Tokenomics Drift : Understanding the timeline and its implications

Drift Protocol project is generating increasing interest in the decentralized finance ( DeFi ) world. For those considering investing in its native token, DRIFT , we break down the tokenomics of Drift , decentralized trading platform Solana . The evolution of the circulating supply, the token release schedule, and their potential impact on the price of DRIFT play a major role in any investment decision.

Table of contents

What does Drift Protocol offer?

Drift Protocol is a decentralized trading platform built on the Solana . It offers:

- Trading perpetual contracts with leverage up to 50x on major assets such as Bitcoin ( BTC ) , Ethereum (ETH) or Solana (SOL) .

- Spot trading with leverage up to 5x, allowing for fast and direct asset exchanges.

- Predictive markets via its BET , where users can bet on real events.

- lending and borrowing service to generate passive income.

All this without KYC (identity verification), while maintaining full custody of your funds in a non-custodial wallet compatible with Solana . Drift also allows shorting the market , which is prohibited on centralized exchanges in some countries (France, Belgium, etc.).

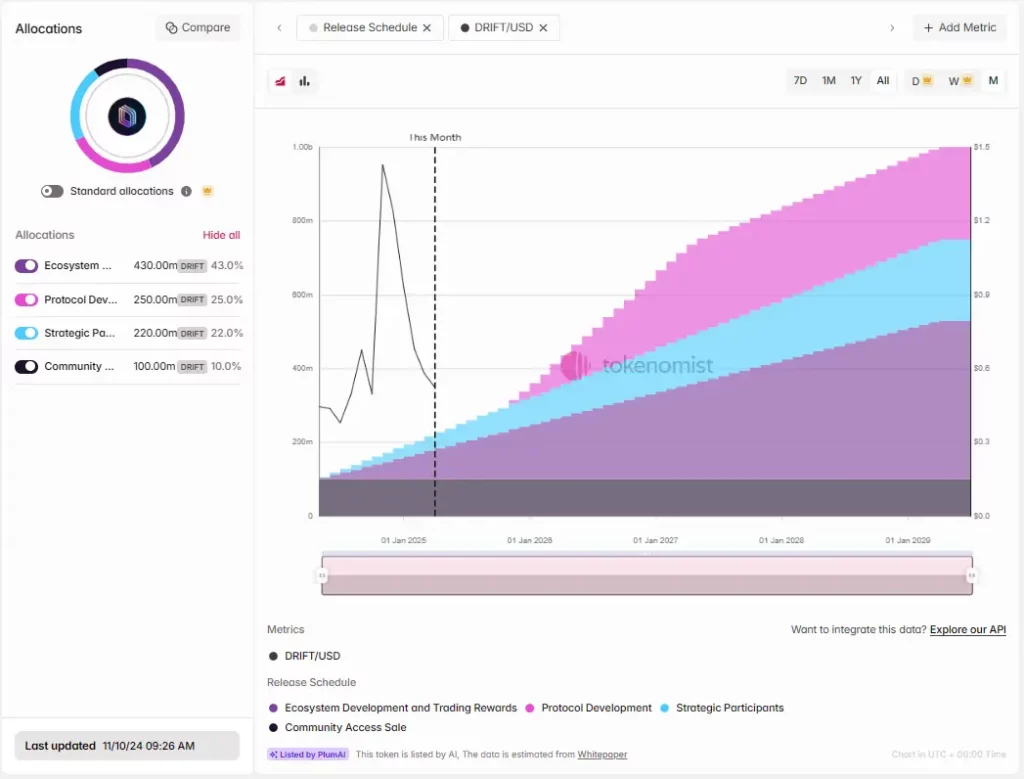

Overview of Drift Protocol tokenomics

The total supply of DRIFT is fixed at 1 billion tokens. As of April 26, 2025, approximately 227 million DRIFT are in circulation, representing about 23 % of the total supply. This means that the majority of the tokens (approximately 77%) are still locked but will be gradually released according to a specific schedule.

Initial distribution of DRIFT tokens

The distribution of tokens follows a strategic logic to support the project's growth:

- Ecosystem development and trading rewards : 43% (430 million DRIFT ).

- Protocol development : 25% (250 million DRIFT ).

- Strategic participants : 22% (220 million DRIFT ).

- Community sale : 10% (100 million DRIFT ).

This data is directly visible on aggregators like Tokenomics .

Tokenomics Drift : Token Unlock Schedule, Cliff, and Linear vesting

The launch of the DRIFT was accompanied by a carefully designed vesting

- A Cliff Unlock took place in May 2024, releasing approximately 100 million DRIFT , representing nearly 44% of the current circulating supply.

- Starting in November 2025 , a new cycle of mass release begins, with approximately 463,000 DRIFT being unlocked each day for several months.

- Between November 2025 and May 2027 , the supply in circulation will almost triple, which represents strong inflationary pressure .

Who are the newly released tokens intended for?

- Ecosystem development : to fund trading rewards, liquidity incentives, future airdrops.

- Protocol development : remunerate developers, support improvements and innovation.

- Strategic participants : partners who have invested in or supported the project from its inception.

- Community sale : reserved for initial users who participated in the launch.

This planned release stems from a successful initial fundraising round that financed development without relying solely on the secondary market. The strategy aims to balance the injection of liquidity with the long-term valuation of the project.

Impact of token release schedule on price

The sales pressure generated by the rapid increase in available supply could put downward pressure on the price of DRIFT , especially between the end of 2025 and 2027. During each new unlocking phase:

- Beneficiaries can sell their tokens to secure their earnings.

- The market needs to absorb a significant amount of new tokens.

- Dilution can slow price growth if demand does not increase as quickly as supply.

To better anticipate these effects and estimate future price levels, feel free to consult our article dedicated to our Drift Protocol price predictions .

Why does Drift remain attractive despite inflation?

Despite the prospect of significant dilution, Drift Protocol retains several major advantages:

- Its decentralized trading operates without banking intermediaries or intrusive verification.

- The ability to retain full ownership of one's assets through one's own portfolio.

- Access to short selling is often impossible on centralized platforms in certain jurisdictions.

- Competitive trading fees compared to market standards.

- Growth potential if DeFi volumes continue to migrate away from CEXs .

Visual summary of Drift 's tokenomics

- Maximum offer : 1 billion DRIFT

- Offer valid until April 26, 2025 : ~30 %

- Next mass releases : starting in November 2025

- Expected completion of most of the vesting : sometime in 2027

Where to buy DRIFT ?

DRIFT token is available on several platforms:

- Bitvavo An excellent option for European users, offering:

- Fees among the lowest on the market.

- regulated environment registered with the financial authorities (Netherlands).

- Local deposit methods (SEPA, iDeal, bank cards).

- An intuitive interface suitable for both beginners and advanced users.

- Kraken : A solid and globally recognized platform, suitable for experienced traders.

- Directly on Drift Protocol via its spot market by pairing DRIFT / USDC (by connecting via Phantom, Trust Wallet , Exodus etc).

Conclusion

Understanding Drift Protocol 's tokenomics is essential to assessing its investment potential. Between a fairly aggressive phased release model starting in late 2025 and solid technological and commercial fundamentals, Drift decentralized trading universe .

If you're considering buying DRIFT , be aware of the upcoming inflationary environment while keeping an eye on the growing DeFi ecosystem on Solana . And for a more in-depth analysis, consider checking out our price predictions for the Drift Protocol.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .