Is Bybit legal in Italy?

If you're wondering whether Bybit is legal in Italy , the answer is nuanced. The cryptocurrency trading platform is not registered with the OAM (Organismo Agenti e Mediatori), the regulatory authority for cryptocurrency service providers in Italy. However, Bybit remains accessible to Italian users , as Italy is not on the platform's list of restricted countries.

However, the lack of official authorization raises questions about the potential risks for users. In this article, we will analyze the regulatory framework , the legal risks involved, and alternatives that comply with Italian regulations.

The regulatory framework for exchanges like Bybit in Italy

Italy follows a strict approach to regulating crypto-assets . Two main institutions oversee the activities of exchange platforms:

CONSOB (Commissione Nazionale per le Società e la Borsa): The Italian financial markets authority, responsible for monitoring and regulating financial institutions. It has the power to sanction and prohibit platforms operating without authorization.

The OAM (Organismo Agenti e Mediatori): Responsible for the registration and control of platforms offering cryptocurrency services, ensuring compliance with national and European standards.

Since May 2022, all platforms offering cryptocurrency services to Italian residents must be registered with the OAM ( Financial Markets Authority). This registration aims to ensure transparency, combat money laundering, and protect investors.

Furthermore, CONSOB has strengthened legal tools at its disposal to combat non-compliant platforms. According to Article 7-octies of Legislative Decree 58/1998 , it can:

Furthermore, thanks to the Growth Decree (Law No. 58 of June 28, 2019, Article 36, Paragraph 2-terdecies) , CONSOB can order Internet service providers to block platforms operating without authorization . It regularly updates the list of blocked sites and can impose fines of up to €5 million or 3% of the turnover of a non-compliant company (in accordance with Article 191 of Legislative Decree 58/1998).

However, Bybit has not taken the steps to obtain the OAM and is therefore not recognized as a legally authorized service provider to operate in Italy.

Is Bybit banned in Italy?

The National Commission for Companies and the Stock Exchange (CONSOB) has the power to order the blocking of websites offering financial services without authorization. Since July 2019, CONSOB has blocked more than 1,200 illegal sites .

Currently, Bybit is not blocked by Italian internet service providers, but its lack of registration with the OAM exposes users to risks. In the event of a dispute, legal recourse may be limited.

What sanctions can the Italian authorities apply against Bybit?

Italy has a legal framework that allows regulators to block access to unauthorized platforms . CONSOB can therefore request ISPs (Internet Service Providers) to make the site inaccessible from Italy.

Regarding users, no criminal penalties are foreseen for simply using Bybit. However, funds stored on an unauthorized platform may be more difficult to recover in the event of a dispute or sudden closure.

In which countries is Bybit accepted?

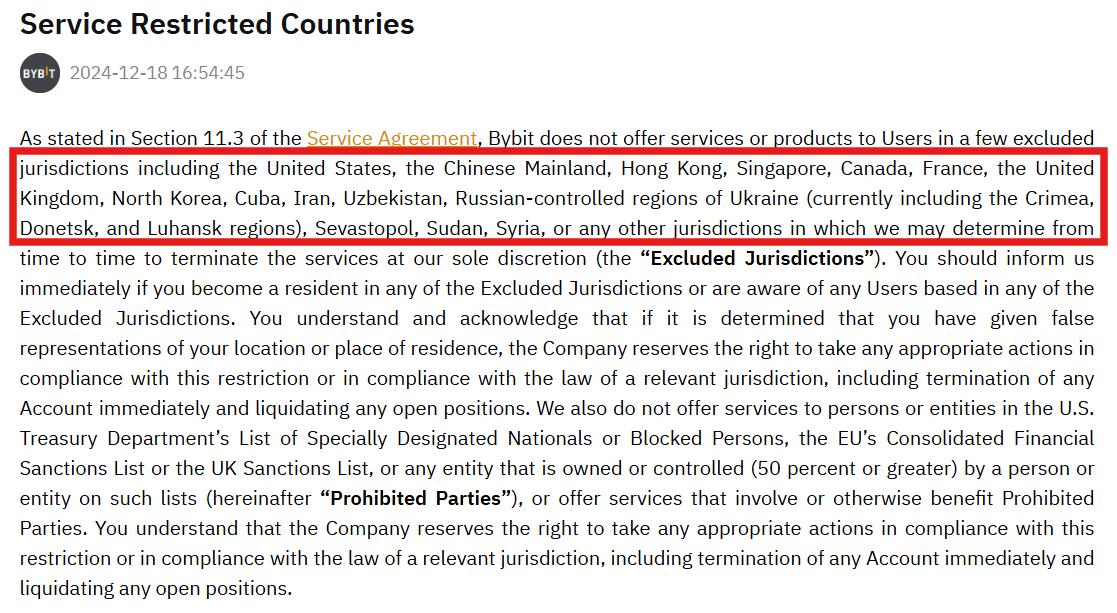

Bybit is currently available in over 160 countries , but some jurisdictions impose restrictions. Among the restricted countries are the United States, Canada , China, Singapore, the United Kingdom , and France , due to strict financial regulations or sanctions. Other regions, such as Crimea, Donetsk, and Luhansk, are also inaccessible due to international sanctions.

On the regulatory front, Bybit is actively seeking official licenses to strengthen its legitimacy in several markets. The platform has announced its efforts to obtain MiCA (Markets in Crypto-Assets) certification in Europe. This certification would grant the platform a financial passport to operate throughout the European Union , including Italy, without having to register with each national regulator. In parallel, it is also aiming for a trading license in Hong Kong , a key market for crypto-assets in Asia. Obtaining these certifications would guarantee better user protection and strengthen the platform's compliance with local financial regulations.

Bybit's Licenses and Regulations outside of Italy

Bybit has obtained several regulatory licenses in key markets , enabling it to comply with financial authority requirements and expand its legal reach. Key authorizations include:

- Kazakhstan : Holds a license issued by the Astana Financial Services Authority (AFSA) , allowing it to operate as a regulated digital asset trading platform, while also offering custody and investment management services.

- Cyprus : Approval to provide crypto-asset exchange and custody services, in accordance with European regulations, thus consolidating its presence in the EU market.

- Georgia : Registered with the National Bank of Georgia as a Virtual Asset Service Provider (VASP) , ensuring compliance with local regulations.

- Dubai : Acquisition of a provisional license issued by the Virtual Asset Regulatory Authority (VARA) , first step towards full authorization to operate with retail and institutional investors.

Thanks to these certifications, Bybit continues its development while seeking to align itself with the regulatory standards of the jurisdictions where it is established.

Regulated alternatives to Bybit in Italy

For Italian traders seeking a platform that complies with local regulations, here are three reliable alternatives:

You can buy Bitcoin and other cryptocurrencies in Italy with OKX .

OKX offers:

- Strict regulatory compliance, OKX being one of the first platforms to have held the European license ( MiCA ). It is on the AMF whitelist.

- A dual interface: a simplified application for beginners and an advanced platform offering volume-dependent fees and a competitive order book.

- Very competitive fees on the market: 1% on the simplified platform and a maximum of 0.35% on the advanced platform .

- Access to several hundred cryptocurrencies to potentially diversify your portfolio in addition to Bitcoin.

- Additional services such as staking to generate returns on these cryptocurrencies.

OKX has one of the richest offerings on the market.

More information about the rewards can be found here.

If you're unsure how to use an online wallet and are new to cryptocurrency, we've created a detailed, step-by-step illustrated guide with screenshots. It will help you grasp the fundamentals and learn to navigate with confidence.

What you will learn:

✔ Buying your first cryptocurrencies – A detailed tutorial to get started on a centralized exchange platform.

✔ Securing your transactions – Best practices for buying, selling, and trading cryptocurrencies while minimizing risk.

✔ Understanding stablecoins stablecoin Their usefulness, differences, and how to use them to stabilize your funds during periods of volatility.

✔ Mastering a decentralized wallet ( DeFi ) – Learn how to manage your assets without intermediaries and interact directly with the blockchain.

✔ Transacting via a decentralized wallet – A practical guide to trading cryptocurrencies independently.

✔ Exploring decentralized finance ( DeFi ) – Discover advanced concepts like staking and NFTs .

📥 Download your free guide by filling out the form below:

Conclusion: Is Bybit legal in Italy?

While Bybit is accessible in Italy , the platform is not regulated by local authorities . Italian users can therefore use it, but without legal protection in the event of a dispute .

To avoid risks, it is strongly advised to choose platforms regulated by local authorities.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital .

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .