Ledger transaction fees: understanding all the costs of a Ledger wallet

Ledger and fees: what you need to know right away

Ledger is the world leader in hardware wallets for securing cryptocurrencies . Transaction fees on Ledger depend on the type of operation: transfer on the blockchain , buying or selling via Ledger Wallet , staking , token conversion . Ledger does not take a margin on network fees , but buying or selling through an intermediary may incur higher fees. The fees are the same regardless of the Ledger model you own.

Table of Contents

Ledger transaction fees: the essentials

Transferring, receiving, depositing: network fees

When you make a transaction (send, withdraw, deposit) with your Ledger wallet , you only pay the network fees imposed by the blockchain . These fees are paid to the miners or validators, not to Ledger . They are variable, determined by supply and demand on the network.

- On the Bitcoin network , fees are expressed in satoshis per byte; they vary depending on network congestion.

- On the Ethereum blockchain , fees depend on the price of gas (gas also depends on network congestion) and the complexity of the transaction (the more complex a smart contract is, the higher transaction fees

- For USDT or ETH , fees can fluctuate from a few cents to several tens of euros depending on network activity.

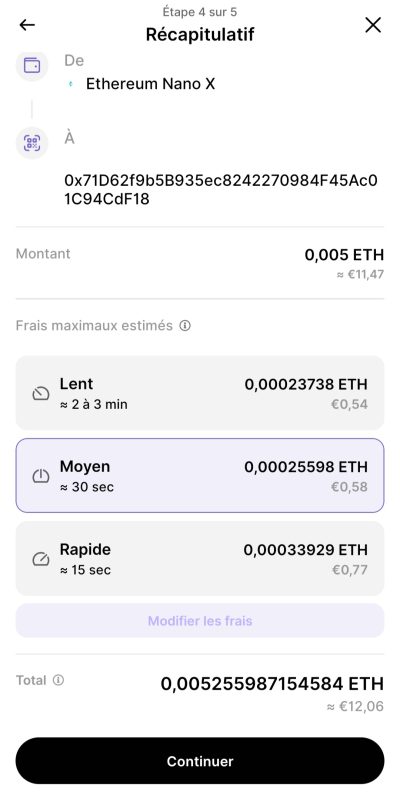

Ledger and the Ledger Wallet app always display the estimated network charges before validation. You can view and sometimes choose the priority level (and therefore the charge amount): fast, standard, or economy.

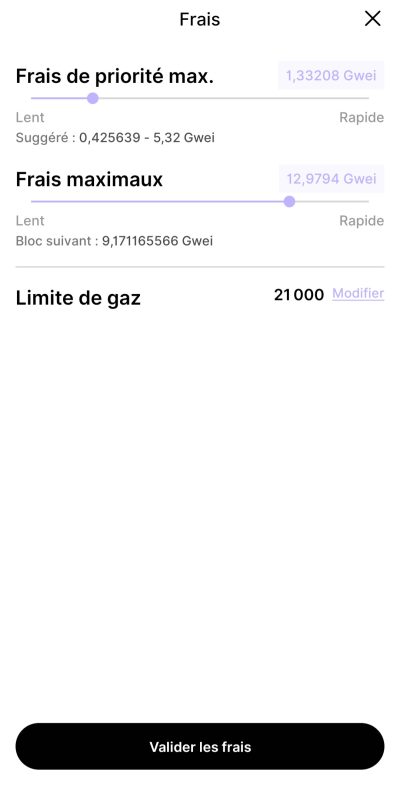

users can also choose to manually set the fees to optimize the cost of the transaction .

Does Ledger take a margin on transaction fees?

No, Ledger does not charge any network fees for standard cryptocurrency transfers to or from a Ledger hardware wallet . The amount paid corresponds exactly to what the blockchain . Therefore, there are no hidden fees on these transactions: only the miners or validators are compensated.

Ledger deposit fees

Receiving cryptocurrencies in your Ledger wallet is always free. Any fees come from the exchange or wallet, never from the Ledger Ledger itself . For example, if you transfer BTC or ETH from Binance or OKX to Ledger , the originating platform withdrawal fees , but Ledger adds nothing.

To see all this more concretely, and to develop a more complete mastery of the tools, finance and legal constraints, we invite you to discover the BSM program .

It includes detailed video tutorials on centralized exchanges, software wallets, hardware wallets, and best practices. The program can be accessed from the header or the link above. The program also covers the theory necessary to fully understand how the monetary system works and Bitcoin's role within it.

Buying cryptocurrencies via Ledger Live: what are the fees?

Purchase function and partners: Coinify, Moonpay, Mercuryo, etc.

Ledger Wallet buy crypto " function directly from the interface, thanks to partners like Coinify , Moonpay , Ramp, and Wyre. Cryptocurrencies are then delivered directly to your Ledger wallet , making it easier to secure your assets without using an exchange , this simplicity comes at a price: purchase fees are generally higher than on a traditional centralized exchange.

- By bank card, the fees are approximately 4.5% (source: Ledger , Coinify, Moonpay ).

- With a SEPA transfer, the fees drop to around 1.7%.

- In addition to this, there are sometimes network fees for delivery to your wallet .

- The spread (difference between purchase price and market price) can also increase the total cost.

You can view the detailed charges before each transaction in Ledger Wallet . Ledger 's fees for the purchase therefore consist of partner commissions, any network fees , and the spread.

Compare purchase fees on Ledger Live and other platforms

On Ledger Wallet, purchase fees amount to 4.5% by bank card and 1.7% by SEPA transfer.

Ledger Wallet is therefore rarely the cheapest option for buying cryptocurrencies, but it offers the security of the Ledger hardware wallet and the simplicity of a direct deposit. For European users who want to buy their cryptocurrencies at a lower cost, you can, for example, buy your cryptocurrencies on OKX and then secure them on Ledger.

OKX offers:

- Strict regulatory compliance, OKX being one of the first platforms to have held the European license ( MiCA ). It is on the AMF whitelist.

- A dual interface: a simplified application for beginners and an advanced platform offering tiered pricing based on volume.

- Very competitive fees on the market: 1% on the simplified platform and a maximum of 0.35% on the advanced platform .

- Access to several hundred cryptocurrencies to potentially diversify your portfolio in addition to Bitcoin.

- Additional services such as staking to generate returns on these cryptocurrencies.

OKX has one of the most comprehensive offerings on the market. We are not affiliated with them, but we use their referral link.

More information about the rewards can be found here.

Selling cryptocurrencies via Ledger Wallet: what are the fees?

Selling cryptocurrencies via Ledger Wallet also involves partners. Fees payment method (SEPA, card). Generally, they are comparable to those for buying : between 1.7% and 4.5%.

Exchange fees and token conversion on Ledger Live

Ledger Wallet allows you to convert one cryptocurrency to another (for example, BTC to ETH or USDT ) using providers like Changelly or Paraswap. Exchange fees

- A commission from the partner (often 0.25% to 1%, depending on liquidity and token).

- cryptocurrency pair chosen.

- Network fees for each transaction on the blockchain .

It is advisable to consult the summary before confirming, as fees may be higher for exchanges involving tokens or during network congestion.

Ledger Staking : what are the fees and how does it work?

Staking cryptocurrencies via Ledger Wallet

Staking involves locking up assets to participate in validating transactions on a Proof of Stake ( staking blockchain and receive rewards. On Ledger Wallet , you can stake numerous cryptocurrencies, including Ethereum , Polkadot , Solana , Tezos , Cosmos , and others.

What are the fees for staking?

- Ledger does not charge any direct fees for staking .

- The fees are taken by the validators to whom you delegate your assets : usually between 4% and 10% of the rewards depending on the cryptocurrency .

- network fees apply when transferring or withdrawing staking .

Ledger and staking fees : the platform always displays the estimated amount before validation. Ledger does not apply any staking Ledger , but you should check the commission of your chosen validator.

Flexible Staking or locked staking : fee differences

- Staking : you can withdraw your cryptocurrencies at any time, only network fees apply.

- Staking : your assets are locked for a set period. Fees are similar, but rewards are generally higher.

Ledger Live fees: summary and best practices

- Sending or withdrawing cryptocurrencies : only network fees apply, Ledger does not take any margin.

- Receiving crypto : free on Ledger , only the fees of the sending exchange platform

- Buying/selling via Ledger Live payment method , plus spread and network fees . For example, for a purchase of €150:

- Swap/conversion : between 0.25% and 1% commission, plus spread and network fees .

- Staking Ledger fees , minimal network fees

How to view and optimize fees on Ledger Wallet?

Before confirming a transaction on Ledger Wallet, you can view a breakdown of the various fees applied, whether it's for sending, exchanging, or buying cryptocurrency. For each transaction, network fees are displayed, and you can choose the priority level: a high priority speeds up the transaction, which can be useful if the network is congested or if your transaction is likely to get stuck in the queue, but this comes with higher fees. Conversely, selecting a low priority results in very low fees, although confirmation will take longer.

Finally, you can also regularly check the network status and use Ledger Wallet's advanced options to choose the best strategy depending on the situation: prioritize speed, cost savings, or asset consolidation. This allows you to buy, send, or receive cryptocurrencies while maintaining control over fees and transaction speed.

Ledger and fees: what you need to know

- Ledger does not take a margin on transaction fees : only network fees apply for a transfer or withdrawal.

- To buy or sell via Ledger Live , the fees are set by the partners (Coinify, Moonpay , etc.), often higher than on a classic exchange platform

- Staking via staking Ledger to validator commissions, with no additional Ledger

- The fees are always displayed before confirmation.

Frequently Asked Questions about Ledger transaction fees

What are the fees for sending Bitcoin or Ether from Ledger ?

The fees are those of the Bitcoin network or the Ether blockchain , varying according to congestion. Ledger does not take any commission.

Does Ledger charge a fee for receiving cryptocurrencies?

No, receiving cryptocurrencies on a Ledger Ledger is still free.

Are the fees fixed or variable?

Network fees are variable, determined by the blockchain and congestion at the time of the transaction. Buying or selling fees via Ledger Wallet are set by Ledger chosen partner.

Can you buy cryptocurrencies cheaper elsewhere?

Yes, exchange platforms (OKX, binance , Kraken , etc.) often offer lower fees buying or selling. However, you will then need to transfer the funds to your Ledger wallet if you wish to secure them offline.

Where can I find a detailed breakdown of the fees?

You can see all the charges in the summary of each transaction on Ledger Wallet Ledger support documentation .

Conclusion: Ledger offers transaction fees, transparency, and security

Ledger and the Ledger Wallet offer complete transparency regarding transaction fees : only network fees apply to transfers, while buying , selling , or staking staking are handled by intermediaries who set their own pricing structures. To secure your cryptocurrencies while controlling costs, it's recommended to always review the fee before each transaction and compare them with an exchange platform more information on fees and managing your Ledger wallet , the FAQ is regularly updated.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital.

All our articles undergo rigorous fact-checking. Every key piece of information is manually verified against reliable and recognized sources. When we cite a source, the link is always integrated into the text and highlighted in a different color to ensure transparency and allow readers to directly access the original documents.

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .