From Trust Wallet to bank account: essential methods for converting your crypto to fiat currency

Looking to transfer your crypto assets from Trust Wallet to your bank account ? There are several ways to sell your cryptocurrencies and receive fiat currency (euros, dollars, etc.) in your account. In this article, you'll understand the two main methods for making this withdrawal. The first involves using providers integrated directly into the mobile app , and the second involves transferring your funds to a centralized exchange platform ( CEX ). Each approach has its advantages and disadvantages in terms of transaction fees , availability , and processing times . Discover which one suits you best.

Table of contents

From Trust Wallet to bank account: Advantages and disadvantages of both methods

Before going into the technical details, here's a quick overview of the strengths and limitations of each approach to migrating from Trust Wallet to a bank account :

- Use an integrated payment provider (MoonPay, Ramp, etc.)

- Advantages : quick to implement, directly accessible from the Trust Wallet , smooth interface.

- Disadvantages : fees can be high (service fees, bank card or SEPA transfer KYC steps with the provider.

- First, transfer your cryptocurrencies to a centralized exchange

- Advantages : more liquidity , often lower transaction fees stablecoins against USD/EUR) before selling.

- Disadvantages : requires additional handling ( sending cryptos from Trust Wallet to the exchange platform ), requires mastering the CEX interface and waiting for the transaction to be finalized ( blockchain + internal exchange delays).

In both cases, you will need to convert your tokens to fiat currency via a crypto-to-fiat bridge . The choice depends on your profile, your location, and the cryptocurrency you are looking to sell.

From Trust Wallet to bank account: Trust Wallet 's built-in providers

1. Overview of integrated services

Trust Wallet is a non-custodial wallet focused on security and decentralization . It does not directly handle bank withdrawals , but it offers third-party partners for buying and selling cryptocurrencies. These providers include:

- MoonPay : known for its simple interface and range of supported crypto-assets

- Ramp or Transak : other solutions offering crypto-to-fiat in various regions of the world.

The main advantage: you can complete the conversion directly from the mobile app , without going through another website. However, the fees charged by these providers can be high, especially if you sell frequently or in large amounts.

2. Practical steps to sell your cryptos through an integrated provider

The procedure varies slightly depending on the provider, but the basics remain similar. Let's say you want to sell BTC or ETH with MoonPay . Here are some example instructions:

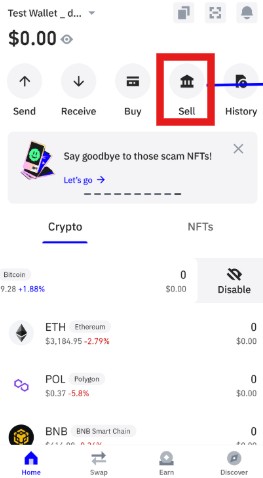

- Open Trust Wallet on your phone.

- In the Home Sell option or “Sell” (depending on the interface version)

- You will probably be asked for identity documents and a bank account statement (RIB) for the SEPA transfer .

- After confirmation, the third-party service calculates its network and conversion fees.

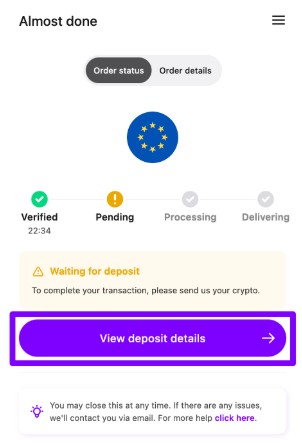

- Send the amount to crypto at the address provided by the service provider.

- You may need to scan a QR code or manually enter the delivery address.

- Once the transaction is validated on the blockchain , the service provider will send you the sum in euros (or dollars) to your bank account .

Costs and deadlines

Transaction fees include :

- Provider fees ( MoonPay , Ramp…): a percentage plus a fixed amount, depending on your country.

- Gas fees : the blockchain may require a commission (often on Ethereum or BNB Smart Chain).

- bank charges (rare, but some banks charge for receiving international transfers).

Delivery times vary between 1 and 5 business days, depending on your location and the wire transfer method used. Some solutions (e.g., bank cards ) are faster but more expensive.

Advantages of this solution

- No need to create a new account on an exchange .

- The process is relatively simple; everything is done within Trust Wallet .

- Ideal for one-off sales or small amounts.

Disadvantages

- Fees can sometimes be high: the percentage can range from 2% to 5%, or even more, depending on the service provider .

- Limit if you sell large quantities or if you have to manage several unsupported LTC coins ltc

- Withdrawal limits may be low, depending on your country's regulations.

For many casual users, this solution remains attractive for transferring digital assets into euros or USD without additional handling.

From Trust Wallet to bank account: Part 2, Using a centralized exchange platform (CEX)

1. Presentation of the method

The second option is to transfer your crypto from Trust Wallet to a centralized exchange like Binance , OKX , or Bitvavo . Once your tokens are received on this CEX, you can sell them for fiat currency (EUR, USD, etc.) and withdraw the bank account. The principle is simple:

- Locate the deposit address on the exchange (corresponding to your cryptocurrency).

- Send your funds from Trust Wallet to this address.

- blockchain confirmation .

- Sell your cryptos on the CEX, either directly at the market price (market order), or via a limit order to potentially obtain a better price.

- Make a SEPA transfer or a card withdrawal from the CEX to your bank account .

This is the preferred method for many regular users, as the fees are often lower than with integrated providers. However, there are a few nuances to consider.

2. Concrete steps to withdraw your cryptos via a CEX

a) Preparation on Trust Wallet side

- Check that you have enough cryptocurrency to cover the gas fees . For example, if you are sending ERC -20 , you will need ETH to pay for the transaction.

- Identify the token you want to transfer ( BTC , ETH, BNB …) and select the associated blockchain Trust Wallet .

b) Retrieve the deposit address on the exchange platform

- Log in to your account on a centralized exchange .

- Go to the “ Deposit” section.

- Choose the cryptocurrency and carefully check the network (for example: ERC-20 or BSC) so as not to make a mistake.

- Copy the delivery address .

c) Transfer from Trust Wallet to the exchange

- Open Trust Wallet and select the cryptocurrency in question.

- Press Send or “Send”.

- Paste the previously copied drop-off address.

- Enter the amount you wish to transfer.

- Confirm and pay the network fees .

- Wait for confirmation (may vary from a few seconds to several minutes depending on the blockchain ).

To see the steps in detail, screenshot by screenshot, we have created an identical example with Exodus in our free guide which can be downloaded below:

d) Sale on the exchange platform

- Once the funds have arrived, your balance on the CEX should show the amount received.

- Go to the Trading or Markets .

- Choose the pair that corresponds to your crypto. For example, if you have BTC and want euros, look for the BTC /EUR .

- Sell your cryptos via a market order (immediate execution) or a limit order (price control but uncertainty regarding execution time).

The balance is then found in euros (or dollars) in your CEX fiat wallet.

e) Fiat withdrawal to your bank account

- Go to the Withdraw in fiat currency.

- Select your method: SEPA transfer , bank card , sometimes PayPal .

- Enter your bank details (IBAN, SWIFT, etc.) if this is your first time.

- Confirm the transaction. Transfer times generally vary between 1 and 3 business days for a wire transfer.

The money arrives in your bank account . Depending on the platform, a fixed fee or a percentage applies, but these fees are generally lower than with Trust Wallet .

3. Advantages and limitations of using a CEX

- Benefits :

- Lower transaction fees

- Wide selection of trading pairs , including stablecoins such as USDT , USDC , BUSD, DAI, etc.

- You can optimize your conversion by choosing the right time to sell, or use advanced orders to take advantage of volatility .

- Disadvantages :

- Requires creating an account on an exchange , with KYC and two-factor authentication .

- This involves a two-step process: crypto transfer → sale → fiat withdrawal.

- Additional time to familiarize oneself with the interface (especially for beginners in trading ).

Despite these minor drawbacks, the majority of traders and advanced users prefer to use this method for its flexibility and reduced costs.

From Trust Wallet to bank account: Similarities and key points to remember

- KYC verification : whether you use an integrated provider or a centralized exchange , expect to have to prove your identity (identity card, passport, proof of address…).

- Cryptocurrency security : Before transferring your funds, make sure you are on the correct network. A blockchain or address error could result in the loss of your tokens .

- Costs : Always check gas charges and service fees, and compare prices if possible. The more transactions you make, the more crucial cost optimization becomes.

- Timeframe : Bank transfers can take 1 to 5 days depending on the geographical area. With some services, you can receive the money faster, but at a higher price.

- Liquidity : If you are selling exotic cryptocurrencies, not all providers or exchanges support them. In this case, it is sometimes necessary to first convert to stablecoins ( USDT , USDC ) or BTC /ETH to finalize the withdrawal.

From Trust Wallet to your bank account: Conclusion, Which option to choose?

Ultimately, sending your crypto from Trust Wallet to a bank account is quite simple, provided you understand the two main methods:

- Use integrated service providers as MoonPay, Ramp, Transak directly from the application.

- Easy to set up.

- Potentially higher costs and variable geographical coverage.

- Transfer your assets to a centralized exchange (Binance, Coinbase, Kraken, etc.).

- Lower costs.

- More control over liquidity and sale date.

- Additional steps (creating an account, going through trading ), but profitable for significant amounts.

For small sales or occasional use, the first solution may suffice, while more active users — or those looking for fees — will prefer a centralized exchange .

⚠️ Important note : Some users occasionally report the apparent disappearance of funds from Trust Wallet . In most cases, this is due to either a temporary display error or a security breach that led to a compromise. Before panicking, consult our comprehensive guide on the subject to understand the possible causes and what to do by following the blue link.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice .

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .