influence your investment .

Table of Contents

Crypto Staking yield: Why can it be profitable?

Cryptocurrency staking involves locking your cryptocurrencies Proof of Stake protocol to contribute to the validation staking transactions on a blockchain network . In exchange, you receive rewards in the form of additional tokens. This mechanism presents itself as a way to generate passive income without requiring expensive infrastructure. Unlike mining ( Proof of Work ), it relies on the concept of "financial participation" rather than computing power.

The Foundations of Crypto Staking

In a Proof of Stake , participants deposit a certain number of tokens to contribute to validating transactions and creating new blocks. The higher your stake, the greater your chances of being selected as a validator and receiving rewards . In practice, unless you hold substantial funds in a single cryptocurrency (often tens of thousands of euros), you will not directly validate transactions.

The vast majority of individual investors therefore opt for delegated staking . This means they entrust their tokens to large validators – often specialized companies or centralized exchanges – who handle validating blocks on their behalf. In exchange for this delegation, the validators pay a portion of the generated earnings to the delegators, after deducting a commission .

More information about the rewards can be found here.

It's a model that allows you to generate passive income without needing computer equipment or advanced technical skills.

Key Points to Remember

- The interest rate is often expressed as APY (Annual Percentage Yield), that is, an annual percentage.

- Rewards vary depending on the blockchain, the amount of tokens staked staking and the lock-up period .

- Re - staking (or re- staking ) allows the use of multiple protocols to generate even more returns .

Key Points to Remember

- The interest rate is often expressed as APY (Annual Percentage Yield), that is, an annual percentage.

- Rewards vary depending on the blockchain, the amount of crypto staking , and the lock-up period .

- Re - staking (or re- staking ) allows the use of multiple protocols to generate even more returns .

What Returns Can Be Expected from Crypto Staking ?

Potential earnings vary from one blockchain to another. On established networks like Cardano or Ethereum , more moderate rates are often observed, ranging from 1% to 5%. On newer or less capitalized projects, some emerging blockchains offer rewards that can climb to 8%, or even 10% or more. Others, like Solana , often offer returns of around 5% to 7%.

Factors Impacting Rates

- capitalization : the more mature a blockchain is, the more validators it attracts, which lowers the passive yield .

- Lock-up period staking schemes offer a higher fixed rate

- The project's monetary policy : the reward systems (inflation or redistribution) vary according to the protocol.

How to Access Crypto Staking and Find the Best Returns?

To maximize your potential earnings with crypto staking , you need to know where and how to delegate your funds, depending on your profile and desired level of control. Here's a practical overview of the different methods for accessing staking , comparing returns , and avoiding the most common pitfalls.

1. Choose a Suitable Staking Method

via a centralized exchange

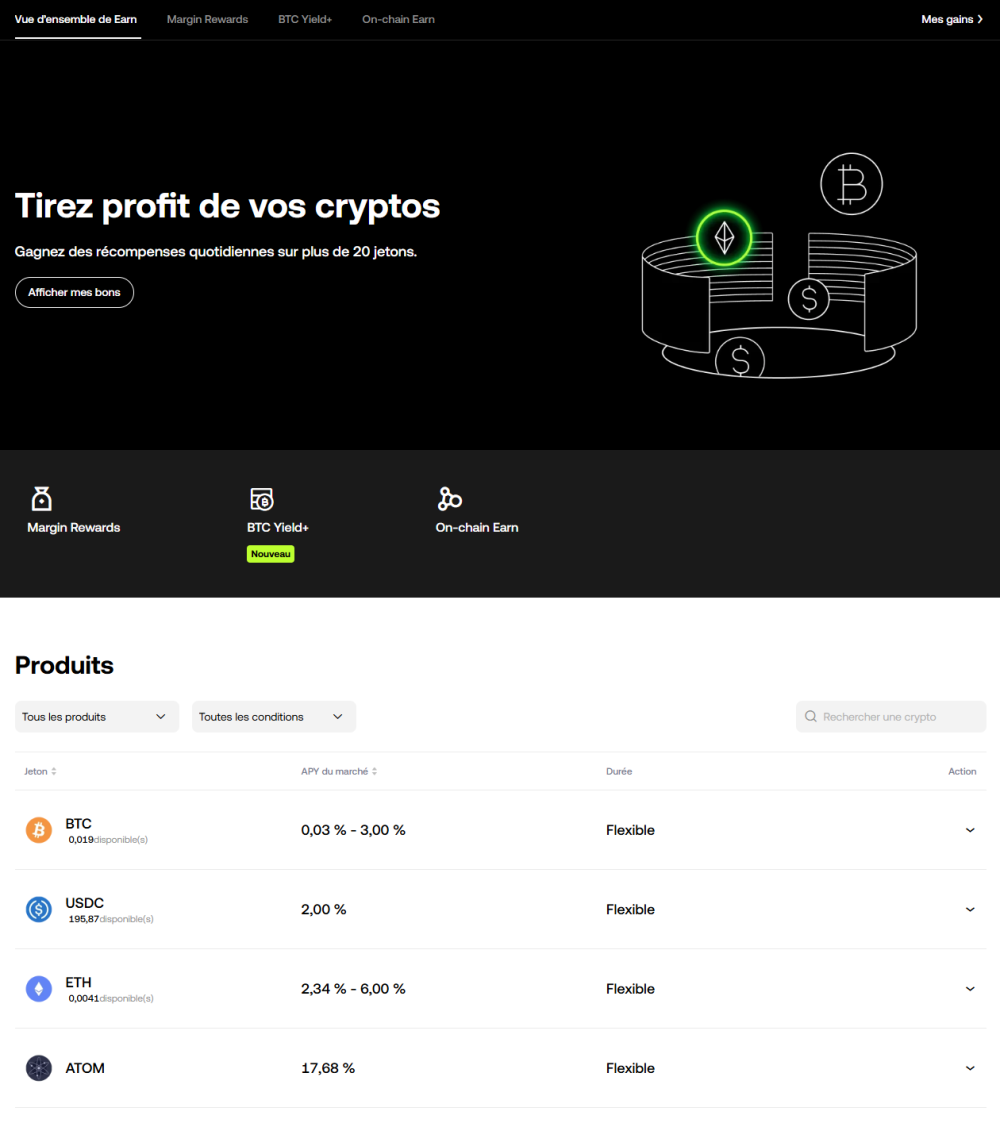

If you're a beginner, the simplest method is to stake your cryptocurrencies directly through a centralized exchange . Platforms like OKX, for example, offer staking integrated into their user interface. Once your tokens are deposited on the platform, you simply need to:

- Choose the asset you wish to stake

- Select a staking : flexible or locked

- Confirm the blocking period and the proposed APY

This solution is ideal for its simplicity and accessibility, but it involves entrusting the safekeeping of your assets to the platform.

Here are some examples of returns via the OKX earn tab:

More information about the rewards can be found here.

Via a personal wallet (non-custodial wallet)

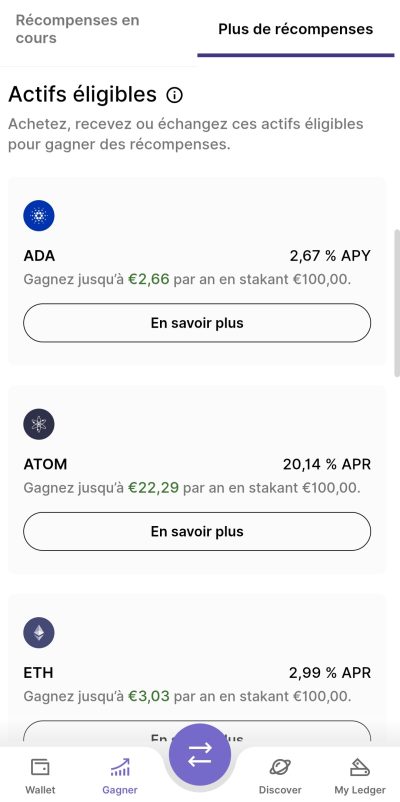

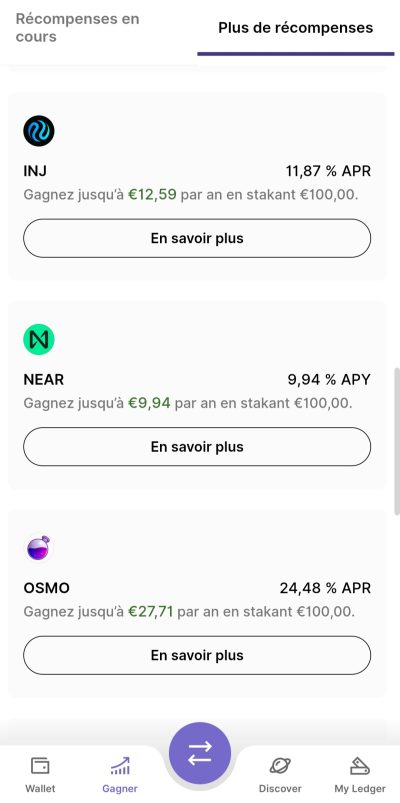

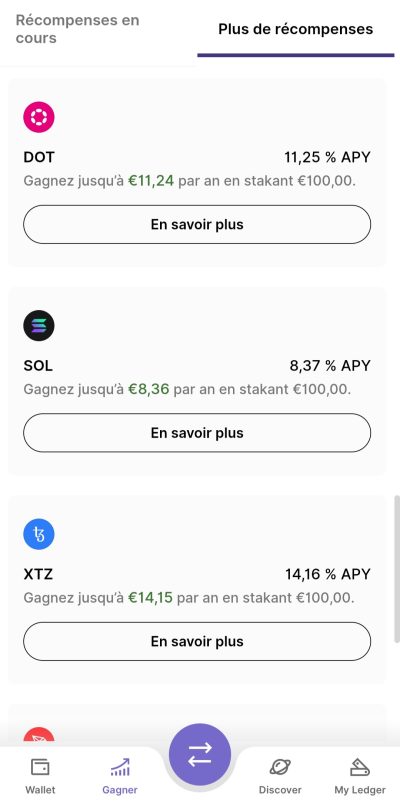

For those who wish to retain full control of their private keys, staking can be done directly from a personal wallet such as Ledger Live , Metamask , Keplr , or Trust Wallet or other. These wallets often include a delegation interface allowing you to assign your tokens to a validator in just a few clicks.

Not all wallets support all assets. For example:

- Metamask does not support Cardano staking because it is not an EVM-compatible blockchain Cardano

- Ledger Live supports staking of Polkadot , Tezos , Solana , Ethereum , etc.

Before choosing a wallet, make sure to check if it supports the token you want to stake, and if it allows direct delegation or via an integrated DApp .

Here are some examples of returns from the Earn tab of Ledger Live:

For a more comprehensive understanding of the tools and legal constraints, we invite you to explore the BSM program .

It includes detailed video tutorials on centralized exchanges, software wallets, hardware wallets ( Ledger Flex setup tutorial with transactions), and essential best practices. The program is accessible from the header or the link above. The program also provides an in-depth understanding of the monetary system, Bitcoin , and more advanced financial concepts.

By connecting your wallet to DAppspecializing in staking

Another method involves using specialized DApp such as Lido (for Ethereum , Polygon , Solana ), Marinade (for Solana ), or Rocket Pool (for Ethereum ). These protocols allow you to connect your wallet (Metamask, Ledger , etc.) and stake your funds via a decentralized interface, often with the possibility of obtaining a liquid derivative token (such as stETH, mSOL) representing your position.

staking method is also the one with risk of scams . Numerous fake DApp mimic official websites to siphon your funds via malicious smart contract . Before confirming a transaction, always verify:

- The domain name (often scammers use names very similar to official sites with a reversed letter or a displaced period)

- The exact address of the DApp (only use official links from CoinMarketCap, CoinGecko or verified social networks)

- The contract displayed in your wallet: if it asks for unusual permissions or access to all your funds, refuse immediately

In summary, prioritize staking via your secure wallet or centralized exchange if you are a beginner. Never connect your wallet to a DApp whose authenticity you have not 100% verified.

2. Compare Yields and Conditions

Each platform, whether centralized or not, offers different rates for the same asset.

To avoid missing out on better rates, you can use tools like Waltio , Staking Rewards.com , or DefiLlama to:

- Compare APYs across platforms

- Check the service and management fees

- Consult the security notes for the validators or protocols.

3. Check Service and Network Fees

Fees can significantly reduce your net return . They take several forms:

- Transaction fees (gas fees): particularly on Ethereum , they can be high depending on network congestion.

- Validator fees : these vary from 1 to 20% depending on the network and the validator.

- Withdrawal or exit fees from staking : some platforms apply them at the end of the blocking period.

4. Understanding Blockage Duration

There are two types of staking :

- Flexible Staking : you can withdraw your funds at any time, but the interest rate is usually lower.

- Locked Staking : funds are locked for a fixed period (7, 30, 60, or even 90 days or more). The APY rate is higher, but the capital is unavailable.

Some networks also impose an unlocking period after the end of staking, lasting up to 28 days.

5. Monitor Re-Staking Opportunities

Restaking involves using the same tokens to secure multiple networks, or automatically reinvesting rewards to earn staking interest . Protocols like EigenLayer on Ethereum a large scale. It allows for the multiplication of yield sources, but also involves a higher level of complexity and risk.

Make sure you fully understand the implications ofstaking and only use proven and recognized protocols.

Crypto Staking yields: A closer look at some blockchains

Ethereum

With the transition to Proof of Stake , Ethereum introduced staking staking pools such as Lido.

Cardano

Its delegation mechanism allows you to stake ADA without a lock-up period, meaning you can withdraw your funds at any time. The passive yield flexible staking solution .

Polkadot

Polkadot is characterized by a staking , often yielding between 8% and 10%. However, there is a unlocking period of approximately 28 days to withdraw your DOT. Validator fees vary, so it is essential to check the charges before staking your tokens. The attractive returns encourage many investors to invest in this project.

Solana

Solana typically offers rewards between 5% and 7%. Its fast and low-cost blockchain attracts developers and users looking for a high-performing ecosystem. To stake on Solana , you can use a dedicated wallet or exchanges that offer staking with just a few clicks.

Crypto Staking yield: Potential risks

Despite its advantages, crypto staking involves certain risks that are best understood. Here are the key points:

1. Market Risk

If your tokens are locked, you cannot sell them quickly if the price collapses. In the volatile cryptocurrency market , this constraint can lead to significant unrealized losses. Before staking, ensure you are prepared to maintain your position even in the event of a rapid price drop.

2. Validator Risk

If you delegate your assets to a validator who makes mistakes or is attacked, you may incur financial penalties (slashing). It is recommended to choose reliable validators and diversify your investments to limit this risk . However, this remains relatively rare.

4. Liquidity Risk

An unlocking period may apply before you can retrieve your tokens, ranging from a few days to several weeks. This is an important factor to consider if you anticipate needing liquidity quickly.

Crypto Staking Yield: How to Start Staking (Key Steps)

For beginners, the crypto staking may seem complex. However, the steps are quite simple:

- Choose an eligible cryptocurrency: check if the crypto you hold supports Proof of Stake . The most common ones are Ethereum , Cardano , Polkadot , Solana , etc.

- Deciding to use a exchange platform or a personal wallet:

- On an exchange like OKX you can usually stake in just a few clicks.

- On a wallet like Ledger , you delegate directly to a validator to remain in control of your keys.

- staking plan : flexible or locked. Compare interest rates and withdrawal conditions.

- Validate the operation and start receiving rewards according to the protocol's periodicity (often every epoch, i.e., several times a day or week).

Crypto Staking yield: The importance of compound interest

An often underestimated advantage is the ability to reinvest rewards to generate compound interest . Specifically, your earned tokens are automatically reinvested in your staking to generate further rewards . Over time, this effect can become exponential, especially if the project's valuation increases.

Simplified Calculation of Compound Interest

Let's say you have 1,000 tokens of a given cryptocurrency offering an APY of 7%. After a year, you'll have approximately 70 more tokens. If you reinvest them immediately, the following year the 7% will apply to 1,070 tokens, roughly 75 more tokens, and so on. Over several years, this strategy can generate a significant return compared to a simple, uncompounded fixed yield. This, of course, assumes that the token's price has also performed well. Generating a very high return on a token whose price is plummeting is not a sound strategy.

Crypto Staking yield: What about taxation?

Taxation varies by country, and in France, the official regulations surrounding crypto staking remain unclear. Tax authorities often consider received tokens as taxable income at the time of receipt. You must then declare any capital gains when selling or converting these tokens back into fiat currency. As a precaution, keep accurate records of your transactions, ideally using crypto management software such as Koinly, Waltio, or Cryptotaxcalculator.

If you reside outside of France, check the local regulations. In some countries, taxation only occurs upon sale. In others, there is a specific framework that treats staking rewards staking it is strongly advised to consult a professional for any significant investment.

Conclusion: Should you get into Crypto Staking ?

Crypto staking is an increasingly popular strategy for generating returns . Interest rates staking exceed those of traditional investments, and you simultaneously support the security of a blockchain network . However, it's not without risk . Before taking action, take the time to compare different options, calculate your fees, and verify the reliability of the project and the platforms used. The solutions available today, whether exchanges or non-custodial wallets, make crypto staking accessible to everyone.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital.

All our articles undergo rigorous fact-checking. Every key piece of information is manually verified against reliable and recognized sources. When we cite a source, the link is always integrated into the text and highlighted in a different color to ensure transparency and allow readers to directly access the original documents.

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .