How to get your money back on the blockchain?

Wondering how to go from a digital asset to fiduciary currency on your bank account? The direct answer is to convert your tokens to the blockchain to euros or dollars via appropriate platforms. The objective: to obtain a fiat currency usable in everyday life. In this article, you will discover the solutions, steps and precautions to make a successful and secure withdrawal We will also go further in the technical aspects in order to give you a solid understanding of the whole process.

Table of contents

How to get your money back on the blockchain: Understand the bases of the blockchain and the Fiat currency

The blockchain in a few words

The blockchain is a distributed register that stores and secures information decentralized. Each operation, or transaction , is validated by a set of nodes (computers) which ensure its authenticity. Thanks to this structure, any fraudulent modification becomes extremely difficult because it would be necessary to simultaneously handle the entire blockchain network .

What is Fiat currency?

The Fiat currency , like the euro or the dollar, is a currency issued by a government or a central bank. It is no longer attached to a physical value (such as gold), but derives its value from the confidence that the population and the institutions grant it. When you are looking to recover your money from the blockchain , you actually aim to exchange digital assets (such as cryptocurrency ) for the national currency deposited on your bank account.

How to get your money back on the blockchain: choose your wallet, custom or non-custodial

The differences between a Custodial Wallet and a Non-Custodial Wallet

Bitvavo

For European residents, we recommend Bitvavo in particular. This platform offers:

- Very competitive costs (maximum 0.25 % on the platform for beginners and even 0.05 % max on USDC pairs of the Pro Platform).

- Very rare applied spreads and explicitly mentioned if necessary, including on the beginner interface.

- Over 350 cryptocurrencies available.

- An environment regulated and registered with European financial authorities.

- A simplified interface for beginners.

- The possibility of making free deposits in euros by bank transfer or SEPA.

- Excellent security with partial insurance on funds in the event of a problem.

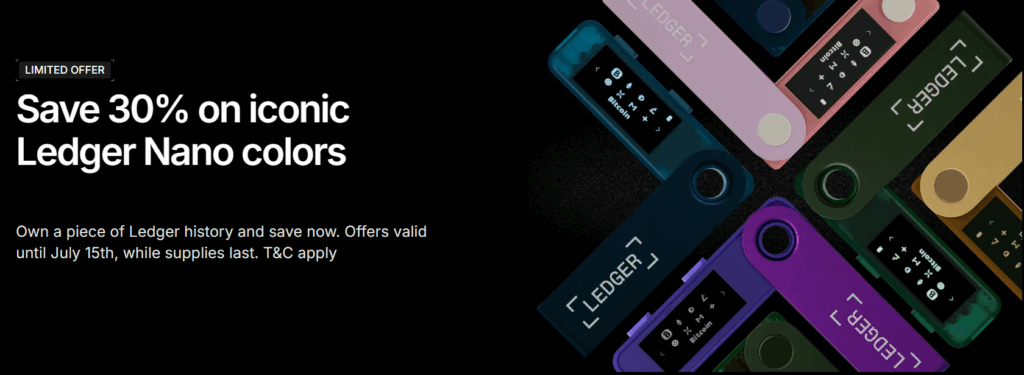

For more information, we invite you to visit our comparison of Ledger models as well as our comparison between Ledger and Trezor.

The fundamental steps to recover your money from the blockchain

If your funds are on the blockchain, it means that you have a digital portfolio (Metamask, Ledger, Tangem, Exodus ...)

To withdraw your funds, some methods are available to you. Here are the main lines that summarize the most common process:

Select a centralized platform ( CEX ) to sell your cryptocurrency against Fiat currency.

Convert your tokens to euros, dollars or other currency.

Place your Fiat currency on your bank account.

Note: it is also possible to go through certain non-customs portfolios such as Metamask, Trust Wallet or Silver, which integrate third-party services like MoonPay, Sardine, Transak or Ramp. These providers allow you to buy or sell your cryptocurrencies directly from your wallet (so with your FODNS directly on the blockchain), with withdrawal or payment in Fiat currency via bank transfer or card. You are thus master of your private keys, while accessing an exit door to the fiduciary currency. These services are subject to KYCprocedures, and the costs may vary depending on the provider, the location and the volume exchanged.

How to get your money back on the blockchain: go through an exchange to convert your cryptos into fiat

Centralized exchanges (CEX) such as Binance or OKX are very popular for converting cryptocurrency into Fiat currency. They generally offer an intuitive interface, low costs and access to multiple trading . Here are the classic steps:

- Create an account on the Exchange and carry out the KYC (Know Your Customer) verification. You will need to provide official documents to prove your digital identity.

- Transfer your assets from your wallet to your account on the platform. To do this, inform the public reception address.

- Sell your cryptos on the Exchange: you will then get a balance in euros or dollars.

- Remove this balance from your bank account via SEPA transfer, bank card or other methods offered. To do this, we invite you to consult our article on how to withdraw your money from Binance .

The main force of CEX is their liquidity , which allows you to quickly convert significant amounts at often low costs so well chosen.

How to get your money back on the blockchain: bet on the stablecoin s

The stablecoin s is then a major asset. These tokens, indexed to a Fiat currency (most often the dollar), make it possible to protect themselves from fluctuations and store value without immediately leaving the crypto world. This can be advantageous, in particular to submit to tax obligations in many countries. To recover your funds in euros or dollars, you will then suffice to follow the same process as with the other cryptos:

- stablecoin S balance on your wallet .

- Transfer these stablecoin to a centralized exchanges Stablecoin -Euro or stablecoin -Dollar trading stablecoin

- Exchange your stablecoin for fiat currency .

- Proceed with bank withdrawal

This approach has several advantages: limit the risk of volatility and facilitate transactions .

How to get your money back on the blockchain: key points of vigilance before removing your fiat currency

Transaction costs and deadlines

Each transaction on the blockchain leads to transaction costs , also called “Gas Fees” in some cases (such as Ethereum ). In addition, centralized exchanges often charge additional costs for the withdrawal and conversion to euros or dollars. It is crucial to calculate the total cost in order to avoid unpleasant surprises. Finally, SEPA transfers can take between 1 and 5 working days depending on the bank and the country.

Regulatory compliance and taxation

As soon as you enter the world of Fiat currency , regulation is essential. The centralized exchanges apply checks: KYC verification , blocking of accounts suspected of fraud , etc. They ensure compliance with regulatory compliance to combat money laundering and financing terrorism.

On a tax level, the law varies from country to country. In France, the added value on cryptocurrencies is subject to tax according to a particular scale during the transition from Crypto to Euro . It is compulsory to declare it.

Security and management of private keys

Theft or loss of your assets may occur if you neglect the protection of your access. The private key is the secret combination which allows the expenditure or the transfer of your cryptos. On the Custodial Wallet , you depend on the Crypto scholarship to secure your funds. On a non-Custodial Wallet , you are solely responsible for the conservation of your keys. A current recommendation is to store an offline copy, possibly on a physical medium (paper, encrypted USB key, etc.).

Concrete scenarios to withdraw your euros or dollars

Case 1: Direct conversion via a centralized exchange

Imagine that you have 1 BTC (Bitcoin) on your wallet . If the price of the BTC is $ 80,000, you can transfer it to a Binance or Kraken , sell it to the market price and recover the equivalent in euros or dollars. Then you just have to initiate a bank transfer. The delay may be 24 hours to 72 hours depending on the platform and your bank.

Case 2: Sale of crypto from exodus via MoonPay

Imagine that you have 500 USDC on your non-Custodial Exodus wallet, directly on the Ethereumblockchain. To recover this money in euros on your bank account, you open the Exodus application and select the "Sell" option. Exodus then invites you to go through MoonPay, a third -party provider integrated into the application. After choosing USDC as an asset for sale, you enter your IBAN, check your identity via the KYC de MoonPayprocedure, then validate the transaction. MoonPay takes the USDC from your exodus portfolio and, within 1 to 3 working days, you receive the equivalent in euros directly on your bank account. The sale is done without going through a centralized exchange, while keeping custody of your funds until the transaction.

FAQ: Answers to recurring questions

1. Can we withdraw our funds without going through a centralized platform?

In the majority of cases, direct conversion to euros or dollars is carried out via a centralized exchange. Some wallets offer the possibility of buying and selling directly on the blockchian via intermediate services, Masi is not still standard.

Otherwise, you can postpone your sale using stablecoin s.

2. Is it possible to keep your cryptocurrency on a Dex and remove in Fiat later?

Decentralized exchanges ( DEX) generally do not manage direct Fiat conversion. You will remain in the crypto ecosystem. To obtain euros or dollars, you will still have to go through a centralized exchange or the intermediate service of a wallet ( MoonPay , Sardine or other).

Conclusion on how to get your money back on the blockchain

To recover your money from the blockchain and bring it back in the form of Fiat currency in your bank account, you must comply with several key steps: choose a wallet , select a centralized exchange or a portfolio with intermediate services, convert your cryptos, then remove your funds. Each method (CEX, integrated wallet) has its own advantages and disadvantages, and it is essential to master the concepts of safety , KYC verification and transaction costs to avoid any unpleasant surprises.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

All our articles are subject to a rigorous verification of the facts . Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color , in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .