Fresh purchase crypto Binance : know them and minimize them

If you are considering or using Binance , a common question relates to the costs of purchasing crypto on Binance . In this article, you will discover in detail the applied prices and especially how to optimize them. Whether you are completely new or already familiar with the platform, the objective is to help you reduce your commissions as much as possible and to understand every detail of the tariff structure, from deposits to trading spot via future and withdrawals.

In short: Crypto purchasing costs in Binance

In 2025, Binance remained one of the most competitive cryptocurrency exchange platforms on the market. Basic costs on the SPOT market are around 0.10 % for Maker or Taker type orders. These prices can be reduced thanks to the use of BNB to pay the commissions, with a reduction of 25 % on the costs, or by entering a VIP program. Binance is one of the most competitive costs at the expense. In addition, deposits and withdrawals of funds in euros or cryptos obey specific rules that should be known to avoid paying too much. In the following, we will approach each aspect of these trading costs and the most effective strategies to reduce them.

Table of contents

Understanding the structure of crypto purchasing costs on Binance

In the world of decentralized finance , Binance is renowned for its commissions and its important liquidity . The costs are available according to several products: the Spot market (for the purchase and direct sale of cryptocurrencies), future contracts (term contracts) and options . In France future Binance are not available.

In parallel, the Exchange also offers various means of deposit and withdrawal, each involving different costs.

Fresh on the Spot market

The spot is the basic market, the one you buy and sell cryptocurrencies ( BTC , ETH, BNB , etc.) at market prices. The costs first depend on the distinction between Maker and Taker Order:

- Maker order : Your Limit type order creates liquidity by entering the order book. As long as your order is not executed immediately, you are a “maker”.

- Taker order : when an order runs directly at the market price (market) or will immediately take existing liquidity, you are a “taker”.

In 2025, for a standard user (VIP 0), the Maker and the Frais Taker on Binance each are around 0.10 %. It is therefore enough to multiply the amount of your transaction by 0.10 % to obtain the applied commission.

If you buy for example 1 ETH at $ 1,500, the cost of the transaction amounts to $ 1.50 (0.10 % of $ 1,500). But there are several tips to pay less, including:

- Use the BNB BNB commissions (native token of the platform) grants a reduction on the costs of around 25 % (standard Spot rate).

- Go up in VIP level : the VIP program makes it possible to reduce the commissions as soon as you reach a certain threshold of trading volume (30 days) and from BNB balance . However, large volumes should be made to achieve this.

Fresh on future and derivative products

Futures or term contracts) and other derivative products (such as perpetual future ) have a different cost structure. At the standard level, Maker costs started around 0.02 % and Taker costs around 0.04 %. Again, the use of BNB to pay the costs will allow you to save (around 10 % on this market), and access to VIP levels will gradually lower these commissions.

Options costs

With regard to options (financial instruments to buy or sell an asset at a price set in advance), Binance generally applies a rate of approximately 0.03 % for Maker like Taker. However, this market is changing regularly, and it is recommended to check the table made available by Binance to find out the specific prices of the moment.

Deposit and withdrawal fees

Beyond the trading costs, it is necessary to take into account deposit and withdrawal costs, whether in Fiat (EUR, USD, etc.) or crypto coins

- Deposits in euros : Binance SEPA transfers with generally fixed costs of € 1 only, regardless of the amount. Bank card deposits (visa or mastercard) are often billed up to 2 % of the amount.

- Withdrawals in euros : the withdrawal via SEPA is charged at € 1, while withdrawal via bank card (if available in your area) can cause additional costs (variable depending on the region and the payment institution).

- Cryptos deposits : no deposit costs. Transfer BTC , ETH, USDT or other tokens from an portfolio to Binance does not generate an additional commission (apart from the Gas Fee of the network paid at the time of sending, which is not taken by Binance but by the blockchain concerned).

- Cryptos withdrawals : vary according to the blockchain and the congestion of the network. For example, withdrawing BTC on the Bitcoin network can cost 0.00005 BTC , while using a network like BEP-20 ( Binance Smart Chain) will reduce the cost to 0.0000039 BTC . The withdrawal costs can therefore be significantly optimized by choosing the right blockchain when a cryptocurrency is available on several networks.

Summary table for crypto purchase costs on Binance

The table below presents a general overview of the main costs Binance Crypto and withdrawals in 2025. The exact amounts are likely to evolve, but this overview illustrates the orders of magnitude:

| Type of fee | Standard rate/cost | Reduction if payment in BNB | Noticed |

|---|---|---|---|

| Spot (maker/taker) | 0,10 % / 0,10 % | 25 % discount | VIP 0 (standard user) |

| Future (maker/taker) | 0,02 % / 0,04 % | 10 % discount | Variable levels according to VIP |

| Options (Maker/Taker) | 0,03 % / 0,03 % | N/A (often not applicable) | Can fluctuate according to demand |

| EUROS DEPOSIT (SEPA transfer) | 1 € | — | Fixed costs |

| EUROS DEPOSIT (bank card) | 2 % of the amount | — | Varies according to the region |

| Removal in euros (SEPA) | 1 € | — | Single price |

| Cryptos removal | Depends on the network | — | Suitable for congestion |

To compare these costs to other platforms, we invite you to conult our comparison of trading costs of the main cryptocurrency exchange platforms and our detailed comparison of costs between Binance and Coinbase .

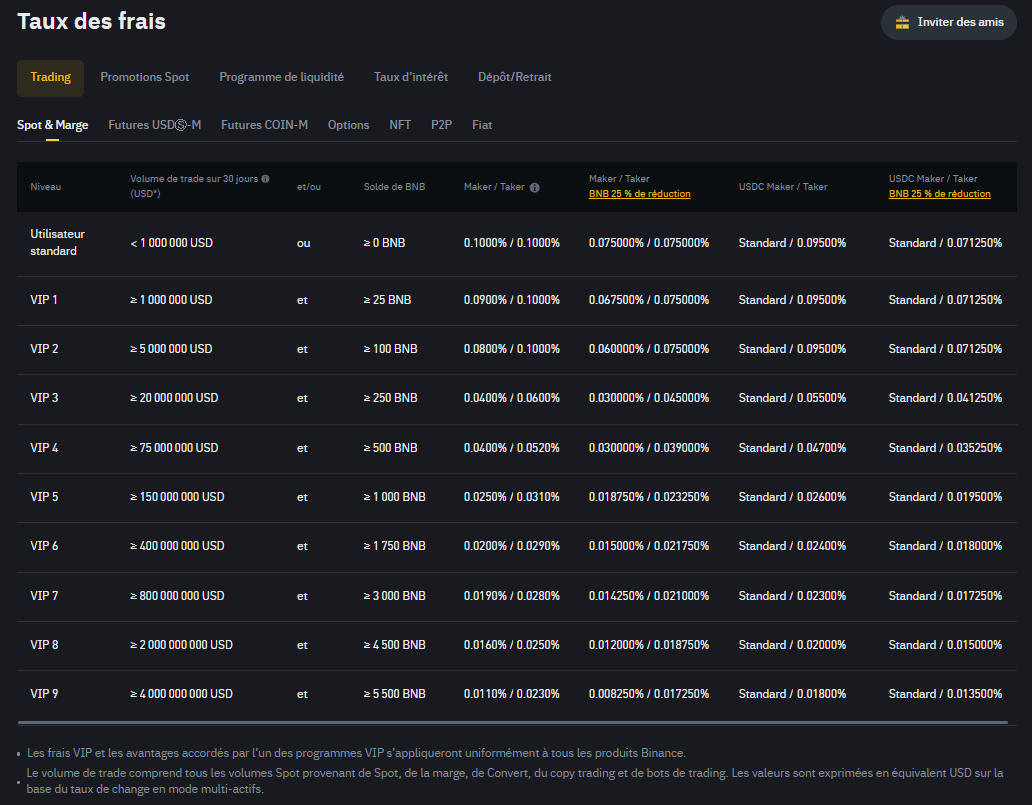

The VIP program: a lever to reduce crypto purchase costs on Binance

Binance offers a VIP program made up of 9 levels. Access to these levels depends both on your 30 -day trading volume BNB you hold in your account. The more you climb in these levels, the more trading costs drop. This is worth as much for the Spot market as for the term markets.

Here is a non -exhaustive overview of the conditions of the VIP program in 2025:

In practice, reaching even the VIP 1 level already requires a relatively large trading activity, coupled with the detention of at least 25 BNB . BNB costs to your VIP advantages, thereby reducing the costs significantly.

Optimizing its crypto purchase costs on Binance : 2 strategies

Pay the commissions in BNB

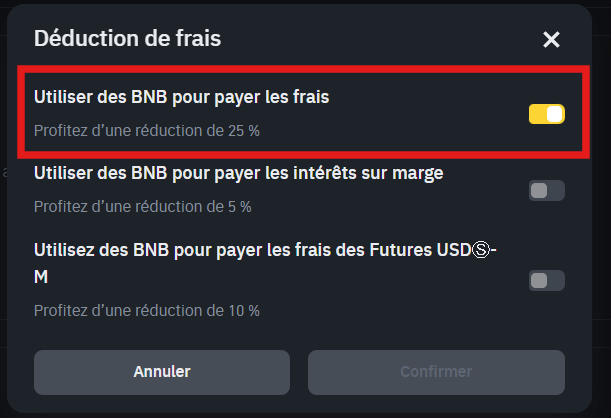

The simplest tip is to activate automatic payment of trading costs in BNB . Concretely, Binance proceeds to a deduction directly on your BNB , which makes you benefit from discounts : up to 25 % on the Spot market, 10 % on future, etc. At the scale of a year of regular trading, this can represent significant sums.

Place and withdraw your funds in euros via SEPA

The fees of 2 % for payment by bank card may seem attractive if you want funds instantly. However, if you have the possibility of making a separate transfer, you will pay only € 1 fixed. On a deposit of € 1,000 for example, the SEPA transfer costs only € 1, against € 20 for a payment per card at 2 %. Same logic for withdrawal, where a separate transfer costs only € 1. This approach optimizes the cost of entry and withdrawal of money with Binance .

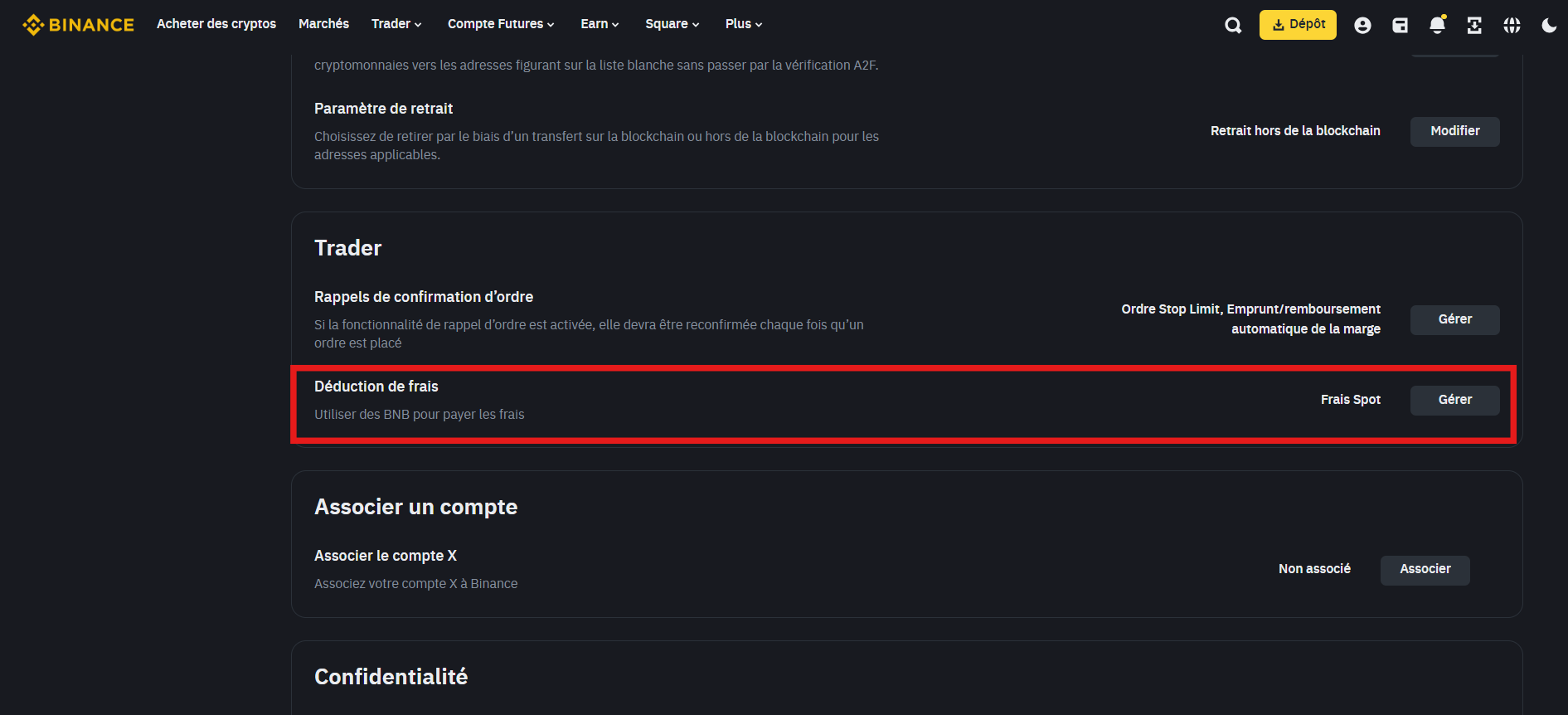

How to reduce your Crypto purchasing costs on Binance by paying them in BNB ?

- Go to Settings:

- Go down to the Trader tab and deduction of costs:

- Make sure you have BNB on the account and activate the option:

Network costs, Gas Fees and alternative networks

One of the major advantages of Binance is the multiple choice of blockchains for the withdrawal or deposit of the same asset. For example :

- The BTC can be removed via the Bitcoin native network, the Lightning (in some cases) or the Binance Smart Chain (BEP-20) depending on availability.

- The ETH can be sent to the Ethereumnetwork, the Binance Smart Chain (BEP-20), Arbitrum, Polygon, or Base. Each of these networks invoices distinct transaction costs (Gas Fees).

So, if you are looking to minimize the costs , you can select a less congestioned alternative network. However, make sure to check that the destination platform supports this network well, otherwise you will permanently lose your funds. In fact, the optimization of crypto purchase costs on Binance is not only based on the Exchange commission, but also on the choices of the blockchain for withdrawals and deposits.

Encrypted examples to view the impact of crypto purchase costs on Binance

Example 1: Purchase of $ 2,000 BTC in spot

Imagine a standard user (VIP 0) who wants to buy BTC. Without paying in BNB, the commission is 0.10 %. On a purchase of $ 2,000, this represents:

Costs = $ 2,000 x 0.10 % = $ 2

If he decides to have enough BNB and pay the costs with the latter, he obtained a 25 %discount. Instead of $ 2, he will pay:

Costs = 2 $ x 0.75 = $ 1.50

A saving of $ 0.50 on a single transaction. This may seem derisory, but accumulated on dozens or hundreds of orders in the year, the difference becomes significant.

Example 2: Intense trading on the Spot market

Suppose a day-trader achieves $ 100,000 in purchases/sales every day. Over a 30 -day month, it's $ 3,000,000. Without reduction, the costs would amount to:

$ 3,000,000 x 0.10 % = $ 3,000

Passing through BNB, these costs fell to $ 3,000, or $ 2,250. The economy is $ 750 per month, or $ 9,000 per year, just by paying its commissions with BNB. Better still, if this trader is eligible at VIP 1 or VIP 2 level, it can further reduce these costs.

Crypto purchase fees on Binance : stablecoinpairs without cost

With a aim of gaining market share or during targeted promotions, Binance sometimes offers stablecoin S pairs (for example USDC / USDT , TUSD / USDT , FDUSD / USDT ) with 0 costs (Maker and Taker), or with 0 costs on Maker only. These offers have a particular interest in arbitrations or for those who manage liquidity between different stablecoin s. stablecoin - stablecoin pairs exempt from costs for a few weeks or months.

Very competitive costs compared to competition

On the world market, Binance is still positioned as one of the lowest costs

Consequently, a person who seeks to invest in small sums or trader at higher frequency will find in Binance a very attractive pricing model.

Answers to some frequent questions

Are there any hidden costs on Binance ?

According to the official documentation of the platform and the multiple audits of the community, there is no really hidden expenses on Binance . All costs are announced on transparent pages: trading costs, Fiat deposit costs, withdrawal fees, etc. What could be learned at hidden costs would be slipping variations if you use the Binance . But you can avoid it by trading Idrely on the order book. There are also unpredictable variations concern the congestion of the Blockchain network, but that does not be Binance strictly speaking.

Does Binance invoice inactivity costs?

No, there is no fee for an account remaining inactive. You can leave your funds on the platform, and as long as you do not trade and you do not remove your crypto, you pay no penny.

Are the transfers between Binance users paying?

If you use the “internal transfer” function to send cryptos to a friend who also has a Binanceaccount, this does not generate any costs. You just need to know the recipient's BUID (user identifier) to carry out the operation.

Conclusion: manage its crypto purchase costs on Binance well to boost its yields

The control of costs Binance purchase crypto constitutes a key element for any investor or trader wishing to maximize his earnings. Between the different VIP levels, the possibility of paying in BNB , the 0 costs on certain pairs, and the choice of the right network for your withdrawals, you have many options to optimize your experience. On small volumes, each euro counts; On large volumes, optimization of costs can result in several thousand euros in annual savings.

In summary, if you want to reduce your trading costs on Binance in 2025, keep in mind the following points:

- Activate the regulations of BNB commissions (up to 25 % spot in spot).

- Favor, when possible, the limits (maker) orders to benefit from potentially lower costs.

- Regularly check the 0 costs promotions, especially on the stablecoins pairs.

- Place euros via a SEPA transfer to pay a single euro of costs, rather than 2 % per card.

- Consider the VIP program if you trade large volumes and keep an important BNBbalance.

Thanks to these strategies, you will have all the keys to adapting your trading decentralized market and fully benefiting from the opportunities offered by cryptocurrencies, with a minimum impact on your commissions. Finally, remember to compare the solutions proposed by competition if you judge that Binance no longer corresponds to your specific use. That said, for the majority of traders, the combination of advantageous prices, a complete ecosystem (spot, future, options, NFT, etc.) and the ease of use make Binance one of the essential platforms in 2025.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .