Since the appearance of Bitcoin in 2009, cryptocurrencies have been evolving in market cycles, punctuated by increases called bull run Run S. Different theories exist on the causes of these cylces: some believe that the halving of Bitcoin, where the mining reward is divided by two, creates a rarefaction of the offer. Others believe that the global state of the global economy largely influenced by Fed guiding rates would be the cause.

The end of 2024 could be a period of bull run , marked by economic and financial elements which promote investment in digital assets. Let us explore the different theories on the causes of these bull run S and estimates on the end of the bull run 2024 .

Table of contents

The impact of the Bitcoin halving in 2024

Halving an essential mechanism of Bitcoin protocol. Every four years approximately, the award for each mined block is reduced, thus reducing the contribution of new Bitcoins on the market. This rarefaction process is designed to encourage stability in the Bitcoin economy by limiting its inflation and guaranteeing demand greater than the supply.

In 2024, Halving could again play a major role in the dynamics of cryptos. With less new bitcoin bitcoin and growing interest in cryptocurrencies, its value could increase, triggering a lever effect on investments and promoting the diversity of assets in the investor portfolio Many investors consider Bitcoin as a risky asset in diversifying their movable investments .

Historically, this event has always triggered a significant increase in the price of bitcoin and, by extension, of the Crypto market as a whole.

Theories on the end of the bull run 2024

Historically, each Bitcoin halving was followed by a bull run a few months later. For example :

-

Halving in May 2020 : The Bitcoin Summit was reached in April 2021, 11 months later.

-

Halving in July 2016 : Bitcoin culminated in December 2017.

With the halving of April 20, 2024 and now the same difference between Halving and Bis Market Summit on the overview of the previous cycles, some believe that the peak could arrive around March 2025. But it is important to remember that this correlation remains a theory. There is no final evidence that Halving is the only cause of the bull runS.

Edit of 07/02: In view of the current advancement of the various indicators, the theory of a peak in March seems very unlikely. Monitoring of the indicators mentioned below will be always more relevant to determine a market peak than any other impression, theory or other.

Why this theory is questioned

Some analysts point out that the global economy has an equally significant impact. For example, an accommodating monetary policy, such as low interest rates, stimulates appetite for risky assets.

Influence of the drop in Fed rates in September 2024

The American Federal Reserve (Fed) lowered the interest rates of 0.5 % on September 18, 2024, which had a direct impact on the Crypto market. Low rates promote investments in risky assets, as liquidity is more easily available. This monetary movement also encourages investors to seek financial assets , and cryptocurrencies benefit from it.

This drop in rate reflects an accommodating monetary policy that stimulates the global economy by encouraging liquidity in the markets, thus promoting investments in digital currencies. In a low rate environment, volatile assets, such as cryptocurrencies, appear to be an interesting consideration for traditional investments in currencies, stocks and obligations.

Trendy reversal signs on the markets in September 2024

September 2024 was marked by strong tendency reversal signals, with emerging cryptocurrencies like Bittensor , Suis, Fetch .ai, Pendle and Superverse showing upward performance after several months of correction. Institutional investors, encouraged by the drop in rates, have seen this trend the opportunity to diversify their portfolio and strengthen their exposure to cryptos, perceived as a short-term active ingredient capable of generating significant gains.

The return of inflation and the decline in monetary policy thus creates a favorable environment for cryptos, whose role becomes central in the landscape of modern financial assets.

4 -year cycles in the Crypto market

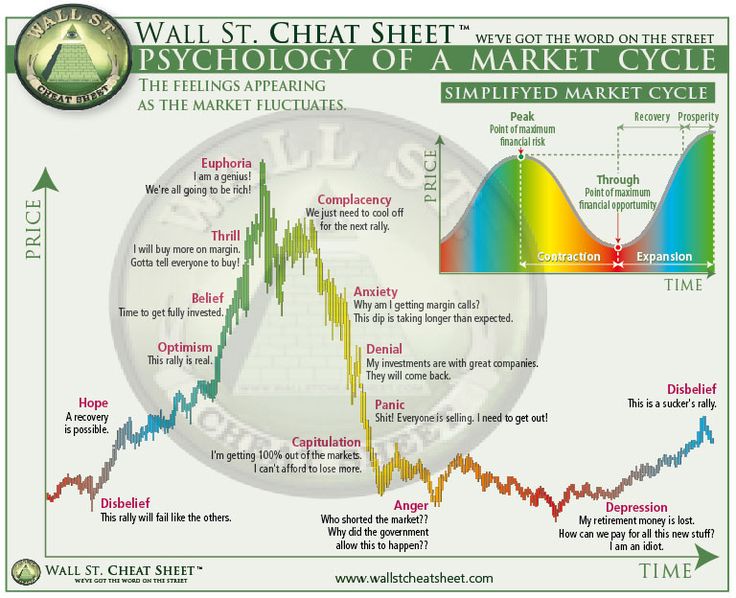

Since the creation of Bitcoin, the market has followed a regular cyclic scheme , marked by phases of accumulation, euphoria, correction, then recovery. These cycles are of an average duration of four years.

In 2024, the market seems to enter a new recovery phase after the mid-cycle correction between March and September 2024.

The scheme seems to be repeated, and the signs of a trend reversal begin to appear. This cyclic dynamic, which attracts global funds to cryptocurrencies, has repercussions on the global economy, because it encourages managers and investors to reconsider their strategies in traditional financial assets.

Cycles of the Crypto market thus influence the asset allocation of numerous investment funds and financial institutions . Emerging countries , in particular, see in this diversification a means of alleviating the global economic impacts by creating investments for investors.

With a trend reversal that begins to take shape in September 2024, the market seems ready to bounce strongly for the end of 2024 .

Estimate of an end date of bull run : Tools to be monitored

Why is this bull run different?

The bull run of 2024 could present particularities compared to previous cycles. First, the cryptos market has clearer regulations and the arrival of many institutional . The latter see it as a means of diversification compared to traditional actions, such as those of CAC 40 or Dow Jones , and an interesting counterpart in an uncertain rate environment.

Cryptocurrencies are also increasingly perceived as securities by financial authorities, and investors use solvency ratios to assess their viability. A solvency ratio is an indicator that measures the capacity of an asset or a company to deal with its long -term debts and obligations. Applied to cryptos, this ratio helps investors estimate the financial stability and the security of the assets, in a similar way to the analyzes carried out for the shares or obligations of traditional companies.

The cryptocurrency market being partially young, it is still very speculative even if decentralized finance ( DEFI ) , the purple or even IoT become value -creating pillars. Each narrative is more or less advanced on the Gartner curve .

Risks and opportunities for investors to the end of the bull run 2024-2025

While the end of the bull run 2024 could be reached around March 2025, investors are at a crossroads between opportunities and risks. A bull run often attracts massive capital, fueled by euphoria and the hope of exceptional yields. However, this market phase, marked by increased volatility, can also cause brutal corrections.

To anticipate an end of the cycle, diversify your investments remains crucial. For example, distributing its portfolio between promising sectors such as artificial intelligence ( AI ), the depolition (decentralized physical infrastructure networks), defi (decentralized finance), or Layer 1 blockchains like Ethereum and Solana , can help limit risks.

Such a strategy makes it possible not to be fully exposed to a single sector, often subject to unpredictable movements during market reversals.

Faq

What is Bitcoin's Halving and its impact on the markets?

Halving decreases in half the reward of minors, creating a rarity that increases demand and can lead to a bull run . This process directly impacts the capitalization of bitcoin and stimulates liquidity in digital currencies.Why is 2024 a promising year for the Crypto market?

In addition to halving, the drop in rates by the Fed encourages investors to risky assets, and bull run could strengthen their presence in the portfolios of many fund managersWhat are the signs of a recovery for the Crypto market?

Several at ltc OOS as Suis and Bittensor show increasing performance in September 2024, indicating a reversal of trend sustained by increased demand in digital active ingredients.What are the risks of volatility during a bull run ?

Volatility can cause rapid price fluctuations, but diversifying assets in the portfolio helps reduce these risks and take advantage of potential increases.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Investments linked to cryptocurrencies are risky by nature, readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. This article does not constitute an investment .

Certain links of this article are affiliated, which means that if you buy a product or register via these links, we will collect a commission from our partner. These commissions do not train any additional cost for you as a user and certain partnerships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .