dYdX Staking : The Complete Guide to Profiting from Your Tokens

DYDX staking DYDX token holders staking DYDX operation while earning rewards. Similar to other blockchains using proof of stake (PoS), this involves delegating tokens to validators who process and validate transactions. On dYdX v4 , built with the Cosmos SDK , staking also aims to support the liquidity necessary for smooth trading on the platform. By depositing their tokens, users contribute to strengthening the overall stability and efficiency of the protocol.

Table of contents

Why staking dYdX ?

staking DYDX offers several advantages:

- Receive rewards in dYdX , proportional to the amount staked.

- Contribute to the security dYdX network .

The technical basics of dYdX staking

DYDX staking is based on:

- A system of validators , elected by the delegation of users.

- A rewards program in DYDX based on the annual inflation of the network.

- A unbonding period if you wish to recover your tokens after staking them.

Current annual inflation is around 14%. This rate partially compensates stakers for their active role in the ecosystem.

How to staking dYdX : A step-by-step guide

Here's how to stake your tokens on dYdX.

1. Obtain DYDX tokens

Before you can staking, you must first purchase DYDXtokens. Here are the best options depending on your location:

For European residents, we particularly recommend Bitvavo . This platform offers:

- Very competitive fees .

- More than 350 cryptocurrencies available.

- A regulated environment registered with European financial authorities.

- A simplified interface for beginners .

- The possibility of making free deposits in euros by bank transfer or SEPA.

- Excellent security with partial insurance on funds in case of problems.

2. Transfer your tokens to a Cosmos-compatible wallet

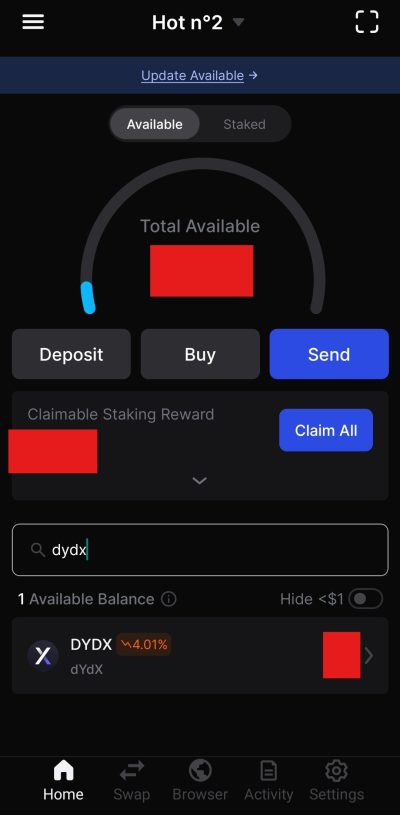

DYDX staking staking directly on its blockchain DYDX you will need:

- A wallet like Keplr Wallet that supports the Cosmos ecosystem

If you don't yet know how to use a decentralized wallet, we invite you to download our free guide containing all the necessary information to use one, screenshot by screenshot.

3. Connect your wallet to the staking interface

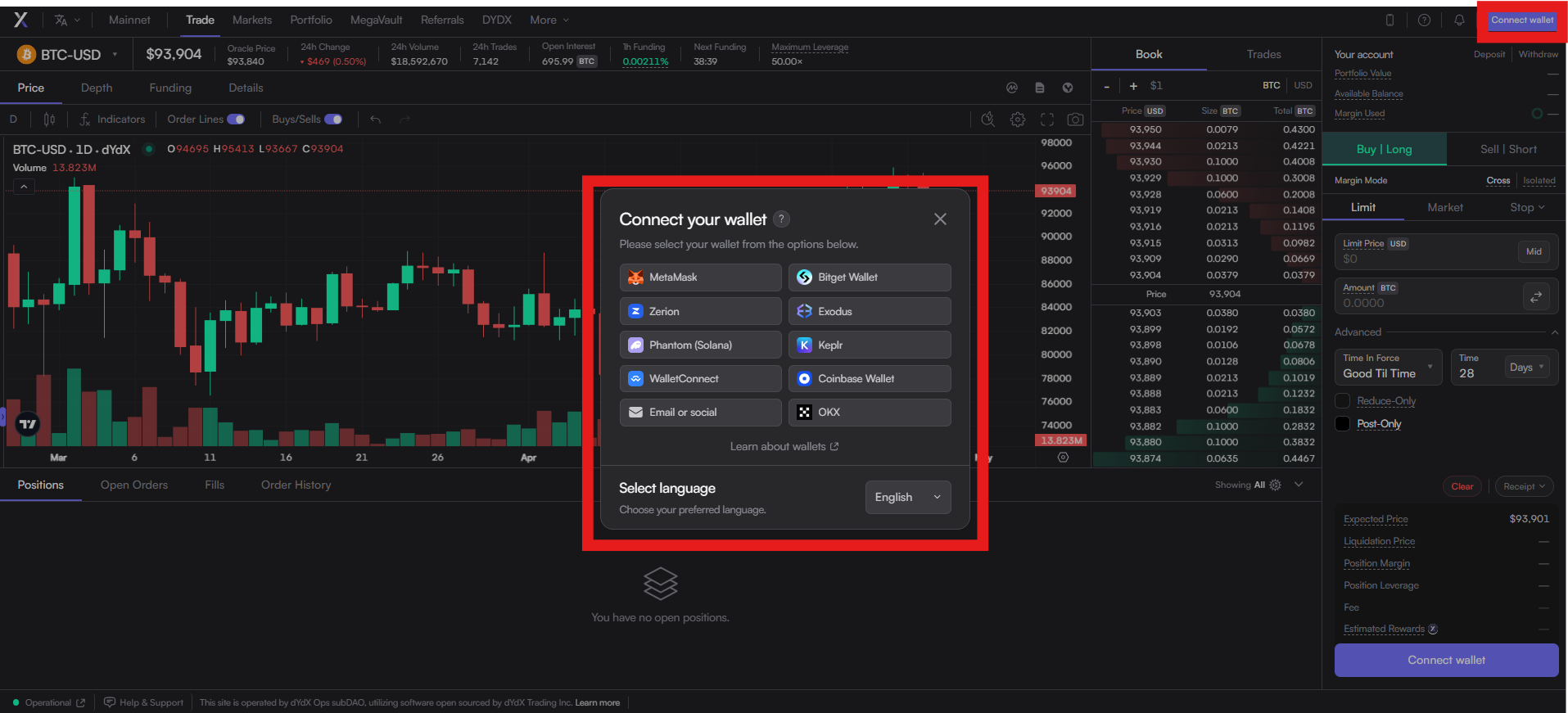

Go to the official dYdX (up-to-date site: dydx.trade dydx and connect your wallet.

- Click on “Connect Wallet”.

- Allow the connection with your browser extension.

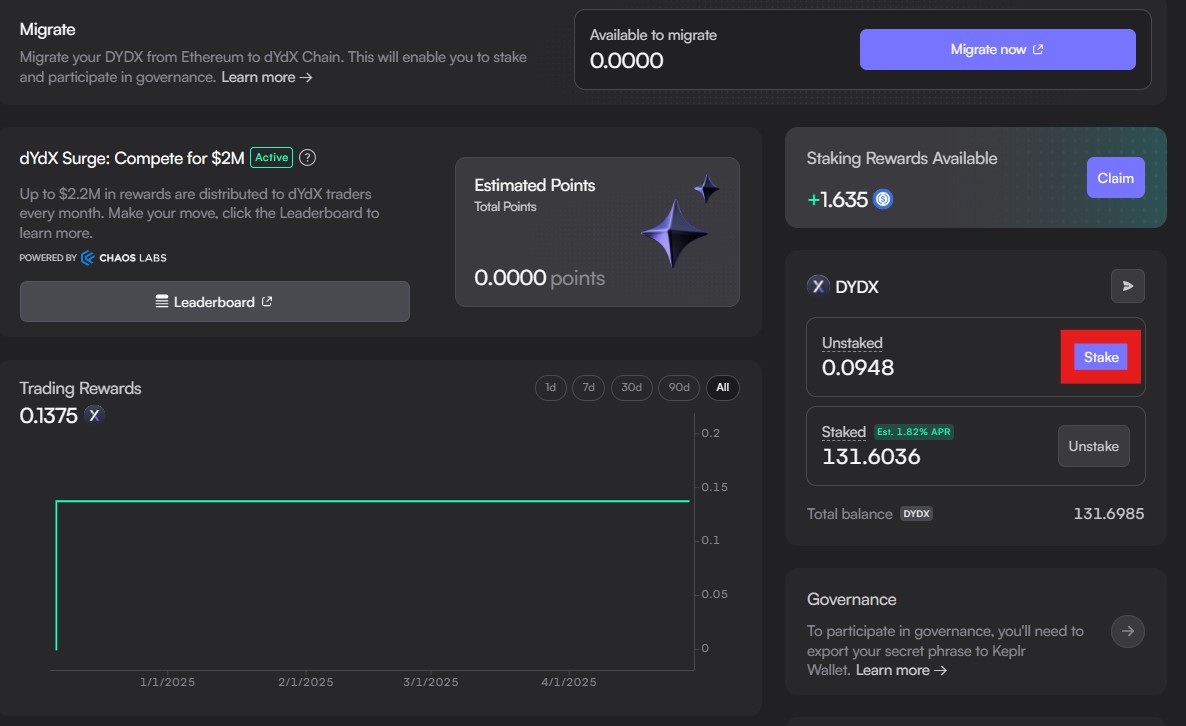

- Go to the " DYDX " tab and then click on "Stake"

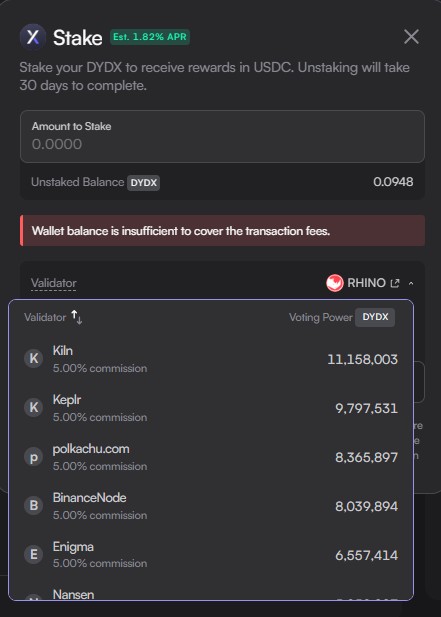

4. Choose a validator

You must enter the amount you want to stake and then select a validator to which you want to delegate your tokens. The criteria for choosing are:

- Commission rate applied by the validator.

- Reliability and performance history (little or no slashing).

- Community engagement and participation in governance.

5. Delegate your tokens

After selecting a validator:

- Click on “Delegate”.

- Confirm the transaction (expect some fees in DYDX).

6. Track your rewards

Once delegated, your tokens will begin generating rewards automatically. You can view them directly in the interface:

- Current balance staked.

- Rewards accumulated.

How to withdraw your staked tokens

To unlock your tokens, here is the procedure:

- Go to the "My Delegations" section.

- Select “Undelegate”.

- Confirm the operation.

Warning: your tokens will then enter a 30-day unbonding period. During this time, they will be unavailable.

What should you pay attention to before staking your DYDX ?

Before you begin, consider the following:

- The unbonding period which ties up your funds for 30 days.

- The risks of slashing if your validator behaves maliciously or suffers a major failure.

- DYDX price volatility : your rewards are in DYDX DYDX therefore subject to fluctuations in its price.

However, DYDX staking remains a solid solution for investors wishing to support the ecosystem while generating a return without relinquishing their assets.

A quick overview of DYDX tokenomics

According to Tokenomist data, the issuance of DYDX tokens follows a relatively healthy pattern:

- The bulk of the token release already took place in 2024.

- Residual inflation is now low, limiting selling pressure .

- The distribution remains balanced between investors, founding team and community .

This situation encourages price stability over the medium term, a key factor for attractive staking .

DYDX staking : key figures to know

Some useful figures to better understand DYDX staking :

- Current inflation : approximately 14% per year.

- Unbonding period : 30 days.

- Number of validators : around 80.

- Delegation fees : generally between 5% and 10% depending on the validator.

Conclusion: Is staking DYDX worth it?

DYDX staking staking primarily aimed at users who believe in the future of trading and want to strengthen the dYdX while generating passive income. With a robust architecture, sustained growth, and an active community, DYDX dYdX well-positioned to weather market cycles

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .