What crypto mine in 2025?

Do you want to know which crypto mine in 2025 and if the mining remains profitable? Let's start with what interests you most: the profitability of each method, from the simplest to the most demanding in terms of equipment. This article is going straight to the point: you will see why certain cryptocurrencies are almost no longer viable for an individual and which can still offer correct profitability We will rely on data from whattomin.com market trends .

Table of contents

What crypto mine in 2025: GPU mining, limited profitability in 2025

The Mining GPU has long been a popular choice thanks to its flexibility and its relative accessibility. Whattomine.com statistics show that most shabby cryptos via graphics card display very low gross income and, above all, profits often negative once the electricity has been deducted. Let's see why.

Strong competition and increased difficulty

- The chopping rate on many blockchains is constantly increasing, making proof more difficult to satisfy.

- Algorithms designed to be GPU-friendly (Progpow, Kawpow, modified Equihash) sometimes end up invaded by specialized farms. Result: the difficulty climbs and the individual reward falls.

- Energy costs are increasing, cutting off any chance of profitability for an individual.

Concrete examples on Quai, Cortex and Zano

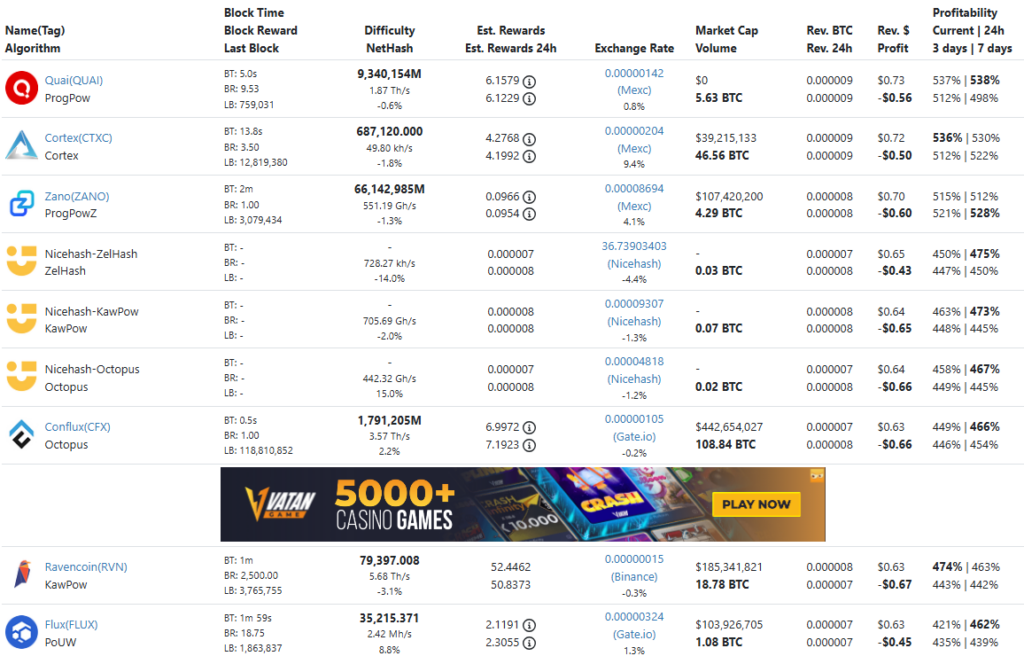

Recent data (March 2025) show that projects like Quai (Quai) , Cortex (CTXC) or Zano (Zano) do not report enough to cover electricity expenses.

- Quai : Progpow algorithm, Block Reward of around 9.53 quai, but a negative daily profit (-0.56 $ according to Whattomine.com) for a standard RIG.

- Cortex IA project , algorithm Cortex, which often gives up $.51 in net profit, despite a block reward at 3.50 CTXC.

- Zano : Progpowz, Block Reward to 1.00 Zano, bringing a gross gain of $ 0.71 per day but a profit of approximately $ -0.59.

Admittedly, these cryptocurrencies sometimes display profitability presented at more than 400 % on certain rankings. But beware: this “gross” figure simply compares the relative profitability between different cryptos, without including the electricity bill. In the end, the net balance sheet often remains negative.

Main reasons for this deficit

- Low price : the majority of these tokens are negotiated with a few cents, or even less, which is not enough to cover the costs.

- Wave asic : some Progpow or Kawpow algorithms do not (yet) have (yet) official, but as soon as an ASIC or FPGA solution is born, the hashrate explodes.

- City electricity : $ 0.12/kWh or more, it is almost impossible for an “amateur” minor to make his RIA .

Quick conclusion on the Mining GPU

Despite the versatility of the GPU (it can be reassigned to another algorithm or even sold to gamers), GPU mining remains unattractive in 2025. The real figures indicate that you risk paying more electricity than you will gain in cryptocurrencies. For an enthusiast, it is possible, but to make a profit, it is better to turn to more suitable solutions.

What Crypto Mininer in 2025: Minage by Asic: the most profitable, but at what price?

The ASIC (Application-Specific Integrated Circuits) are machines designed to undermine a precise algorithm. In 2025, according to Whattomine.com mining market in terms of gross profitability, especially on cryptos like Bitcoin , Dogecoin , Ecash or DGB . However, investing in an ASIC is not trivial.

What crypto mine in 2025? Asic Sha-256: Bitcoin, Ecash and Fractal Bitcoin

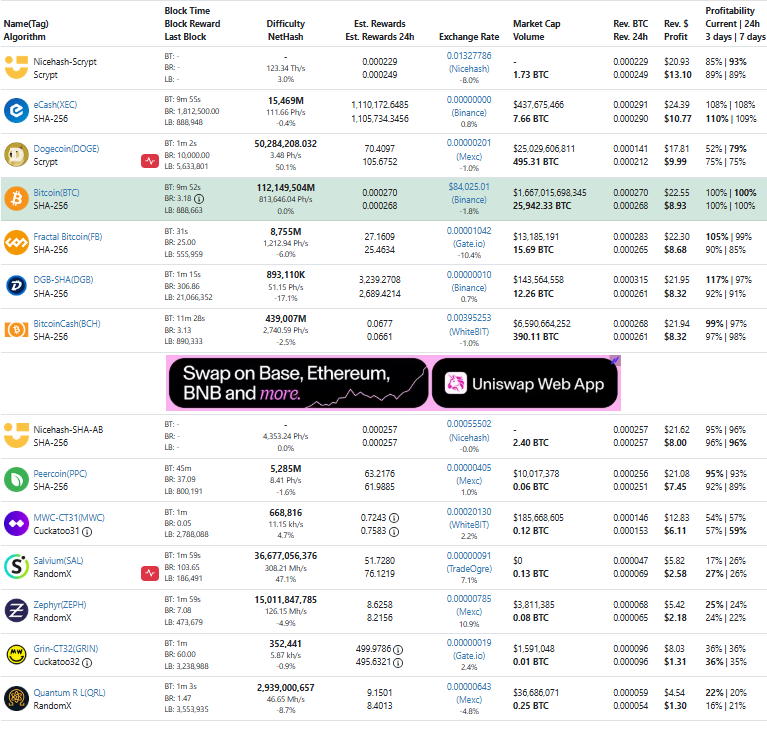

- Bitcoin ( BTC ) remains the reference: Block Reward at 3.19 BTC post-Halving, massive difficulty (112,149.504m), and a hashrate around 821,000 ph/s. A latest generation ASIC (Antminer S19, for example) can generate about $ 22.55 in daily income for $ 8.92 net profit, according to the energy price grid of $ 0.10/kWh.

- ECASH (XEC) : Block Reward of 1,812,500 XEC, Block Time at 10 minutes. Daily income can be around $ 24.39, with around $ 10.87 in margin after costs. Price variations (very volatile) strongly influence.

- Fractal Bitcoin (FB) : a more recent SHA-256 project, sometimes offering $ 26-27 in gross income with competition that remains low.

What crypto mine in 2025? ASIC SCRYPT: Dogecoin and Litecoin in merged mining

Dogecoin 's mining (DOGE) is inseparable from that of Litecoin ( LTC ) , the two cryptos sharing the SCRYPT algorithm and being mined simultaneously via the Merged Mining . This means that a minor cannot extract only Doge Litecoin blocks in parallel.

With an efficient ASIC SCRYPT like the Antminer L7 , it is possible to generate $ 18 to $ 20 in day revenue per day , but part of the gains is absorbed by Litecoin , which appears to be loss on whattomin.com . In other words, DOGE alone could be much more profitable, but the obligation to undermine LTC considerably reduces the overall profits .

Although Litecoin is structurally less speculative than DOGE , its integration into Merged Mining ensures a certain stability of income. However, minors must monitor the evolution of the Dogecoin price , which is the main profitability engine on this duo.

What crypto mine in 2025? Kaspa (Kas): The Faluing Star of Kheavyhash

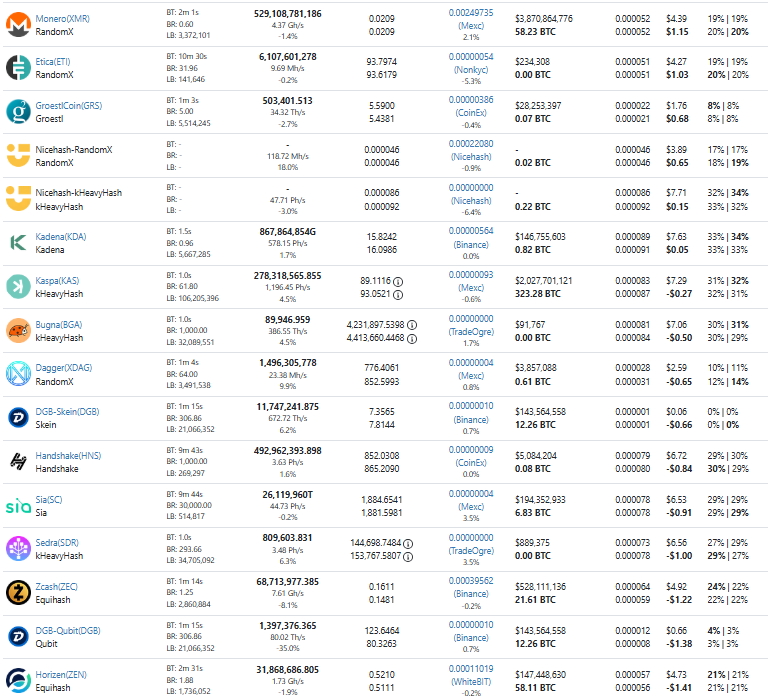

Kaspa caused a lot of ink to flow in 2024 with ultra-resentable ASICs when they launch (KS3, KS5, etc.). Minors could garner more than $ 130 a day at first, then the difficulty jumped and profitability collapsed.

- Its algorithm, Kheavyhash , and its distribution policy (-8 % of rewards per month) compress profits as soon as the Hashrate Global climbs.

- The latest models, like Antminer KS3, were sold more than $ 10,000 when they left. Today, these machines report less than $ 8 per jouret a negative profit.

What crypto mine in 2025? Advantages and disadvantages of ASICs for an individual

- Benefits :

- Better energy efficiency than GPUs.

- Putting up often higher when the course is maintained.

- A stable algorithm (SHA-256 or SCRYPT) can last for several years.

- Disadvantages :

- Very high initial cost ($ 2,000 to $ 10,000, or even more).

- An ASIC is only dedicated to a single algorithm, it is impossible to switch to another crypto if profitability falls.

- The noise and heat generated are high, requiring a dedicated space and a good cooling system.

Summary: ASIC, an assumed choice

In 2025, the ASICs retained the best profitability provided they have access to low -cost electricity (hydroelectric, subsidized areas, etc.) and actively monitor the price of the mined crypto. If you are an individual with a limited budget, it is better to carefully calculate your king before you start. The yields are more stable than on GPU, but the competition is rough and the technical obsolescence rapid.

What crypto mine in 2025: mining via CPU, niche or opportunity?

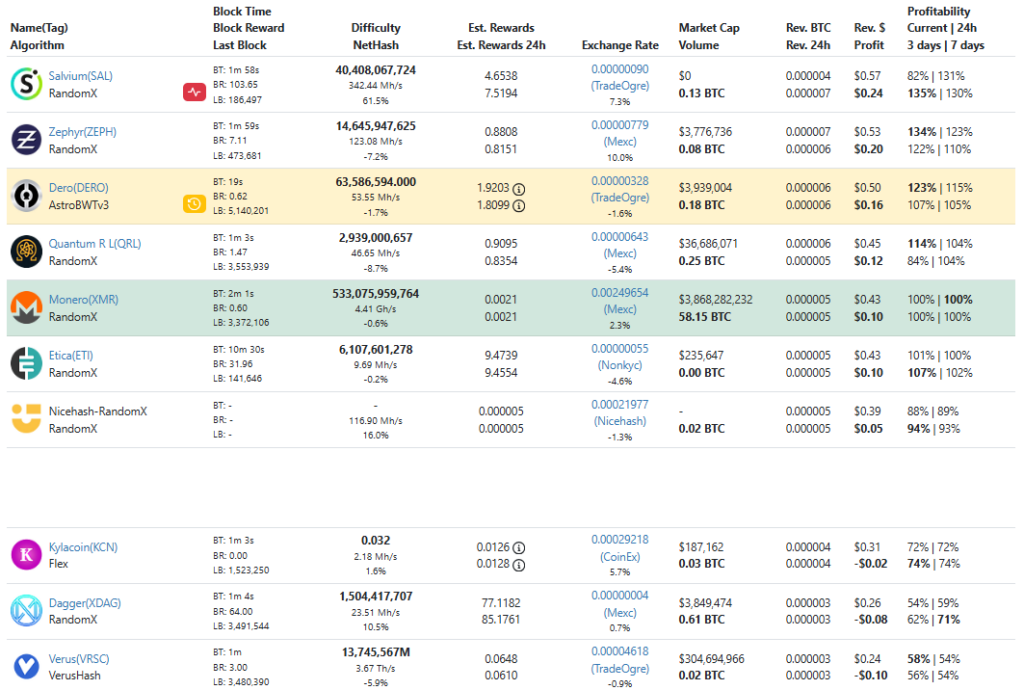

CPU mining focuses on asic and sometimes little suitable for GPUs . The flagship examples in 2025 are Monero (XMR) , Zephyr (Zeph) , Dero (Dero) or Etica (ETI) , all based on a randomx (or variant) algorithm.

What crypto mine in 2025? Monero (XMR), the reference in confidentiality

- Algorithm : Randomx, regularly updated to rule out the ASICs and maintain decentralization .

- Block Reward revolving around 0.62 XMR (in constant decrease depending on the emission controlled), for a 2 -minute block time.

- A high -end CPU (AMD Ryzen 9) can generate approximately $ 0.50 net per day with Monero, according to Whattomine.com .

Although this figure remains modest, the Monero community is solid. Those who value confidentiality prefer to mine XMR rather than buy on a centralized exchange.

What crypto mine in 2025? Zephyr (Zeph) and Dero (Dero)

- Zephyr : 15 s block time, reward ~ 7.08 Zeph. Market data indicate a gross profit from $ 0.40 to $ 0.50 per day for a CPU. Zeph's course is very volatile, which can create brief profitability windows.

- Dero Astrobwtv3 algorithm , ~ 19 S of Block Time. Gains close to 1.90 dero per day in total on the network, but few CPU minors arrive at a positive net balance if electricity is expensive.

What crypto mine in 2025? Threats and limits of CPU Mining

- CPU Mining remains the slowest and least profitable : we are talking about a few cents or fractions of dollar in clear, depending on the location.

- The energy consumption of a CPU is not huge, but the winning/expenses ratio often remains very low.

Conclusion on CPU mining

Miner on processor in 2025 is more a militant choice (supporting a confidential or decentralized crypto) than a pure profitability If you already have a powerful CPU and want to accumulate a little monero or dero without investing in an ASIC or a GPU , why not? But don't expect to make real income.

What crypto mine in 2025: can an individual still mine in 2025? Key points

Whattomine.com data , it clearly appears that mining has become highly competitive. Here are the major elements to consider before embarking on the adventure.

The cost of energy, the first profit factor

- At $ 0.05/kWh, a machine or Asic can still be profitable . At $ 0.15/kWh, you will probably pay more electricity than you will gain from cryptos.

- Halving pressure , because the block reward decreases and the competition does not weaken.

Choice of cryptocurrency and market monitoring

- The price of a mined corner remains decisive: a simple doubly of the value can transform a deficit operation into a treasure.

- An ASIC calibrated on a stable algorithm (SHA-256, SCRYPT) retains a higher used value than specialized equipment on an ephemeral project.

Investment size and time horizon

- If you opt for a high -end ASIC

- With a Rig GPU , you have flexibility (resale to players, transition to another algorithm, etc.) but the risk of zero or negative profit is high.

- CPU Mining is accessible to almost everyone, but the financial margin is low, even non -existent, except to have free or subsidized electricity.

Conclusion: What crypto mine in 2025 according to your profile?

Let's summarize according to the equipment and your objectives:

If you hesitate between the GPU or the ASIC

- GPU : Less profitable according to current paintings of Whattomine.com , most profits are in negative (Zano, Cortex, etc.). Better to consider this option if you want to participate in emerging projects, support a specific algorithm or keep the possibility of reselling your graphics card.

- Asic : more expensive, but potentially more stable in the long term if you target heavy goods vehicles (Bitcoin, Litecoin / Dogecoin , etc.). Grute revenues can be around $ 20-25 per day, with net profits of $ 8-12 depending on electricity.

If you want to mine at CPU

- Monero remains the benchmark crypto for confidentiality and decentralization . You can generate ~ 0.40-0.50 $ per day with a high-end processor.

- DERO , ZEPHYR or ETICA sometimes display peaks of profitability, but it is very variable. The market remains too narrow to guarantee lasting gains.

Final advice

- Calculate your potential costs and earnings precisely thanks to a simulator (such as whattomin.com ), taking into account the cost of kWh, real hashrate and price fluctuations.

- Monitor ASIC manufacturers' news : a new, more efficient machine can drop the profitability of your equipment in a few weeks.

- Anticipate the resale of your equipment if you see that the difficulty climbs too fast or that a competitor offers an ASIC twice as powerful.

In short

- GPU mining is almost no longer profitable in 2025, except in very specific cases.

- The ASIC dominate (Bitcoin, Dogecoin , Ecash), but require a substantial investment.

- CPU mining is possible (Monero, etc.), but reports little.

The final choice depends on your budget, your energy prices and your market knowledge .

This is the essential to determine what crypto mine in 2025 with maximum realism. Analyze your costs, monitor the evolution of blockchains and algorithms, and keep in mind that profitability depends strongly on market volatility Mining is an area where patience, technological monitoring and good risk management remain essential.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital .

To go further, read our pages legal notices , privacy policy and general conditions of use .