marketing (MLM) , or marketing with multiple stations, has become a powerful tool to promote products and services. Applied to cryptocurrencies, this model takes on a new dimension, offering opportunities for income and community engagement.

Table of contents

What is multi-level marketing (MLM)?

The basics of Multi-Level Marketing (MLM)

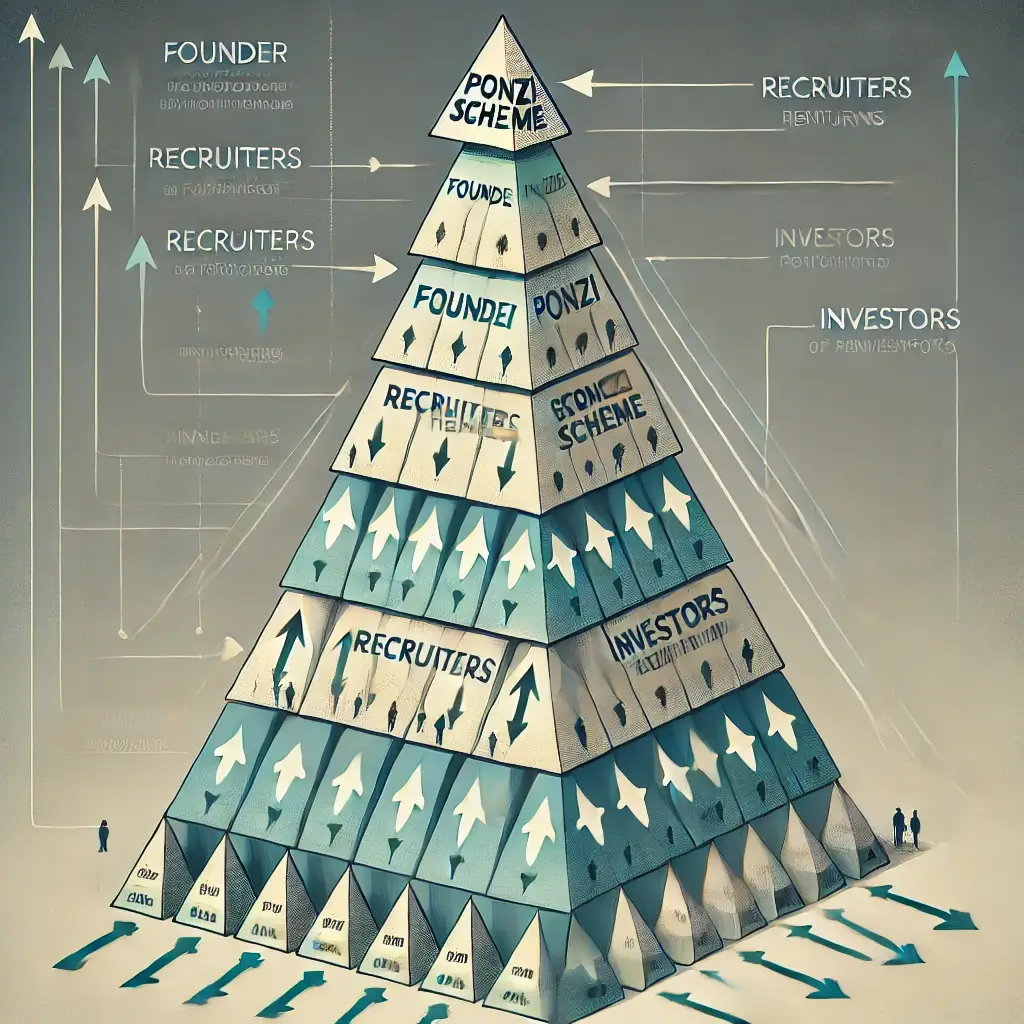

Multi-level marketing (MLM) is based on a key concept: allowing participants to generate income not only thanks to the sale of products or services, but also by the recruitment of new members. These recruits, called "Downline", can in turn recruit other people, thus forming a network structure. The commissions, from sales or membership fees, are distributed over several levels, which explains the "multi-level" name.

The traditional functioning of multi-level marketing (MLM)

In a traditional model, participants act both as sellers and recruiters. They market various products (cosmetics, food supplements, etc.) while developing a network of downstream members. The more this network grows, the more passive income increases, in particular thanks to the commissions generated by the sales of members of the network. Although this model is legal, it is sometimes confused with Ponzi patterns , which are based solely on the entry of new members without real sale of products or services.

Recruitment and commissions of a multi level marketing (MLM)

Network structure and hierarchical levels

In a multi level marketing (MLM) , each recruited member fits into a hierarchical network , often represented in the form of a pyramid. The recruiter becomes the "godfather" of the new member, and the latter is considered a direct recruit . The recruits themselves can then recruit other members, thus creating several levels in the network.

Each level (or "downline") generates commissions for members above in the hierarchy. It is this system of "cascade" which makes recruitments lead to commissions for sponsors.

Commission generation mechanisms

a) Membership fees

In many multi -level marketing (MLM), new members pay entry or membership fees to reach the network or buy a starter pack. Some of these costs are redistributed in the form of a commission to the direct recruiter and sometimes to his sponsors in the higher levels.

Example :

- A new member pays € 200 to join.

- The direct recruiter receives € 50 in committee.

- High level recruiters (for example, both levels above) also receive a share, like 30 € for level 2 and 20 € for level 3.

b) Purchases of products or services

Network members are often encouraged to buy products or services for themselves or to resell them. With each purchase made by a member, part of the income (the margin or a predefined commission) is distributed among several levels of the hierarchy.

Example :

- A member buys for € 100 of products.

- 10 % of this sum (€ 10) is distributed as follows:

- 5 € to direct recruiter.

- 3 € to the recruiter of the upper level.

- € 2 to the recruiter of the next level.

c) Recruitment or team bonus

- multi level marketing systems offer specific bonuses to achieve recruitment objectives. For example, a recruiter can receive an additional bonus after recruiting 5 or 10 members. These bonuses can also increase if the recruits themselves recruit other people, thus expanding the network.

The risks linked to this practice

- Dependence on recruitment: if the system is mainly based on recruitment rather than the sale of products/services, it can be assimilated to a pyramid of Ponzi , which is illegal in many countries.

- Seturation of the market: at a certain point, it becomes difficult to recruit new members, which can lead to a collapse of the network.

- Loss of confidence: systems that remunerate recruitment too generously in relation to sales are likely to be perceived as fraudulent.

What makes an MLM in cryptocurrency?

A multi-level marketing system (MLM) applied to cryptocurrencies is characterized by the convergence of two elements:

- The management of commissions via smart contract deployed on a blockchain , which guarantees transparency and automation.

- The creation of value in the ecosystem of decentralized finance ( DEFI ) , by offering innovative products or services linked to digital assets.

These two factors, combined, distinguish cryptocurrency MLMs from traditional models, while strengthening their credibility and relevance in the financial field.

Transparency thanks to the blockchain

As part of an MLM Crypto, the blockchain plays a central role by ensuring total transparency of commission transactions and payments.

Why is it essential?

- Elimination of intermediaries : All transactions are directly registered on a public register, available by any participant.

- Reduction of manipulations : It becomes practically impossible for a central entity to modify or obscure the data.

- Reinforced confidence : members can check their gains in real time, thus increasing their confidence in the system.

Concrete example:

a multi level level marketing project (MLM) which uses blockchain could sell tokens or services related to the DEFI. When a member makes a sale or sponsors someone, the transaction is recorded in the blockchain, detailing the amounts and the commissions divided between the levels. This transparent process reinforces the confidence of participants while making the system more robust.

Commissions automation with smart contract

Smart smart contract S , these autonomous blockchain programs, are at the heart of the automation of payments in multi -level marketing (MLM) crypto. They make it possible to remove any human intervention in the management of commissions.

Functioning :

- When a member performs a transaction (purchase or sponsorship), the smart contract executes automatically.

- It instantly calculates and distributes the commissions at each level of the network.

- Everything is done according to predefined rules, inscribed in the smart contractcode.

Major advantages:

- Reliability : no errors or human interventions.

- Speed : payments are instantaneous.

- Cost saving : No need for a financial department to manage payments.

A value proposal anchored in decentralized finance

The other pillar of multi -level marketing (MLM) in cryptocurrency is the proposal for innovative products or services, often in connection with decentralized finance. Unlike traditional MLMs which focus on physical products, multi level marketing (MLM) in cryptocurrencies use digital tools to offer solutions adapted to modern investors.

What products/services are offered?

- Tokens or cryptocurrencies : to buy, use or resell, these digital assets are often at the heart of MLM systems.

- Staking and passive yields : services that allow you to block funds to generate interest.

- Online training : to initiate users to the cryptocurrency ecosystem.

- DEFI applications : digital portfolios, decentralized exchange platforms or financial management tools.

The MLM model in cryptocurrency: a natural evolution

By combining the automation of payments thanks to the smart contractS and a proposal for a value focused on decentralized finance, the MLM in cryptocurrency represent a natural evolution of network marketing. This model meets the expectations of a technophile audience, in search of transparency, speed and innovative financial products.

The evolution of multi -marketing (MLM) in the cryptocurrency ecosystem

Why the multi level marketing (MLM) and cryptocurrencies form a winning duo

Cryptocurrencies, based on principles of decentralization and transparency, go perfectly with the Multi-Level Marketing (MLM) . This link is reinforced by the use of smart contract S , automated programs that manage payments and contractual relations between the parties.

What intermediaries are replaced by the smart contractS?

Traditionally, MLM systems require several intermediaries to operate effectively, such as:

- Financial administrators , who ensure the calculation and distribution of commissions to members.

- Auditors , who check the compliance of transactions.

- Network managers , who monitor members' activity and validate commission levels.

With the smart contract , all these tasks are automated. These programs, hosted on the blockchain, manage:

- The collection and distribution of commissions , without human errors or delays.

- Traceability of transactions , accessible to all participants for total transparency.

- Validation of engagement levels , such as new recruitments or achieved objectives.

This replacement of the intermediaries not only reduces costs, but also eliminates the risks of fraud and manipulation, thus strengthening the confidence of participants in the network , that is to say MLM members and their recruits.

Concrete case of success and failures in multi level marketing (MLM) in cryptocurrencies

The Troncase case

Troncase was presented as a platform of " decentralized smart contract based on the Blockchain Tron. high passive return promises , often qualified as "zero risk". Here's what Troncase "sold":

Membership of the system : the new members had to make an initial TRX investment This amount was used to finance the pool of returns promised.

Fixed daily yields : Troncase promised attractive daily interest rates, often between 1 % and 3 % per day . These yields had to be paid thanks to the contributions of new entrants.

A recruitment and commissions system :

- Each recruit was to attract new investors to receive commissions.

- These commissions were based on the amount invested by the new members .

- Recruiters also affected commissions on several levels downstream, typical of multi level marketing structures (MLM).

In summary, the "members" did not sell a specific product or service. They were encouraged to recruit other investors , promising them the same high yields that they hoped themselves to receive.

Why were new recruits attracted?

High and passive promises of yields :

- Troncase attracted investors by making them shim quick and substantial profits without having to make efforts, beyond a simple TRX deposit.

Apparent transparency of smart contract :

- The fact that payments are automated by a smart contract on the Tron Blockchain gave an impression of safety and absence of manipulation. Each transaction was publicly visible, which temporarily strengthened confidence.

Aggressive marketing :

- The members were motivated to recruit thanks to very generous commissions, often on several levels of the pyramid.

- A well -established marketing discourse presented Troncase as an "life change opportunity" , especially for those who entered the system early.

What caused the fall of Troncase?

The absence of real product or service :

- Troncase did not generate any added value or external income. The yields came only from funds injected by new recruits , a typical Ponzi scheme.

Dependence on infinite growth :

- For the promised yields to be held, a constant entry of new members . As soon as the recruit flow has slowed down, the system found itself unable to pay the yields, resulting in a collapse.

Loss of confidence :

- Once some members have ceased to receive their payments, confidence has collapsed, causing general panic and massive withdrawal of the funds still available.

Lesson to be drawn from the Troncase case

Troncase offered nothing tangible, which made him fundamentally unbearable. What attracted recruits was:

- Unrealistic promises of passive yields.

- The belief in blockchain technology and the transparency of smart contract , which gave an appearance of credibility to the system.

How to identify a multi level marketing (MLM) in reliable cryptocurrencies?

The criteria to recognize a serious project

In the world of multi-level marketing (MLM) applied to cryptocurrencies, it is essential to differentiate the serious projects from doubtful diagrams. Here is how to assess a project to avoid traps and make informed choices:

1. Check a clear and transparent regulation

- For what ? Regulation shows that the project respects local and international laws, which reduces the risk of fraud.

- How to do it?

- Look if the company is registered with regulatory organizations in its country of origin.

- Consult the opinions or warnings of financial authorities such as the SEC (United States) or the AMF (France).

- Assemble the transparency of the documentation: Does the project publish external reports or audits?

2. Identify tangible products or services

A tangible product is a key element to distinguish a serious multi -level marketing (MLM) from a simple pyramidal diagram. Here's how to identify it:

- Ask the right questions:

- What does the project really sell? Is it a product or service that you can use, consume or resell?

- If tokens or cryptocurrencies are offered, what is their concrete use (payment, education, investment)?

- Are there evidence of intrinsic value, such as functional platforms or educational tools?

- Drive research on the product:

- Read user reviews on specialized forums or platforms (BitcoinTalk, Reddit, Trustpilot).

- Analyze feedback on the quality and usefulness of products (e.g. practical training, technological platforms, investment tools).

- Beware if the only "product" is access to future income.

3. Understand the economic model

A balanced economic model guarantees that project income is not only based on recruitment. Here are the steps to check it:

Analyze income flows:

- Do revenues come mainly from the sale of products or services?

- Does the project generate independent revenues of registrations (such as the rental of nodes, the sale of training, or blockchain services)?

Study the documentation:

- Examine white pods (Whitepapers) or similar documents. Look for clear explanations on financing sources and the distribution of profits.

- Make sure that the promises of earnings are not disproportionate. For example, very high guaranteed yields (> 10 % per month) are often alert signals.

Ask yourself about the viability of the system:

- Does the project have a real user community for its products or services?

- If the recruitment stops, can the system continue to operate thanks to existing sales?

- Are there any partnerships or collaborations with other credible companies?

4. Look for proofs of activity and transparency

- Check if the project regularly publishes reports on its performance or news.

- Identify the founders and those responsible. Do they have a solid reputation in the cryptocurrency or marketing industry?

Conclusion on multi level marketing (MLM) in cryptocurrencies

Further reading: To deepen your knowledge of cryptocurrency projects, click on the words in bold to discover our articles on launchpads , airdrops and vesting .

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Investments linked to cryptocurrencies are risky by nature, readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are affiliated, which means that if you buy a product or register via these links, we will collect a commission from our partner. These commissions do not train any additional cost for you as a user and certain partnerships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .