Investing in cryptocurrencies can be daunting, especially in such volatile markets. Wondering how to invest in crypto without risking everything? Dollar- ( DCA ) is a well-known investment method for volatile markets. By investing a fixed amount at regular intervals, DCA helps avoid the pitfalls of market fluctuations and build a portfolio with peace of mind. Let's see how this strategy works and why it's so popular in the crypto world.

Table of contents

What is DCA in Crypto?

Dollar Cost Averaging (DCA) is an investment strategy that involves fixed amount asset , such as Bitcoin or Ethereum Ethereum at regular intervals (daily, weekly, or monthly). For example, you could buy €50 worth of Bitcoin every month, regardless of its price. This allows you to smooth out the cost of acquiring the asset over the long term , a particularly valuable technique in a market as volatile as the cryptocurrency market.

Advantages of DCA in Crypto

DCA in crypto offers several advantages:

- Risk reduction : Rather than buying at the peak, DCA allows for smoothing purchase prices.

- Serenity : No need to "time the market", which reduces the stress of investing.

- Accessibility : Suitable even for beginners, as it does not require daily course attendance.

How does DCA work?

Choose a frequency (monthly, weekly), an amount, and stick to your strategy. For example, buy €100 worth of Bitcoin every month for a year. At the end of this period, you will have accumulated a certain amount of Bitcoin, while avoiding large purchases when the price is high.

Why Choose DCA for Investing in Cryptocurrencies?

Because cryptocurrencies are subject to significant fluctuations, dollar-cost averaging (DCA) is an ideal solution for building a portfolio while minimizing risk. DCA in crypto allows you to control emotions, avoid impulsive decisions, and maintain investment discipline.

Steps to Implement a DCA Strategy on Binance

Here are the steps to automate a Dollar Cost Averaging (DCA) strategy on Binance :

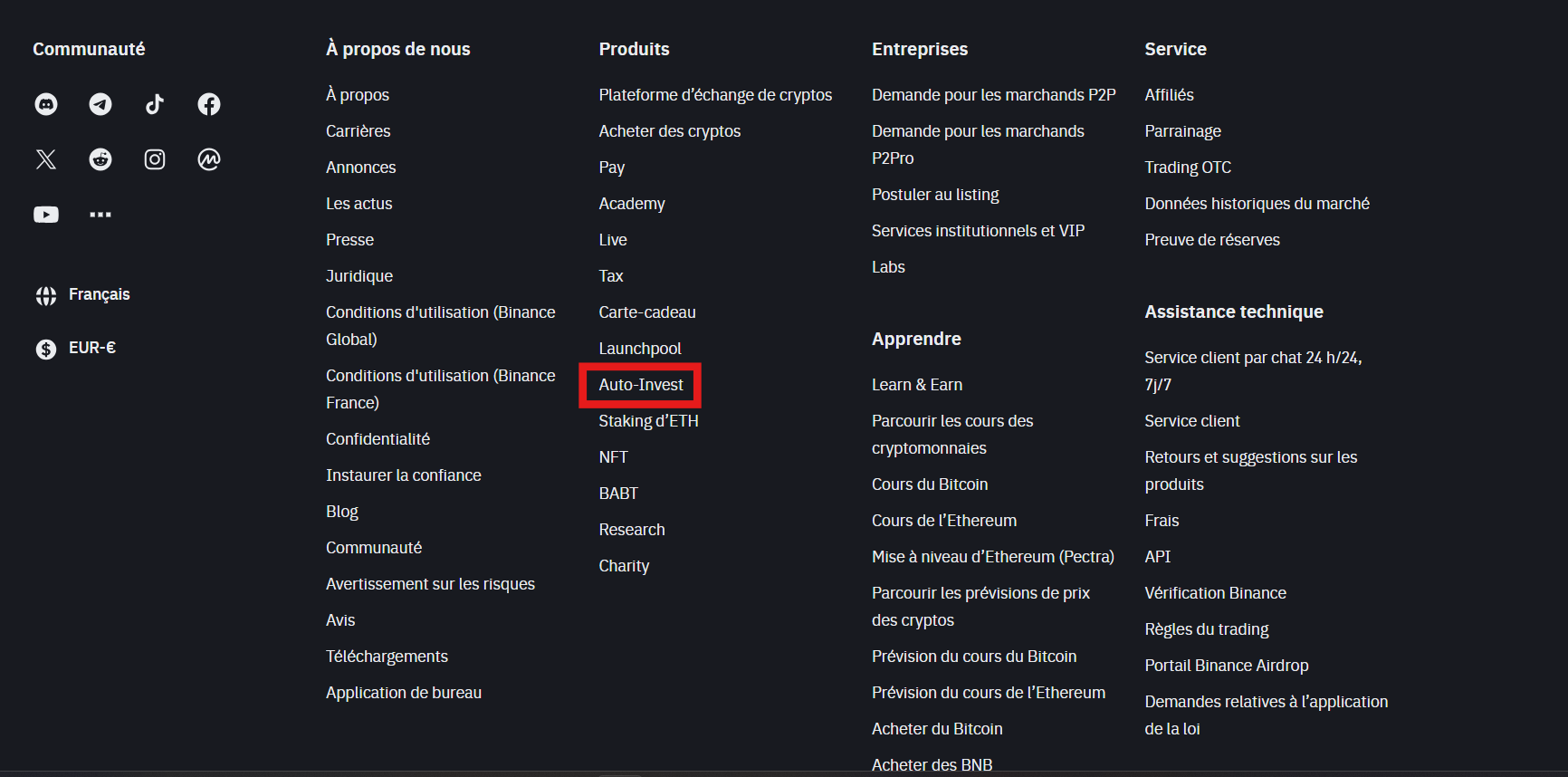

Step 1: Access the Auto-Invest feature

- Log in to your Binanceaccount.

- Scroll to the bottom of the Binancehomepage.

- In the "Products" section, select Auto-Invest

Step 2: Create an Auto-Investment plan for DCA

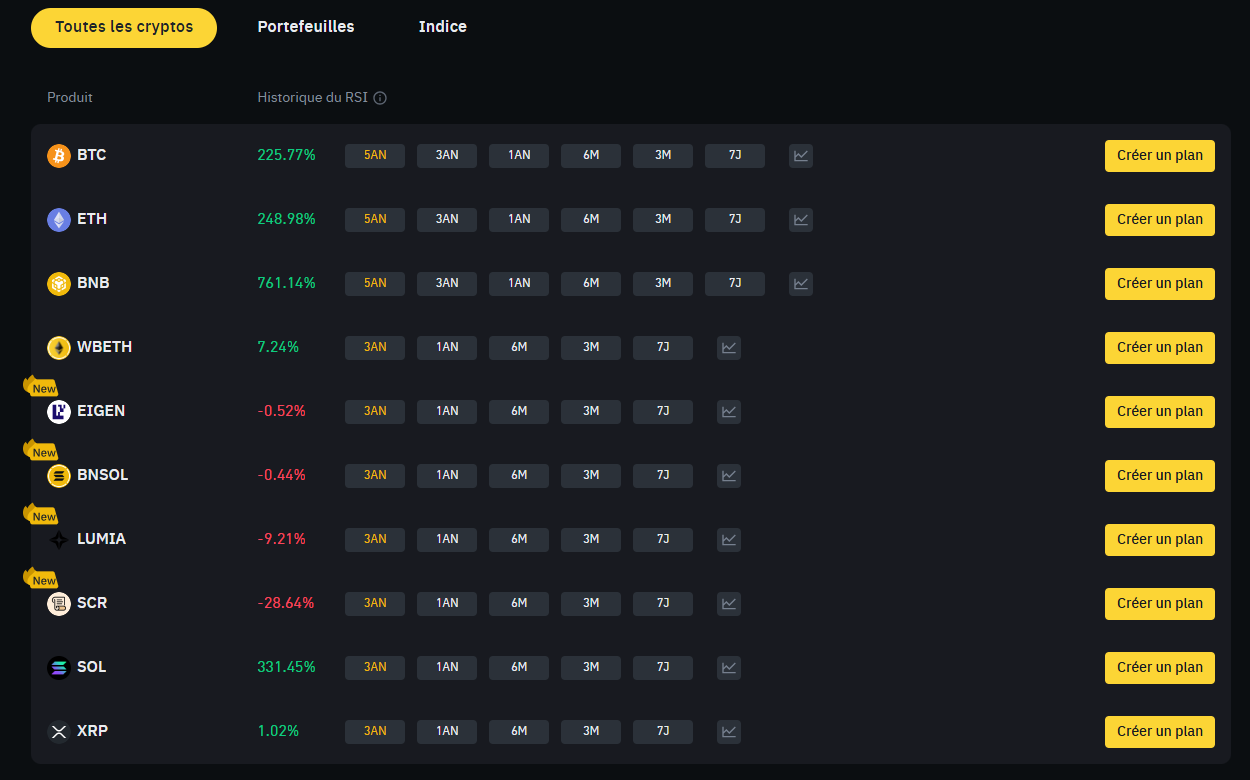

In the Auto-Invest interface, choose the cryptocurrency you wish to buy regularly

- For example, if you want to invest in Bitcoin (BTC), click on Create a plan next to BTC

2. Fill in the investment plan details:

-

- Plan name : Choose a name for your plan (optional).

- Crypto allocation : Ensure that the desired cryptocurrency is selected (in this example, 100% in BTC ).

- Amount per period : Enter the amount you wish to invest at each time interval and in which currency you wish to make the transaction (in this example it is USDC )

- Payment order : Choose the payment source (wallet or credit card).

- Frequency : Select the purchase frequency (daily, weekly, etc.).

Step 3: Confirm the plan

- After configuring all settings, click Next to review your plan details and ensure you have enoughUSDC for transactions to complete.

- Confirm your plan to activate automatic DCA investment.

Once these steps are completed, Binance will automatically make regular purchases of the selected cryptocurrency, according to the frequency and amount defined in your Auto-Invest plan.

The Limits of DCA in Crypto

Dollar Cost Averaging (DCA) is a simple and effective investment strategy, but it has its limitations, particularly in the volatile and cyclical cryptocurrency market. Ignoring cycles can prevent investors from fully capitalizing on the rapid and significant price surges that sometimes characterize the sector. Indeed, when a sudden bull market occurs, DCA, with its regular and smoothed purchases, risks reducing potential gains compared to a single, lump-sum investment before the surge.

However, for an investor who firmly believes in the potential of decentralized finance but wants to limit their exposure to market fluctuations, DCA remains an attractive strategy. It reduces volatility risk by avoiding ill-timed buying decisions. DCA is therefore particularly well-suited to those seeking to limit risk while betting on the gradual growth of the crypto ecosystem.

Tips to Maximize DCA in Crypto

Adjust your buying frequency according to volatility. If the market is very volatile, switching to a lower buying frequency may help.

Conclusion on DCA in crypto

Dollar- cost averaging (DCA) in crypto is an excellent way to enter the cryptocurrency market without being exposed to the risks of significant price fluctuations. It is particularly suitable for patient and disciplined investors who want to build a crypto portfolio steadily.

FAQs about DCA in Crypto

What is DCA in crypto?

DCA is an investment method that involves regularly buying cryptocurrencies to smooth the average purchase price.What is the best frequency for DCA?

It depends on your goals, but a monthly or weekly frequency is generally used.Is DCA suitable for all cryptocurrencies?

Yes, but it works particularly well with volatile cryptocurrencies like Bitcoin and Ethereum .Can I lose money trading dollar-cost averaging (DCA)?

Like any investment, DCA carries risks. However, it helps minimize the impact of price fluctuations.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Investments linked to cryptocurrencies are risky by nature, readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. This article does not constitute an investment advice.

Certain links of this article are affiliated, which means that if you buy a product or register via these links, we will collect a commission from our partner. These commissions do not train any additional cost for you as a user and some even allow promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .