What is the most expensive NFT in the world?

The most expensive NFT in the world is a digital work called "The Merge", created by the artist Pak and sold for the sum of $ 91.8 million. This record was recorded in December 2021, on the Nifty Gateway platform ( official source ). This spectacular sale arouses many questions about the real value of NFT (non -fungible tokens) and the mechanisms that justify such prices.

Table of contents

NFT the most expensive in the world: How to explain such a price?

The NFT market is based on a fundamental principle: digital rarity . Unlike cryptocurrencies like Bitcoin or Ethereum , which are interchangeable between them (fungible), an NFT (non -fungible ) is unique . He can represent a work of art, a collection object or even an asset in a video game. Its value is therefore determined by supply and demand , rarity is often a key factor.

In the case of "The Merge" , this uniqueness is not based on a single NFT sold to a single buyer, but on an unprecedented concept: a fractional , scalable and dynamic NFT. Several elements contributed to its record price of $ 91.8 million .

- The artist Pak , a figure in the world of the NFT, had already sold several works to several million dollars, strengthening the credibility and interest of collectors for "The Merge".

- An innovative sales model based on units called " masses ", which buyers could acquire individually or in a group.

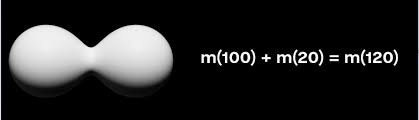

- A unique melting mechanism where, the more a buyer had "masses", the more they were merged to form an increasingly large NFT.

- A sale made in full euphoria Crypto at the end of 2021, where investors were ready to spend colossal sums for digital assets.

The key element here is that "The Merge" is not a unique NFT but a set of split tokens purchased by 29,983 collectors , totaling 312,686 units ("masses") . Each holder has a "portion" of the work, which evolves according to acquisitions and residents on the secondary market.

A work of art that merges over time

One of the most characteristic aspects of "The Merge" is its programmed fusion mechanism . Unlike traditional NFT, where each token remains distinct, here, the masses bought by the same user automatically merge into a single larger NFT .

In other words:

- If a buyer had 3 masses and acquired 2 more, his NFT did not remain composed of 5 distinct units, but merged into a single larger entity .

- This visual merger was represented by white spheres which grew as the buyer accumulated masses.

- The greater the "mass", the more its owner was distinguished in the community, creating a competition phenomenon between collectors .

This innovative concept has encouraged a behavior close to the FOMO ( Fear Of Missing Out , the fear of missing an opportunity), where some investors have sought to accumulate a maximum of "masses" to dominate the collection and obtain a more imposing work than the others.

A market under the influence of speculation

When the NFT exploded in popularity in 2021, they became highly speculative assets . Some buyers saw in them a new investment class , while others were betting on the fashion effect to resell their acquisitions at a higher price.

"The Merge" benefited from this excitement effect, notably thanks:

- To intense media coverage , making this event a key moment in the history of NFT.

- At the entrance to influential collectors , who helped to increase the auctions.

- The innovation of the split model , which gave the impression that a large audience could participate in a unique work, creating a new dynamic of engagement.

However, the rarity of "The Merge" was partially artificial . Unlike a work of physical art that is naturally unique, here it is mechanics of fusion and branding around the artist Pak who created this perceived rarity .

New artistic and financial experience

"The Merge" is an artistic experiment in motion , where the concept of digital property is constantly evolving . It is a work that has no fixed form , because it changes with each transaction and depends on the decisions of buyers.

But this model also raises questions:

- Can a fractional work have the same value as a single NFT as Beeple's "Everyday"?

- If each buyer resells his masses individually, is the value of the whole still legitimate?

- Does the craze for these new mechanics are based on real artistic innovation or a simple speculative bubble?

With decline, the fall in the NFT market in 2022-2023 showed that many of these purchases were motivated by speculation , and not by a purely artistic or cultural appreciation. However, the impact of "The Merge" will remain engraved in the history of digital art, not only as the most expensive NFT ever sold in terms of cumulative value , but also as a project which has redefined the way in which we perceive property in the web3 .

The most expensive nft in the world: other exceptional sales

Everyday: The First 5000 Days

Before "The Merge", the most publicized work was "Everydays: The First 5000 Days" by the artist Beeple (Mike Winkelmann), sold for $ 69.3 million in March 2021 at Christie's ( Official Source ). It is a collage of 5,000 images that the artist has created daily for more than 13 years.

This consistency and being the first NFT sold by Christie's have largely contributed to its success:

- The innovative aspect of selling an NFT in a prestigious auction house.

- International media coverage around Beeple.

- The remarkable artistic journey (13 years of daily production).

This sale propelled Beeple to the rank of the most expensive artists on the planet and highlighted the boom of non -fungible token as a form of legitimate art.

Clock: political commitment

Another striking example, "Clock" is an NFT created by the artist Pak in collaboration with Julian Assange. Sold for $ 52.7 million, it takes the form of a clock with the days of detention of the Wikileaks founder. In this case, the militant dimension plays a decisive role in valuation: more than 10,000 people have contributed to its funding.

Human One: sculpture in perpetual movement

"Human One" by Beeple, sold for $ 28.9 million in November 2021, constitutes an UFO in the landscape: this work combines a 3D digital sculpture representing a constant visual evolution astronaut, and an NFT which allows Beeple to modify the virtual environment around this astronaut.

The most expensive NFT in the world: cryptopunks, precursors and references

If we often evoke massive sales linked to emblematic artists like Pak or Beeple, there are also historical collections that have become cult in the universe of NFT. Cryptopunks, launched in 2017 by Larva Labs ( official source ), are considered one of the first series of non -fungible tokens on Ethereum . Each of these 10,000 small pixelized characters has various attributes (glasses, hats, masks, etc.), some of which are particularly rare, and therefore very sought after.

Among the cryptopunks sold at exorbitant prices, we find:

- Cryptopunk #5822, sold for $ 23.7 million.

- Cryptopunk #7523, nicknamed "Alien Covid", at $ 11.8 million.

- Cryptopunk #4156, sold to $ 10.26 million.

Why are they so expensive?

Several elements explain their price:

- Rarerity: certain visual characteristics (alien skin, hat, etc.) are present on a very limited number of punks.

- Historical collection: being one of the first collections, it enjoys an aura of "pioneer" in the world of NFT.

- Speculation and status effect: Having a rare cryptopunk is displaying a certain status within the Crypto community.

The dynamics of supply and demand also plays a role. Many collectors keep their cryptopunks, which still increases the value of those who are sold.

The most expensive NFT in the world: zoom in on underlying technology

Blockchain and property certificates

To understand how a digital asset can sell for several million dollars, it is important to enter into the technical mechanics: an NFT is generally issued on a blockchain, often Ethereum , via a smart contract . This intelligent contract records all token transactions, guaranteeing thus:

- Traceability: each sale, each change of owner is registered in the blockchain.

- Authenticity: we know exactly what is the original and what are the possible copies.

- Immutability: this information is unfarable as long as the blockchain remains decentralized and secure.

This technical security strengthens the confidence of investors, which can pay significant sums while having the certainty of holding the "official". In an increasingly digital world, this proof of property is often compared to a traditional property title, with the difference that it is on a decentralized network.

Smart contractS and Programmability

NFTs can also be scheduled to carry out certain specific actions. For example, an artist can include in the contract code the possibility of touching a percentage (royalty) on each future resale of his work. For "The Merge", Pak used this logic to merge the tokens acquired by the various buyers over time. In other projects, there are game mechanics, collaborations between artists or secret functions that are revealed after a certain number of transactions.

This programmability explains why the NFT market is not limited to art: today there are NFTs in the metavers , decentralized finance ( DEFI ), virtual real estate or even in video game licenses. The concept therefore goes far beyond the simple images of pixelized monkeys or punks.

Focus on fractional property

The concept of fractionation, widely popularized by "The Merge", could be generalized in the future. The idea is to allow multiple investors to buy shares of the same NFT, thus making more accessible the purchase of very expensive works. The shares are represented by several tokens linked to the original work. Thus, one can imagine that a large digital part of high value is not owned by a single person, but by hundreds, even thousands of co -owners. This model, close to the tokenization of assets, is particularly studied in the DEFI sector and could be available on other markets (real estate, musical licenses, etc.).

The most expensive nft in the world: critical decline, speculative bubble or cultural transformation?

The fact that a NFT sends more than $ 90 million inevitably arouses debates on the sustainability of this market. Several questions arise:

- Does the NFT market are based on a real innovation or simply on the hope of a future capital gain?

- Do collectors buy these works for their artistic value or for the sole purpose of speculating?

- How to assess an asset whose rarity is often decided by a code, therefore artificially?

After the explosion of 2021, the market experienced significant fluctuations in 2022 and 2023. The volume of sales sometimes fell, and many projects have seen their value drop. Despite this, some leading NFT retain an enormous appeal.

A market looking for maturity

As the regulations are clarified and decentralized finance evolves, there is a professionalization of the sector. The great actors of traditional art, like Christie's or Sotheby's, continue to explore this niche, while new specialized platforms are emerging. The NFTs are no longer confined to the Geek universe: they now receive luxury brands, sports teams, museums or music labels.

It is in this context that analysts believe that NFTs could register in the long term. However, caution remains in order: like cryptocurrencies, these assets remain extremely volatile.

NFT the most expensive in the world: can we still invest in NFT?

Although "The Merge" remains the most expensive NFT in the world, many other interesting projects are negotiated at much more affordable prices. Before you get started, certain stages should be observed:

- Do their own research: analyze the team at the origin of the project, the community around the work, the history of residents.

- Check the authenticity: Always see the smart contract and be sure to buy a verified NFT on a reliable marketplace (Opensea, Looksrare, Rarible, Nifty Gateway, etc.).

- Define a strategy: is it a long-term purchase by passion or a speculative investment Identify your time horizon.

- Establish a realistic budget: invest only the money you are ready to lose, because volatility is very high.

The growing role of alternative blockchains

If Ethereum remains the most popular blockchain to emit NFT, other networks gain ground, including Solana , Polygon or BNB Chain. Each blockchain offers advantages in terms of transaction, speed or user communities.

The place of metarers

Another factor that can influence the value of some NFT is their integration into the metarers. Several virtual worlds (The Sandbox, Decentraland, etc.) offer the possibility of building galleries, creating game experiences or monetizing digital land. In these universes, objects and works of art nft are integrated immersively. Some investors see in the development of the metarers a vector of continuous growth for digital collections, thus raising demand and, therefore, the potential price of certain parts.

The most expensive NFT in the world: analyzes, predictions and perspectives

It would be risky to predict whether a new NFT will exceed "The Merge" at $ 91.8 million. Crypto market cycles are known for their extreme volatility. However, some elements seem to indicate that the concept of non -fungible tokens will not disappear:

- Institutional adoption: Large companies test NFT for their marketing campaigns or the sale of exclusive digital products.

- Cultural evolution: An increasing number of digital artists adopt this format, seeing it as a means of living fully from their art without traditional intermediaries.

- Generation Z and Y: The youngest see NFT as a natural extension of their online interactions, particularly in games or social networks.

A niche market or a new ecosystem?

Despite growing popularity, some say that NFT will remain a relatively specialized market segment, attractive for crypto and art enthusiasts, but without real mass impact. Others, on the contrary, believe that the tokenization of all types of assets (art, real estate, intellectual property rights) will transform in depth the way of possessing, exchanging and consuming. In this vision, record sales such as "The Merge" would only be a taste of a much wider movement.

Conclusion: very fragile dazzling growth

In summary, the most expensive NFT in the world remains Pak "The Merge", with a colossal amount of $ 91.8 million. This record illustrates the power of speculation, the strength of the concept of digital rarity and the contribution of blockchain in ownership certification. It also testifies to the extreme volatility of the sector: this same market which broke records in 2021 and early 2022 experienced housing phases, proving that the NFT are not a guaranteed Eldorado.

Beyond the fashion effect, the NFT symbolize a new way of designing artistic creation, the collection and investment. They open the way to various applications in metavers and decentralized finance, where digital property and smart contractcould transform our habits.

If you plan to invest, it remains essential to inform you, to assess risks and to fully understand the underlying technology. Caution is in order: like any artistic work, the valuation of NFT remains highly speculative.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .