Since September and October 2024, Suit has been able to capture the attention of investors thanks to the rise in value of his native token, the Su . But what really retains market interest is the technology that underlies this new generation blockchain. Designed by Mysten Labs , a team of former Meta , followed to push the limits of scalability thanks to an innovative architecture based on objects.

So, is it a revolution in the blockchain world or a simple fashion effect? In this article, we give you our opinion on the Crypto SU , by exploring its strengths, its risks and its future prospects. We will see in particular how its scalability , its total Value Locked ( TVL ) increasing and its economic model can impact its long -term adoption. But also, we will analyze the inflation of her token and the selling pressure that she can induce. Finally, we will compare follows to its direct competitors such as Solana and Ethereum , in order to better understand if this blockchain has the means to impose itself sustainably.

Table of contents

Introduction to the Crypto Suit project: Genesis of a daring project

In 2021, the Startup MySten Labs was born under the leadership of former Meta engineers (ex-Facebook). Their common experience on Diem (a cryptocurrency initially planned by Facebook) provided them with a solid technical soil to build a new blockchain. Thus was born , designed to exceed the limits encountered on Ethereum or Bitcoin, whether in terms of costs, speed or capacity to accommodate complex decentralized applications ( DApp S ).

As of September-October 2024, we are witnessing an outbreak of the price of the AU , marking curiosity, even enthusiasm, of the community. However, the real innovation of Sui is not limited to the simple increase in an asset on the markets. Its object-centric structure, its parallel treatment of transactions and its modular management of the blocks (or rather the absence of traditional blocks) make it a blockchain which stands out. This is what makes the whole Crypto Suit also scrutinized: many wonder if this technology has the potential to sustainably upset the ecosystem.

Suis Crypto: Why does technology intrigue so much?

To really understand the value of the Su sur Project, you have to look at the spine of the Suit Blockchain: a distinct transactional model and an architecture designed to avoid congestion.

Parallel treatment thanks to the-centric object structure

Unlike traditional blockchains like Bitcoin or Ethereum , where transactions must be sequentially in blocks, follows a more flexible approach using object management .

In the context of sui, an object represents a separate data unit which can be a token, an NFT, a smart contract or any other digital active active in the blockchain. Each transaction on suis concerns one or more specific objects , which allows an independent and parallelized as long as no other transaction seeks to modify the same object at the same time.

Concrete example

Imagine a game based on the blockchain where each player has a nft sword and a chest of SUP pieces .

- Transaction A : Player 1 sells his sword NFT to player 2.

- Transaction B : Player 3 sends 50 sui to player 4.

These two transactions concern different objects (an NFT and SUP tokens). Suis can therefore execute them simultaneously , without the need for a global consensus.

On the other hand, if two transactions aim to modify the same object , for example:

- Transaction C : Player 1 sends the same sword NFT to player 2 and player 5 at the same time.

Here, a conflict is created because the same object NFT cannot be sent to two people at a time . Suit must then apply a more classic consensus to ensure that only one of the transactions will be validated , while the other will fail.

Diem's inheritance and the role of Mysten Labs

MySten Labs capitalized on the experience accumulated during the development of Diem. They sought to solve the problems of scalability and safety that Diem also aims to settle, while retaining the spirit of a modern blockchain: a mixture of Proof of Stake , technical modularity and flexible transactions management. The result is embodied today in Suit , an infrastructure which takes up certain principles of engineering tested within Facebook, but in a much more open and decentralized setting.

The rise of the END token end of 2024

SUET token quickly caught the attention, to the point of fueling many speculation. Although the spectacular increase in its price in September-October 2024 aroused the interest of traders, we must not forget the fundamentals: more than just cryptocurrency, it is a utility token used for the payment of gas costs, governance and staking . In fact, the price of the suits depends:

- Adoption of built -on applications and protocols ,

- Emission policy ( jacket calendar ),

- Speculative movements and the hype that surrounds any promising new entrant to the crypto universe.

SUP performance: a focus on scalability

Official figures

Such claims up to 120,000 TPS (transactions per second) in ideal test scenarios. The engineers of Mysten Labs, however, specify that this is a theoretical maximum, measured with simple and energy -consuming transactions.

In real conditions, observations show that SUPs generally caps around 900 TPS , a very honorable level but still below Solana (1,000 TPS). This performance nevertheless places in the category of so -called “high speed” blockchains, capable of competing with other post -efficient projects.

Gas and fast path fees

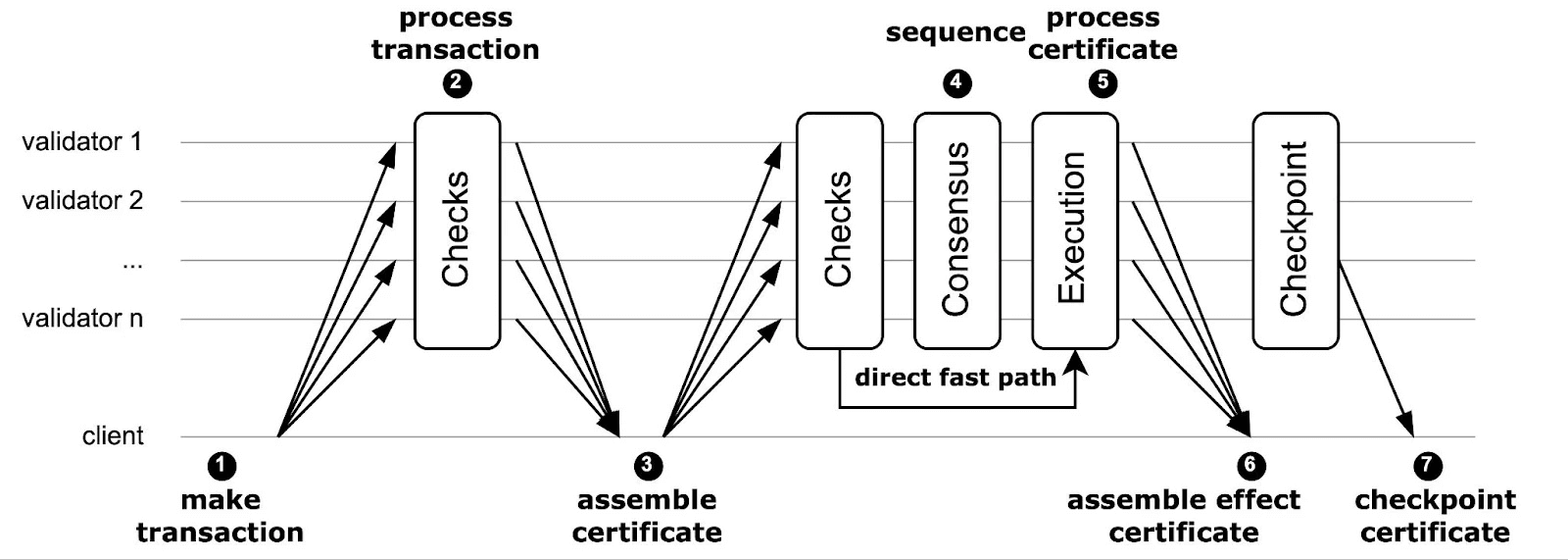

For transactions without conflict, Suit uses a fast path allowing them to be validated in the blink of an eye, without resorting to a global consensus. This mechanism results in gas costs : on average, $ 0,00018 per transaction. Beyond a simple marketing argument, this level of costs attracts tired users of the high costs of Ethereum . This participates directly in the gradual increase in TVL (Total Value Locked), an index revealing interest in an deffi .

The Validators of Sui: A separate role

In most Proof of Stake , the validators offer and validate classic blocks. Sur suis, there are no rigid blocks, but transactions validated individually or by lots of certificates. This model avoids the overload generated by too large blocks and promotes the fluidity of the network. However, this mechanism requires from the validators a real capacity for adaptation, because the quantity of parallel transactions can be immense. This specificity strengthens the positioning of sui as an efficient , but also raises the question of decentralization (how many validators are really involved, and how is governance exercise?).

Tokenomics of the Su: Why an opinion on the Crypto Suis cannot ignore inflation

The total offer and the jacket calendar

With 10 billion on planned tokens, the Blockchain follows a monthly liberation strategy: each 3ᵉ day of the month, 0.82 % of the total offer is unlocked. In October 2024, only 2.76 billion followed, or 27.63 % of the total. This issue represents a monthly inflation of 2.8 % until June 2025, when it should start slowing down.

This calendar is not trivial for any notice on the Crypto Suit : it involves continuous selling pressure, which only real adoption can compensate. Experienced investors know this: the more token on the market, the more the price may stagnate or lower if demand does not progress in parallel.

Multiple roles of suis

The SU has several roles: it pays transactions, allows you to vote on the governance of the protocol, and can be delegated to strengthen network security. This complementarity partially supports the request in SUP, beyond speculation. Thus, if the DApp continue to proliferate on Su Suis, users will need to buy suis to interact with these protocols ( staking , costs of costs, etc.). Ultimately, it is this intensive mechanism of use that could absorb the growing offer.

Will sales and TVL pressure: will adoption be enough?

What does TVL tell us?

TVL (Total Value Locked) measures the total amount of capital blocked on a blockchain, especially in its DEFI protocols (loans, decentralized exchanges, etc.) TVL An TVL suggests that many users trust the infrastructure and lock their assets there to generate yields or facilitate exchanges. For the past few months, the TVL of Su surdus, proof that the Defi community has taken a look at this network.

Why adoption is crucial for a positive opinion

In any opinion on the Crypto Suit , the dynamics of supply and demand cannot be ignored. If the monthly liberation of tokens follows an additional flow of assets (and potentially dumping), a solid demand from actual use can counterbalance this dilutive effect.

- Favorable scenario : TVL is still growing, many protocols are flourishing, and the sui finds a concrete utility (transaction, staking , governce). The newly issued offer is absorbed, even insufficient, creating buying pressure and supporting the price.

- Pessimistic scenario : the market gets tired, the TVL does not take off as much as hoped, and the released tokens become a difficult to sell. The course of the sui can then fall, further slowing down the adoption of the blockchain.

The example of Solana as a mirror

Many compare SU to Solana , another fast blockchain that has experienced a tumultuous destiny. Solana attracted a TVL during its ascent, but also faced technical constraints and a global sawtooth market. A opinion on the Suit nuanced crypto therefore consists in recalling that even a solid technology does not guarantee long -term success if the community slows down or the macroeconomic environment deteriorates.

Su sur Crypto Opinion: The vision of Crypternon

Our opinion on the Crypto Suit project is as follows:

- Performance potential : SU is among the fastest and innovative blockchains, with unique flexibility to welcome various projects.

- Additional adoption : the increase in TVL seems to confirm the interest of the community, and several DApp of DEFI or Gaming are launching SU.

- Inflation problem : new sui tokens being regularly released, the sales pressure can slow down price growth. The key question remains: will the SUP ecosystem grow quickly enough to absorb the afflux of tokens?

Su sur Crypto Opinion: Adoption, hype and speculation

The major role in the adoption of protocols

To sustainably support Suis, developers and investors must continue to build and use attractive protocols:

- Dex (decentralized exchanges) ultra-fast,

- Loan and loan platforms,

- staking solutions,

- NFT marketplaces,

- Blockchain games exploiting the speed and parallelism of suis.

Each protocol that attracts a community strengthens the demand for supreme tokens. Users will need SU to pay transactions, staker or participate in governance. Thus, the more the ecosystem expands, the more the blockchain affects and the price of suis is likely to go up.

The speculative hypothesis: when the hype takes over

Cryptocurrencies are still young and therefore often moved by hype. Less technologically advanced projects than SUD have sometimes seen their token explode, powered by speculators. It is therefore obvious that the course of the suis is also influenced by the general feeling of the market. In a bull market (bull run), the demand for follow could flambé, regardless of the actual progression of the DApp. Conversely, if the global market plunges (Bear Market), even a powerful blockchain can see its token back.

Security, decentralization and governance on sui

Security: a less conflicting object model

By isolating transactions by objects, suit drastically the possibilities of simultaneous conflicts or massive fraud. Each transaction can be traced via an object identifier that records the history. Thus, if a malicious actor tries to manipulate an object, he can only affect a limited field of blockchain, which simplifies the identification of anomalies and protection against complex attacks.

Storage fund and data management

Follow also innovates with a storage fund , funding the long-term costs of on-chain storage. Users who delete obsolete data recover part of the costs, which encourages not to overload the blockchain and master the size of the history. The idea is to make the system lasting, rather than accumulating unnecessary data for eternity.

Decentralization in question

Like any Blockchain Proof of Stake, decentralization on sui depends on the number and distribution of supper tokens. With a jacket calendar that regularly releases tokens, it must be ensured that no restricted group covers the majority of the offer, at the risk of unbalanced governance. The Community of SU will have to monitor this aspect to avoid reproducing the limits sometimes observed on other POS blockchains, where some validators hold excessive power.

Comparison with other new generation blockchains

Sui vs Solana

- Similarities : both want to be fast blockchains, with high speed, with inexpensive transactions.

- Notable differences Solana 's architecture , based on Proof of History and an accelerated sequential treatment.

- Common challenges : Keeping user confidence by avoiding breakdowns, network congestion, and stimulating an ecosystem of constantly expanding applications.

Suis vs Ethereum

- Performances : Ethereum is slower and more expensive in costs, even if the transition to ETH2 ( Proof of Stake Layer 2 solutions gradually change the situation.

- Ecosystem : Ethereum remains the richest blockchain in DApp S, developers and capital. Follow must compete in innovation and attract major projects if it wants to become a lasting alternative.

- Philosophy : Ethereum values an already mature ecosystem, while Suis positions itself as a new, more agile solution, but still little run in intensive production.

Su vs aptos

Aptos, also founded by former Meta engineers, emphasizes Move language. SUI also uses MOVE, but with specific adaptations oriented around object logic. The two projects follow a similar trajectory, seeking to establish itself as the new generation of POS blockchains. On most of the plans (speeds, objectives, founding teams), they look alike, hence the importance of following her singularity - which she tries to do through her object -oriented structure.

Where to buy sui?

If you want to buy suis , several centralized exchange platforms (CEX) allow you to easily acquire by using traditional currencies or other cryptocurrencies. Among the most reliable options, we find Binance , Coinbase and Bitvavo .

- Binance is one of the largest exchanges in the world, offering high liquidity and competitive costs. It allows you to buy suis with bank cards, separate transfers and other cryptocurrencies via trading pairs like sui/ USDT or sui/ BTC .

- Coinbase , although offering often higher costs, is an interesting option for users looking for an intuitive and regulated platform. You can buy sui in a few clicks with a credit card or a bank deposit.

- Bitvavo is distinguished by its transparency and the absence of hidden Spreads. This approved European platform makes it possible to buy suis at competitive costs and offers various payment methods, in particular Ideal , SEPA and Bancontact , which makes it particularly practical for European users.

Conclusion: Su Crypto Avis - A high potential blockchain with high inflation

If we had to summarize a SUR Crypto opinion in a few points, we would remember:

- Innovative technology : architecture object-centric and the parallel management of transactions give SUA a competitive advantage in terms of performance.

- Inflation and tokens offer : the sustained pace of liberation of tokens sui remains the main risk, because it requires that adoption is gaining power to compensate for the excess offer.

- Growth adoption : TVL is climbing, more and more Defi projects are testing blockchain, and the modular structure seduces developers.

- A uncertain future : as any new entrant, Suis must still prove itself in the face of established or emerging competitors ( Solana , Ethereum , Aptos). Market cycles and speculation can influence valuation, regardless of the quality of the protocol.

Clearly, the Blockchain Suis is not just a speculative straw fire. His solid technical foundations make him one of the serious candidates for the emergence of a new generation of blockchains capable of managing both decentralized finance, the creation of complex applications and NFT accommodation. However, everything will depend on the capacity of the ecosystem to go beyond the constraint of inflation and to consolidate its adoption . The project remains promising, but would require careful follow -up for any cautious investor.

Faq

1. What is the particularity of the structure of object objects?

The structure of objects allows each transaction to be treated independently, thus facilitating the parallelization of transactions and improving the scalability of the network.

2. How does the Tokenomics of Su?

The Tokenomics of SUD includes a total offer of 10 billion tokens, with 2.76 billion in circulation in October 2024. A monthly release of 0.82 % of the total offer occurred each 3rd day of the month, resulting in monthly inflation of around 2.8 % until June 2025.

3. What are the average gas costs on suis?

Gas on sui are particularly low, with an average of $ 0,00018 per transaction, making it one of the most affordable blockchains.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Investments linked to cryptocurrencies are risky by nature, readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. This article does not constitute an investment .

Certain links of this article are affiliated, which means that if you buy a product or register via these links, we will collect a commission from our partner. These commissions do not train any additional cost for you as a user and some even allow promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .