dYdX Tokenomics: everything you need to know about distribution and the vesting schedule

dydx 's tokenomics are based on a precise distribution structure and a vesting . As of the end of April 2025, approximately 76.5% DYDX tokens is already in circulation. Let's analyze the key data together to understand the economic workings of the dYdX . For a detailed overview of the services offered by the platform, we invite you to visit our dYdX project review .

Table of contents

dYdX tokenomics: Token distribution overview

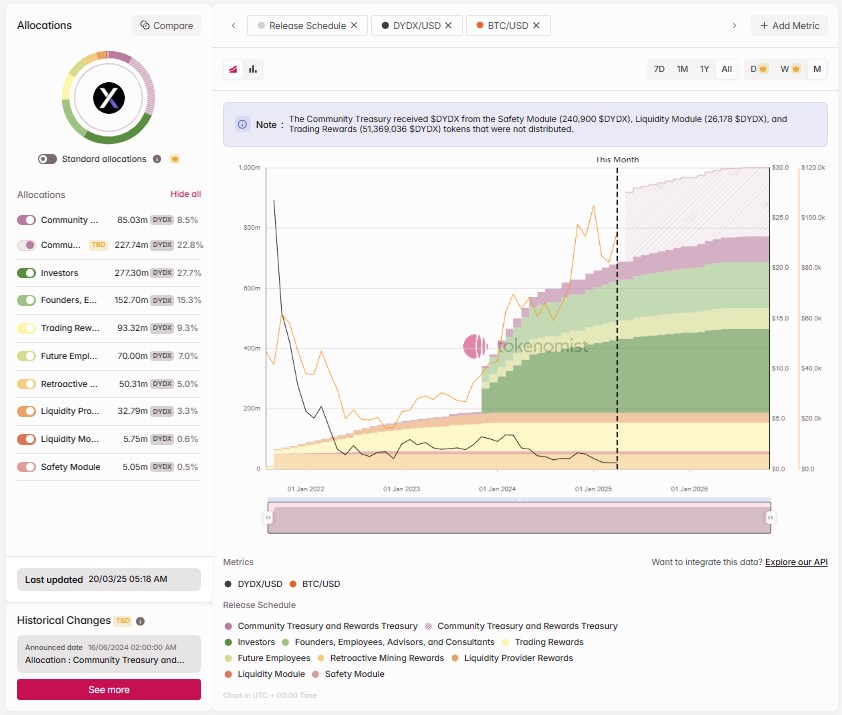

The initial distribution of the DYDX token is divided into several major categories:

- Investors : 27.7%, representing approximately 277.3 million tokens

- Founders, employees, advisors : 15.3%, or approximately 152.7 million

- Trading rewards : 9.3%, or approximately 93.3 million

- Future employees : 7.0%, or 70 million

- Retroactive rewards (mining) : 5.0%, or 50.3 million

- Liquidity providers : 3.3%, or 32.8 million

- Safety module : 0.5%, or 5.05 million

- Community treasury : 8.5%, or 85 million

- Community Treasury TBD : 22.8%, or 227.7 million (allocation yet to be determined)

Analyzing this release schedule and the progress of the vestingcalendar, we can see that the majority of DYDX tokens have already been released. This significantly reduces potential inflationary pressure and limits the risk of massive sell-offs in the coming months.

dYdX tokenomics: vesting schedule ?

Vesting vesting how the tokens that are still locked are gradually released. According to current data:

- 68% of the tokens have already been unlocked (i.e., 680 million DYDX ).

- 9,22 % remain stuck.

- 22,77 % correspond to allocations whose release will depend on governance decisions (TBD).

The next major unlocking event is scheduled for May 1, 2025 , with 8.33 million DYDX , or 1.09% of the current circulating supply.

A closer look at the main types of vesting

- Cliff Unlock: A large number of tokens were released all at once in 2021 (initial rewards, retroactive rewards, etc.).

- Linear Unlock: Since December 2023, the remaining allocations have been released gradually month by month until 2026 for founders, investors and employees.

Impact of vesting on the price of DYDX

Massive unlock events can lead to downward pressure, especially when they involve large quantities held by private investors or internal teams. However, with the majority of the DYDX vesting already completed, the impact of each new unlock is much more limited.

The Tokenomics chart clearly shows that supply growth will slow sharply after 2025, which is generally positive for the price in the long run .

In-depth analysis of community finances

A significant portion of the DYDX remains allocated to the Community Treasury :

- 85 million tokens have already been reserved.

- 227.7 million tokens are awaiting future allocation (TBD), which will be decided by the protocol's governance.

This reserve can be used for:

- To fund new technical developments.

- Accelerate adoption through grants and rewards.

- Implement incentive programs for users and validators.

dYdX tokenomics: What are the uses of the token?

The DYDX has several uses in the ecosystem:

- Trading Fee Discounts: Reduced trading fees for users holding DYDX .

- Staking : Participation in securing the dYdX v4 network, based on Cosmos SDK.

- Governance: Possibility of voting on changes to the protocol.

dYdX tokenomics: Analysis of the current situation (April 2025)

As of the end of April 2025:

- The price of the DYDX fluctuates around 0,65 $.

- The market capitalization is approximately $504 million .

- The fully diluted value (FDV) is close to $657 million .

The inflation rate is relatively low following the significant releases of 2023-2024. Furthermore, the TVL (Total Value Locked) remains strong, with approximately $246 million locked according to DeFiLlama.

Why is DYDX 's tokenomics relatively healthy for an investor?

The tokenomics structure of dydx is relatively robust compared to other DeFi :

- Majority of tokens already unlocked , limiting future inflation.

- Actual utility of the token (reduced fees, staking , governance).

- Sustained liquidity on the platform and active trading across multiple markets.

For a patient investor, the expected slowdown in inflation from 2026 onwards could strengthen the long-term attractiveness of DYDX , especially if perpetual trading on decentralized chains continues to develop.

Where can I easily buy DYDX ?

To acquire DYDXtokens, we primarily recommend:

- For European users : Bitvavo is an excellent option. Based in the Netherlands, this platform is regulated, offers very competitive fees, and provides easy deposits via bank transfer or credit card in euros. Furthermore, Bitvavo is known for its transparency, intuitive interface, and additional protections for client funds.

Conclusion: What to think about the tokenomics of DYDX in 2025?

DYDX 's tokenomics offers compelling advantages for those considering investing in or using the platform. The risk of runaway inflation is now significantly reduced, while the token's utility is enhanced by the migration to the dYdX Chain (Cosmos SDK).

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .