Crypto mining: profitability, operation and better cryptocurrencies to mine

Can we really earn money by validating transactions on a network? The answer is nuanced. Crypto's mining can be profitable if you control equipment, optimization of energy costs and market volatility What are the costs to be expected? What cryptocurrencies are the most suitable? How to assess your king ? In this article, we will review the key points to know so that your investment in mining is a success.

Table of contents

What is cryptocurrency mining?

The principle of mining is based on a Proof of Work work algorithm. Concretely, it is a question of involving the computation power of your computer equipment in order to calculate the complex cryptographic equations. The objective: to check the accuracy of the transactions, to secure the network and add a new blockchain block . In exchange for this service, minors receive a reward , called a reward of the block , generally paid into the cryptocurrency concerned.

The more competitive a network, the higher the mining difficulty This is why Bitcoin 's mining today requires specialized machines (called ASIC ) to remain competitive. Conversely, some ltc oins allow you to undermine with simple GPUs (graphics cards) or even a powerful CPU. But what about their return?

Why can mining be profitable?

If the price of cryptocurrency increases and your operating costs (electricity, maintenance, etc.) remain stable, you can generate an interesting profit, especially during the market increase. To this are added other factors:

- difficulty : the lower it is, the easier it is to “win the race” to find the right block and touch the reward .

- technology : Some blockchains have more or less suitable algorithms for specialized machines ( ASIC ), influencing competition.

- Equipment acquisition cost high -end GPU ASIC can represent a heavy initial investment.

- Personal strategy: Do you keep the cryptocurrency or do you sell regularly to cover expenses?

The essential question remains: can profitability This is what we will see in more detail.

The variables that influence the profitability of crypto mining

1. The price of cryptocurrency and its volatility

cryptocurrency price directly affects your return on investment. When Bitcoin reaches heights, many actors embark on mining, making the difficulty higher and increasing competition. Significant volatility can vary your earnings from simple to triple: it is a fact to take into account in any Crypto profitability mining .

2. electricity costs

Miner requires energy, often intensively. ASIC or GPU days a week, which can increase the electricity bill. The higher your kWh rate, the more difficult it will be to reach profitability . This is the reason why many mining farms are in regions where energy is inexpensive (sometimes near hydraulic or geothermal sources).

3. The equipment: Asic or GPU?

If you are targeting very competitive blockchains (like Bitcoin ), you will have to invest in a ASIC to hope to compete with large farm s. On the other hand, if you target ltc OOS or emerging projects, a high -end GPU Each option has its advantages and disadvantages:

- An asic offers a hashrate for a specific algorithm, but is less flexible.

- A GPU can undermine several different corners, offering more agility to adapt to the market.

4. The difficulty of the blockchain

The difficulty varies automatically to maintain a constant validation period. On Bitcoin , it adjusts every 2016 blocks, which corresponds to about two weeks. If the overall hashrate network climbs rapidly, the difficulty will also increase. Your machine will then have to provide more efforts to undermine the same reward . On other blockchains, the adjustment algorithm can be faster or slower.

Crypto and profitability mining: reference sites

Before you embark on the adventure, you can compare the prospects for earnings thanks to specialized tools:

- Whattomine.com: This site allows you to enter your hatching , your Watts consumption and the cost of your electricity. He will then tell you the most profitable cryptos to mine.

- Asicminerue.com: Ideal for assessing the king of a ASIC . cryptocurrency course and the average electricity price.

These platforms provide estimates based on market news, volatility and network difficulty . The data change daily, or even every hour.

Crypto and profitability mining: what cryptocurrencies are mine in 2025?

The question of the “what corner miner?” often comes back. The answer depends on your budget, your goals and your risk . Here are some examples of popular projects that can potentially offer profitability depending on the equipment and market conditions.

Bitcoin : the undisputed leader

Bitcoin remains the most famous and exchanged cryptocurrency . However, mining ASIC equipment and access to inexpensive electricity to maintain a positive margin. With each “halving” (every four years), the block reward is reduced, which can influence profitability . In 2025, she already descended to 3.125 BTC per block . This means that you must carefully calculate your acquisition cost , your operating costs

For more details, see our article dedicated on which crypto mine in 2025 .

Crypto and profitability mining: can we still mine at home? The realities of “home mining”

mining rig at home , that is to say a specially assembled computer to undermine cryptocurrencies. Several factors come into play:

- Sound and thermal nuisances : an ASIC or an GPU generates significant warmth and high noise, which can be complicated to manage on a daily basis.

- Electricity : your invoice may climb. In some cases, your current contract will not be enough, and you will have to consider a more suitable solution (three -phase subscription, for example).

- Yield : it all depends on the equipment chosen. An ASIC can be profitable if you have a competitive energy rate, while an average range GPU

Some minors circumvent these drawbacks by joining an online mining pool Cloud Mining , which we are going to talk about.

Crypto and profitability mining: Cloud Mining, an alternative to the purchase of equipment

Cloud mining is to rent a hash power in a datacenter . Instead of buying an ASIC or a GPU , you pay a provider who takes care of equipment, electricity and maintenance. The advantages:

- No noise or heat at home.

- No acquisition cost for equipment.

- No need for advanced technical skills to configure and maintain.

However, Cloud Mining also presents risks:

- Profitability not always there: depending on the contracts, the costs can be raised.

- Reliability of the service provider: You must give your confidence to a third -party business. In the event of bankruptcy or scam, you lose your bet.

- Lack of flexibility: you are linked by a subscription or a contract, which limits your ability to switch to another cryptocurrency if profitability decreases.

How to calculate the profitability of its crypto mining?

1. Basic parameters

To determine the potential profitability mining , you must take into account:

- Hashrate : hash power (expressed in H/S, MH/S, GH/S, Th/s, etc.).

- Electric consumption (in watts): the more powerful your equipment, the more it consumes.

- Cost of KWH in your region: it is often the determining factor.

- Price of the cryptocurrency : this determines the value of the award (in euros or dollars).

- Difficulty of the network : the higher it is, the more you will have to provide efforts to undermine a block .

- Block reward : for example, 3.125 BTC for Bitcoin after the last Halving .

2. Practical tools

As mentioned above, calculators like Whattomine or Asicminarye greatly simplify this process. You enter your configuration and your electric price. These platforms update the market data in real time to estimate your daily or monthly profit.

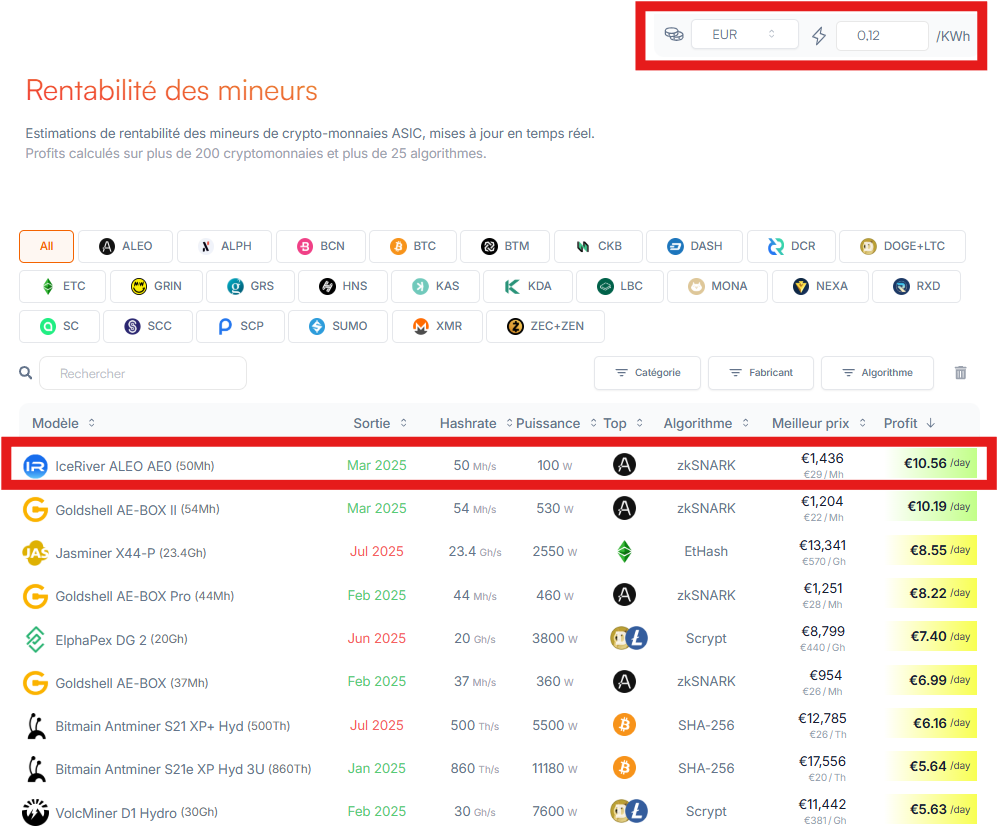

Example of profitability with the Iceriver Aleo Aeo (50 Mh/s) - Simulation according

Among the models of ASIC minors scheduled for 2025, the Iceriver Aleo Aeo is distinguished according to asicminary by its combination of high energy efficiency and attractive net yield. This model specializes in Zksnark , used in particular for cryptocurrencies focused on confidentiality and zero knowledge evidence.

Here are the characteristics of the machine:

- Model : Iceriver Aleo Aeo

- Release date : March 2025

- Hashrate : 50 MH/s

- Electric consumption : only 100 watts

- Estimated price : 1 436 €

- Net daily profitability : € 10.56 / day

The most remarkable here is the very low consumption of the machine (100 W), which makes its energy efficiency efficient. The calculation of profitability is based on an electricity cost of € 0.12/kWh , as indicated at the top right of the interface.

Quick calculation of daily consumption:

- 100 W = 0.1 kW

- 0.1 kW x 24 h = 2.4 kWh / day

- 2.4 kWh x 0.12 € = 0.29 € of electrical cost per day

Estimation of return on investment (king):

- Machine price: € 1,436

- Daily profit: € 10.56

- Estimated king : 1,436 / 10.56 ≈ 136 days , or about 4 and a half months

Crypto and profitability mining: return on investment and perspectives in 2025

The mining remains, in 2025, a competitive sector. Industrial farms can deploy thousands of ASIC , taking advantage of scale savings. However, an individual can still generate profit if:

- It has access to low -cost electricity.

- He chooses cryptocurrencies adapted to his equipment.

- He regularly monitors his king and adapts his strategy to the market.

The opportunities sometimes move to less known projects, but potentially more profitable in the short or medium term. Some of ltc can prove to be very lucrative for a short period, until difficulty and competition increase.

Should we embark on Crypto mining in 2025?

The answer depends mainly on your investor profile. Crypto profitability mining is not guaranteed and implies risks:

- Fluctuation of the price (your production can fall into value if the market drops).

- Possible regulatory developments (some jurisdictions restrict access to electricity for minors or prohibit practice).

- Maintenance and renewal of equipment, which can become obsolete quickly.

On the other hand, for a patient and informed investor, with a suitable environment (good electrical power, effective ventilation), mining remains a means of generating passive income by accumulating cryptos. It's up to you to determine if the game is worth the candle.

Advantages and disadvantages of crypto mining

To conclude, here is a summary of the main strengths and limits of mining :

Benefits

- Passive income : Once your rig or asic is configured, it generates corners without constant intervention.

- Direct access to cryptocurrencies : you get digital assets without going through a purchase.

- Participation in blockchain security : you support the network and contribute to its integrity.

- Flexibility (especially with a GPU ): possibility of mine different corners if profitability fluctuates.

Disadvantages

- Often high initial material investment

- Energy costs that can weigh on the budget.

- Volatility : the value of the mined corners can fall suddenly.

- competition on popular cryptos like Bitcoin .

- Maintenance and logistics: Heat management, dust and risk of breakdowns.

Conclusion on the Crypto M river and its profitability

Several points are crucial:

- Choose the cryptocurrency according to your convictions and your equipment ( ASIC or GPU ).

- Precisely calculate its acquisition cost , its electricity costs potential margin

- Follow market volatility difficulty .

- Consider Cloud Mining if you do not want to accommodate the equipment at home.

- Adapt your strategy in the event of a sudden change in demand or a halving.

Tools like Whattomine and Asicminerue greatly facilitate real -time analysis. From there, profitability will depend on your ability to manage risks and optimize your installation. Some private minors manage to make a regular benefit, while others prefer to turn to staking or more traditional investments.

Investments in cryptocurrencies are risky. Crypternon could not be held responsible, directly or indirectly, for any damage or loss caused following the use of a property or service put forward in this article. Readers must do their own research before undertaking any action and investing only within the limits of their financial capacities. Past performance does not guarantee future results. This article does not constitute an investment advice.

Certain links of this article are sponsorship links, which means that if you buy a product or you register via these links, we will collect a commission on the part of the sponsored company. These commissions do not train any additional cost for you as a user and certain sponsorships allow you to access promotions.

AMF recommendations. There is no guaranteed high yield, a product with high performance potential implies a high risk. This risk taking must be in line with your project, your investment horizon and your ability to lose part of this savings. Do not invest if you are not ready to lose all or part of your capital.

All our articles are subject to a rigorous verification of the facts. Each key information is verified manually from reliable and recognized sources. When we cite a source, the link is systematically integrated into the text and highlighted by a different color, in order to guarantee transparency and allow the reader to consult the original documents directly.

To go further, read our pages legal notices , privacy policy and general conditions of use .