Staking crypto: risks, methods and how to assess them

Staking crypto risks: Understanding the dangers before launching

Staking consists in immobilizing its cryptocurrencies on a blockchain using the evidence of evidence ( POS ) or its variants, in order to staking transactions and receive staking rewards in the form of new tokens . If the cryptocurrency staking allows you to generate a passive income and obtain an return , it exposes to specific risks, variable depending on the staking used: centralized platform CEX ), non-custodial wallet , staking pool or liquid staking . Here is a complete panorama of the risks linked to staking and the means to assess them.

Table of contents

What are the risks of Crypto staking ?

Market risk and volatility

The main danger of staking is not in staking in itself but in what it implies, that is to say the blocking of funds with high volatility of the market . Even if you receive rewards , the value of the cryptocurrency can fall sharply during the blocking period or the staking period . For example, staking offering 10 % return can be widely canceled if the Token drops by 40 % over the same period. This risk is accentuated by the impossibility of selling or transferring assets during the blocking period.

Liquidity risk

The blocking periods imposed by the protocol or the platform prevent from withdrawing or selling its crypto-active instantly. If a sharp decline occurs, users cannot react quickly, which accentuates potential losses. The risks of liquidity are therefore to be taken into account, especially on blockchains where one sting staking last several days, or even weeks.

Slashing risk

Slashing is an applied penalty if the validator you have delegated your tokens commits a fault: validation of a transaction , double signature, or prolonged inactivity. Part of the tokens in staking can then be destroyed, directly impacting users who have delegated to this validator . On Ethereum , for example, less than $ 3 million ETH have been lost via slashing since 2021, a small share of stakes, but the risk exists.

Risk of hacking and safety

storage platforms or smart smart contract used for staking staking the target of flaws or hacks. In case of hack, the digital assets deposited can be stolen or definitively lost. This counterparty risk concerns all the solutions where you do not control your private keys.

Counterpart risk

When you store your cryptos via a platform ( CEX ), you depend on the solvency and management of the platform . A defect, bankruptcy or mismanagement can lead to the loss of your crypto . This risk is reduced to non -custom staking , but there is still a technical risk.

Intelligent contract risk

Flights linked to flaws in smart contract specifically used for cryptocurrency staking DEFI . However, when they arise, they can have a severe impact on users.

According to recent data from Dapp Radar in 2025 , RUG Pull or flawless exploitation incidents in DEFI protocols , including those offering staking , decreased in frequency (7 cases recorded in early 2025 against 21 in 2024), a drop of 66 %. However, financial losses have exploded, reaching nearly $ 6 billion, including a large part linked to a single project (mantra), which shows that even if the attacks are less frequent, they are often more devastating.

In the specific context of staking, flaws in smart contractcan allow an attacker to divert cryptocurrencies deposited in a staking pool or a liquid stakingprotocol. These attacks directly affect users who see their funds immobilized or stolen without recourse. Although the documented cases of massive flights via flaws in staking contracts are fewer.

In summary, even if the risks linked to staking by smart contract are not the most frequent, they remain a real danger which can heavily affect users. This underlines the importance of favoring audited protocols, recognized and with a good reputation, in order to limit exposure to these major technical risks.

Associated risks according to the staking method

Staking on centralized platform (CEX)

- Risk of counterpart: loss of crypto in the event of bankruptcy or hacking of the platform .

- Blocking risk: The platform can impose a blocking period or delay withdrawals.

- Less control over the selection of validators , therefore indirect exposure to slashing .

- Example: staking on Gemini.

Staking via non -custodial wallet (direct delegation)

Staking via non -custom Wallet (direct delegation) consists in directly delegating your cryptocurrencies to a validator on the blockchain, which offers you total control over your funds and the management of your private keys.

- This method exposes you to the risk of slashing: if the validator you have chosen commits an error or acts in a malicious manner, part of your funds can be penalized.

- There is also a technical risk: loss of access to your wallet or poor manipulation can cause the loss of your assets.

To stike your cryptocurrencies in a non -custom way, just use a compatible wallet like Ledger, which we particularly recommend. Ledger is a cold wallet, that is to say a hardware portfolio that stores your privately offline keys, thus offering maximum security against hacks and malicious software.

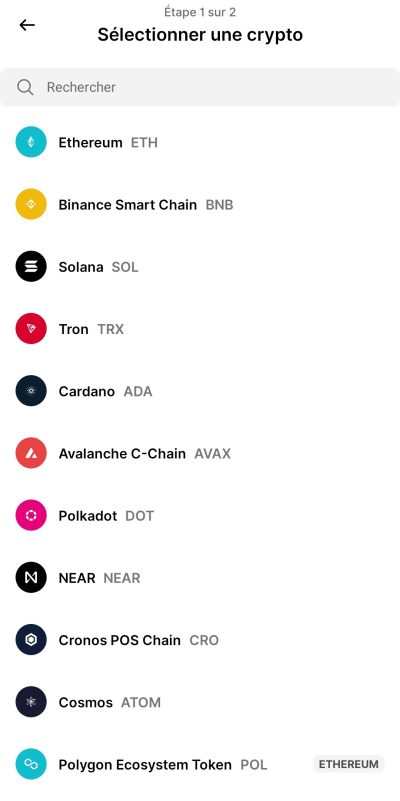

In addition to security, Ledger staking options directly via its Ledger Live application: Ethereum , Solana , Cosmos, Polkadot , Tezos , and many others .

You can follow and manage your awards, explore new opportunities and easily choose the validator to delegate your funds.

In summary, non -Customer staking Ledger combines offline safety, total control over your funds and access to multiple blockchains and validators, while limiting the risks linked to centralized platforms or to the custody by a third party . For more details, we invite you to read our guide to find out Ledger model to choose and how to make staking on Ledger Live step by step .

Liquid staking

- Allows you to receive liquid tokens crypto stakes (eg Steth on Lido).

- Risk of decorrelation: token can lose its parity with the original assets.

- Less risk of blocking, but exposure to the volatility of derived token

How to assess and reduce the risks linked to staking ?

Choose the blockchain and cryptocurrency

- Favor blockchains that have experienced their POS consensus mechanism ( Ethereum , Solana , Cosmos) and cryptocurrencies with strong liquidity and investors' confidence .

- Analyze the history of Slashing penalties and the reliability of the validators .

Before staker, it is useful to consult the history of the network in terms of Slashing (penalties inflicted on validators): tools like Beaconcha.in (for Ethereum) make it possible to analyze the reliability of validators and their performance history.

Carefully select validators or delegates

- Check the activity time ( uptime selashing rate of the validator .

- Avoid delegating to a single validator to limit exposure to Slashing .

This information is generally accessible in the staking interface of your Wallet (like Ledger Live, etc.) or on explorers such as Mintcan or Solscan.

Understand the conditions of the protocol and the platform

- staking rules , blocking periods , the frequency of rewards and possible costs.

- Take into account taxation on staking awards .

Use recognized and audited staking platforms

- Favor staking platforms with reliable safety and history audits.

- Avoid protocols that are too recent or without transparency on fund management.

Reduce liquidity risk

- Avoid staker all of its assets : keep a reserve for trading or unforeseen events.

- Liquid staking options for more flexibility, while knowing the associated risks.

Is Staking risky? Synthesis of potential risks

- Volatility of the market: potential losses superior to yields if the price of the token falls.

- Blocking period : unable to sell for a certain period .

- Slashing : partial loss of Tokens in the event of a validator .

- Piracy or bug of the platform or protocol .

- Risk of counterpart on the CEX .

- Regulatory and tax risks.

- Liquidity risks : Difficulty getting your crypto-actives .

Staking can be a source of yield, but is never without risk

Staking attracts for its yields and the possibility of staking rewards while securing the blockchain network . However, understanding the risks and knowing how to assess them according to the method ( platform , Wallet , Pool , Liquid staking ) is fundamental to protecting its cryptocurrencies . The risks linked to staking are not negligible: volatility, blocking, slashing , hacking, counterpart, regulation. It is therefore crucial to adapt your strategy, to diversify your staking options and never invest more than what can be lost.

FAQ: staking Crypto Risks

What are the risks linked to staking on a centralized platform?

The linked risks include loss of access to your crypto in the event of bankruptcy or hacking of the platform , the risk of blocking withdrawals for a period of several days or week, and an indirect exposure to Slashing according to the management of validators .

Can staking be without risk?

There is always a risk : no protocol or platform is infallible. Even staking volatility risks .

How to reduce the risks of Crypto staking ?

To reduce the risks , diversify your validators , favor platforms , find out on the blocking period and keep part of your digital assets .

What are the main Slashing penalties?

Slashing penalties vary according to the blockchain : they can range from the loss of a few tokens to the entire delegated put, depending on the severity of the validator .

Is staking suitable for all profiles?

Note that staking is not suitable for everyone: it is mainly suitable for those who agree to block their crypto for a certain period and who include potential risks .

Conclusion

Cryptocurrency stuking is an effective strategy for generating passive income staking securing blockchains but there are risks linked to staking to assess. Between volatility , slashing , blocking periods , hacking and regulatory risks, each method presents specificities to be understood. Before delegating or staging your cryptocurrencies , analyze the risks of crypto staking and adapt your strategy to your profile and your objectives.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .