Finding a safe and easy-to-use crypto platform can quickly become a headache. If you've landed here, you probably want to know if Gemini is a good platform to start with.

Is Gemini reliable?

Gemini is one of the oldest platforms in the sector, founded in 2014 by the Winklevoss brothers.

Table of contents

Gemini is one of the few crypto companies with both a PSAN registration in France and a MiCA in Europe. The PSAN (Digital Asset Service Provider) registration certifies that the platform meets compliance, anti-money laundering, and fund protection requirements. You can verify its status on the official AMF register .

It also holds the MiCA (Markets in Crypto-Assets) framework, bringing a new, unique European regulatory level, ensuring financial supervision comparable to that of traditional players.

The platform was also recently listed on the stock exchange , a sign of a commitment to transparency and regular publication of financial data.

Security on Gemini

Gemini has built its reputation on security. Unlike many newer platforms, it has operated for over ten years without any major hacking incidents affecting funds stored in cold storage.

Its measures include:

- majority of funds are stored in a "cold wallet " (offline)

- separation of customer assets and company funds

- two-factor authentication required

- regular external audits

- Limited insurance on certain assets

Who is Gemini best suited for?

Gemini is especially suitable for users who are looking for:

- a simple and clear cryptocurrency buying platform

- a European regulated framework

- the possibility of diversifying with tokenized shares

- competitive trading fees

- a secure environment

Interface and ease of use

The mobile app and website are designed to make buying digital assets instant. Registration takes just a few minutes with standard KYC identity verification.

The menus are well-presented and easy to understand, and the advanced options don't overwhelm the user. Switching to ActiveTrader is straightforward for those who want to progress to more advanced trading.

Gemini Fees: What You Need to Know

On the standard interface, Gemini applies fixed fees for instant orders, plus a convenience fee of approximately 0.50% included in the displayed price. Specifically, a simple purchase in euros results in:

- €1 fee for orders up to €10

- €1.50 between €10 and €25

- €2 between €25 and €50

- €3 between €50 and €200

- 1.49% above €200

These amounts make small purchases less attractive, especially when using a bank card, which incurs a 3.49% fee on the deposit. Bank transfers and cryptocurrency deposits are free. It is therefore preferable to use these methods, particularly bank transfers if you do not yet own any cryptocurrencies.

For fiat currency withdrawals, some bank transfers may incur fees. Cryptocurrency withdrawals use dynamic fees, directly linked to network costs (e.g., gas fees on Ethereum), meaning Gemini does not charge an additional margin.

The ActiveTrader platform offers a fee structure based on a maker/taker model. Base fees start at around 0.20% for maker orders and 0.40% for taker orders, decreasing progressively with trading volume. This option is very attractive for those who execute multiple trades.

To learn how to buy cryptocurrencies on Gemini, use the ActiveTrader interface and even decentralize your funds, we offer our free step-by-step guide with supporting screenshots.

What you will learn:

✔ Buy your first cryptocurrencies on Gemini, using the ActiveTrader interface

✔ Understanding key concepts such as the use of stablecoin and the basics of taxation related to cryptocurrencies

✔ Mastering a decentralized wallet ( DeFi ) – Learn to manage your assets without intermediaries and to interact directly with the blockchain.

✔ Conducting transactions via a decentralized wallet – A practical guide to trading cryptos independently.

✔ Explore decentralized finance ( DeFi ) – Discover advanced concepts like staking and NFTs .

📥 Download the guide freely by filling out the form below:

Investing in DCA on Gemini

Gemini allows you to implement DCA ), an investment strategy that involves regularly buying a small amount of cryptocurrency, regardless of the market price. The goal is to smooth out the purchase cost over time and reduce the impact of volatility, making it particularly suitable for beginners who don't want to manage market timing.

Scheduling is done directly from the interface: you choose the asset, the amount, and the purchase frequency. This automation simplifies long-term investing without requiring constant monitoring.

Asset presentation based on narratives and current events

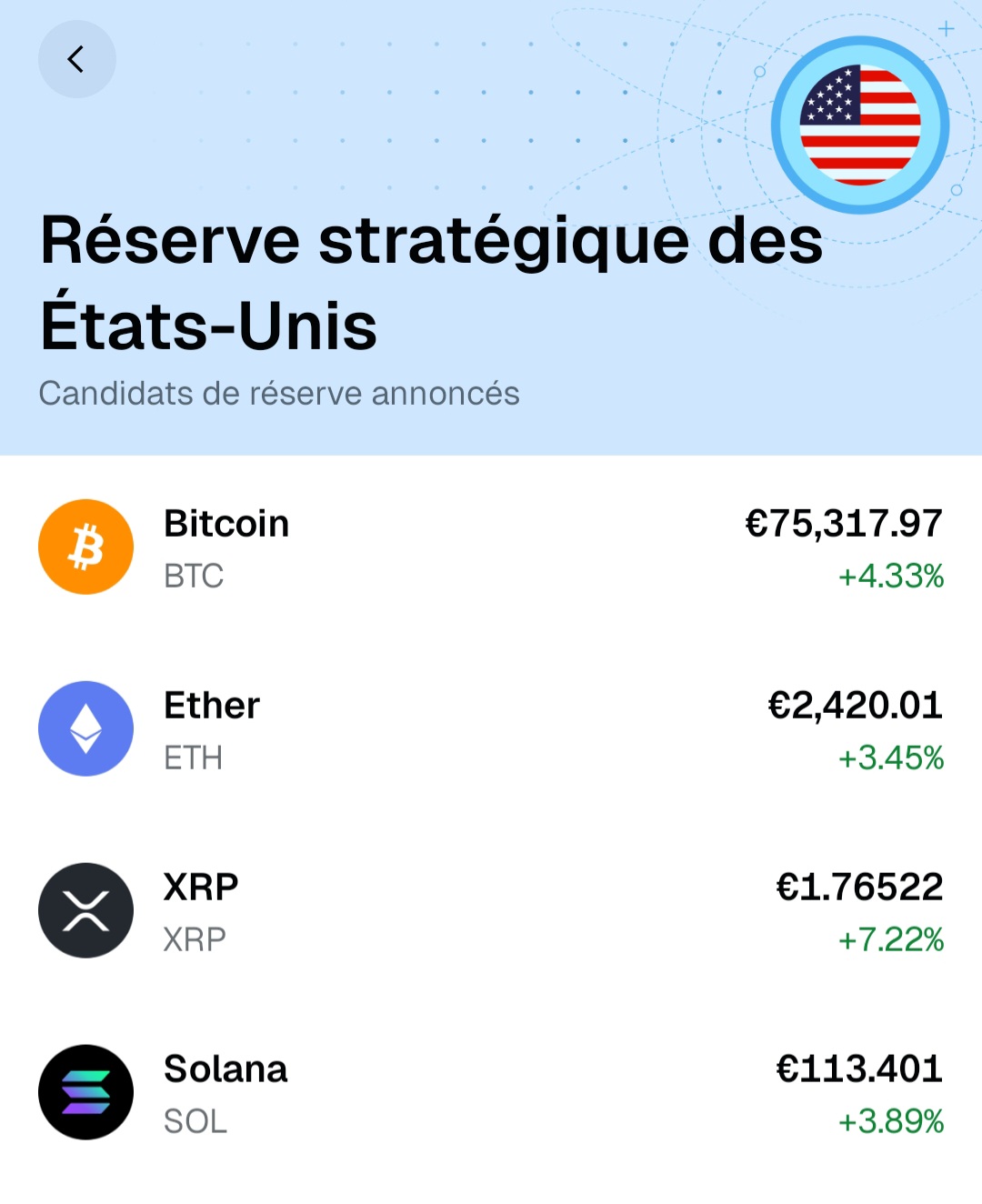

Gemini also highlights assets based on market themes and financial news. For example, the platform features cryptocurrencies associated with narratives such as AI, blockchain infrastructure, or energy, helping users identify trends.

There are also categories linked to macroeconomic topics, such as assets likely to be included in the US strategic reserve, a theme frequently raised in American institutional discussions surrounding Bitcoin and its potential role as a digital strategic reserve. This gives investors a more contextualized view of the available assets.

Cryptocurrency choices

Gemini offers a catalog of over 60 cryptocurrencies. For a beginner wishing to access the main cryptocurrencies, this is more than enough: Bitcoin, Ethereum , Cardano , Solana , Polygon , Chainlink , Aave , etc.

However, those who want to trade very recentltccoins or popular memecoinmight be frustrated.

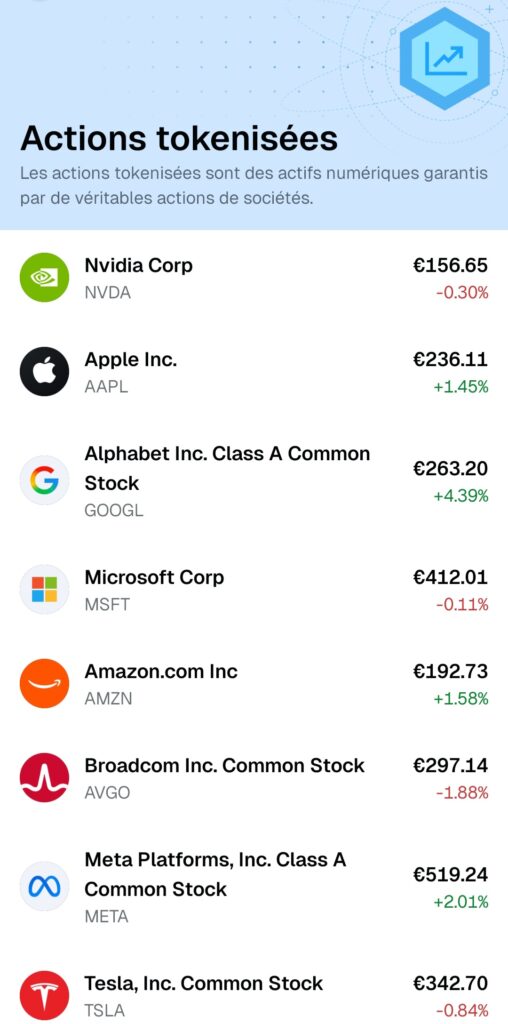

Tokenized shares: a real advantage

One of Gemini's unique features is the ability to buy tokenized shares like Apple, Tesla, or Nvidia. These assets represent fractions of traditional shares in token form—a unique option in the cryptocurrency exchange market.

How does it work?

These tokens are backed by actual shares held by an institutional partner. The major difference compared to a traditional broker is:

- you do not hold the share directly

- you hold a token representing this stock

- Background holding is done on the blockchain

This allows you to combine crypto and stocks on a single interface. It also allows you to buy and sell stocks 24/7, rather than being restricted by market hours with traditional brokers.

Staking on Gemini

staking options on networks like Ethereum and Solana . staking involves locking up your cryptocurrencies to participate in validating transactions on a Proof of Stake . In exchange for this participation, the user receives regular rewards, generating passive income .

On Gemini, the process is simplified: the platform automatically delegates funds to validators, without requiring any technical configuration or node management. This approach appeals to novice users who want to earn additional income while retaining control of their assets.

Liquidity and order execution

Liquidity is very good across all available pairs. Execution is fast on ActiveTrader thanks to a deep order book.

Customer support

Gemini has responsive support accessible via form and chat.

Strengths

- proven safety

- MiCA and PSAN regulated environment

- simple interface

- accessible staking

- ActiveTrader with very attractive fees

- purchase of tokenized shares

Weak points

- Not the largest cryptocurrency catalog if you're looking for exotic assets.

- rather high bank card fees

- significant fees from the traditional platform for small purchases

Our review of Gemini

Gemini stands out for its security, regulated framework, and a rare feature: tokenized shares. For a beginner looking for a simple, reliable platform without excessive exposure to the risks associated with unregulated players, Gemini is a solid option.

However, if your priority is access to a large number ofltccoins or minimal fees under all circumstances, other platforms may be more suitable.

Conclusion

Gemini is a robust crypto exchange platform, particularly suited to beginners looking to invest in major cryptocurrencies within a clear regulatory framework. The availability of tokenized shares, staking , and ActiveTrader makes it a versatile solution.

To reduce costs, prioritize bank transfers and the ActiveTrader platform.

Its proven reliability over more than 10 years represents a definite advantage for those who wish to invest with confidence.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .