Mantra Crash: Critical and technical analysis of the causes of OM's brutal decline

The mantra crash recently rocked the universe of cryptocurrencies, with the token OM of Mantra which dropped almost 90 % in a few hours. This spectacular collapse has made several billion dollars of market value disappear and raised many questions about its real causes. In this article, we analyze the elements likely to explain this crash, by taking a critical look at the internal mechanisms, the opacity of the data and the environment of the blockchain associated with the RWA (Real-World Assets) that the project claims tokenize.

Table of contents

Context and course of the mantra crash

The token OM experienced a rapid ascent in 2024, showing an increase of more than 400 %. This increase had captured investors and strengthened the credibility of the project, in particular thanks to strategic partnerships such as the one concluded in January 2025 with the Damac group to tokenize up to $ 1 billion in real assets . However, in April 2025, the token underwent a sudden drop, from more than $ 6 to around $ 0.58 in less than 24 hours, resulting in a loss of market capitalization estimated between $ 3.5 and $ 4.5 billion.

The first explanations put forward by the mantra team pointed to forced liquidations on centralized exchanges, which would have triggered a domino effect on the entire OM market. The co -founder JP Mullin mentioned on X (formerly Twitter) that "lever -effect positions" initiated without warning by certain exchanges would have been at the origin , according to him, of the collapse.

Mantra crash: forced liquidations, a disputed hypothesis

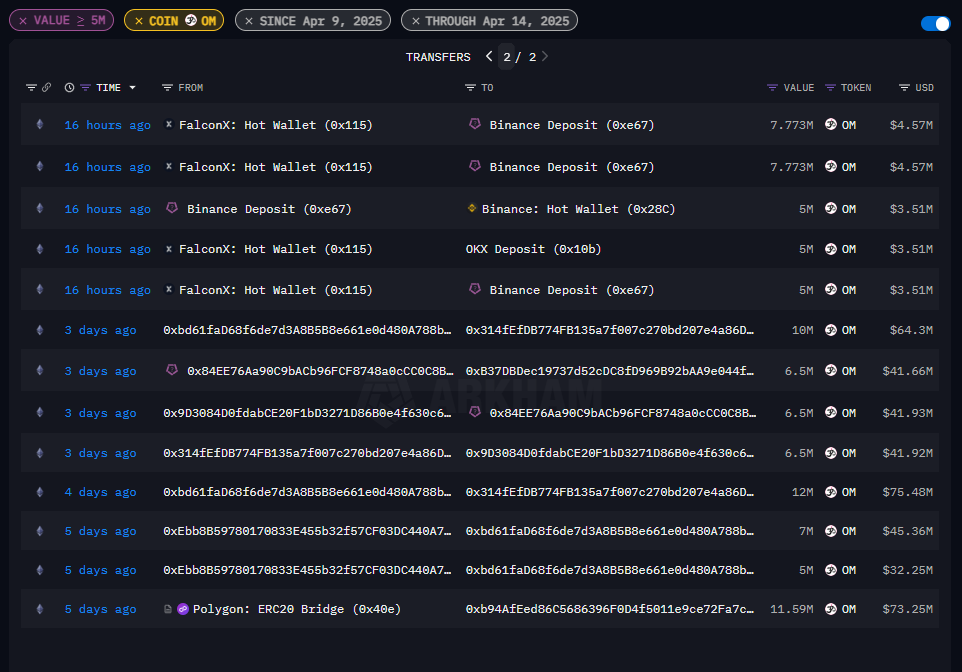

On-chain data show that significant transfers to centralized exchanges such as Binance and OKX have been saved. Several deposits sometimes exceeding 7 million tokens have been identified, notably from addresses linked to actors like Falconx. However, these transfers seem to have occurred mainly after the start of the fall in the price, not upstream. In other words, it was not these movements that have initiated the collapse; Rather, they seem to represent a reaction to a market already in fall.

On centralized exchanges, automatic liquidations are triggered by risk management mechanisms when the collateral of a position no longer covers the required amount. It is therefore very unlikely that these platforms manually orchestrate coordinated liquidations. In the absence of concrete evidence of a malicious intervention or a collusion between different platforms - which would be legally risked for each of them - the hypothesis of forced liquidations remains unlikely.

Potential interests of the team in this context

If we consider the hypothesis of a DUMP coordinated by large carriers or early investors, several explanations can be put forward:

- Early profits: significant investors, anticipating a drop in price or deterioration of confidence in the Token, could have liquidated part of their positions to convert their tokens into stable currencies.

- OTC sale: It is also possible that Over-the-Counter (OTC) transactions, carried out outside of public procurement, took place at reduced prices in order to quickly monetize a portion of the tokens allowance before the end of the vesting periods .

Mantra crash: data opacity and limited transparency

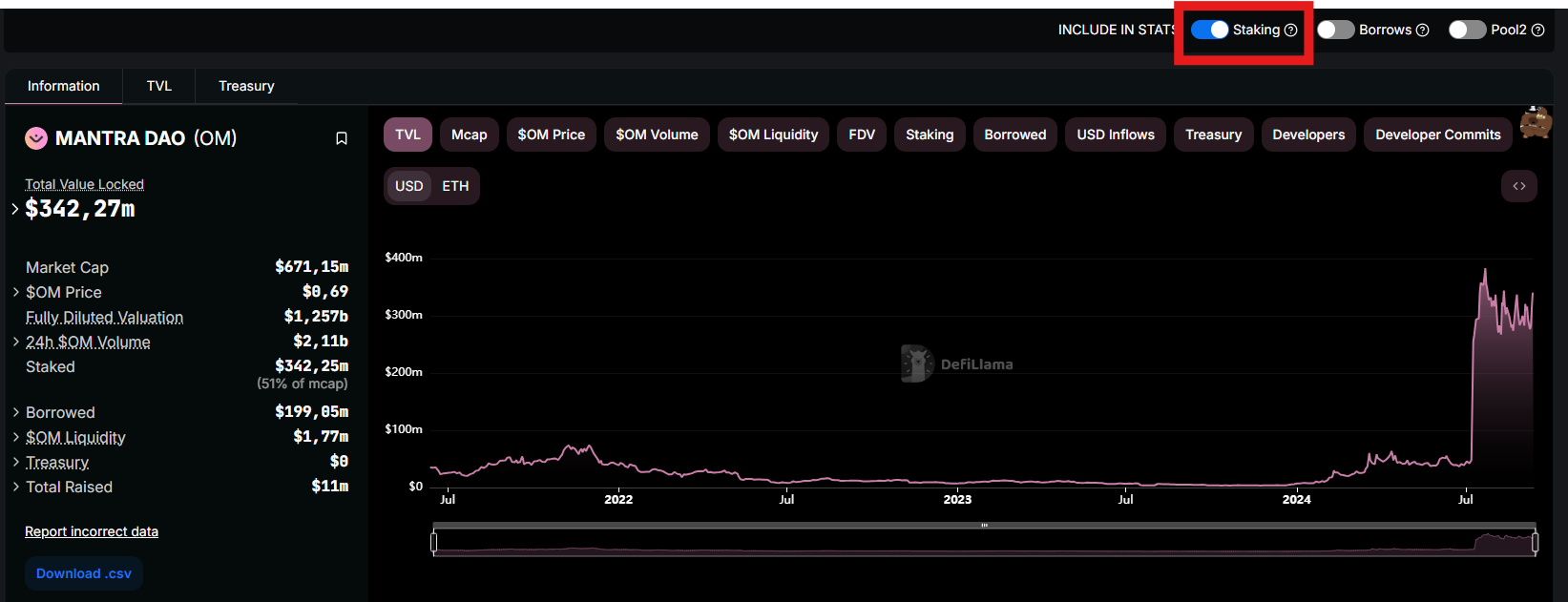

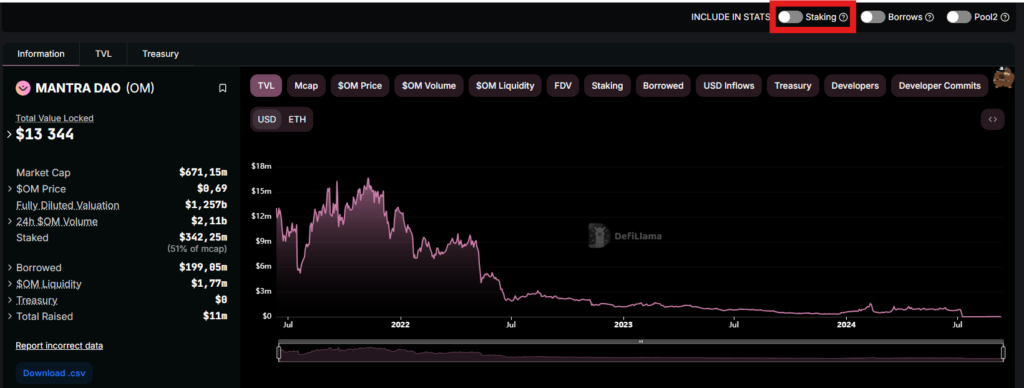

Another major mantra problem concerns the transparency of blockchain economic indicators. The follow -up tools, such as Defi LLAMA , show that TVL (Total Value Locked) stuking mechanisms rather than a real transactional activity. Before September 2024, TVL was very low compared to other active blockchains such as Ethereum or the Binance Smart Chain. Current data seem to artificially inflate the total amount locked without reflecting real economic use. Data has also been inaccessible since September 2024.

This opacity makes it difficult to assess the real performance of the network and the viability of the project.

Positioning on the tokenization of real assets (RWA)

Mantra presents itself as a project aimed at tokenizing real assets (RWA) such as real estate and raw materials. In 2024, the Token OM had increased by more than 400 %, supported by partnerships, notably with the Damac to Tokenize up to $ 1 billion in the United Arab Emirates. However, the recent crash questions the credibility of these announcements. The low real economic activity on the Mantra blockchain, associated with a TVL largely due to internal stuking, contrasts with the initial promises of asset tokenization.

These inconsistencies raise questions about the economic model of the project and its ability to generate a real long -term , as opposed to an artificial accumulation of value.

Conclusion on the mantra crash

The crash of almost 90 % of the Mantra token OM highlights technical and transparency issues that remain misunderstood. On-chain data indicate that important tokens transfers to Binance and OKX were carried out mainly after the start of the crash, making it difficult to validate the hypothesis of a deliberate intervention of the exchanges.

In addition, the opacity concerning TVL - widely generated by Staking - and the lack of data after September 2024 strengthen doubts about the real economic activity of the Mantra blockchain. While the Prix du Token had previously shown growth signs, especially with an increase of +400 % in 2024 and promising partnerships, the recent Krach exposes flaws in the management of the offer and the communication of the project.

Ultimately, it appears that no concrete evidence makes it possible to affirm only a malicious orchestration or a collusion between Exchanges is at the origin of the crash. The phenomenon seems rather resulting from a massive sale initiated by important carriers, exacerbated by low liquidity and limited transparency.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .