How to avoid the flat tax on cryptocurrency gains ?

When declaring your cryptocurrency income, you're probably wondering if it's actually possible to circumvent the 30% flat tax . The short answer is: generally speaking, you can't escape the flat tax. However, there are tax optimization strategies that allow you, within certain legal limits, to defer your taxes. Nevertheless, no solution completely eliminates taxation in France.

In this article, we will detail the mechanisms that apply to the taxation of cryptocurrencies, the special cases, as well as some tips to optimize your declarations.

This article is not written by tax professionals; it is for informational purposes only and is based on research into French cryptocurrency taxation. It is not a substitute for consulting a tax lawyer specializing in digital assets

How to avoid the flat tax on cryptocurrency gains: Understanding the scope of the flat tax

What is the Single Flat-Rate Levy?

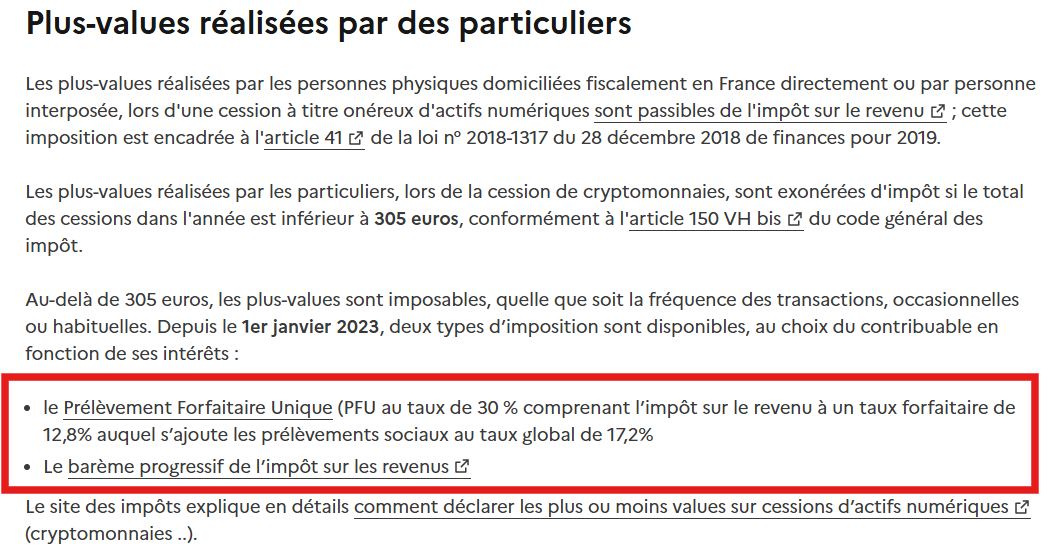

The Single Flat-Rate Levy, more commonly known as the PFU, is a flat tax rate applicable since 2018 to various forms of capital income. It is often referred to as the crypto flat tax when it comes to taxing capital gains from the sale of digital assets. The overall PFU rate is 30%, comprising:

– 12.8% income

tax – 17.2% social security contributions.

This system was introduced by Law No. 2017-1837 of December 30, 2017, the 2018 Finance Law. In practice, gains made on cryptocurrencies such as Bitcoin, Ethereum , or any other LTC coin Ethereum into ltc category , provided they are considered capital gains from the sale of digital assets and you are a French tax resident.

Why this tax?

The main objective is to simplify the tax landscape surrounding capital income. The government has therefore unified the tax rate for stock market gains, bank interest, dividends, and, by extension, profits from cryptocurrencies. This also aims to provide investors with greater clarity, rather than subjecting them to sometimes complex progressive tax brackets.

However, this simplification may be considered detrimental to those who make modest gains in cryptocurrencies or whose marginal tax rate is normally less than 30%. This explains why the question " How can I avoid the flat tax on cryptocurrencies? " comes up frequently, even though, as we have indicated, complete circumvention remains impossible at present.

Table of Contents

How to avoid the flat tax on cryptocurrency gains : General principles of taxation in France

Scope of the flat tax on cryptocurrencies: who is affected?

French tax law considers cryptocurrencies as "digital assets" within the meaning of Article 150 VH bis of the General Tax Code (CGI). Therefore, any person fiscally domiciled in France who realizes capital gains on the sale of cryptocurrencies is required to declare these gains to the tax authorities.

Specifically, you are affected if:

You sell your cryptocurrencies for fiat currency (euro,

dollar, etc.). You exchange your cryptocurrencies for a good or service (as in the case of buying with Bitcoin).

Flat tax on digital assets: Taxable events

The current tax regime is based on the concept of "transfer for consideration." In other words, as long as you only conduct crypto-to-crypto transactions (for example, Bitcoin in exchange forEthereum), there is no tax trigger. However, as soon as you convert your BTC to euros, or purchase goods with your crypto, taxation applies.

Article 150 VH bis of the French General Tax Code (CGI) requires you to calculate all your capital gains realized during the year by combining them into a single amount. This means you must add up all your gains from the sale of cryptocurrencies and deduct the total purchase cost. For this purpose, we partner with Koinly, a leader in the field. Koinly is software that automates the calculations required for your declaration of digital asset disposals.

To use it, you create an account, you connect all your accounts and wallets, therefore both centralized exchanges, the software wallet(s) as well as the physical wallet(s).

Koinly reconstructs your cash flows,

calculates your potential capital gains or losses,

and generates reports that simplify the completion of appendix no. 2086.

Flat tax on cryptocurrency gains: calculating taxable capital gains

To calculate the amount you will be taxed on when you sell cryptocurrencies, the tax authorities use a specific formula. Here's how it works, explained step by step.

Flat tax on crypto: the formula for calculating taxable capital gains:

Gross capital gain = Selling price – [(Total purchase cost of all your cryptos) x (Selling price / Total value of your portfolio)]

Let's look in detail at what these terms mean:

- Selling price (Transfer price) : This is the amount in euros you receive when you sell your cryptos.

- Total cost of purchasing the wallet : This is the total amount you spent to buy all your cryptocurrencies, including those you have not yet sold.

- Total portfolio value : This is the value of all your cryptos at the time of sale, even those you still hold.

- (Selling price / Total portfolio value) : This fraction allows us to calculate the portion of the purchase cost corresponding to the cryptos sold.

Explained with an example:

You bought €5,000 worth of Bitcoin and €5,000 worth of Ethereum , for a total investment of €10,000 . At some point, the total value of your portfolio reached €20,000 (because the price of cryptocurrencies increased). You then decided to sell €5,000 worth of Bitcoin.

Your taxable capital gain will be calculated as follows:

- We determine the portion of the purchase cost associated with the sale:

(10 000 € × 5 000 €) / 20 000 € = 2 500 € - The formula is applied:

Gross capital gain = €5,000 – €2,500 = €2,500

You will therefore be taxed on €2,500 of capital gains.

Capital losses: can you deduct your losses?

If you sell certain cryptocurrencies at a loss (i.e., for a price lower than your purchase price), these losses can be deducted from gains made on other sales in the same year . This reduces the total amount you will be taxed on.

Warning! If, after subtraction, your total is negative (you have lost money overall), you cannot carry this loss forward to the following year , unlike with stock market investments where losses can be used to reduce future taxes.

Capital losses: can you deduct your losses?

If you sell certain cryptocurrencies at a loss (i.e., for a price lower than your purchase price), these losses can be deducted from gains made on other sales in the same year . This reduces the total amount you will be taxed on.

Warning! If, after subtraction, your total is negative (you have lost money overall), you cannot carry this loss forward to the following year , unlike with stock market investments where losses can be used to reduce future taxes.

This rule means that in crypto, it is best to optimize sales while keeping in mind that losses can only be offset within the same fiscal year.

How to avoid the flat tax on cryptocurrency gains : Optimization strategies

How to avoid the crypto flat tax: The progressive income tax scale

By default, capital gains on cryptocurrencies are taxed at a flat rate of 30%. However, you have the option to choose the progressive income tax scale if that is more advantageous for you. This is only beneficial for those with lower incomes.

How to avoid the flat tax on cryptocurrency: Take advantage of small transaction amounts (€305)

A full exemption applies to annual sales whose total amount does not exceed €305 (Articles 150 VH bis and 79 of the Finance Law). This means that if you occasionally sell very small amounts of cryptocurrency each year, without exceeding this limit, you will not be taxed on these gains.

However, this strategy is only realistic for investors with very low trading volumes. It is indeed difficult to generate significant capital gains below this threshold.

How to avoid the flat tax on cryptocurrency gains: Tax deferral via stablecoin

Many crypto holders now prefer to convert to stablecoin(USDT, USDC, DAI, etc.) to secure their profits without having to return to fiat currency. As long as you remain within the cryptocurrency market, the tax authorities do not consider this a taxable event.

More information about the rewards can be found here.

A conversion from BTC to USDT , for example, is not taxed immediately.

However, as soon as you convert your USDT , USDC , or other stablecoins back into euros, the capital gain generated since the initial acquisition (or the last taxable conversion) becomes taxable.

This allows you to defer taxation if you don't need your euros immediately. Be aware, however, that using stablecoin to purchase goods or services can be reclassified as a taxable event, as it constitutes a transfer for consideration.

Transaction fees and other charges

When declaring your capital gains, remember to deduct transaction fees and bank charges related to the sale. These costs reduce your gross capital gain. For example, if you sell €10,000 worth of Bitcoin and pay €20 in fees, your taxable base is only €9,980.

To maximize this deduction, it's essential to keep a thorough record of your transactions (exchange logs, bank statements, and any invoices). Tracking tools like Koinly or Waltio allow you to automatically manage this data and generate an accurate report for the tax authorities.

How to avoid the flat tax on cryptocurrency gains : is it possible? The illusions

How to avoid the flat tax on cryptocurrencies: Tax relocation abroad

Some investors are considering relocating to a country with more favorable tax treatment for cryptocurrencies , such as Portugal. Indeed, until recently, Portugal had a very attractive tax regime for cryptocurrencies. However, legislation there is evolving, and several bills aim to regulate the taxation of digital assets.

If you transfer your tax residence outside of France, you are no longer subject to French capital gains tax on the sale of digital assets. However, this process implies a real and lasting change of tax residence. The French tax authorities may reassess your situation if they consider that you have maintained economic and family ties in France.

Furthermore, France does not have an exit tax on cryptocurrencies, unlike on company shares. Digital assets are generally exempt from this tax, but the rules can change. This radical approach should therefore not be taken lightly: a poorly planned tax relocation can lead to disputes and penalties.

Professional activity (mining, staking, intensive trading)

When your activity in the cryptocurrency market is considered professional (high-frequency trading, arbitrage services, intensive mining, organized staking ), you fall under a different tax regime (BIC or BNC depending on the nature of the activity). Under this regime, you can deduct certain business expenses, but your profits are taxed according to business rules and no longer under the private capital gains regime.

Mining is generally considered a service and is taxed under the BNC (Non-Commercial Profits) regime.

Intensive trading, depending on the criteria of habit and repetition, may be reclassified as BIC (Industrial and Commercial Profits).

These specific regimes are not necessarily more advantageous than the flat tax, as tax rates can rise rapidly depending on the profits generated, not to mention social security contributions. Therefore, it is not accurate to say that you "avoid" the flat tax by becoming a professional: you are simply changing your tax status.

How to avoid the flat tax on cryptocurrency gains : Essential precautions for controlled taxation

Keep a comprehensive record of your transactions

To optimize your tax situation, the first rule is to keep track of every transaction.

Unless you conduct very few transactions, manual tracking is not very realistic. That's why automation and tracking software was developed.

They allow us to note:

The date and time of the transaction.

The exact amount of cryptocurrencies bought or sold.

Platform fees.

The exact equivalent (euros, stablecoin , other cryptocurrencies).

This information will allow us to accurately calculate your taxable base, deduct your expenses, and avoid any disputes in the event of a tax audit.

Declare your foreign accounts (non-French PSAN)

If you hold accounts on exchanges established outside of France, you are required to declare them (form no. 3916 bis). Since January 1, 2024, the registration criteria for digital asset service providers (DASPs) have been strengthened, and failure to declare them can result in substantial fines.

The French tax authorities are increasingly cooperating with foreign authorities, particularly through the automatic exchange of information. Therefore, failing to declare your foreign crypto accounts is not a way to "avoid" the flat tax, but rather a direct path to an audit.

Use tax tracking software

As mentioned above, specialized platforms exist to help you centralize the history of all your transactions. They provide you with a consolidated view of your portfolio, regardless of the centralized exchange or wallet used.

These software programs can be invaluable for avoiding calculation errors and correctly declaring your capital gains or losses. In the event of an audit, being able to justify each transaction is a decisive advantage.

Seek guidance from a tax lawyer specializing in cryptocurrencies

Given the rapidly evolving regulations (and the ambiguities that sometimes remain), guidance from a legal professional is recommended. A law firm specializing in crypto taxation, such as ORWL, can guide you through:

- Check the consistency of your statements.

- Identify legal tax optimization schemes.

- Set up a suitable legal structure (company, etc.) if you have large-scale projects.

- Managing regularization in case of past difficulties.

Why is this important?

Tax rules regarding digital assets are constantly evolving. An experienced lawyer keeps abreast of the latest legislative developments and court rulings, helping you avoid the pitfalls of misinterpreting the law.

Summary and conclusion on how to avoid the crypto flat tax

Answer to the question "How to avoid the flat tax on cryptocurrency gains?"

Ultimately, the most honest answer remains: the flat tax cannot be simply abolished. French law imposes a 30% tax rate on capital gains from cryptocurrencies, and this system is designed to be applied extensively to individuals. However, several legal solutions exist to reduce or defer this tax burden:

- Opt for the progressive tax scale if your tax bracket is less than 30%.

- Keep your earnings in stablecointo delay taxation until you return to euros.

- Use the exemption on small sales (less than €305 per year).

- Consider making a donation to clear unrealized capital gains, subject to paying transfer taxes and complying with anti-abuse rules.

- Do not neglect to keep rigorous accounts (made easier by software like Koinly) and to declare all your foreign accounts.

- Consult a specialist tax lawyer to benefit from personalized advice that complies with current regulations.

The risks of an incorrect declaration

Failing to declare earnings or grossly underreporting capital gains can lead to severe penalties. The tax authorities have extensive resources to monitor your transactions, particularly through information provided by digital asset service providers (DASPs), which are subject to identity verification for all users, and by commercial banks. Penalties can reach up to 80% for fraud, not including late payment interest.

The importance of professional support

Given the rapid pace at which cryptocurrency taxation is evolving, you would be well advised to consult a tax lawyer specializing in digital asset regulations. They can help you with:

- Analyze your personal situation (capital gains, assets, matrimonial regime, etc.).

- Implement optimization strategies (progressive scale, donation, company formation, etc.).

- Avoid legal and tax pitfalls (failure to declare a foreign account, fraudulent schemes, etc.).

Stay informed of upcoming reforms or draft legislation that could change your tax situation.

Conclusion on how to avoid the crypto flat tax?

Don't look for a secret formula to completely avoid taxes: there isn't one. However, transparent tax filing, combined with legitimate tax optimization strategies, will allow you to protect your assets.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital .

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .