Is OKX banned in France?

A persistent rumor suggested that the OKX platform was banned in France. Yet, the crypto exchange has indeed returned to the country, and in a new guise. What exactly happened? Why did OKX suspend its services, given that it was already registered with the French Financial Markets Authority (AMF)? And above all, what regulatory changes made this return possible? The answer lies in one word: MiCA .

OKX has recently strengthened its presence in France thanks to increased compliance with the European framework. Having obtained PSAN registration and adapted its operations to new regulatory requirements, the crypto platform is making a strong comeback. The MiCA license , which harmonizes the regulation of crypto-assets across Europe, now provides a clearer framework for operating legally in all member states, including France. With this development, does OKX offer a more sustainable solution?

With millions of users worldwide, OKX now allows French residents to access a wide range of services: spot cryptocurrency trading , derivatives, staking , automated trading bots , and much more. This comprehensive suite appeals to both beginners and experienced traders. In this article, we will detail the OKX platform , its legal evolution, the advanced features available, and we will also suggest some crypto alternatives for those who wish to compare.

Finally, we will share practical tips for regaining total control over your digital assets, by storing them autonomously on the blockchain , away from the risks inherent in centralized platforms.

Table of Contents

Why did people believe that OKX was banned in France?

To fully understand the story, we need to go back to December 2023. At that time, OKX obtained PSAN (Digital Asset Service Provider) registration with the AMF (French Financial Markets Authority). This PSAN status is essential for a crypto company to offer its services on the French market, as it guarantees, at a minimum, the platform's compliance with the basic rules of national regulation.

- Implementation of KYC (Know Your Customer) procedures,

- Combating money laundering and terrorist financing (AML/CFT),

- Security and safekeeping of funds under demanding conditions.

However, in practice, registering an exchange as a Digital Asset Service Provider (DASP) does not automatically authorize it to offer all of its products. As soon as more complex services are involved (derivatives, futures contracts, etc.), French regulations become particularly stringent. This is why, after obtaining its DASP registration, OKX decided to suspend some of its services in France, perhaps to avoid facing the restrictions imposed by the AMF (French Financial Markets Authority) on certain risky products.

As a result, this suspension caused confusion among users, who believed that OKX was banned in France . However, the platform did indeed have PSAN (Digital Services Platform) accreditation, but not under the conditions that would allow it to fully deploy its services. Hence the regulatory uncertainty that led OKX to withdraw, pending a more uniform and clearer framework at the European level.

More information about the rewards can be found here.

The arrival of the MiCA license: a new beginning for OKX France

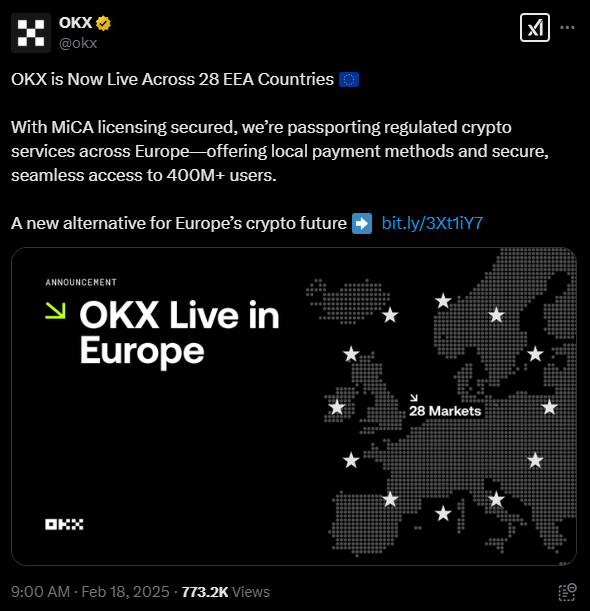

On February 18, 2025 , the news broke: OKX obtained a MiCA (Markets in Crypto-Assets) license through its European entity based in Malta. MiCA is a regulatory framework established by the European Union to harmonize cryptocurrency rules across the EEA (European Economic Area). Thanks to this license, OKX is no longer unavailable in France.

Unlike national regulations (such as the French PSAN status), the MiCA offers a European passport . In other words, if an exchange is validated in one of the member states, it can offer all of its services in the 28 countries concerned, without having to go through country-by-country registration procedures.

For OKX , this is therefore a major change. Not only is the exchange now free to operate legally in France

This development is crucial for many decentralized finance enthusiasts. Before MiCA , OKX had to contend with the sometimes contradictory laws of each member state, which inevitably limited its development in Europe. The MiCA simplifies procedures, ensures a more consistent level of security, and clarifies the offering available to users.

In short, we better understand why OKX is "back" in France in February 2025 : the exchange has chosen to wait for the implementation of the new European regulatory framework to reactivate its services, both at the French and European levels.

What exactly does the MiCA license for OKX entail in France?

Beyond the simple notion of a "European passport", the MiCA license includes several aspects that are of direct interest to the user:

Expansion of the product range

- With MiCA , OKX can offer its French clients a full range of trading services : spot, margin, derivatives (futures, options), etc.

- PSAN-registered platforms could already offer certain options, but often with a more restrictive framework.

Transparency and security obligations

- MiCA significant transparency measures on exchanges regarding fund management, the publication of proof of reserves, and solvency.

- This allows the user to more easily verify the financial stability of the platform, which significantly reduces the risk of sudden collapse (like that of FTX).

Trust and recognition in the markets

- MiCA approval , OKX benefits from easier access to payment services (SEPA integration, iDEAL, Bancontact, etc.).

- For the user, this guarantees the ability to deposit and withdraw their euros without any problems.

Regulatory convergence

- MiCA harmonizes constraints and obligations in each member country, avoiding distortions of competition.

- As a result, an exchange can deploy the same interface and the same products for the entire European market, without fear of being blocked in any particular state.

More information about the rewards can be found here.

How to use OKX France today?

Registration and KYC verification

To start using OKX France OKX account and then complete the KYC . You will need to provide an official ID , sometimes proof of address , and a selfie or short video to validate your identity. This process is quick, often completed in a few minutes, and meets the compliance requirements imposed by MiCA and the AMF to strengthen risk management .

This level of rigor allows OKX to offer its services within a clearer framework, while providing users with a more reliable platform. OKX is a crypto platform that now adheres to strict regulatory standards, making account opening more reassuring for French investors.

Deposits and withdrawals in euros

Once your account is verified, you can fund your balance via SEPA transfer , bank card (Visa/Mastercard) , or sometimes other methods such as Bancontact or iDEAL, depending on your country. Withdrawals via SEPA are preferred due to their simplicity and very low fees , making them suitable for professional and individual traders stablecoin funds are also easily convertible to other cryptocurrencies or withdrawable if needed.

Spot trading and derivatives

OKX stands out with its wide range of trading pairs , including both major cryptocurrencies and more niche tokens. OKX supports over 350 cryptocurrencies. With spot trading , you buy and sell your cryptocurrencies ( BTC , ETH, USDT , etc.) directly via crypto/fiat or crypto/crypto pairs, depending on the country.

Note that currently in France, OKX only supports crypto/fiat pairs , which can pose tax complications that should not be overlooked.

But OKX is also a platform known for its futures contracts : derivative products such as futures contracts allow you to speculate on the rise or fall of an asset without owning it. Thanks to the legal framework provided by MiCA , professional traders can once again access it legally.

Staking and Earn Services

OKX also offers "Earn" features to generate passive income. You can stake staking , participate in liquidity pools , or lend your tokens via various integrated protocols. These solutions allow you to monetize your crypto , but they also carry risks related to the protocols and market volatility .

Trading bots

One of advanced services is native integration of trading bots . You can configure automated strategies such as DCA , grid trading, or arbitrage. These tools are useful for optimizing your crypto trading without spending all day in front of your screen, while maintaining complete control over the settings .

Using an integrated wallet and DeFi interactions

Finally, OKX Wallet is a non-custodial Web3 wallet that allows you to keep your private keys while accessing the DeFi ( staking , NFTs, DApp , etc.). Unlike a centralized trading account, this wallet offers enhanced security and complete autonomy over your funds.

OKX allows you to manage all your assets across different blockchains, choosing between centralized and self-custody according to your preferences. And if needed, OKX customer support is available to assist users. Numerous customer reviews highlight the quality and responsiveness of their support.

What if you prefer not to use a centralized exchange?

Beyond the question "Is OKX banned in France?", there's a more fundamental issue of sovereignty over your funds . If you're worried about account freezes or suspensions, or if you simply want to hold your cryptocurrencies without any intermediaries , several decentralized solutions are available.

You can buy your cryptocurrencies through a DEX like Uniswap , PancakeSwap, or SushiSwap, or use non-custodial fiat-to-crypto ramps such as Ramp Network or MoonPay , which are compatible with wallets like MetaMask or Trust Wallet . These options allow you to acquire assets without going through a centralized exchange.

But for maximum security , the best approach is still to transfer your cryptocurrencies to a physical wallet . Brands like Ledger (French) or Trezor (Czech) offer robust cold wallet outside of any connected environment .

👉 If you'd like to explore the differences between the models and decide which one to choose, we invite you to consult our Ledger model comparison and our comprehensive comparison between Ledger and Trezor .

This way, you'll benefit from maximum control, security, and independence : the very reason blockchains were developed.

A free guide to understanding everything step by step

For those who wish to embark on this adventure, or even explore another PSAN-approved platform, we have developed an ultra-detailed guide with screenshots at each step. In this guide, you will find:

- How to create an account on a centralized exchange,

- How to deposit and withdraw euros safely

- How to decentralize your funds and interact directly with the blockchain,

- Practical tips to avoid beginner mistakes.

The idea is to demystify how a centralized exchange works and help you navigate between traditional finance and decentralized finance (DeFi). Screenshots and step-by-step explanations will help you maintain confidence at every stage. To receive it, fill out the form below:

Conclusion: Is OKX banned in France? Not really, and here's why…

To summarize concisely, OKX was never truly banned in France . While it was indeed registered as a Digital Asset Service Provider (DASP) with the AMF (French Financial Markets Authority) since December 2023, the platform preferred to suspend a significant portion of its services to avoid conflicts with national regulations, particularly those concerning derivatives.

When the MiCA license came into effect in January 2025, OKX obtained a European passport that allowed it to redeploy its entire offering in France. Since February 2025, OKX France has been fully operational, with secure access, the ability to easily deposit and withdraw euros, and a very comprehensive range of products (spots, derivatives, staking , earn, trading bots).

For the end user, this is excellent news , as it diversifies the regulated platforms available in Europe.

Finally, if you're still hesitant to entrust your cryptocurrencies to a centralized intermediary, you can always turn to decentralized wallets and DEXs . In this case, remember that you'll need to already own some crypto to pay network fees and learn how to secure your private keys yourself (explained in our guide).

Ultimately, OKX is far from being banned in France . It has simply gone through a strategic withdrawal phase to comply with best regulatory practices.

To better understand the status of the various exchange platforms in France, including those on blacklists like Bitget , KuCoin and MEXC , we invite you to read our various articles on the subject.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital .

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .