DYDX Crypto Price prediction: analysis 2025, 2026 and 2028

The token DYDX , the cornerstone of the decentralized trading platform of the same name, arouses growing interest among investors looking for yields in the Crypto derivative markets . In April 2025, while A LTC ltc Season Index remains at the lowest, the price of the DYDX revolves around $ 0.64, far from its 2.7 dollars summit reached in December 2024. So what are the realistic predictions for DYDX by 2025, 2026 and beyond? Here is our detailed analysis.

Table of contents

DYDX Crypto Price prediction: the current context of the market and DYDX

At the end of April 2025, the A ltc Oin Season Index being extremely low, we are probably close to a historic low point. In this context, solid projects with real use cases, such as dYdX , draw the attention of experienced investors.

dYdX platform has distinguished itself by offering a decentralized trading of perpetual contracts with reduced costs and in non-custodial .

Some key figures extracted from recent data:

- TOTAL VALUE LOCKED ( TVL ) : $ 246 million (Source: Defillama)

- Annual income : $ 12.37 million

- Perpetual trading volume (24 hours) : $ 75.32 million

These figures place DYDX among the leaders of decentralized exchanges specialized in derivative products.

dYdX 's value proposal , we invite you to visit our full opinion on dYdX .

DYDX Crypto Prize prediction: role and utility of the token DYDX

The token DYDX is used for:

- Govern the platform via community votes

- Obtain cost discounts

- incentive awards for trading

- Participate in economic security staking modules (SAFETY MODULE, Liquidity Module)

The real usefulness of the DYDX is therefore directly linked to the activity and the economic health of the platform.

DYDX 's Tokenomics: a factor to monitor

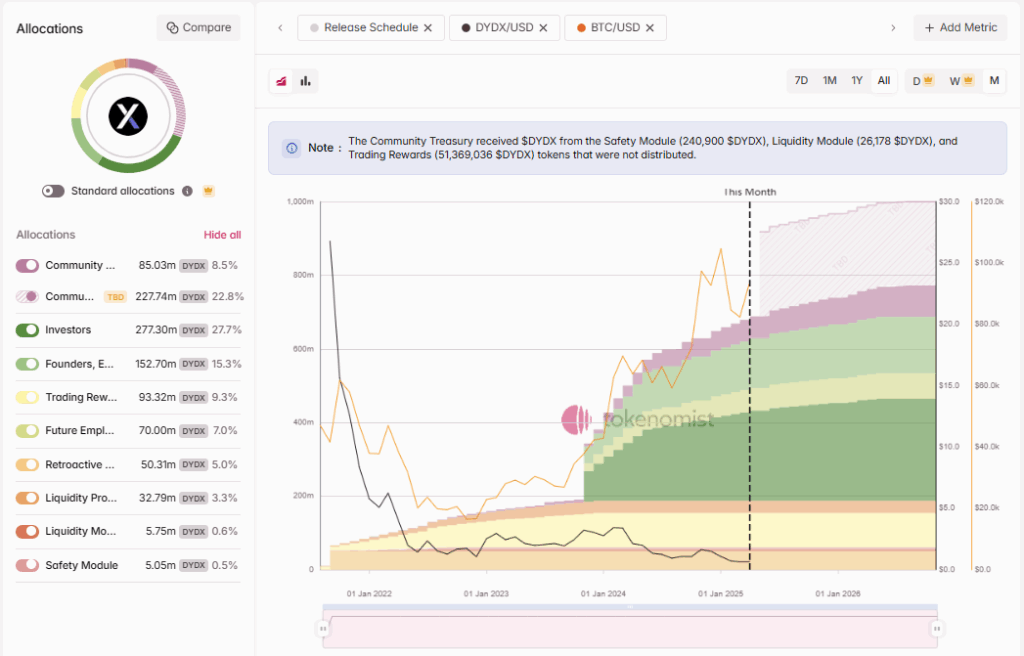

According to tokenomics.io data, the distribution of the token DYDX is as follows:

- Investors : 27,7 %

- Founders and employees : 15,3 %

- Trading awards : 9,3 %

- Community : 22,8 %

- Other allowances (stakers, developers, liquidity providers) : remains distributed

Dydx 's Tokenomics shows that the majority of DYDX dYdX have already been distributed, notably to investors , founders , employees and through trading awards . release calendar reveals , most of the inflationary pressure focused on the first three years after the launch. Now, the remaining inflation is relatively moderate, with a slower liberation rhythm planned until 2028. This mechanically reduces the risk of strong future selling pressure, a favorable point for the valuation of the token over the long term.

DYDX Crypto Prize prediction: Analysis of the activity of the DYDX

On Defillama , dYdX 's development activity remains rather sustained. The project records an average of 142 commits per week and 420 commits per month, with around active developers each week.

A Commitation corresponds to a modification made to the source code of the project: this can be a bug correction, the addition of a new feature, a performance improvement or a security update. Each Commitation therefore represents a small additional step towards the improvement and solidity of the protocol.

This pace of contributions reflects a living and constantly evolving ecosystem , a fundamental criterion for assessing the resilience and innovation capacity of dYdX in the face of a perpetual movement and technological environment. A regularly updated project inspires more confidence in users and investors, because it proves its commitment to remain efficient, secure and competitive.

DYDX Crypto Price prediction for August 2025

In view of the past cycles and the current context, we can sketch a first projection.

- Hypothesis: Resumption of the cycle in the summer of 2025.

- Increasing factors: Recailed volume on perpetuals , increased interest in decentralized trading, limitation of future offers on CEX due to regulations.

Prediction : a return around 2.5 to 5 dollars seems plausible in the event of a strong market impulse.

DYDX 2026 price forecast: relapse after euphoria

As in any crypto cycle, a phase of euphoria is generally followed by a severe correction.

- Hypothesis: bull run finished in mid-2026, return to reasonable valuations.

- Decrease factors: Reduction in the volume of trading in Bear Market .

Prediction : a relapse towards 0.80 to $ 1.10 appears realistic at the end of 2026.

Long -term projection DYDX 2028

In the very long term, DYDX retains serious assets:

- Continuous rise in decentralized trading

- Growing adoption of perpetual contracts on non-custodial platforms

- Continuous improvement in the protocol (switch to DYDX V5 possible by then)

Prediction : In the event of a strong recovery of the crypto markets by 2027-2028, DYDX could reach between 4 to 6 dollars , if the project maintains its dominant position.

DYDX Crypto Price prediction: DYDX strengths to take into account

- Very competitive costs for derivative trading

- Non-custodial : your funds remain under your control

- High liquidity on many crypto pairs

- and functional trading interface

- Active community and many developers

Risks associated with DYDX

- Selling pressure linked to the progressive release of tokens, but it remains moderate.

- Strong volatility of the crypto market

- Risk of regulation targeting derivative products

- Competition of new decentralized platforms like Drift

Our final opinion on the price prediction of the Crypto DYDX project

DYDX is a solid project, well rooted in the world of decentralized trading . TVL and income data confirm its relevance on the market.

In summary:

- August 2025 : possible return between 2.5 and 3.2 dollars

- At the end of 2026 : probable correction to 0.80 to $ 1.10

- 2028 : potential rebound between $ 4 and $ 6 in the event of a Haussier Global market

Always do your own research and adapt your exposure according to your risk appetite.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .