How to trader on Coinbase : Complete Guide

Do you want to know how to trader on Coinbase effectively and securely? This article explains the essential points to take advantage of the exchange interface proposed by the trading platform . Whether you are a beginner or experienced, you will discover here the different steps to start placing your orders, as well as the more advanced features, such as access to Coinbase Advanced and its options for term or perpetual . We will also approach the transaction costs , sometimes high, and the existing alternatives to optimize your budget.

Table of contents

How to trader on Coinbase : Tour of the platform

Coinbase is among the reference platforms when talking about crypto markets . Created in 2012, the company has established itself as a reliable player, in accordance with regulations and offering an environment suitable for beginners. Users appreciate in particular:

- A clear and simplified interface for the purchase/resale Cryptos .

- KYC verification and two -factors authentication).

- A large panel of cryptocurrencies .

- Learning tools and accessible customer support.

However, Coinbase is not necessarily the cheapest platform in terms of transaction costs . Also, to deepen the comparison, you can consult our comparison of the costs of cryptocurrency platforms . That said, if you still choose Coinabse, here is how to trader on Coinbase and what are the different features to know (but most of the features are the same for all platforms).

How to trader on Coinbase : registration and account creation

To start, you have to register. This step is essential to take advantage of the platform services. It takes place in several phases:

- Initial registration : go to the official website or the mobile application. Enter your information (email address, password, etc.) then validate.

- KYC verification : Coinbase requires identity verification by downloading an official part (identity card or passport). This procedure strengthens security and legal compliance.

- Addition of a payment method : Choose between bank card, SEPA or PayPal transfer. The cards are faster, but often more expensive in fresh; The transfers are cheaper, but slower.

Once these formalities are filled, you access your crypto wallet , which will allow you to buy, sell or transfer assets. If you have any hesitation, do not hesitate to insert a screenshot Coinbase home page when creating an account to better view each step.

Basic interface: purchase and sale of cryptocurrencies

The main interface of Coinbase is designed to simplify the purchase/resale Cryptos . A few clicks are enough to acquire tokens at market prices. Here's how to proceed:

- Connect to your account and select “Buy/sell”.

- Choose the cryptocurrency you want (Bitcoin, Ethereum , etc.).

- Indicate the amount in euros (or dollars) that you want to invest .

- Confirm the transaction after verifying transaction costs .

That's it. In a few seconds, your cryptocurrencies appear in your Coinbase wallet . To resell them, the process is similar, but you select “Sell” instead of “buy”. Simple and effective, this basic module is a good introduction to the Crypto markets without getting lost in too advanced features.

How to trader on Coinbase : Discover Coinbase Advanced, the advanced interface to trade

If the starting interface is suitable for beginners, it is quickly limited when you want to use technical analyzes or place stop-limited orders . This is where Coinbase Advanced , successor to the old Coinbase Pro .

Accessible from your account, this more advanced interface offers:

- An tradingView graphic , where you can apply indicators (RSI, MacD, Bollinger strips, etc.).

- The visualization of the Order Book and the History of Orders in real time.

- The possibility of laying stop-limited or “trailing stop” orders with advanced parameters.

- Information on liquidity and pants .

Types of orders available on Advanced Coinbase

Coinbase Advanced is not limited to purchases/sales at market prices. You benefit from a variety of types of orders to optimize your input and output points:

- Market Order: Order immediately runs at the best available price, ideal for entering or going out quickly.

- Orders with limited courses (limit order): you define a specific price to which the order must run. Perfect for precisely controlling your investment budget.

- Stop-limited orders: combine a trigger price (stop) and a limit price. Practices to protect yourself from high fluctuations or materialize a stop-loss.

Spot, perpetual and term contracts: understand the difference

In addition to the “classic” market (known as Spot ), some platforms offer derivative products , such as term or perpetual . Historically, Coinbase advanced Coinbase advent , more elaborate solutions are looming to allow the use of leverage or the short position:

- Spot : you buy and really have cryptocurrencies . The profits or losses depend on the price of the assets you have.

- Under -term contracts : you are committed to a future price for an asset, with a defined deadline. This allows you to cover or speculate on larger variations, sometimes using margins .

- Perpetual : similar to term contracts, but without fixed deadline. Their price is adjusted via funding mechanisms to wedge on the spot.

Coinbase has gradually introduced perpetual offers for certain customers, but these features remain limited according to regions and local regulations. So check if your country allows these tools. For example, it is impossible for the moment to trade perpetual contracts in France on centralized exchanges.

To do so, you will need to go through decentralized trading platforms such as Drift and DYDX ( Drift costs and DYDX costs are even more competitive than those of the best centralized platforms). To access it, it is advisable to use an online wallet (hot wallet ) such as Metamask , Trust Wallet , Exodus…

To learn how to use a decentralized wallet, we offer our free step-by-step guide with screenshots.

What you will learn:

✔ Mastering a Decentralized Wallet ( DeFi ) – Learn how to manage your assets without an intermediary and interact directly with the blockchain.

✔ Transacting via a Decentralized Wallet – A practical guide to trading crypto independently.

✔ Exploring Decentralized Finance ( DeFi ) – Discover advanced concepts like staking and NFTs .

📥 Download the guide freely by filling out the form below:

To illustrate the configuration of a perpetual contract or a position on derivative products , you can include a screenshot of the derivative contract interface if you have access to it.

How to trader on Coinbase : Fresh on Coinbase , how to optimize your costs?

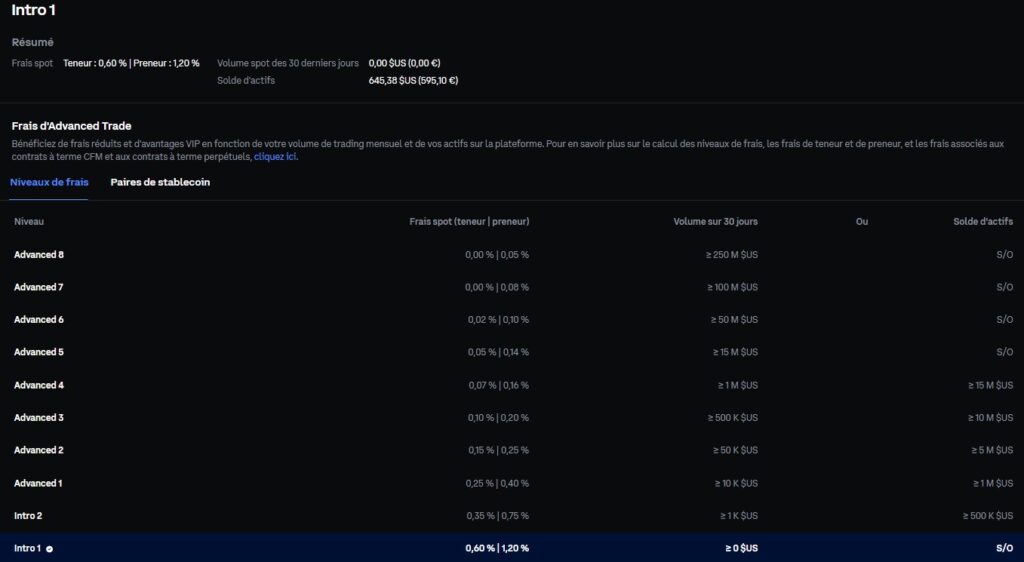

On the basic version of Coinbase , transaction costs can rise to several percent, which remains high. Orders on Coinbase Advanced generally apply the so-called Fresh Maker-Taker (system inherited from Coinbase Pro ), where:

- The maker (the one who adds liquidity in the order book ) pays less costs, or even is paid in rare cases.

- Taker (the one that immediately takes liquidity a higher rate.

For some users, total costs can be around 0.1 % and 0.5 % depending on their monthly volume and their status. These figures must be compared to other platforms: many competing exchanges offer more attractive scales. So do not hesitate to consult our “ comparison of the costs of the main cryptocurrency platforms ” to determine if Coinbase remains the most advantageous option or if you should distribute your trading elsewhere.

Concrete example of costs structure

Imagine a user with a volume of day trading of around 8,000 dollars a month. On Coinbase Advanced, it can benefit from a “maker” rate around 0.35 % and a “taker” rate close to 0.75 %.

On other platforms, these rates may be half less than less. The impact on your profitability becomes considerable when you chain orders, especially for the followers of scalping or swing trading .

How to trader on Coinbase : set up a coherent trading strategy

Having access to advanced features is not everything. To hope to generate gains, you need a robust strategy and clear goals. Here are some tracks:

1. Choose your trading style

- Scalping : you accumulate many small gains while enjoying very frequent micro-flow. The costs can quickly increase.

- Day Trading : You open and close your positions in the same day, reducing your “Overnight” risk exposure.

- Swing Trading : you keep a position over several days or weeks to grasp a background movement, while avoiding an excess of orders.

2. Operating technical analyzes

- Use the tradingview graph to locate patterns (triangle, double top, head and shoulders, etc.).

- Follow indicators such as RSI, MacD or mobile averages in order to identify the areas of over -rascal or occurrence.

-

Press yourself on visual tools like Crypto Bubbles to identify assets in outperformance or underperformance in different periods. This makes it possible to identify anomalies, potential reversals or simple overcouting movements.

- Rely on the index (available on specialized sites) to assess the global feeling of the market, even if this data remains indicative.

3. Manage risks and set objectives

- Define a Stop-Loss and a Take Profit for each position, in order to know in advance when cutting your losses or collecting your profits.

- Fraction your investments. Avoid betting everything on a single order.

- Limit the use of the lever : even if Coinbase Advanced margins products , it is easy to amplify your losses.

Always favor long -term consistency rather than the search for rapid gain, especially in an environment where volatility can be extreme.

How to trader on Coinbase : keep your cryptocurrencies safe

Even if Coinbase is known to be a trading platform , it is advisable to transfer your funds to an crypto wallet (often called Wallet) when you do not trade. Two main options:

- Cold wallet Ledger or Trezor type ): you physically hold your , offline keys

- Software Wallet : An application on your computer or smartphone, controlling your private keys.

Keep too much assets on an exchange exposes you to the risk of hacking or regulatory blockages. So secure your long -term assets. Coinbase also offers its own wallets, but full control of your keys remains an additional security guarantee.

How to trader on Coinbase : Advanced user guide, practical steps to place a complex order

If you start on Coinbase Advanced , here is a simple approach to take a limit order with a stop-loss :

- Connect to your Coinbasearea, then select “AdvancedCoinbase ” from your dashboard.

- Choose the desired trading pair (for example BTC /EUR) from the list of Crypto markets .

- Locate the TradingView graph to define your target price by analyzing the supports and resistances.

- Under the order form, select “Limit”. Indicate the limit price you want to buy (or sell).

- Activate the STOP-Limit if you want to protect your position. You will have to define a trigger price ( stop ) and a limit price.

- Check the Maker-Taker fees applied according to your current status.

- Validate your order. It will appear in the history of orders , awaiting execution until the course has reached your target price.

If you anticipate a quick movement, favor a market order to be executed instantly. However, remember that you will pay a higher TAKER

How to trader on Coinbase : monitoring and optimizing your trading

Once your positions are open, you can consult and adjust them from the history of orders or the “portfolio” in the Coinbase . You will find there:

- The quantity of tokens held and the total value in euros.

- The current orders (limit or stop-limited not filled).

- The possibility of modifying the price of an order or canceling an order pending.

To follow the overall performance, you can also export your history and carry out your own analyzes via a spreadsheet. Many traders calculate their profitability by integrating the total amount of the transaction costs , in order to determine whether it is more judicious to stay on Coinbase or reduce these costs by migrating to a competitor.

For example, do not hesitate to consult our comparison of costs between Binance and Coinbase To better assess the differences according to your volume of trading.

Conclusion on how to trader on Coinbase

Knowing how trader on Coinbase or another platform opens the door to a vast and dynamic crypto ecosystem. The mixture of an intuitive interface and advanced features via Coinbase Advanced makes it a popular choice, especially for those who start and then want to progress to more technical options. Despite everything, its transaction costs can represent a brake if you practice day trading or scalping . In this case, comparing different exchanges remains essential to optimize your costs.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .