Which crypto miner should I use in 2025?

Want to know which crypto to mine in 2025 and whether mining will still be profitable? Let's start with what interests you most: the profitability of each method, from the simplest to the most demanding in terms of hardware. This article gets straight to the point: you'll see why some cryptocurrencies are practically no longer viable for individuals and which ones can still offer returns . We'll use data from whattomine.com market trends .

Table of contents

Which crypto mining to use in 2025: GPU mining, limited profitability in 2025

GPU mining has long been a popular choice thanks to its flexibility and relative accessibility. However, recent statistics from whattomine.com show that most cryptocurrencies mined via GPUs generate very low gross revenue and, more importantly, often show negative profits after electricity costs are deducted. Let's see why.

Strong competition and increased difficulty

- The hash rate on many blockchains is constantly increasing, making Proof of Work more difficult to achieve.

- Algorithms designed to be GPU-friendly (ProgPow, KawPow, modified Equihash) sometimes end up being overrun by specialized farms. As a result, the difficulty increases and the individual reward decreases.

- Energy costs are rising, eroding any chance of profitability for an individual.

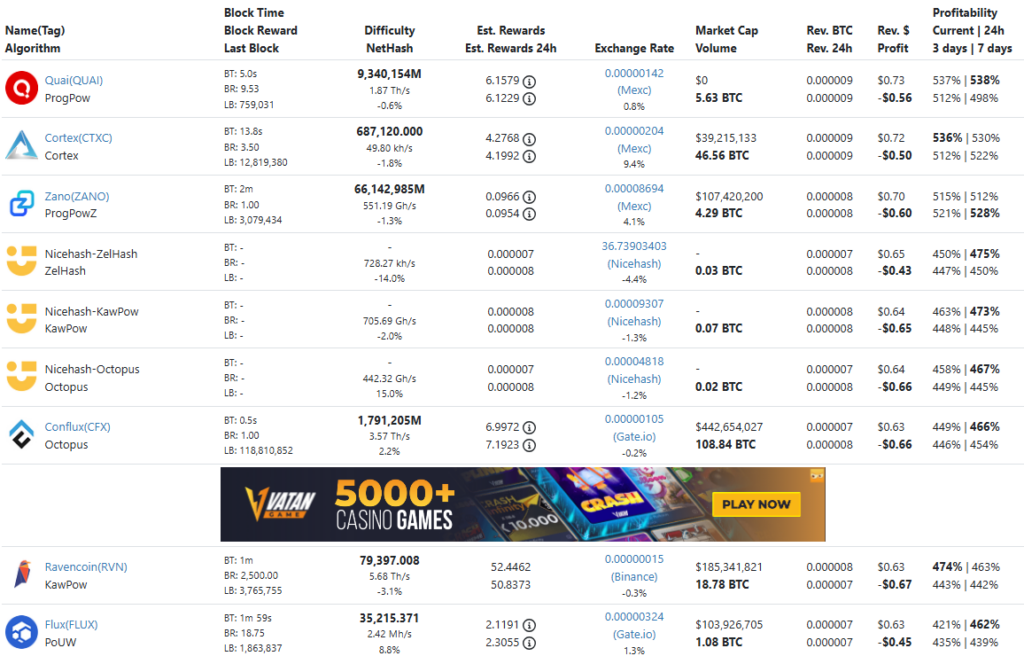

Concrete examples on Quai, Cortex and Zano

Recent data (March 2025) shows that projects like Quai (QUAI) , Cortex (CTXC) or Zano (ZANO) do not generate enough revenue to cover electricity costs.

- Quai : ProgPow algorithm, block reward of approximately 9.53 QUAI, but a negative daily profit (-$0.56 according to whattomine.com) for a standard rig.

- Cortex : AI project, Cortex algorithm, which often generates -$0.51 net profit, despite a block reward of 3.50 CTXC.

- Zano : ProgPowZ, block reward at 1.00 ZANO, bringing a gross gain of $0.71 per day but a profit of approximately -$0.59.

Admittedly, these cryptocurrencies sometimes boast profitability rates exceeding 400% in certain rankings. But be warned: this "raw" figure simply compares the relative profitability between different cryptocurrencies, without including the cost of electricity. Ultimately, the net result often remains negative.

Main reasons for this deficit

- Low prices : the majority of these tokens trade at a few cents, or even less, which is not enough to cover the costs.

- ASIC wave : some ProgPow or KawPow algorithms do not (yet) have official ASICs, but as soon as an ASIC or FPGA solution is released, the hashrate explodes.

- Expensive electricity : at $0.12/kWh or more, it is virtually impossible for an "amateur" miner to make their rig .

Quick conclusion on GPU mining

Despite the versatility of GPUs (they can be repurposed for other algorithms or even resold to gamers), GPU mining remains unattractive in 2025. Actual figures indicate that you risk paying more in electricity than you earn in cryptocurrency. For a hobbyist, it might be feasible, but to make a profit, it's better to look for more suitable solutions.

Which crypto to mine in 2025: ASIC mining: the most profitable, but at what price?

ASICs (Application-Specific Integrated Circuits) are machines designed to mine a specific algorithm. By 2025, according to whattomine.com , they will clearly dominate the mining in terms of gross profitability, particularly for cryptocurrencies like Bitcoin , Dogecoin , eCash , and DGB . However, investing in an ASIC is not without risk.

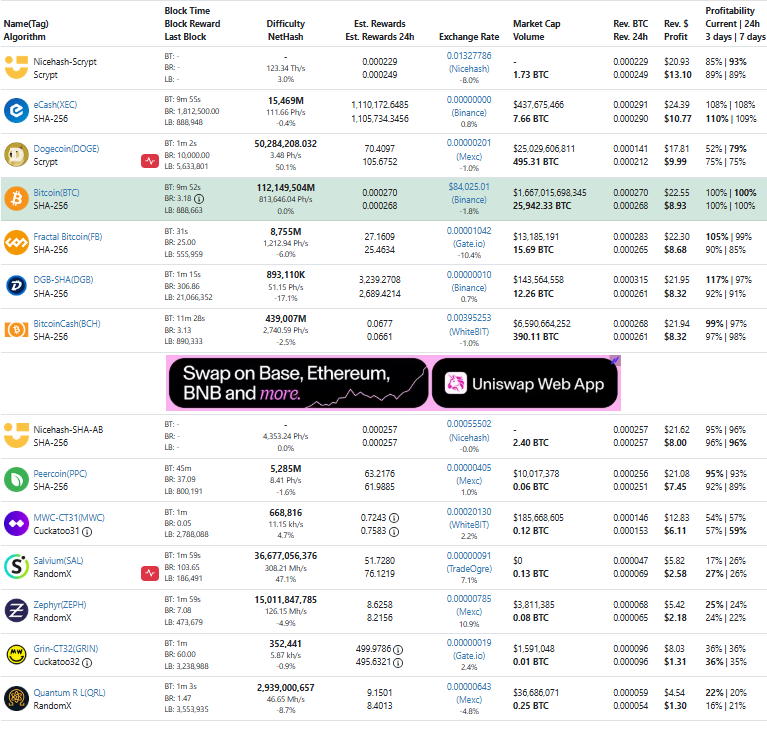

Which crypto miner should you use in 2025? SHA-256 ASICs: Bitcoin, eCash, and Fractal Bitcoin

- Bitcoin ( BTC ) remains the benchmark: block reward of 3.19 BTC post-halving, massive difficulty (112,149,504M), and an hashrate of around 821,000 Ph/s. A latest-generation ASIC (Antminer S19, for example) can generate approximately $22.55 in daily revenue for a net profit of $8.92, based on the energy tariff of $0.10/kWh.

- eCash (XEC) : Block reward of 1,812,500 XEC, block time of 10 minutes. Daily earnings can reach approximately $24.39, with a profit margin of around $10.87 after costs. Price fluctuations (which are highly volatile) have a significant impact.

- Fractal Bitcoin (FB) : a newer SHA-256 project, sometimes offering $26-27 gross income with competition that remains low.

Which crypto to mine in 2025? Scrypt ASICs: Dogecoin and Litecoin in merged mining

Dogecoin (DOGE) mining is inextricably linked to Litecoin ( LTC ) , as both cryptocurrencies share the Scrypt algorithm and are mined simultaneously through merged mining . This means that a miner cannot mine only DOGE Litecoin blocks in parallel.

With a high-performing Scrypt ASIC like the Antminer L7 , it's possible to generate $18 to $20 in gross revenue per day , but Litecoin mining , which shows a net loss on whattomine.com . In other words, DOGE alone could be much more profitable, but the requirement to mine LTC significantly reduces overall profits .

Although Litecoin is structurally less speculative than DOGE Dogecoin revenue stability. However, miners must monitor the Dogecoin price , which is the primary driver of profitability for this pair.

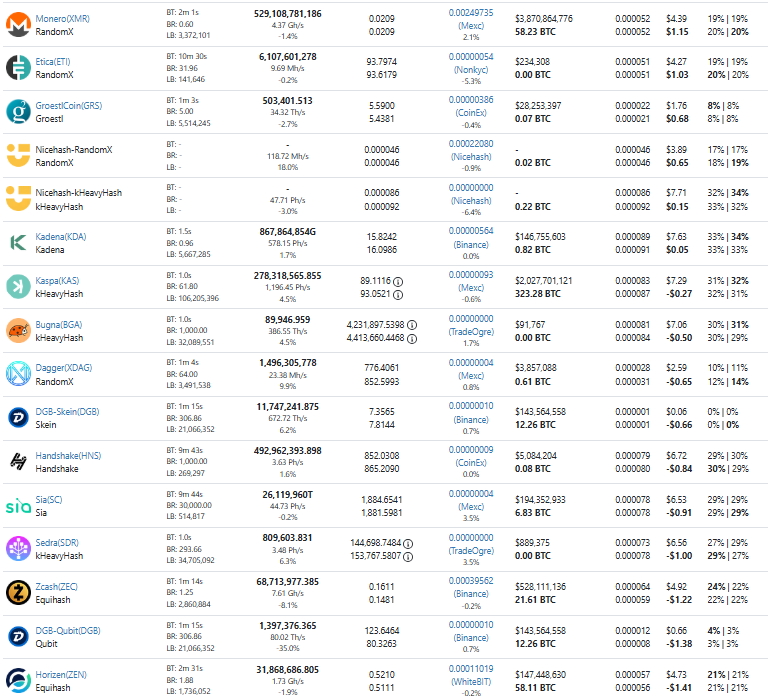

Which crypto miner will be best in 2025? Kaspa (KAS): the fallen star of kHeavyHash

Kaspa made headlines in 2024 with its ultra-profitable ASICs at launch (KS3, KS5, etc.). Miners could earn over $130 per day initially, but then the difficulty skyrocketed and profitability plummeted.

- Its algorithm, kHeavyHash , and its distribution policy (-8% rewards per month) compress profits as soon as the overall hashrate

- The latest models, like the Antminer KS3, sold for over $10,000 at launch. Today, these machines earn less than $8 a day and are operating at a loss.

Which crypto miner to use in 2025? Advantages and disadvantages of ASICs for individuals

- Benefits :

- Better energy efficiency than GPUs.

- Profitability is often higher when the share price remains stable.

- A stable algorithm (SHA-256 or Scrypt) can last for several years.

- Disadvantages :

- Very high initial cost ($2,000 to $10,000 or more).

- An ASIC is dedicated to only one algorithm; it is impossible to switch to another crypto if profitability falls.

- The noise and heat generated are high, requiring a dedicated space and a good cooling system.

Summary: ASIC, a deliberate choice

In 2025, ASICs will still offer the best profitability , provided you have access to low-cost electricity (hydroelectric, subsidized zones, etc.) and actively monitor the price of the mined cryptocurrency. If you're an individual with a limited budget, it's best to carefully calculate your ROI before investing. Returns are more stable than with GPUs, but competition is fierce and technology becomes obsolete quickly.

Which crypto miner to use in 2025: CPU mining, niche or opportunity?

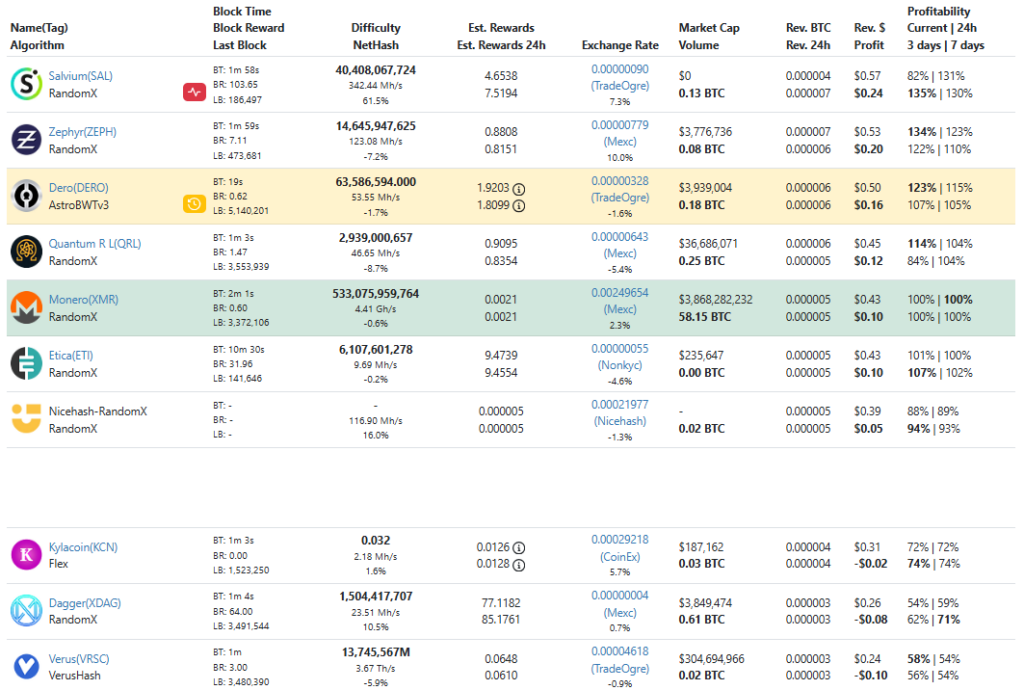

CPU mining focuses on cryptocurrencies that are resistant to ASICs and sometimes poorly suited to GPUs . Key examples in 2025 include Monero (XMR) , Zephyr (ZEPH) , Dero (DERO) , and Etica (ETI) , all based on a RandomX (or variant thereof).

Which crypto miner should you use in 2025? Monero (XMR), the benchmark for privacy

- Algorithm : RandomX, regularly updated to eliminate ASICs and maintain decentralization .

- Block reward hovering around 0.62 XMR (constantly decreasing depending on the controlled emission), for a block time of 2 minutes.

- A high-end CPU (AMD Ryzen 9) can generate approximately $0.50 net per day with Monero, according to whattomine.com .

Although this number remains modest, the Monero community is strong. Those who value privacy prefer to mine XMR rather than buy it on a centralized exchange.

Which crypto to mine in 2025? Zephyr (ZEPH) and Dero (DERO)

- Zephyr : 15-second block time, reward ~7.08 ZEPH. Market data indicates a gross profit of $0.40 to $0.50 per day for one CPU. The price of ZEPH is highly volatile, which can create brief profit windows.

- Dero AstroBWTv3 algorithm , ~19 s block time. Total daily earnings close to 1.90 DERO on the network, but few CPU miners achieve a net positive balance if electricity is expensive.

Which crypto miner will be best in 2025? Threats and limitations of CPU mining

- CPU mining remains the slowest and least profitable : we are talking about a few cents or fractions of a dollar net, depending on the location.

- The energy consumption of a CPU is not enormous, but the gains/expenses ratio often remains very low.

Conclusion on CPU mining

Mining on a CPU in 2025 is more of a political statement (supporting a niche or decentralized cryptocurrency) than a profit-making . If you already own a powerful CPU and want to accumulate some Monero or Dero without investing in an ASIC or GPU , why not? But don't expect to generate any real income.

Which crypto to mine in 2025: Can an individual still mine in 2025? Key points

Based on data from whattomine.com , it's clear that mining has become highly competitive. Here are the key points to consider before embarking on this adventure.

The cost of energy, the primary profit driver

- At $0.05/kWh, a machine or ASIC can still be profitable . At $0.15/kWh, you'll likely pay more for electricity than you earn in crypto.

- The halving intensifies the pressure, as the block reward decreases and competition does not weaken.

Cryptocurrency selection and market monitoring

- The price of a mined coin remains crucial: a simple doubling of the value can transform a loss-making operation into a treasure.

- An ASIC calibrated on a stable algorithm (SHA-256, Scrypt) retains a higher second-hand value than specialized hardware on an ephemeral project.

Investment size and time horizon

- If you opt for a ASIC , expect a budget of several thousand euros and a potentially long depreciation period.

- With a GPU , you have flexibility (resale to players, switching to another algorithm, etc.) but the risk of zero or negative profit is high.

- CPU mining is accessible to almost everyone, but the financial margin is small, or even non-existent, unless you have free or subsidized electricity.

Conclusion: Which crypto mine should you use in 2025 based on your profile?

Let's recap based on your equipment and objectives:

If you are hesitating between a GPU or an ASIC

- GPU : Less profitable according to current charts from whattomine.com , most profits are negative (Zano, Cortex, etc.). It's best to consider this option if you want to participate in emerging projects, support a specific algorithm, or retain the ability to resell your graphics card.

- ASICs : More expensive, but potentially more stable in the long term if you target major cryptocurrencies (Bitcoin, Litecoin / Dogecoin , etc.). Gross earnings can reach around $20-25 per day, with net profits of $8-12 depending on electricity costs.

If you wish to mine using the CPU

- Monero remains the leading cryptocurrency for privacy and decentralization . You can generate approximately $0.40-$0.50 per day with a high-end processor.

- Dero , Zephyr , and Etica sometimes show peaks in profitability, but this is highly variable. The market remains too small to guarantee sustainable gains.

Final advice

- Calculate your costs and potential gains precisely using a simulator (like whattomine.com ), taking into account the cost of kWh, the actual hashrate and price fluctuations.

- Keep an eye on ASIC manufacturers' news : a new, more efficient machine can cause your equipment's profitability to plummet in a matter of weeks.

- Anticipate the resale of your equipment if you see that the difficulty increases too quickly or that a competitor offers an ASIC twice as powerful.

In short

- GPU mining is virtually unprofitable by 2025, except in very specific cases.

- ASICs Bitcoin , Dogecoin , eCash), but require a significant investment.

- CPU mining is still possible (Monero, etc.), but it yields little.

The final choice depends on your budget, your energy rates and your knowledge of the market .

Here's the essential information for realistically which crypto mine to use in 2025. blockchains and algorithms, and keep in mind that profitability is heavily dependent on volatility . Mining is a field where patience, staying up-to-date with technological advancements, and sound risk management remain crucial.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .