Coinbase withdrawal fees: How to save on each transaction?

Whether you withdraw euros to your bank account or send your tokens to an external portfolio, it is essential to know these costs precisely and to know how to reduce them. In this article, you will understand in detail the withdrawal costs applied to Coinbase , the difference between the different types of withdrawals (Fiat or Crypto) and especially the strategies to pay less.

Table of contents

Understand the structure of the costs: between fixed costs and variable costs

Coinbase is one of the main cryptocurrency exchange platforms in the world. Launched in 2012, it claimed more than 100 million accounts verified internationally in 2022, according to its own figures. Since its creation, it has seen its offer of services extend: simple interface for beginners, possibility of negotiating several cryptos, staking , payment card, advanced trading As the offer has grown, the pricing grid has also gained complexity. Coinbase withdrawal costs , you must first dissociate the different types of costs:

- Blockchain transactions costs.

- The commissions that the platform applies according to the network or the means of payment.

- Potential costs during conversions or inter-door transfers.

Network costs: Why are they billed?

When we speak of withdrawal in cryptocurrency (BTC, ETH, LTC, etc.), the transactions are validated by minors or validators on the blockchain concerned. These validators receive awards in the form of “mining costs” (or network fees). On Coinbase, the user who sends tokens out of the platform is led to pay for these costs, generally estimated in advance. However, their final amount may vary depending on the congestion of the network at the time of withdrawal.

Cryptocurrency withdrawal fees on Coinbase are directly linked to the network fees imposed by the blockchain concerned. However, Coinbase applies an internal calculation system to determine these costs before displaying the estimated cost of the user.

🔹The impact of congestion on Bitcoin and Ethereum

- Bitcoin : When there are a lot of transactions pending in Mempool, minors favor those offering higher costs. This leads to an increase in mining costs , especially during periods of high activity on the market.

- Ethereum : On this blockchain, Gas fees vary according to the request for space in each block. When a large number of transactions are sent simultaneously (e.g. NFTS , arbitrations on the Dexs , high volatility on the stablecoin s ), the price of the Gas can reach peaks, making withdrawals very expensive.

🔹 The method of calculating Coinbase fees

Coinbase assesses the network fees based on several parameters:

- Real -time estimate : Coinbase consults the current state of blockchain and anticipates the average costs necessary to confirm a transaction quickly.

- Grouping of transactions (batching) : to optimize costs, Coinbase sometimes combines several withdrawals in a single transaction, thus reducing the share of costs paid individually by each user.

- Volatility of network costs : The costs indicated before validation of a withdrawal can slightly differ from those actually paid to minors, due to the rapid variations in congestion.

- Optimization via transaction pools : Coinbase could sometimes group transactions in larger blocks to negotiate better prices, although this is not always transparent for the user.

🔹 Real fees paid vs. Fresh displayed: does Coinbase take a commission?

Unlike certain platforms, Coinbase does not systematically apply an additional commission on cryptocurrency withdrawals.

- The amount billed generally corresponds to the real costs of the network , although optimization via batching can create a slight gap.

- On certain specific protocols such as the Lightning Network for Bitcoin , Coinbase however takes a fixed commission of 0.1 % of the amount sent , in addition to the network fees.

🔹 Are the Coinbase fees higher than those of the blockchain?

It depends on the context:

- In some cases, the costs displayed by Coinbase can be slightly higher than minimum network costs , especially if the platform applies safety margin to guarantee rapid transactions treatment.

- On the other hand, thanks to the batching , the costs can sometimes be lower than if the user himself sent a transaction from a personal wallet, because the grouping of operations reduces the overall load.

🔹 Comparison with an external crypto wallet

If you use a non -custodial wallet (like Metamask, Exodus, Trust Wallet , Ledger ), you can generally manually adjust the costs according to the desired speed of execution.

- With a personal wallet , you can usually pay less by opting for lower costs (at the risk of slower validation).

- On Coinbase , you cannot adjust these costs manually, but you benefit from an optimized estimate that avoids long expectations.

Internal costs: commissions on the platform

In addition to network costs, Coinbase can apply a specific commission. For example, when we withdraw from cryptocurrency to an external portfolio, the platform invoices an amount to cover costs. On some blockchains (like Bitcoin via the Lightning Network), Coinbase practices distinct pricing:

BTC shipments are fast and inexpensive in theory. At Coinbase , treatment fees of 0.1 % of the amount transferred are billed on these specific withdrawals.

As for withdrawal from fiduciary currency (euros, dollars, etc.), there are variable commissions:

A SEPA transfer released in euros (to a bank in the SEPA zone) can lead to fixed costs, often around € 0.15 (the exact amount dependent on the country).

Withdrawals on a bank card can be subject to a commission of around 2 % of the amount, with a fixed minimum (eg € 0.55).

These prices can fluctuate according to the updates of the Coinbase . It is therefore advisable to consult the conditions indicated at the time of the transaction.

Summary of Coinbase withdrawal costs

| Type of withdrawal | Applied fees | Details |

|---|---|---|

| SEPA transfer | 0,15 € | Fixed costs, delay of 1 to 3 working days |

| Withdrawal on bank card | 2 % (min. 0.55 €) | Fast but more expensive removal |

| Bitcoin removal (on-chain) | Variable (network fees) | Depends on the congestion of the Bitcoin network |

| Bitcoin removal (Lightning Network) | 0.1 % of the amount | Additional fixed costs applied by Coinbase |

| Withdrawal in Ethereum | Variable (Frais Gas) | Strongly influenced by network congestion |

| Cryptos withdrawal (other networks) | Variable according to Blockchain | Layer 2 and alternative blockchains in Ethereum (BSC, Solana , Suis, Aptos, etc.) are often cheaper |

| Withdrawal via paypal | Variable | Depends on the country and the motto |

For a complete overview of all the costs applied between the 2 largest current exchange platforms, consult our comparison of costs between Binance and Coinbase .

Coinbase withdrawal fees in Fiat coins: what you need to know to spend less

When you withdraw euros or dollars from Coinbase to your bank account, you are no longer subject to the mining costs of a blockchain, but rather to the banking prices or the commissions imposed by the interface. SEPA withdrawals are generally less expensive and deemed to be simpler:

SEPA transfer: The best simplicity/cost ratio?

The SEPA transfer remains the most used method in Europe to transfer its Coinbase funds to a current account. Several advantages stand out:

- Correct speed: Most SEPA transfers led in 24 to 72 hours.

- Reduced cost: in the majority of cases, the costs linked to these withdrawals are fixed and low (often around € 0.15).

- Increased security: IBAN must be validated and correspond to your identity.

- To minimize your Coinbase in Fiat withdrawal costs, favoring the separate transfer is often a good idea. However, it should be noted that if you live outside the SEPA zone or make transfers in other currencies (USD, GBP, etc.), you could deal with different costs.

Withdrawal on bank card: why is it more expensive?

Coinbase also allows direct withdrawal to a credit or debit card. This solution may seem more practical, especially if you wish to immediately have your funds without waiting for the processing time for a bank transfer. However, speed has a price. Indeed, card withdrawals are generally billed between 1.5 % and 2.5 % of the amount withdrawn, depending on the region and the card used.

This additional cost is explained by the interchange commissions imposed by the card networks (visa, mastercard) and by additional processing costs.

So always check the details of the costs before confirming your withdrawal.

To limit your invoice, it is better to go through a separate transfer, even if it means waiting a little longer before seeing your funds in your bank account.

Coinbase with cryptocurrencies withdrawal: Understand each parameter

For many users, directly withdraw their assets from an external portfolio ( Ledger, Tangem or Exodus type) remains a priority, especially when they wish to keep them in “Cold Storage” or carry out other operations on DEFI platforms. Here are the criteria that influence these withdrawals:

The choice of network: a lever to reduce the bill

Some cryptocurrencies are compatible with several blockchains or several layer solutions. For example, the ETH can be sent via the main Ethereumnetwork, but also via sidechains or Layer 2 like Arbitrum or Optimism (if the platform allows it). The BTC, on the other hand, can go through the native network of Bitcoin or through the lightning network.

When you select the network for your shipment, always compare the costs estimated by Coinbase .

A shipment to Ethereum can cost more than a shipment via a secondary network if the Ethereum is saturated.

On Bitcoin, going through Lightning Network can offer very low network costs, but Coinbase applies its 0.1 %processing costs, which makes the comparison necessary.

In general, if your recipient accepts several networks, take the one where congestion is the weakest and where the estimated costs are less. However, keep in mind that each network has its own rules and addresses. Making an address error (sending BTC to the Ethereum , for example) can lead to the irreversible loss of your funds.

Fixed costs vs. Variable costs: how the platforms calculate them

Coinbase regularly declares that the costs displayed when validating a withdrawal may vary during the same day. Indeed, the internal algorithm is based on:

Real -time pricing of the network (mining costs, gas, congestion, etc.).

Any internal commissions (lump sum or proportional).

The grouping of several withdrawals in one (batching).

It is therefore that two withdrawals identical to a few hours apart does not display the same amount. This fluctuation is a concern for some users, who sometimes prefer to postpone their withdrawal when the blockchain is less crowded.

Coinbase and spread withdrawal fees: don't confuse everything

Often, users are surprised to see a difference between the value of their cryptocurrency at the time of the sale and the amount they finally get. This difference can come:

Spreade

The Spread is the gap between the purchase price and the sale price of a cryptocurrency. On Coinbase, when you place a “simple” order (purchase or instant sale), the platform may include a Spread in the displayed price, which allows it to “lock” the course for a few seconds or minutes, time required to execute the order.

The more volatile the market, the higher the Spreading.

Coinbase can keep part of this gap as remuneration, in addition to its displayed transaction costs.

If you use “ Coinbase Advanced” (the old Coinbase ), you interact directly with the order book and often reduce these price differences. In this case, the Spread is less, because you directly fix the price of your limit order.

Internal conversion commissions

When you decide to sell a crypto to convert it to euros, the service applies a fixed or variable percentage, distinct from the Spread. For example, for a small amount of BTC sold, you could pay a higher commission percentage to what you would pay for a large volume. The accumulation of conversion commissions and Spread can sometimes be higher than expected. To escape the Spread, interact directly with the order book on Coinbase Advanced.

Case of withdrawals with Coinbase One: what advantages?

Coinbase One is a paying subscription offered by the platform, which allows you to benefit from certain advantages, including the absence of transaction costs for purchases and sales (under certain conditions). However, this subscription does not fully exercise Coinbase withdrawal costs:

- Network costs continue to apply for withdrawals to cryptocurrency.

- Possible conversion costs, or Spread, can always influence the final amount.

- FIAT withdrawals can keep a fixed cost (e.g. for a separate transfer, you always pay bank charges if taken).

The ONE Coinbase offer is especially interesting for traders that make many purchases/sales. Withdrawals remain subject to the standard conditions of the network, even if ad hoc reductions can be offered.

Optimize withdrawals: concrete strategies to pay less

Wait a favorable window on the network

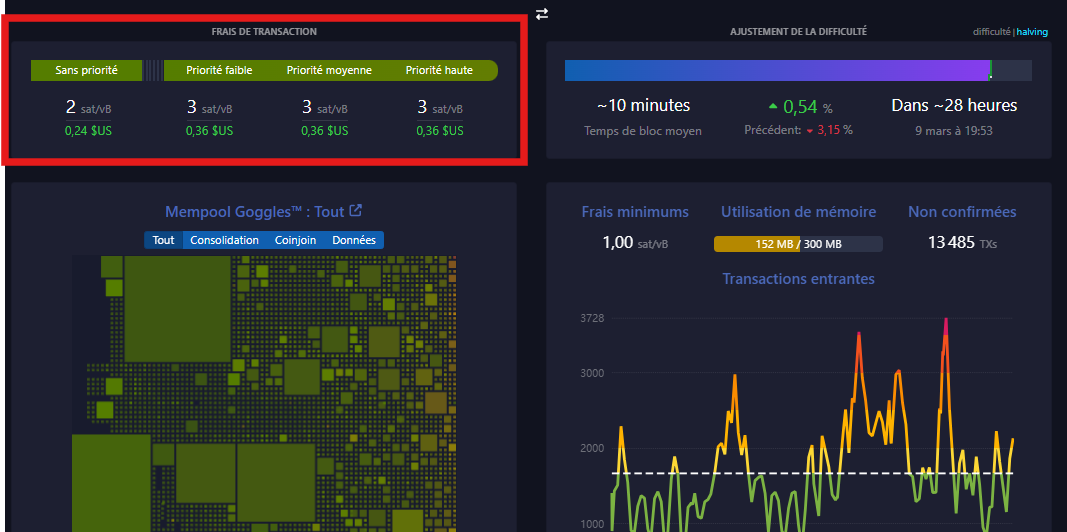

On Ethereum or Bitcoin, transaction costs may vary from hour to hour. There are third -party sites (such as Ethereum Gas Tracker from Etherscan for Ethereum Ethereum or Mempool.Space for Bitcoin) which show in real time congestion and the average cost of a transaction.

On Bitcoin, if you see that the mempool is not very busy, this is the perfect time to make your withdrawal.

On Ethereum , wait for a moment of low activity (sometimes at night in Europe) to take advantage of Gas Fees reduced.

Use Coinbase Advanced

Coinbase offers an advanced interface (formerly Coinbase Pro) which makes it possible to manually fix the selling or purchase prices, and avoids part of the whole Spread imposed during rapid transactions. You can thus sell or convert your cryptos to a more advantageous course before withdrawn, reducing losses linked to implicit commissions.

Group withdrawals

If you plan to make several withdrawals over the same period, it may be more profitable to convert everything and then make only one big withdrawal, rather than multiplying small outings. Fixed costs will be paid only once, and you will avoid accumulating several commissions.

For example, if each withdrawal costs you € 0.15 + a variable percentage, a single transfer of € 2,000 will be cheaper than two transfers of € 1,000 each.

In the same way, for crypto, you can reduce costs by grouping your tokens on a single network, provided that the conversion is advantageous.

Convert into a crypto at network fees below

Some blockchains (BSC, Solana, Suis, Aptos, Base, etc.) generally have very low network costs. If your final destination supports these cryptos, you can convert your balance to a cryptocurrency compatible with these networks, then remove these tokens.

Once received on your external wallet or on another platform, you can convert them into the desired crypto. This manipulation generally saves you on network costs, although you should check the conversion commission applied by Coinbase and that the conversion costs do not exceed the withdrawal costs saved.

Specificities concerning certain Coinbase services

Withdrawal fees and staking

If you make staking, you will not have specific costs for “destiving” your assets, apart from any costs related to the network if you then send them to another portfolio. Coinbase takes a commission from staking awards (up to 35 % according to cryptocurrencies), but this does not constitute a “withdrawal fees” proper: it is rather a percentage taken from the interests generated.

Withdrawal and Coinbase Card Card

The Coinbase Card allows you to spend your cryptocurrencies directly in store or online. “Withdrawal fees” as such do not exist during a payment, but the platform may include a spread in the crypto-fiat conversion rate. If you use an ATM (DAB) with this card, expect to pay higher costs (possibility of 2.49 % or more, depending on the conditions and commissions of the DAB operator).

Watch out for withdrawal address errors

An error in the destination address can result in a total loss of funds, because blockchains do not allow cancellation or automatic dismissal in the event of a nonexistent address. Coinbase cannot generally recover your cryptos if you are mistaken about network or type of address. So scrupulously check each character and privilege the copy-pumpy to the manual copy.

What evolution of Coinbase withdrawal costs for the future?

Coinbase withdrawal costs have already experienced several developments over the years. The platform regularly adapts its pricing policy to work:

- Of the adoption of new scaling solutions (e.g. Arbitrum, optimism).

- Mining cost variations on blockchains.

- From its desire to attract or retain new users (promotional offers, temporary drop in costs, etc.).

We can expect Coinbase to continue to align with the innovations in the sector.

For example, if transactions via Lightning Network are commonplace and become even more affordable, the 0.1 % commission could evolve. Likewise, the growing adoption of certain less expensive blockchains can lead the platform to offer more withdrawal options for the same cryptocurrency, with more or less cost differences.

Summary of good practices to pay less fees on Coinbase

- Favor the SEPA transfer for your withdrawals in euros, rather than the bank card.

- Monitor the congestion Ethereum blockchains before making a crypto removal.

- Compare the costs according to the network (Lightning vs. on-chain for Bitcoin, L2 vs. Main network for Ethereum ).

Use Coinbase Advanced to reduce the Spread on your exchanges. - Gather withdrawals when possible, in order to pay less fixed costs.

- Convert your cryptos into an asset offering lower network fees

Conclusion: Master costs to optimize withdrawals

Coinbase withdrawal costs depend on multiple factors: targeted blockchain, payment method, platform offer, market volatility and even your conversion choices. Knowing the Coinbase pricing policy is essential to avoid paying more than necessary. The commissions can quickly accumulate if we do not pay attention to the available withdrawal options.

By following the good practices described, you can minimize the impact of these costs, which you want to withdraw euros on your bank account or transfer cryptocurrencies to an external wallet. Make sure you check in real time the estimated amount of the costs and, if possible, to wait until the right time to carry out the operation (lower congestion, cheaper network, etc.). Finally, if you are a regular trader, consider the use of Advanced Coinbase to reduce price differences at the time of the sale. The important thing is to combine strategic approach and understanding the pricing mechanisms to make the most of your withdrawals.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .