What are the prospects for the price of gold by 2025?

Gold it has a place in your portfolio. In this article, we'll first look at the fundamental forces behind its value, then the macroeconomic context and the signals to watch for to anticipate its trajectory towards the end of 2025. This article does not constitute investment advice.

Table of Contents

Intrinsic value of gold: what underlies its price

Rarity and limited reserve

Gold is a precious metal with a limited supply. Unlike fiat currencies, which can be printed, gold cannot be created at will. This is one of the main factors influencing the price of gold .

Inflation hedge and weakened fiat currency

Gold is often seen as a store of value during periods of inflation or currency depreciation. When a central bank prints money or when the purchasing power of a currency declines, gold can act as a buffer. This is particularly true when the real return on bonds is negative (low nominal rates or high inflation).

Industrial use, jewelry and physical demand

A significant portion of the demand for gold comes from the jewelry sector and industry (connectors, electronic components, dentistry). This physical demand acts as structural support for the price, especially in large gold-consuming economies (India, China).

The monetary and historical role of gold

Gold has long been at the heart of the monetary system. During the gold standard era, currencies were convertible into gold. Then, gradually, fiat currencies replaced it. But gold retains a symbolic role and anchors trust. Over time, it has become a safe-haven asset—that is, an asset to which investors turn in times of crisis or uncertainty.

Macroeconomic factors that weigh on the price of gold

Key interest rates and monetary policy (particularly the Fed)

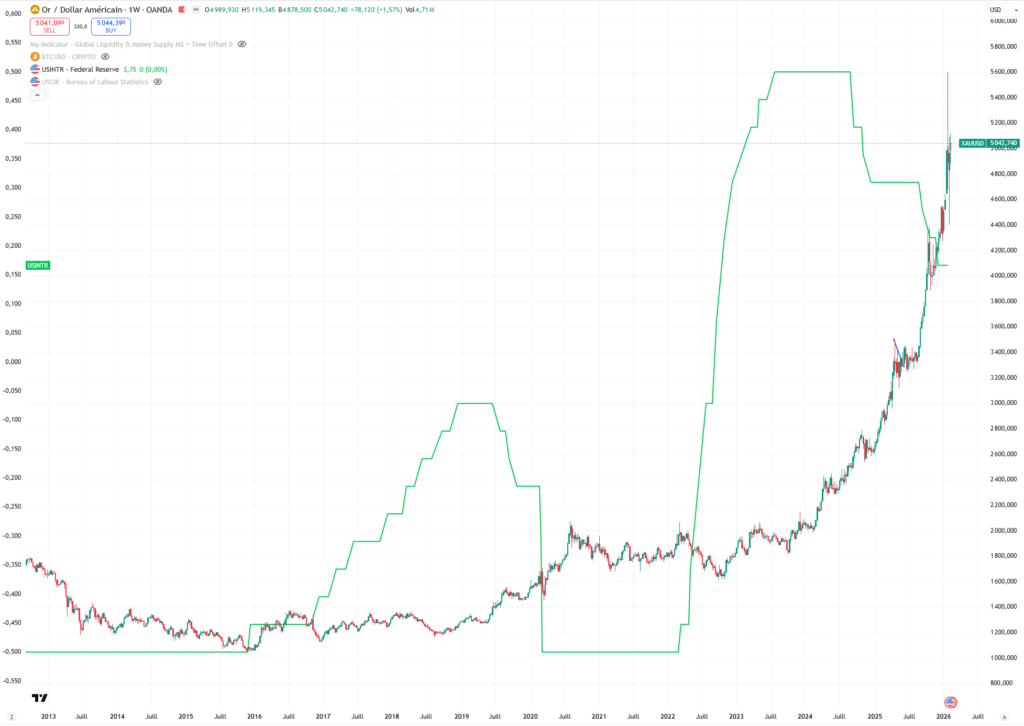

Interest rates appear to be a lever for gold. When the US Federal Reserve (Fed) raises its rates, it makes bonds more attractive. Conversely, expectations of rate cuts or accommodative policies favor other assets, particularly those considered riskier, such as stocks or cryptocurrencies.

So where does gold fit into all this? Over the past 15 years, the sharp rises in gold prices have begun when interest rates had plateaued, that is, just before the Fed announced monetary easing. But correlation does not necessarily imply causation. Is this a recurring pattern to consider going forward? Time will tell.

Feeling “risk off” versus “risk on”

Gold is a risk-off : it benefits during periods of risk aversion (crises, uncertainties). Conversely, during periods of market euphoria (risk-on), investors favor equities or other assets with greater potential. Geopolitical events (tensions between major powers, conflicts, political crises that undermine confidence in the currency) reinforce the flight to this safe-haven asset. Conversely, a return of global confidence, strong growth, or significant innovations can draw capital toward riskier assets, to the detriment of gold.

Pressures on the US dollar and desensitization (de-dollarization)

Because gold is often priced in dollars, a depreciation of the dollar makes gold cheaper for holders of other currencies, thus fueling international demand. Conversely, a strong dollar puts downward pressure on gold. In 2025, certain geopolitical tensions and the diversification of central bank reserves into other assets (cryptocurrencies, alternative currencies) are fueling the debate on reducing sensitivity to the dollar , which could support gold.

Seasonality: Gold at the end of the year

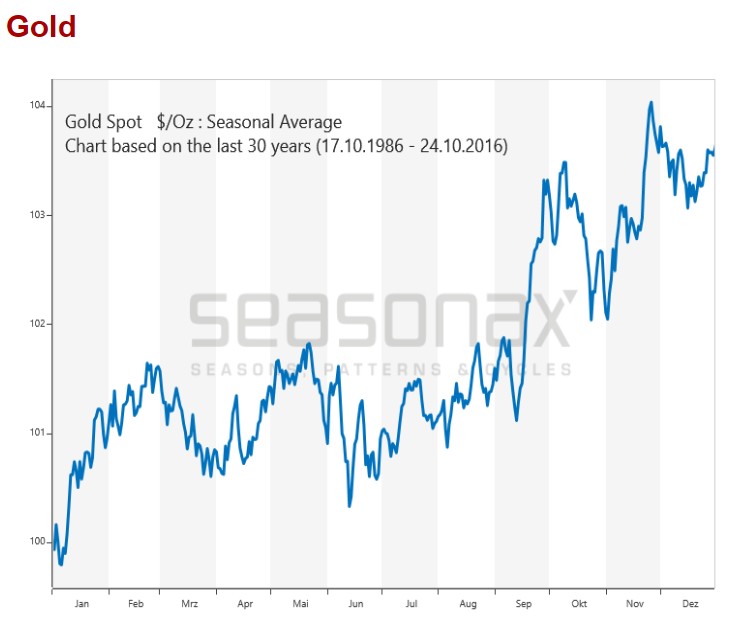

The study of seasonal trends in gold over 30 years (1986–2016) highlights recurring cycles. The graph clearly shows that gold does not react uniformly throughout the year, but rather experiences more favorable periods:

- From January to February, the price generally progresses steadily, driven by physical demand at the beginning of the year.

- From March to June, the trend becomes more erratic with periods of correction. This period is historically weaker, marked by moderate demand.

- From July-August onwards, the curve regains an upward bias, with an initial acceleration that is confirmed in September.

- From September to October, there is marked volatility: after a strong rise, gold often experiences a temporary decline.

- Finally, from November to December, gold regained positive momentum and ended the year on a robust upward trend, as shown by the strong year-end surge on the chart.

In summary, historical data suggests that the most favorable period for gold is between mid-September and the end of January, with a marked peak in September and a sustained upward trend at the end of the year. This seasonality is thought to be linked to increased demand in the jewelry sector (India, China), the holiday season, and the repositioning of institutional portfolios. As of this writing, we have indeed seen a significant surge in the price of gold in September 2025.

Recommendations for a beginner and practical advice

Steps to follow the gold market

- Monitor Fed announcements & comments on inflation.

- Monitor the performance of the dollar (USD indices) and the fluctuations of major currencies.

- Take into account major geopolitical events (risks, crises, conflicts).

Safety advice

Do not allocate an excessive portion of your portfolio to gold, as it is an asset without yield (no dividend, no coupon).

Gold often acts as a complementary diversification tool.

Reassess your position regularly based on macroeconomic developments.

Conclusion

The price of gold is subject to a complex interaction between structural factors (scarcity, industrial use, monetary role) and cyclical forces (monetary policy, expectations, sentiment, global context). Two trajectories appear credible between now and the end of 2025:

The seasonal nature of the year-end could create a slight bias in favor of gold (particularly in November and December), especially if institutional flows remain positive. Finally, for a novice investor, gold acts as a stabilizer and hedge.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital.

All our articles undergo rigorous fact-checking. Every key piece of information is manually verified against reliable and recognized sources. When we cite a source, the link is always integrated into the text and highlighted in a different color to ensure transparency and allow readers to directly access the original documents.

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .