How to avoid the Flat Tax Crypto ?

When declaring your income from cryptocurrencies, you are no doubt wondering whether it is really possible to bypass the flat taxation of 30 % . The quick response is: overall, you cannot escape flat tax. However, there are tax optimization strategies allowing, within certain legal limits, to reduce your taxes . However, no solution completely removes taxation in France.

In this article, we will detail the mechanisms that apply to Crypto taxation, special cases, as well as some avenues to optimize your declarations.

We are not profesons of taxation, this article is informative and resulting from our research on French taxation in cryptocurrencies. In any case, he does not replace a consultation with a tax lawyer specializing in cryptocurrencies.

How to avoid flat tax Crypto: Understanding the scope of flat tax

What is the unique flat-rate levy?

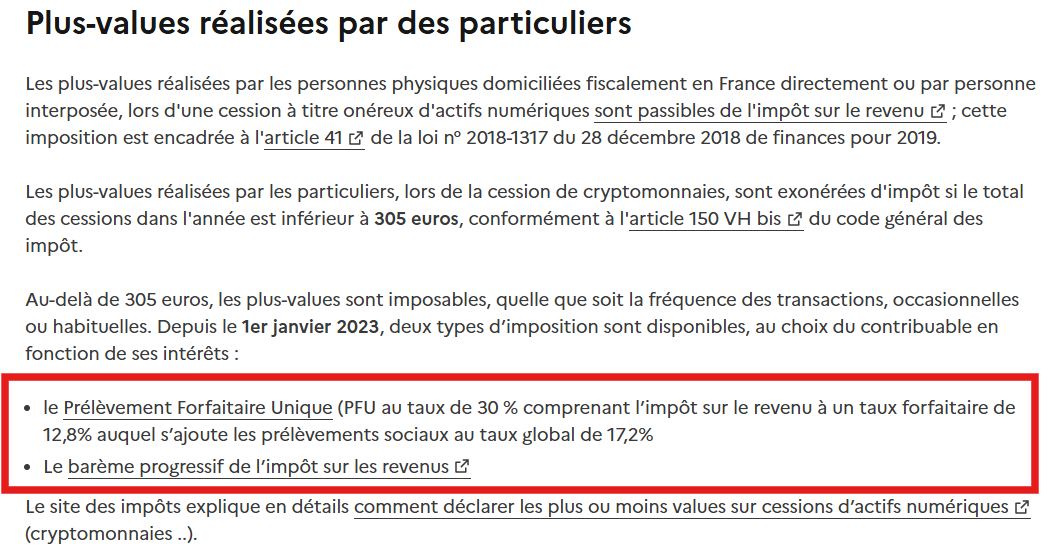

The single flat -rate levy, better known as PFU, constitutes a flat -rate tax rate applicable since 2018 on various capital income. It is often called Flat Tax Crypto when it comes to tax more capital gains from the sale of digital assets. The overall rate of the PFU is 30 %, including:

- 12.8 % income tax;

- 17.2 % of social security contributions.

This system was introduced by law n ° 2017-1837 of December 30, 2017 of finance for 2018. In practice, the gains made on cryptocurrencies such as bitcoin, ethereum Ethereum any other A ltc Oin enter this category, as soon as they are considered as capital gains on the sale of digital assets and that you are French tax resident.

Why this tax?

The main objective is to simplify the tax landscape around capital income. The public authorities have thus unified the tax rate for stock market gains, banking interests, dividends and, by extension, the benefits from cryptocurrencies. This also aims to give visibility to investors, rather than subject them to sometimes complex progressive scales.

On the other hand, this simplification can be deemed penalizing for those who make modest gains in cryptos or whose marginal tax rate is, in normal times, less than 30 %. This explains why the question " How to avoid the Flat Tax Crypto?" »Returns often, even if, as we have indicated, a total bypass remains impossible to date.

Table of contents

How to avoid flat tax crypto: the general principles of crypto taxation in France

The scope of the Flat Tax Crypto: who is concerned?

French taxation considers cryptocurrencies as "digital assets" within the meaning of article 150 VH bis of the General Tax Code (CGI). Thus, any person fiscally domiciled in France and making capital gains on cryptos sales is required to declare these gains to the tax administration.

Concretely, you are concerned if:

You sell your cryptos against euros.

You exchange your cryptocurrencies for a property or a service (case of purchase in bitcoin).

You transfer your cryptoactives to a fiduciary currency account.

Flat Tax Crypto: taxable events

The current tax regime is based on the concept of “disposable transfer”. In other words, as long as you only make crypto crypto transactions (for example Bitcoin in exchange forEthereum), there is no tax trigger. On the other hand, as soon as you convert your BTC to euros, or buy a property with your cryptos, taxation applies.

Article 150 VH bis of the General Tax Code (CGI) requires calculating all your capital gains made over the year by grouping them in one amount. This means that you must add all your earnings from the sale of cryptos and deduce the overall purchase cost. To simplify this task, tools like Koinly, Waltio or Cryptotaxcalculator can automatically generate a clear summary to integrate into your tax declaration (form 2042-C and 2086).

Flat Tax Crypto: the calculation of taxable capital gain

To calculate the amount on which you are going to be imposed when you sell cryptocurrencies, the tax administration uses a specific formula. Here's how it works, explained step by step.

Flat Tax Crypto: the formula for calculating taxable capital gain:

Brute added value = sale price-[total purchase cost of all your cryptos) x (sale price / total value of your portfolio)]]

Let's see in detail what these terms mean:

- Sale price (sale price) : this is the amount in euros you receive when you sell your cryptos.

- Total cost of purchase of the portfolio : this is the total you have spent to buy all your cryptocurrencies, including those that you have not yet sold.

- Total portfolio value : this is the value of all your cryptos at the time of sale, even those that you still keep.

- (Sale price / Total portfolio value) : This fraction makes it possible to calculate the share of the purchase cost corresponding to the cryptos sold.

Explained with an example:

You bought € 5,000 in Bitcoin and € 5,000 in Ethereum , a total of € 10,000 invested. At one point, the total value of your portfolio reaches € 20,000 (because the price of cryptos has increased). You then decide to sell € 5,000 in Bitcoin.

The calculation of your taxable capital gain will be:

- We determine the share of the purchase cost associated with the sale:

(10 000 € × 5 000 €) / 20 000 € = 2 500 € - We apply the formula:

gross added value = € 5,000-€ 2,500 = € 2,500

You will therefore be taxed on € 2,500 in capital gain.

Values: can we deduce your losses?

If you sell certain cryptos at a loss (that is to say for a price lower than that of purchase), these losses can be deducted from the gains made on other sales made the same year . This reduces the total amount on which you will be imposed.

Attention ! If, after subtraction, your total is negative (you have generally lost money), you cannot postpone this loss over the following year , unlike stock market stocks where losses can be used to reduce future taxes.

Values: can we deduce your losses?

If you sell certain cryptos at a loss (that is to say for a price lower than that of purchase), these losses can be deducted from the gains made on other sales made the same year . This reduces the total amount on which you will be imposed.

Attention ! If, after subtraction, your total is negative (you have generally lost money), you cannot postpone this loss over the following year , unlike stock market stocks where losses can be used to reduce future taxes.

This rule means that in crypto, it is preferable to optimize sales by keeping in mind that losses are only compensable within the same fiscal year.

How to avoid flat tax Crypto: optimization mechanisms

In fact, it is impossible to fully remove the tax burden linked to your crypto capital gains. However, several legal mechanisms allow you to reduce or postpone taxation. The strategies presented below should not be perceived as means of fraud or completely escape taxes, but rather as optimization tracks to be studied.

How to avoid flat tax Crypto: the gradual income tax scale

By default, the capital gains tax in cryptocurrencies applies via the flat tax by 30 %. However, you have the possibility of opting for the progressive scale of the IR (income tax) if you are more favorable to you.

If your marginal tax tranche is below 30 %, the progressive scale can allow you to pay less tax.

Conversely, if you are already in a slice of more than 30 %, this option is not recommended.

However, this choice must be made for all of your capital gains on the sale of digital assets, not at the time. You must therefore assess the overall impact on your tax household. In addition, even in the event of an option for the progressive scale, the social security contributions of 17.2 % continue to apply.

How to avoid flat taxpto: take advantage of the small amounts of sale (€ 305)

A total exemption applies to annual sales, the overall amount of which does not exceed € 305 (articles 150 VH bis and 79 of the finance law). This means that if you punctually sell very small amounts of cryptocurrencies each year, without exceeding this ceiling, you will not be imposed on these gains.

However, this strategy is only realistic for very low volume investors. Difficult, indeed, to pass significant capital gains under this threshold.

How to avoid flat tax Crypto: tax transfer via stablecoins

Many crypto holders now favor the passage in stablecoinS (USDT, USDC, DAI, etc.) to secure their profits without ironing by the "Fiat" box. As long as you stay in the crypto ecosystem, the taxman does not consider this as a taxable event.

More information here

BTC conversion to USDT , for example, is not taxed immediately.

However, as soon as you convert your USDT to euros, the capital gain generated since the initial acquisition (or the last taxable conversion) becomes taxable.

This solution allows, in practice, to delay the tax if you do not immediately need your euros. Be careful however, the use of stablecoin s for purchases of goods or services can be reclassified as a taxable event, because it is a transfer for consideration.

Transaction costs and other charges

When you declare your capital gains, do not forget to remove the transaction costs and bank commissions relating to the sale. Indeed, these costs decrease the gross added value. For example, if you sell for € 10,000 in Bitcoin and pay € 20 costs, your taxable base is only € 9,980.

To maximize this deduction, it is essential to properly keep the history of your transactions (Exchange Logs, account statements, possible invoices). Monitoring tools like Koinly or Waltio allow you to automatically manage this data and generate a specific report to the tax administration.

How to avoid flat taxy fax: giving cryptos

For those who wish to transmit their heritage in cryptocurrencies to relatives, the donation can be very interesting. Donations do not trigger taxation on capital gains, since the transfer is not considered "expensive". Cryptos data integrate the heritage of the beneficiary into their value on the day of donation.

If the latter decides to resell the digital assets received, the potential added value will then be calculated in relation to the market value on the day of the donation. In short, if you have had Bitcoin for a long time and they have greatly gained value, the donation followed by a sale makes it possible to "purge" the added value.

However, donation rights apply according to the kinship link and the given amount. Legal abatements (€ 100,000 between parent and children, for example) can avoid any taxation if the donation remains below this threshold. Beyond that, a progressive scale applies, up to 45 % depending on the edge and kinship.

This strategy therefore requires meticulous planning and supporting a tax advisor, a notary or a lawyer in cryptocurrency , in order to avoid rectification for abuse of law (fictitious donation, requalified, etc.).

How to avoid Flat Tax Crypto: is it possible? Failmen

How to avoid Flat Tax Crypto: Tax moving abroad

Some investors think of expatriating in a country where crypto taxation is more advantageous, such as Portugal. Indeed, until recently, Portugal had a very attractive tax regime for cryptocurrencies. However, legislation is evolving there and several bills aim to supervise the taxation of digital assets.

If you transfer your tax residence outside France, you are no longer subject to French tax on capital gains on the sale of digital assets. However, this approach implies an effective and sustainable change in tax domicile. The French tax administration can reclassify your situation if it considers that you have kept economic and family ties in France.

In addition, France does not provide for exit tax for cryptocurrencies, unlike companies. Digital assets in principle escape this device, but the rules may change. This radical method is therefore not to be taken lightly: a poorly prepared tax move can cause disputes and sanctions.

The limits of cryptocurrency donation

If donation is an effective tool for transmitting its heritage, it is not free from controls. To prove that a donation is real, the two parties must comply with declarative obligations. The transfer rights apply according to a specific scale, and any maneuver aimed at artificially transforming a transfer into donation can be reclassified as fraud .

The taxman does not hesitate to sanction the false donations (for example, if the money then returns directly to the donor via an obscure financial assembly). It is therefore essential to ensure that the donation is very real and that it respects all legal conditions (in particular the authenticity of the act, the declaration within a month when the donation is revealed to the administration, etc.).

Professional activity (mining, staking, intensive trading)

When your activity on the cryptocurrency market is considered professional ( high frequency trading staking ), you switch under another tax regime (BIC or BNC depending on the nature of the activity). In this context, you can deduct certain professional charges, but your profits are imposed according to the rules of companies and no longer according to the regime of private capital gains.

Mining is assimilated to a services imposed in BNC (non -commercial profits) in most cases.

Intensive trading can, depending on the habit and repetitive criteria, be reclassified in BIC (industrial and commercial profits).

These specific regimes are not necessarily more advantageous than flat tax, because tax rates can increase rapidly depending on the benefits generated, not to mention social contributions. It is therefore not fair to say that we "avoid" flat tax by becoming professional: you simply change a framework.

How to avoid flat tax crypto: essential precautions for mastered crypto taxation

Keep an exhaustive register of its transactions

To optimize your taxation, the first rule is to keep the trace of each operation.

Unless you do very little transactions, a manual trace is not very realistic. This is why automation and monitoring software have been developed.

They allow us to note:

The date and time of the transaction.

The exact amount of cryptos purchased or sold.

Platform fees.

The exact counterpart (euros, stablecoin s, another crypto).

These data will allow you to accurately calculate your taxable base, charge your costs and avoid any dispute in the event of tax audit.

Declare your accounts abroad (non -French PSAN)

If you hold accounts on exchanges established outside France, you are required to declare them (form n ° 3916 bis). Since January 1, 2024, the registration criteria for service providers on digital assets (PSAN) have been reinforced, and non-declaration can cause substantial fines.

The French tax administration cooperates more and more with the foreign authorities, in particular via the automatic exchange of information. Not declaring your crypto accounts abroad is therefore not a solution to "avoid" flat tax, but rather the direct path to a recovery.

Use tax monitoring software

As mentioned above, specialized platforms exist to help you centralize the history of all your operations. They provide you with a consolidated vision of your wallet, regardless of the exchange or wallet used. Here are some current examples:

- Koinly

- Cryptotaxcalculator

- Waltio

This software can be precious to avoid calculation errors and correctly declare your capital gains or capital losses. In the event of control, being able to justify each transaction is a decisive asset.

Being accompanied by a tax lawyer specializing in cryptocurrencies

Given the rapid development of the regulations (and the inaccuracies that sometimes remain), support by a law of law is recommended. A law firm specializing in Crypto taxation, like ORWL, will be able to guide you for:

- Check the consistency of your declarations.

- Identify legal tax optimization schemes.

- Set up a suitable legal structure (company, etc.) if you have major projects.

- Manage regularizations in the event of past difficulty.

Why is it important?

The tax rules on digital assets are constantly evolving. A seasoned lawyer follows the last legislative developments and the positions of the courts, thus avoiding the traps of a misinterpretation of the law.

Studies, data and perspectives

The rise of cryptocurrency holders in France

According to a study published by the ADAN (Association for the Development of Digital Assets), the number of cryptocurrency holders in France would have increased by almost 28 % in 2023. Among them, a significant proportion questions applicable taxation and judges the flat tax too heavy or poorly adapted to modest income.

The tracks envisaged by the legislator

Several law proposals have already emerged to adjust the taxation on digital assets, for example by reporting the exemption threshold or by offering a postponement of the losses over several years. At this stage, nothing is yet officially acted, but it is likely that the regime will evolve in the years to come, to the rhythm of the massive adoption of cryptocurrencies and decentralized finance.

The importance of regulatory watch

Many European countries are starting to adopt specific tax executives to supervise capital gains on digital assets. Italy, Germany, Croatia and Malta already offer more or less favorable diets. These legislative developments can influence the French position and strengthen the need for harmonization at European level.

Synthesis and conclusion on how to avoid flat tax Crypto

Answer to the question "How to avoid the Flat Tax Crypto?" »»

Ultimately, the most honest answer remains: we cannot cancel the flat tax in a pure and simple way. French legislation requires a rate of 30 % on capital gains in cryptocurrencies, and this device is designed to be applied massively to individuals. However, several solutions legalize, in a legal manner, to reduce or postpone the tax burden, or even to adapt it to your situation:

- Opt for the progressive scale if your tax bracket is less than 30 %.

- Keep your gains in stablecoins to delay taxation as long as you do not return to euros.

- Scrupulously deduct all transaction costs to lower the taxable base.

- Use the exemption from small transfers (less than 305 € per year).

- Consider the donation to purge latent capital gains, subject to paying transfer rights and respecting anti-abuse rules.

- Do not neglect the holding of rigorous accounts and the declaration of all your accounts abroad.

- Use a specialized tax lawyer to benefit from personalized advice and in accordance with the regulations in force.

The risks of a bad statement

Avoid declaring your earnings or improperly minimizing your capital gains can lead to heavy sanctions. The tax administration has extensive means to control your transactions, in particular via the information provided by platforms (PSAN) or banks. Penalties can go up to 80 % increase for fraud, not to mention the late interest.

The importance of professional support

Given the speed with which Crypto taxation is evolving, it has every interest in soliciting a law firm, a chartered accountant or a professional mastering the regulation of digital assets. This one can help you:

- Analyze your personal situation (capital gains, heritage, matrimonial regime, etc.).

- Set up optimization strategies (progressive scale, donation, company constitution, etc.).

- Avoid legal and tax traps (omission to declare an account abroad, abusive assembly, etc.).

Being informed of imminent reforms or bills likely to modify your tax situation.

Conclusion on how to avoid Flat Tax Crypto?

Do not look for the secret recipe to completely escape tax: none exist. On the other hand, a transparent declaration, associated with legitimate optimizations, will allow you to secure your crypto heritage and sleep on your two ears.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .