Is Gate.io accessible in Germany?

If you're wondering whether Gate.io is accessible in Germany , the answer is no. The platform is among the cryptocurrency exchanges restricted in the country due to regulations imposed by the Federal Financial Supervisory Authority (BaFin) . Some users attempt to circumvent this restriction using solutions like VPNs. Why is Gate.io blocked in Germany? What are the risks, and what alternatives exist? Let's break it down together.

Table of Contents

Why is Gate.io banned in Germany?

Gate.io, founded in 2013 in China and now based in several jurisdictions, offers more than 3,600 digital assets in spot, futures and other derivative products.

In Germany, BaFin (the Federal Financial Supervisory Authority) requires that any platform wishing to offer services related to digital assets obtain a cryptocurrency custody license . This license is mandatory for companies offering services such as the custody, administration, or trading of crypto-assets on behalf of third parties. The criteria for obtaining this license include:

-

Capital requirements : Applicants must have sufficient initial capital, generally at least 125,000 euros, to demonstrate their financial stability.

-

KYC regulations : Implementation of rigorous anti-money laundering (AML) and know-your-customer ( KYC ) procedures to prevent illicit activities.

-

Secure IT systems : Development of a robust technological infrastructure to ensure the security of customer data and assets.

-

Effective internal management : Establishment of internal control mechanisms to monitor and manage operational risks.

Gate.io, not having obtained this license from BaFin, has chosen to restrict access to its platform for German residents in order to comply with local regulatory requirements.

In which countries can Gate.io be accessed?

Gate.io is available in more than 165 countries, but some jurisdictions prohibit or restrict access due to local regulations.

Countries where Gate.io is available:

- Latin America: Brazil, Peru, Mexico

- Asia: South Korea, Vietnam, Thailand

- Africa: Morocco, Egypt, Nigeria

- Europe (partially): Italy, Poland, Portugal

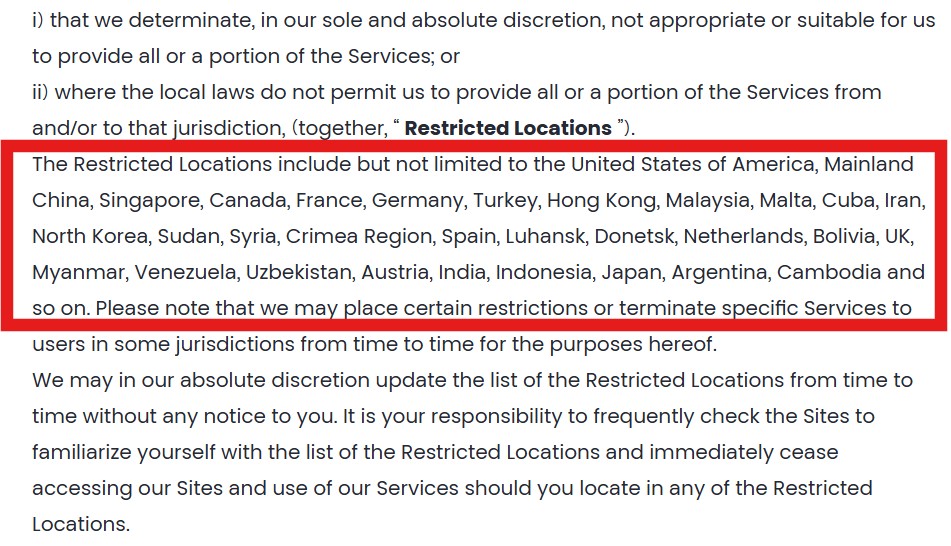

Countries where Gate.io is restricted or banned:

- North America & Europe: United States, Canada, France, Germany, United Kingdom, Netherlands, Austria, Spain, Malta

- Asia & Middle East: Mainland China, Hong Kong, Singapore, Malaysia, Iran, North Korea, Syria, India, Indonesia, Japan

- Latin America & Africa: Venezuela, Bolivia, Argentina, Sudan

- Other conflict zones: Crimea, Luhansk, Donetsk, Myanmar, Uzbekistan, Cambodia

Gate.io reserves the right to update this list at any time, depending on regulatory changes.

Gate.io's regulatory approvals

Gate.io holds several regulatory licenses that allow it to operate legally in certain jurisdictions. These certifications are essential for providing crypto-asset services to residents of the countries in question. However, each nation imposes its own requirements regarding the regulation of digital assets, meaning that authorization obtained in one jurisdiction does not automatically guarantee market access in another country.

Here are some of the main licenses obtained by Gate.io:

- MFSA (Malta) : Category 4 license for virtual asset financial services, authorizing the exchange and custody of digital assets in Maltese territory.

- AUSTRAC (Australia) : Registered as a digital currency exchange service provider, ensuring compliance with anti-money laundering and counter-terrorist financing regulations.

- SCB (Bahamas) : Certification issued by the Bahamas Securities Commission, allowing Gate.io to operate legally in the local cryptocurrency market.

- OAM (Italy) : Registration as a digital asset service provider, guaranteeing compliance with the regulatory requirements of the Italian market.

- DMCC (Dubai) : License granted by the Dubai Multi Commodities Centre, giving Gate.io the right to conduct crypto-asset trading activities in the United Arab Emirates.

Despite these accreditations, Gate.io remains ineligible in some countries such as Germany, where specific requirements must be met to offer services related to digital assets.

Is it possible to bypass the Gate.io restriction in Germany?

Although we do not recommend these methods, some users in Germany use the following solutions to access Gate.io:

Use a VPN : A Virtual Private Network (VPN) allows you to mask your IP address and simulate a connection from another country where Gate.io is accessible. Here are the steps:

- Choose a reliable VPN (NordVPN, ExpressVPN, ProtonVPN…).

- Connect to a server located in an authorized country (e.g., Portugal or Morocco).

- Access the Gate.io website without restrictions.

Risks : Gate.io may detect the use of VPNs and block or suspend your account if the terms of use are not respected.

Would Gate.io be worth it?

Gate.io is one of the exchanges offering the widest range of crypto assets and provides several attractive features:

- More than 3,600 cryptos listed, including rareltc.

- Futures and leveraged margin trading.

- NFT Marketplace.

- Copytrading and automated trading bots.

- Passive returns (staking, yield farming, lending).

However, the platform also has drawbacks:

- Not regulated in Europe.

- Customer service criticized.

- The interface is not very intuitive for beginners.

Thus, although Gate.io offers an impressive range of services, its lack of a regulatory framework in Europe and certain aspects related to user experience must be taken into account.

Gate.io Alternatives in Germany

Since Gate.io is not accessible in Germany due to the lack of BaFin authorization, several regulated platforms allow German residents to legally trade cryptocurrencies.

You can invest in cryptocurrencies in Germany with OKX.

OKX offers:

- Strict regulatory compliance, OKX being one of the first platforms to have held the European license ( MiCA ). It is on the AMF whitelist.

- A dual interface: a simplified application for beginners and an advanced platform offering volume-dependent fees and a competitive order book.

- Very competitive fees on the market: 1% on the simplified platform and a maximum of 0.35% on the advanced platform .

- Access to several hundred cryptocurrencies to potentially diversify your portfolio in addition to Bitcoin.

- Additional services such as staking to generate returns on these cryptocurrencies.

OKX has one of the most comprehensive offerings on the market. We are not affiliated with them, but we use their referral link.

More information about the rewards can be found here.

You've heard of Bitcoin but don't know where to start?

To gain a deeper understanding of how the monetary system and Bitcoin work, and to develop a more complete mastery of the tools, finance and legal constraints (taxation, inheritance, etc.) , we invite you to discover the BSM program .

It includes detailed video tutorials on centralized exchanges, software wallets, hardware wallets, and best practices. The program can be accessed from the header or the link above.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital .

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .