Who validates transactions on the blockchain?

Blockchains are often described as decentralized and secure databases. Their purpose: to record transactions without relying on a central trusted authority. But who validates transactions on the blockchain ? Without a single authority, validation relies on consensus mechanisms and different types of participants. Some are individuals, others are companies, and each plays a crucial role in ensuring the network's reliability. Let's explore how they work and what their specific characteristics are.

Table of Contents

Understanding the fundamental principles of blockchain validation

Before delving into the details of the actors involved, it's helpful to remember the basics: a transaction sent via a blockchain (whether it's Bitcoin, Ethereum Ethereum Solana Solana or another) must be verified and recorded in a block, which will be cryptographically linked to the previous blocks. Validators are the entities (or individuals) who ensure that these transactions are legitimate, that the funds are not spent multiple times, and that the protocol is being followed.

Cryptography in the service of consensus

In a blockchain, transactions are signed using a private key and then broadcast across the entire network. Nodes (connected computers) receive these transactions, validate their cryptographic signatures, and verify that the wallet has sufficient funds. The ultimate goal is to form blocks containing valid transactions and make any attempt at fraud impossible.

Why validators are essential

Without validators, no trust would exist in a distributed system. On a peer-to-peer network, anyone can claim to "create" or "spend" cryptocurrency units. Validators therefore sort the data, verify its consistency, and ensure that everyone plays by the rules set by the protocol. This includes preventing double-spending attacks, maintaining the integrity of the ledger, and enforcing consensus rules.

Who validates transactions on the blockchain: The different consensus mechanisms

The concept of a consensus mechanism refers to the method by which a distributed network reaches agreement on the valid state of the blockchain. Several exist: Proof of Work (PoW), Proof of Stake (PoS), Delegated Proof of Stake ( DPoS ), and many other variations. Each relies on validators, but the approach differs.

Proof of Work (PoW): mining

Proof Proof of Work is historically the first method, popularized by Bitcoin. Validators are called "miners." Their role is to solve cryptographic puzzles by performing intensive calculations, often using specialized hardware (ASICs). When one of them finds the correct solution, they propose a new block to the network. If this block meets the rules (valid transactions, correct format), it is added to the blockchain, and the miner receives a reward (the block reward ) and the transaction fees.

In Proof-of-Work (PoW), power is directly linked to computing power—often called hashrate . The higher a miner's hashrate, the greater their chances of mining a block. The main validators are therefore:

- Large mining pools , such as Antpool, F2Pool, Foundry USA, Binance Pool, and Via BTC , combine the mining power of several individual miners to share the rewards.

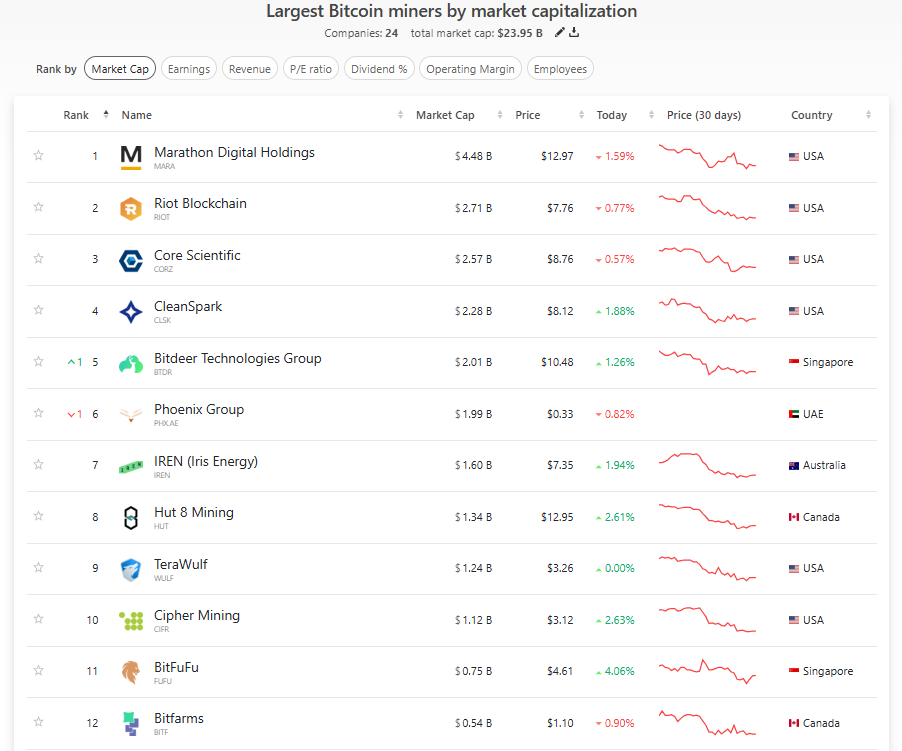

- Specialized companies such as Marathon Digital Holdings, Riot Platforms (formerly Riot Blockchain) or Bitfarms, which manage huge mining farms in areas where electricity is cheaper.

- Individuals: Some enthusiasts continue to mine from home, although profitability depends heavily on the cost of energy and equipment. It is becoming increasingly difficult for individuals to be profitable mining Bitcoin. Other, less competitive blockchains may be more attractive to individuals.

Despite its security advantage (attacking a blockchain in PoW requires considerable computing power, which is why Proof of Work is generally considered the most secure consensus mechanism), PoW is sometimes criticized for its high energy consumption.

Proof of Stake (PoS): staking

With Proof-of-Stake (PoS), validators no longer need to provide computing power. Instead, they lock a given quantity of tokens. Validators are chosen to propose or validate a block based on the number of tokens staked and a pseudo-random algorithm. The "stake" then serves as collateral: if a validator cheats, they risk losing some of their funds. This is called slashing .

Examples of Proof of Stake networks:

- Ethereum staking pools like Lido). Validators, potentially individuals or businesses, receive rewards in ETH.

- Cardano : uses Ouroboros, a Proof-of-Stake protocol where blocks are validated by "Slot Leaders" selected based on their stake (ADA). Tens of thousands of delegators participate, enabling broad decentralization.

- Tezos : here, we talk about “bakers.” XTZ holders can stake and receive rewards. Validator roles are often filled by individuals but also by companies offering professional baking services.

- Solana : combines Proof of Service (PoS) with a timestamping mechanism called Proof of History . Validators are present worldwide, ranging from individuals using home systems to specialized organizations.

PoS requires less energy than PoW and facilitates the deployment of nodes, although the concentration of tokens in certain exchanges (e.g. Binance or Coinbase) raises the question of decentralization.

Delegated Proof of Stake (DPoS)

DPoS introduces an additional layer to validation. Instead of each token holder operating a validator node, users "delegate" their tokens to "super validators" or "super delegates." These are trusted nodes elected to produce blocks and secure the network. In exchange, staking rewards are shared.

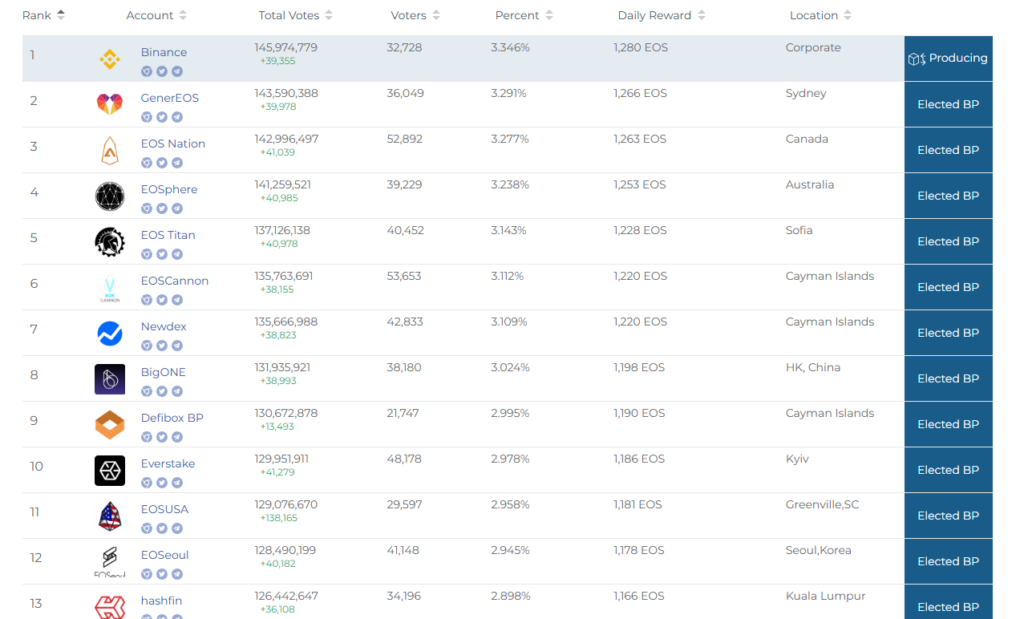

Who are these super validators ? On blockchains like EOS , there are various actors who play a key role in validating transactions and securing the network.

Among them:

-

Companies specializing in staking : Binance staking pool , is one of the main block producers on EOS. Similarly, other players like Newdex and BigONE are companies providing cryptocurrency-related services and operating as validators.

-

Independent organizations providing high availability service**: GenerEOS , based in Sydney, or EOS Nation , operating from Canada, are professional validators that maintain a robust infrastructure to ensure network continuity.

-

Diverse companies with activities in blockchain : EOS Titan , EOSCannon or Defibox BP are entities involved in various Web3 and have gained the trust of the EOS community to ensure the validation of blocks.

-

Technical infrastructures distributed throughout the world : Validators can be found in Asia (EOSphere in Australia, EOS Seoul in Korea, BigONE in Hong Kong, hashfin in Kuala Lumpur) , in North America (EOSUSA in South Carolina, EOS Nation in Canada) and in Europe (EOS Titan in Bulgaria, Everstake in Ukraine) .

The drawback of Delegated Proof of Stake (DPoS) lies in the fact that a limited number of supervalidators are used, which can potentially lead to a centralization of validation power. Nevertheless, this model improves transaction speed compared to systems like Proof of Work .

Who actually validates the transactions on each blockchain?

Who validates transactions on Proof-of-Work blockchains? The major mining companies

In the Bitcoin , the distribution of computing power ( hashrate ) is dominated by several mining pools , which play a key role in validating transactions and securing the network. These pools allow miners to combine their computing power to increase their chances of solving a block and receiving a share of the rewards. Among the most influential pools are:

- Antpool , operated by Bitmain , a mining hardware giant.

- F2Pool , one of the oldest mining pools, active since 2013.

- Foundry USA , dominating the North American market , is largely backed by institutional companies.

- Via BTC , a major player of Chinese .

- Binance Pool , linked to the Binance platform , attracts many miners due to its integrated ecosystem.

More information about the rewards can be found here.

How does a pool coordinate miners' contributions?

Each mining pool functions as a centralized software platform , responsible for orchestrating and optimizing the distribution of work among thousands of miners connected worldwide. This coordination relies on several technical aspects:

-

Distribution of calculations :

- Each miner participating in the pool does not work on the entire mathematical problem , but receives a specific portion of the calculation to be performed.

- The pool divides tasks into sub-problems and assigns these computational fragments to connected miners.

-

Submission and validation of results :

- Once a miner finds a valid partial solution ( share ), it sends it to the pool server.

- The pool collects these solutions and validates whether they contribute to finding a block that conforms to the requirements of the Bitcoin blockchain.

-

Find and propose a block :

- When a miner connected to the pool finds a complete solution (a valid nonce that solves the block), this solution is immediately sent to the Bitcoin network.

- The pool is responsible for officially submitting the block to the network for validation and addition to the blockchain.

-

Award distribution :

- Rather than the winning miner keeping the entire block reward, it is distributed among all the miners who contributed, according to the amount of work they provided ( share difficulty ).

-

Performance optimization :

- The pools monitor the performance of the miners and dynamically adjust the calculations according to the power of each machine.

- They also optimize network latency to submit blocks before other competing pools, thus maximizing the chances of validation.

Who are the participants in mining pools?

The participants in mining pools are diverse and fall into several categories:

-

Individual minors :

- Individuals who own one or more ASICs and wish to pool their power to obtain a stable income.

- They rely on the pool to maximize their profitability and avoid the uncertainties of solo mining.

-

Institutional mining farms :

- Companies operating thousands of ASICs in optimized datacenters (e.g. Marathon Digital Holdings, Riot Platforms, Bitfarms ).

- They manage their own hardware and energy, but delegate block validation to mining pools to ensure a constant flow of rewards.

-

Pool operators :

- The entities that manage the software and network infrastructure of the pool.

- They receive a commission on the rewards distributed to miners in exchange for the service provided.

Thus, mining pools play an essential role in the functioning of the Bitcoin network, ensuring efficient coordination between thousands of geographically dispersed actors.

Who is behind these mining farms?

Mining farms are facilities housing hundreds, or even thousands, of specialized computers ( ASICs ) dedicated to validating transactions by solving complex calculations. Although their operation relies heavily on automation , they also require human supervision to ensure optimal performance.

- Automation : Once configured, these farms operate with minimal human intervention . Management software automatically adjusts mining power based on economic factors (electricity prices, mining profitability) and technical factors (temperature, network load). Some systems even include automatic restart mechanisms in case of failure.

- Human supervision : Despite these optimizations, technicians are essential to ensure regular maintenance , replace faulty ASICs, optimize cooling , and intervene in case of hardware or software problems. Large mining farms often employ dedicated teams that continuously monitor the installation via monitoring systems .

Large companies operating these farms include, in particular:

- Marathon Digital Holdings NASDAQ -listed company with vast mining infrastructure in Texas and North Dakota .

- Riot Platforms (formerly Riot Blockchain): Has one of the largest mining centers in North America.

- Bitfarms : A major player in mining based in Canada , with several farms in North and South America.

These large entities possess colossal computing power , but remain dependent on the Bitcoin network consensus . They do not "validate" transactions on their own , but submit the blocks they find to the network. The final validation decision rests with the blockchain consensus, based on the majority of network nodes.

Who validates transactions on Ethereum and other PoS blockchains?

With the rise of Proof of Stake (PoS) , transaction validation relies on staking pools that pool users' funds to operate validator nodes and secure the network.

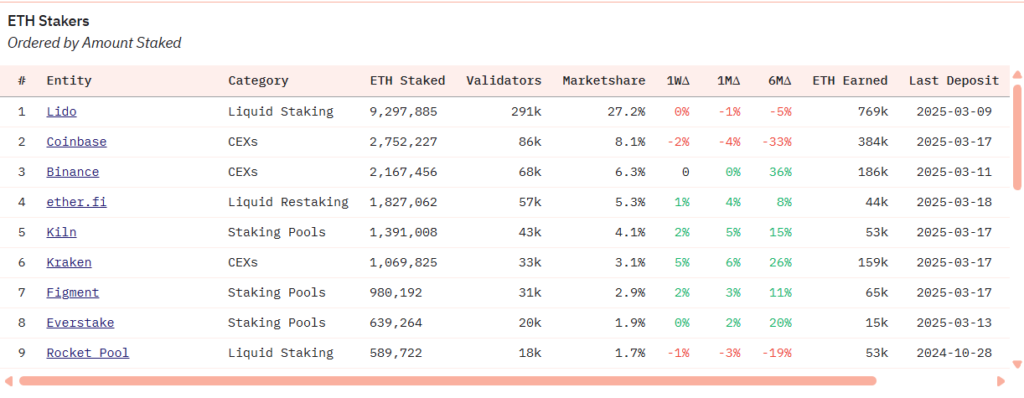

On Ethereum , the main validators are:

-

Lido Finance (9.29M ETH staked, 291,000 validators, 27.2% market share)

- As a leading player in liquid staking , Lido allows users to deposit ETH and receive stETH , a token representing their staked funds.

- This model facilitates access to staking without requiring 32 ETH or technical infrastructure.

- Criticism : Lido holds a dominant market share, posing a risk of centralization .

-

Coinbase (2.75M ETH staked, 86,000 validators, 8.1% market share)

- The American exchange platform offers staking accessible to individuals and institutions.

- Coinbase also provides validation infrastructure under the Coinbase Cloud (formerly Bison Trails).

- Problem : Its importance in the ecosystem raises concerns, particularly regarding its compliance with US regulations .

-

Binance (2.16M ETH staked, 68,000 validators, 6.3% market share)

- Offers centralized staking , where users deposit funds and Binance handles the validation.

- Its model attracts investors seeking simplified management and guaranteed returns.

- Advantage : Strong infrastructure, reliability.

-

ether.fi (1.82M ETH staked, 57,000 validators, 5.3% market share)

- A major player in liquid staking , allowing users to re-stake their tokens on other protocols for additional returns.

- Example of the EigenLayer staking redeployment to secure other Web3 services.

-

Rocket Pool (589K ETH staked, 18,000 validators, 1.7% market share)

- decentralized alternative to Lido, Rocket Pool allows any user with at least 8 ETH to become a validator without depending on a centralized entity.

- Its goal is to reduce the centralization of staking on Ethereum .

The implications of staking on Ethereum

These validators control a significant share of the market , which poses a potential concentration problem .

- Centralized platforms ( Coinbase , Binance , Kraken ) facilitate staking but risk making Ethereum more vulnerable to regulation and censorship .

- Decentralized solutions (Lido, Rocket Pool, ether.fi) offer more resilience, but remain dominated by a small number of powerful players .

Who validates transactions on private blockchains?

Unlike public blockchains such as Ethereum or Solana professional or institutional use , where only designated entities can validate transactions .

- Hyper ledger Fabric : A network used by companies and consortia such as IBM Food Trust , which enables the tracing of the food supply chain. Each validator node corresponds to a supply chain actor (e.g., Nestlé, Carrefour).

- R3 Corda : Finance-oriented blockchain, adopted by BNP Paribas , ING , and other banks to automate secure transactions.

More information about the rewards can be found here.

Who validates transactions on the blockchain: Risks and challenges of validation

Potential attacks

Attackers can target multiple vectors:

- 51% attack : if a validator (or group) gathers more than 50% of the computing power or staked tokens, it can theoretically reorganize the blockchain.

- Sybil attacks : creating multiple identities to influence consensus.

- Censorship : on a permissioned blockchain, validating entities could filter certain transactions.

These extreme scenarios remain rare, as economic interests generally incentivize validators to follow the rules. On Proof-of-Stake (PoS), the slashing mechanism strongly discourages cheating.

The challenge of governance

Beyond the purely technical aspects, who validates and how does this impact the evolution of the protocol itself? On many blockchains, validators vote on proposed improvements. Consensus emerges, and sometimes forks ( bifurcations) appear when disagreements are irreconcilable. Thus, the distribution and diversity of validators directly influence the governance and future direction of the network.

Who validates transactions on the blockchain: How to become a validator

For those wishing to get started, the general steps are:

- Choosing the blockchain : PoW (e.g., Bitcoin) requires a investment . PoS (e.g., Ethereum , Cardano ) requires a certain number of tokens.

- Set up the infrastructure : configure a full (or validation) node on a reliable, high-availability server.

- Respect the protocol conditions : up-to-date software versions, token setup, vigilance regarding operating time.

- Joining a pool or validating solo : In Proof-of-Work (PoW), joining a pool is often essential for an individual miner. In Proof-of-Stake (PoS), it's possible to validate yourself or delegate.

cloud computing solutions or infrastructure providers to minimize the risk of outages and benefit from good bandwidth.

Who validates transactions on the blockchain: The reasons for validation and the economic benefits

Validation (mining or staking) can be profitable. Block rewards or staking interest are a source of income. However, profitability depends on multiple factors:

- Token price on the market

- Commission fees charged by the pool

- Cost of electricity (PoW) or stake size (PoS)

- Quality of the infrastructure

For large companies, it's a way to diversify their crypto portfolio and support the ecosystem. For individuals, validation also allows them to actively participate in decentralization, rather than simply holding tokens.

Who validates transactions on the blockchain: The future of validation

As protocols evolve, we observe:

- A trend towards green blockchain , favoring Proof of Stake or other low-energy consensus mechanisms.

- Increased professionalization: large nodes, stakingcompanies, dedicated service provision.

- Multi-chain solutions (Cosmos, Polkadot) where validation extends to several interconnected networks.

This evolution maintains a central question: how to preserve decentralization and openness to all, while managing competitiveness and technical efficiency? Blockchains continue to test various governance and validation distribution models to find the best balance.

Conclusion: Who validates transactions on the blockchain? An ecosystem of multiple validators

The answer to “ who validates transactions on the blockchain ” is therefore multifaceted. Depending on the consensus mechanism, it may involve:

- pools and industrial farms (Bitcoin, PoW)

- Individuals staking structures ( Ethereum , Cardano , Tezos , etc.)

- delegates or “super validators” (DPoS on EOS or Tron)

- Private consortia ( permissioned blockchains like Hyper ledger )

Everyone is at the heart of the validation process, verifying the authenticity of each transaction and ensuring the security of the distributed ledger. The rules vary from one protocol to another, but the core principle remains the same: to provide a transparent, tamper-proof system free from any central authority. This decentralization involves a diverse range of actors, from large companies and passionate solo entrepreneurs to infrastructure specialists. The more diverse the network becomes, the more resilient it becomes, thus guaranteeing the very essence of the blockchain revolution.

Cryptocurrency investments are risky. Crypternon cannot be held liable, directly or indirectly, for any damage or loss resulting from the use of any product or service mentioned in this article. Readers should conduct their own research before taking any action and only invest within their financial means. Past performance is not indicative of future results. This article does not constitute investment advice.

Some links in this article are referral links, which means that if you purchase a product or sign up through these links, we will receive a commission from the referred company. These commissions do not incur any additional cost to you as a user, and some referrals give you access to promotions.

AMF Recommendations. There is no guaranteed high return; a product with high potential returns implies high risk. This risk must be commensurate with your investment goals, your investment horizon, and your ability to lose some of your savings. Do not invest if you are not prepared to lose all or part of your capital .

To learn more, read our Legal Notices , Privacy Policy and Terms of Use .