How to get a good yield in Staking Crypto: Complete Guide

Have you heard of staking Crypto and you want to know precisely what yields to hope as well as the best way to maximize your earnings? In this article, you will discover everything you need to know: the most frequent interest rates, the different types of platforms, the concept of security and the factors that really influence your investment .

Table of contents

Staking Crypto Dimens: Why can it be lucrative?

Staking Crypto is to block your cryptocurrencies in a Proof of Stake staking order to contribute to the validation of transactions on a blockchain network . In exchange, you receive rewards in the form of additional tokens. This mechanism presents itself as a way to generate passive return without the need for costly infrastructure. Unlike mining ( Proof of Work ), it is based on the concept of "financial participation" rather than the computing power.

The foundations of Staking Crypto

In a Proof of Stake , participants deposit a number of tokens to contribute to the validation of transactions and the creation of new blocks. The higher your bet, the more likely you are to be selected as a validator and receive rewards . In practice, unless you have substantial funds in a single cryptocurrency (often several tens of thousands of euros), you will not directly validate transactions.

The vast majority of private investors therefore opt for the delegated staking . This means that they entrust their tokens to large validators - often specialized companies or centralized exchanges - which are responsible for validating the blocks in their place. In exchange for this delegation, validators donate part of the gains generated to delegators, after having taken a commission .

It is a model that allows you to generate passive income without the need for computer equipment or advanced technical skills.

Key points to remember

- The interest rate is often expressed in the form of APY (Annual Percentage Yield), that is to say an annual percentage.

- The awards vary depending on the blockchain, the quantity of tokens put in staking and the blocking period .

- The Retaking (or Re staking staking allows you to use several protocols to generate even more yields .

Key points to remember

- The interest rate is often expressed in the form of APY (Annual Percentage Yield), that is to say an annual percentage.

- The awards vary depending on the blockchain, the quantity of tokens put in staking Crypto and the blocking period .

- The Retaking (or Re staking staking allows you to use several protocols to generate even more yields .

What yields can we expect in Staking Crypto?

Potential earnings vary from blockchain to blockchain. On established networks like Cardano or Ethereum , more moderate rates are often seen, ranging from 1% to 5%. On newer or less capitalized projects, some emerging blockchains, rewards can climb to 8%, or even 10% or more. Others, like Solana , often offer returns around 5% to 7%.

Factors impacting rates

- The capitalization of the network: the more mature a blockchain, the more validators it attracts, which lowers passive return .

- The blocking duration staking formulas offer a higher fixed rate

- The monetary policy of the project: the award systems (inflation or redistribution) vary according to the protocol.

How to access Staking Crypto and find the best yields?

To maximize your potential earnings with staking Crypto , you need to know where and how to delegate your funds, according to your profile and your desired level of control. Here is a practical overview of the different methods for accessing staking , comparing yields , and avoiding the most common traps.

1. Choose an appropriate Staking method

Via a centralized exchange

If you're just starting out, the easiest way to stake your cryptocurrencies directly from a centralized exchange . Platforms like Gemini, for example, offer staking built into their user interface. Once your tokens are deposited on the platform, all you have to do is:

- Choose the asset you want to stake

- staking formula : flexible or locked

- Validate the blocking period and the proposed APY

This solution is ideal for its simplicity and accessibility, but it implies entrusting the guard of your assets to the platform.

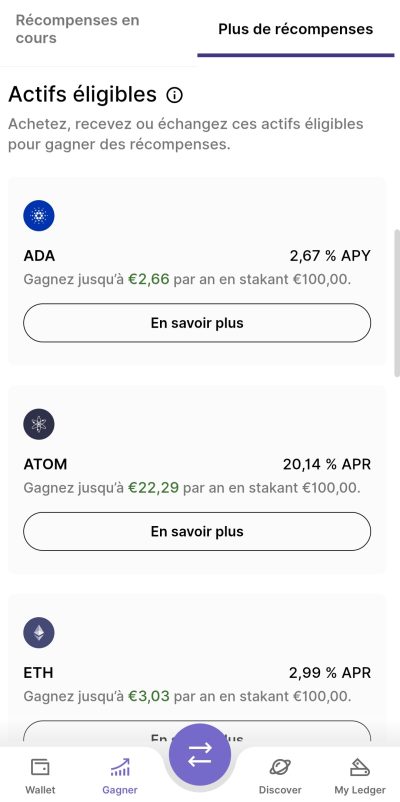

Here are some examples of returns via Gemini's staking tab:

Via a personal portfolio (non-custodial wallet)

For those who wish to keep total control of their private keys, staking can be done directly from a personal wallet like Ledger Live , Metamask , Keplr , Trust Wallet or other. These portfolios often integrate a delegation interface allowing you to assign your tokens to a validator in a few clicks.

Not all wallets support all assets. For example:

- Metamask does not support Cardano staking because it is not an EVM compatible blockchain Cardano

- Ledger LIVE supports Polkadot , Polkadot Tezos Solana , Ethereum staking , Ethereum

Before choosing a wallet, check well if it takes care of the token you want to store, and if it allows the direct delegation or via an integrated DApp

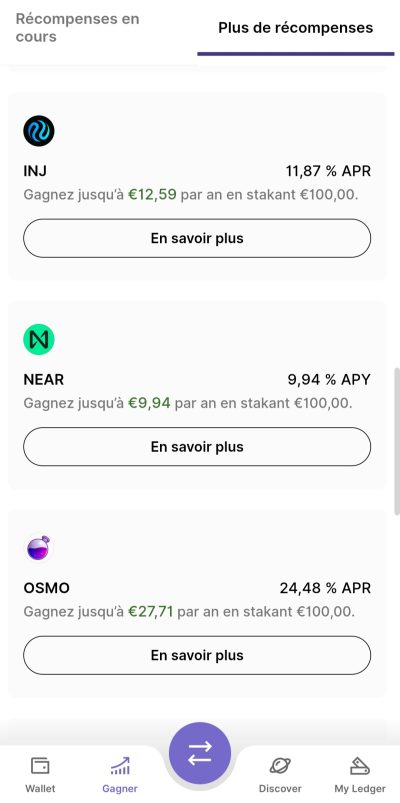

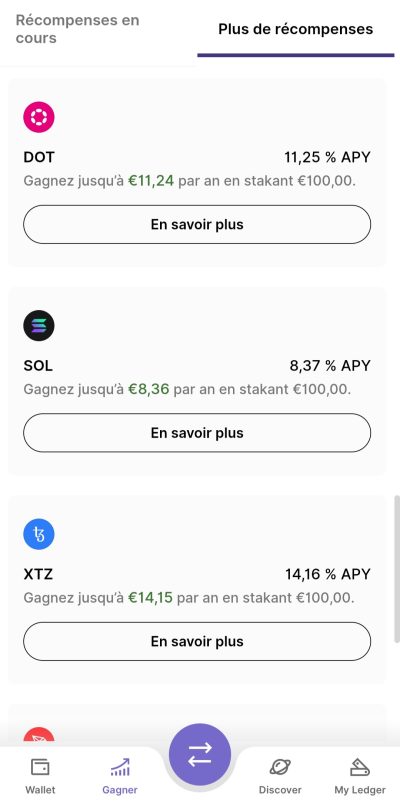

Here are some examples of yields from the Earn tab of Ledger Live:

To learn how to decentralize your funds to an Exodus offline wallet that also offers staking options for around ten cryptocurrencies, we offer our free step-by-step guide, complete with screenshots.

What you will learn:

✔ Master a decentralized portfolio ( DEFI ) - Learn to manage your assets without intermediary and to interact directly with the blockchain.

✔ Perform transactions via a decentralized wallet - a practical guide to exchange cryptos independently.

✔ Explore decentralized finance ( DEFI ) - Discover advanced concepts such as staking and NFT , and optimize your investment strategies.

📥 Download the guide freely by filling out the form below:

By connecting your wallet to DAppS specialized in staking

Another method is to use specialized DApp like Lido (for Ethereum , Polygon , Solana ), Marinade (for Solana ), or Rocket Pool (for Ethereum ). These protocols make it possible to connect your wallet (metamask, Ledger , etc.) and stike your funds via a decentralized interface, often with the possibility of obtaining a liquid derivative token (like Steth, MSOL) representing your position.

But absolute prudence: this staking is also the one where the risks of scams are the highest. Many false DAPPs DApp official sites to siphon your funds via malicious smart contract . Before validating a transaction, always check:

- The domain name (often crooks use names very close to the official sites with an inverted letter or a moved point)

- The exact address of the DApp (go only by official links from CoinmarketCap, Coingecko or the social networks verified)

- The contract displayed in your wallet: if you ask you for unusual authorizations or access to all your funds, refuse immediately

In summary, favor staking via your secure wallet or via your centralized exchange if you are a beginner. Never connect your wallet to a DApp whose 100 %authenticity you have not checked.

2. Compare yields and conditions

Each platform, whether centralized or not, offers different rates for the same asset.

To avoid missing better rates, you can use tools like Waltio , Staking Rewards.com or Defillama for:

- Compare APY according to the platforms

- Check service and management fees

- Consult the safety notes of validators or protocols

3. Check service and network fees

The costs can significantly reduce your net return . They take several forms:

- Transaction costs (Gas Fees): especially on Ethereum , they can be raised depending on the size of the network.

- Validator commissions : They vary from 1 to 20 % depending on the network and the validator.

- staking withdrawal or exit : some platforms apply them at the end of the blocking period.

4. Understand the blocking duration

Two types of staking exist:

- Flexible Staking : you can withdraw your funds at any time, but the interest rate is generally lower.

- Locked Staking : the funds are blocked for a fixed period (7, 30, 60, even 90 days or more). The APY rate is higher, but capital is unavailable.

Some networks also impose a period of unlocking after the end of the staking, up to 28 days.

5. Monitor the RE-Staking opportunities

Re staking or automatically reinvest the awards to benefit from compound interest . Protocols like EigenLayer on Ethereum develop this large -scale model. It allows you to multiply the sources of yield, but also involves a level of complexity and higher risk.

Make sure you understand the implications of REstaking and use only proven and recognized protocols.

Staking crypto yield: zoom in on some blockchains

Ethereum

With the transition to the Proof of Stake , Ethereum introduced staking in its ecosystem. Yields often oscillate between 3 % and 5 %, but they can vary according to the total quantity of ETH stakes and the evolution of the protocol. For staker directly as a validator, you need 32 ETH, which can represent a substantial investment. staking pools such as Lido.

Cardano

Its delegation mechanism allows you to stake Ada without a blockage period, which means that you can withdraw your funds at any time. The passive return is between 3 % and 5 % annual. This system is popular with many ADA holders looking for a flexible staking .

Polkadot

Polkadot is characterized by a staking , often between 8 % and 10 %. However, there is a unlocking period of around 28 days to recover its dowry. The validators' commissions vary, it is therefore essential to check the costs before delegating your tokens. Attractive yields encourage many investors to bet on this project.

Solana

Solana generally offers awards between 5 % and 7 %. Its very fast and low cost blockchain attracts developers and users looking for an efficient ecosystem. For Staker on Solana , you can go through a dedicated Wallet or exchange platforms that offer the staking in a few clicks.

Staking crypto yield: potential risks

Despite its advantages, staking Crypto implies certain risks that it is preferable to know. Here are the essential points:

1. Market risk

If your tokens are blocked, you cannot sell them quickly if the price collapses. cryptocurrency market , this constraint can cause significant latent losses. Before staker, check that you are ready to maintain your position even in the event of a quick price fall.

2. Risk of the validator

If you delegate your assets to a validator who commits errors or undergoes attacks, you can undergo financial penalties (Slashing). It is recommended to choose reliable validators and diversify your investments to limit this risk . But it remains quite rare.

4. Liquidity risk

A unlocking period may apply before you can recover your tokens, which can range from a few days to several weeks. This is an important element to take into account if you plan to need liquidity quickly.

Staking Crypto Dimens: How to start staker (key steps)

For novices, the staking Crypto may seem complex. However, the steps are quite simple:

- Choose an eligible cryptocurrency: Check if the crypto you hold supports the Proof of Stake . The most common are Ethereum , Cardano , Polkadot , Solana , etc.

- Decide to use a exchange platform or a personal wallet:

- On an exchange like Gemini you can usually stake in just a few clicks.

- On a wallet like Ledger , you directly delegate to a validator to stay in control of your keys.

- staking formula : flexible or locked. Compare interest rates and withdrawal conditions.

- Validate the operation and start receiving rewards according to the periodicity of the protocol (often all eras, that is to say several times a day or week).

Staking crypto yield: the importance of compound interests

An often underestimated advantage is the possibility of reinvesting rewards to generate compound interests . Concretely, your tokens won is automatically reintegrated into staking for themselves to produce rewards . Over time, the effect can become exponential, especially if the project is experiencing growth in its valuation.

Simplified calculation of compound interests

Suppose you have 1,000 tokens of a given crypto offering a 7 %APY. After a year, you will have around 70 additional tokens. If you reinvest them immediately, the following year, it is on 1,070 tokens that the 7 % will apply, about 75 more tokens, and so on. Over several years, this strategy can generate an appreciable differential compared to an unpaid fixed yield. This of course implies that the course of the token was also efficient. Generating a very high yield on a token whose course collapses is not a good calculation.

Staking Crypto Efficiency: What about taxation?

Taxation varies by country, and in France, official regulations regarding crypto staking staking unclear. Tax authorities often consider the tokens received as taxable income at the time you receive them. You should then declare your capital gains when you sell or convert these tokens into fiat currency. As a precaution, keep accurate records of your transactions, ideally using crypto management software like Koinly, Waltio, or Cryptotaxcalculator.

If you live outside France, find out about local rules. In some countries, taxation is only done on sale. In others, there is a specific framework that assimilates staking rewards to dividends staking It is therefore strongly advised to consult a professional for any significant amount invested.

Conclusion: Should you embark on the Crypto Staking ?

Stoking Crypto staking increasingly popular strategy to generate yields . Interest rates often exceed those of traditional investments, and you support the security of a blockchain network . However, everything is not without risks . Before taking action, take the time to compare the different options, calculate your costs and check the solidity of the project and the platforms used. The solutions available today, whether they are exchange platforms or non-customs portfolios, make staking Crypto accessible to all.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .